- Immunomedics (IMMU) $3 to $87 up 2,800%, a gain of $20.7 billion. Acquired by Gilead Sciences (GILD)

- Dicerna (DRNA) $3.30 to $38.25 up 1,175%, a gain of $2.9 billion. Acquired by Novo Nordisk (NVO).

- Provention Bio (PRVB) $4.60 to $25 up 443%, a gain of $2.8 billion. Acquired by Sanofi (SNY).

Interesting, all of these stocks were down over 70%-80%, before we added them to the Watch List. They were by no means, market leading momentum stocks. Not that we are an advocate of getting involved in something merely ‘because’ it is down 80%, but when it works, it works!

MANY of the larger cap losers can end up in the very crowded biotech graveyard, when they can’t get further funding to advance the science in trials. Sometimes investors stop funding trials because of bad interim FDA data, and sometimes the investors simply lose patience and get bored.

Combined shareholder gains for our Trifecta, $26.4 billion. Not bad for a free newsletter..

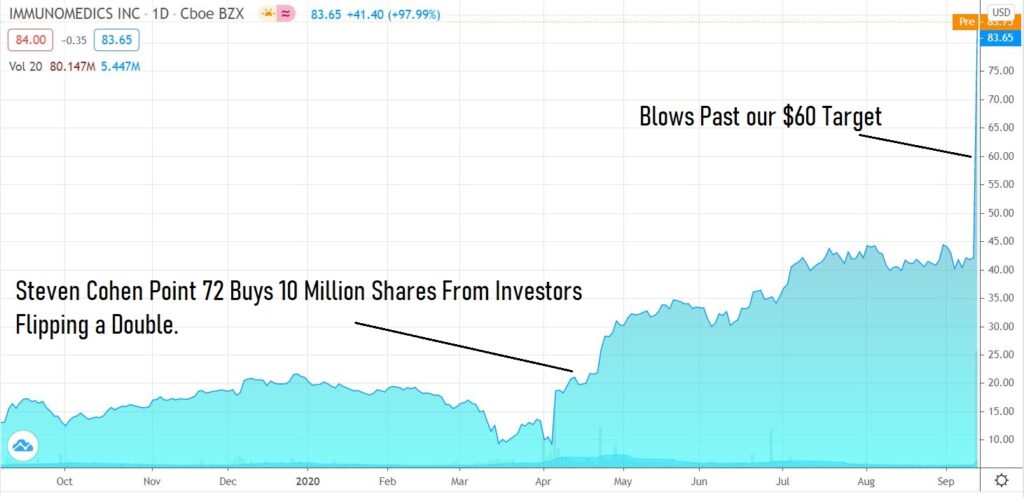

IMMUNOMEDICS

Immunomedics (IMMU) had fallen from $28 to $3.00 when we added it to the Watch List and had a market cap of $288 million. It also traded from $3.00 the day we added it, to $2.00 in the following month. That challenged our conviction, as it was being heavily shorted by some very intelligent and very vocal short sellers. We beat the shorts including Martin Shkreli!

Shareholders gain: $20.7 billion after being acquired by Gilead Sciences (GILD).

Adding Immunomedics (IMMU) $3.00 to Watch List.

VenBio’s Behzad Aghazadeh in Line for a Whopping $2.35 Billion Payout.

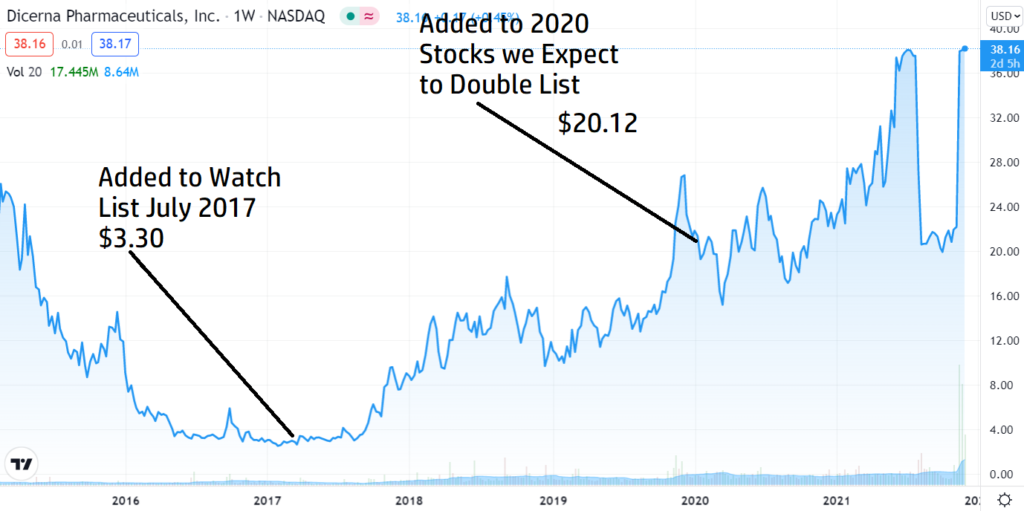

DICERNA

Dicerna (DRNA) up 78% Today. Being Acquired by Novo Nordisk (NVO) for $38.00.

Dicerna (DRNA) was down from $24 to $3.00 and looked left for dead, with minimal cash to fund further clinical trial work. Then they pulled off a $70 million convertible funding at the last minute. Of course the ‘all dilution is bad’ crowd complained loudly. In our opinion, dilution doesn’t kill companies it saves most of them. Assuming they put the funding to good use. Dicerna had a $68 million market cap or $138 million when you include the convert, when we added it to the Watch List.

Shareholders gain: $2.9 billion after being acquired by Novo Nordisk (NVO).

Adding Dicerna (DRNA) $3.30 to Watch List.

Dicerna Announces Closing of $70 Million Convertible Preferred Stock Financing

He Shoots and He Scores. Dicerna (DRNA) up 78%.

(Interestingly, had DRNA had been acquired for stock by NVO instead of cash in November of 2021, shareholders would be up $5.8 billion. Oh well.)

PROVENTION BIO

Sanofi (SNY) to Acquire Provention Bio (PRVB) for $25 a Share. Gains 243%.

Provention Bio (PBIO) was down from $20 and easily one of the most volatile ideas we’ve ever come across, including AFTER getting FDA approval, when it dropped from $10 to $6.75. We still don’t know why Sanofi paid $2.9 billion for Provention Bio last March, but guess it doesn’t matter!

Added to the 2022 Watch List at $4.60 when it was valued at $289 million, it drifted up to near $10 pre-approval, then down to $6.75 the week after approval. There was mass panic.

A few weeks later Sanofi steps up with a $25 per share offer, which for everyone who didn’t sell after the post-FDA approval dump, gladly accepted. Feel sorry for the ‘traders’ who sold at $6.00.

Shareholder gain: $2.8 billion after being acquired by Sanofi (SNY).

Adding Provention Bio (PRVB) $4.60 to 2022 Biotech Watch List.

We’re Bearish, But We’re up 243% in Provention Bio (PRVB) Today.