This is in our ‘Stocks we Hope to Double’ Watch List.

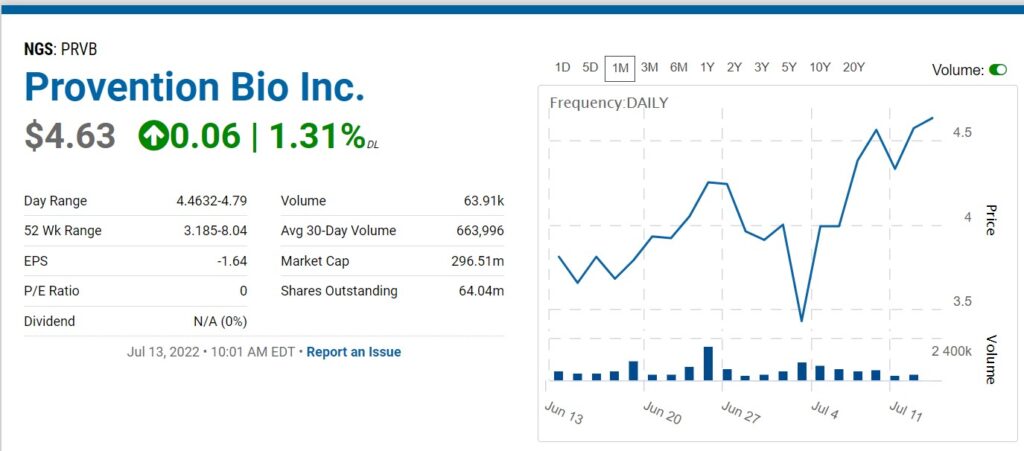

Provention Bio (PRVB) Updates.

RELATED: Revive Therapeutics (RVVTF) Enters the Danger Zone.

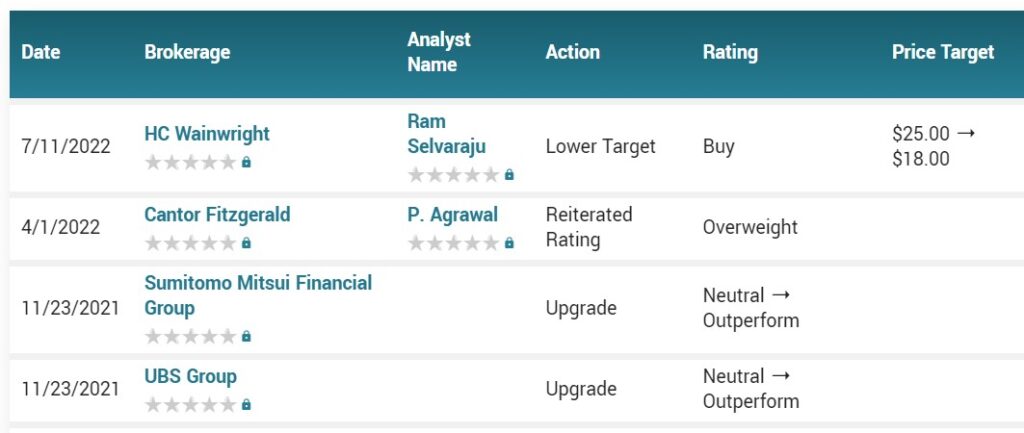

Provention Bio Price Target $18.00 HC Wainwright

Here’s why we’re adding it to the Watch List (game on):

Provention Bio Announces $60 Million Private Placement

RED BANK, N.J. , July 7, 2022 /PRNewswire/ — Provention Bio, Inc. (Nasdaq: PRVB) (the “Company”), a biopharmaceutical company dedicated to intercepting and preventing immune-mediated diseases, today announced it has entered into a securities purchase agreement with institutional investors for the private placement of approximately $60 million of shares of its common stock and warrants to acquire 13,318,535 additional shares of its common stock (the “Warrants”) (collectively, the “Securities”). The Warrants will be exercisable immediately upon issuance, in whole or in part, at an exercise price of $6.00 per share and will have a five-year term.

The Company anticipates aggregate gross proceeds from the offering will be approximately $60 million, before deducting fees to the placement agent and other estimated offering expenses payable by the Company, based on the offering price of $4.505 for each share of the Company’s common stock plus one Warrant.

The Company expects to use net proceeds from the private placement to fund expenses in preparation for the potential launch of teplizumab, to advance its clinical development candidates, as well as for working capital and other general corporate purposes. The transaction is expected to close on or about July 13, 2022 , subject to the satisfaction of customary closing conditions. The private placement investors include Sessa Capital and Armistice Capital Master Fund Ltd.

Jefferies acted as sole placement agent on the transaction.

The Securities to be sold in the private placement have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state or other applicable jurisdiction’s securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state or other jurisdiction’s securities laws. The Company has agreed to file a registration statement with the U.S. Securities and Exchange Commission (the “SEC”) registering the resale of the Securities issued in the private placement.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these Securities, nor shall there be any offer, solicitation or sale of these Securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state. Any offering of the Securities under the resale registration will only be made by means of a prospectus.

About Provention Bio, Inc.:

Provention Bio, Inc. (Nasdaq: PRVB) is a biopharmaceutical company focused on advancing the development of investigational therapies that may intercept and prevent debilitating and life-threatening immune-mediated disease. The Company’s pipeline includes clinical-stage product candidates that have demonstrated in pre-clinical or clinical studies proof-of-mechanism and/or proof-of-concept in autoimmune diseases, including type 1 diabetes, celiac disease and lupus.

Forward-Looking Statements:

Certain statements in this press release are forward-looking, including but not limited to, statements regarding the expected timing for the closing of the private placement and the expected use of proceeds from the private placement. These statements may be identified by the use of forward-looking words such as “expect” and “anticipates,” among others. These forward-looking statements are based on the Company’s current expectations and actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks related to the Food & Drug Administration (the “FDA”) disagreeing with the Company’s interpretation of data, analysis or information in the Biologics License Application (the “BLA”) resubmission; delays in or failure to obtain the FDA approvals for teplizumab or other Company product candidates and the potential for noncompliance with the FDA regulations; risks related to the FDA’s extension of its review period by three months for the BLA for teplizumab; any inability to successfully work with the FDA to find a satisfactory solution to address its concerns in a timely manner or at all during the review process for teplizumab, including any inability to provide the FDA with data, analysis or other information sufficient to support an approval of the BLA for teplizumab; any inability to, in the BLA resubmission or otherwise, satisfactorily address matters cited in the FDA’s complete response letter including relating to pharmacokinetic comparability, product quality, the safety update required by the FDA or any other FDA requirements for an approval of teplizumab; the potential impacts of COVID-19 on the Company’s business and financial results; changes in law, regulations, or interpretations and enforcement of regulatory guidance; uncertainties of patent protection and litigation; the Company’s dependence upon third parties; substantial competition; the Company’s need for additional financing and the risks listed under “Risk Factors” in the Company’s Annual Report of Form 10-K for the year ended December 31, 2021 , the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and other filings the Company makes with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond the Company’s control, you should not rely on these forward-looking statements as predictions of future events. As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. The Company does not undertake an obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by applicable law. The information set forth herein speaks only as of the date hereof.

Investor Contact:

Robert Doody , VP of Investor Relations

[email protected]

484-639-7235

Media Contact:

Kaelan Hollon , VP, Corporate Communications

[email protected]

212-421-4921

#PRVB, $PRVB