THREE PREVIOUS WINNERS*

- Immunomedics (IMMU) $3 to $87 up 2,800%, a gain of $20.7 billion. Acquired by Gilead Sciences (GILD)

- Dicerna (DRNA) $3.30 to $38.25 up 1,175%, a gain of $2.9 billion. Acquired by Novo Nordisk (NVO).

- Provention Bio (PRVB) $4.60 to $25 up 443%, a gain of $2.8 billion. Acquired by Sanofi (SNY).

Interesting, all of these stocks were down over 70%-80%, before we added them to the Watch List. They were by no means, market leading ‘momentum’ stocks. Not that we are an advocate of getting involved in a stock merely ‘because’ it is down 80%, but when it works, it works!

Note, MANY larger cap losers, can end up in the very crowded biotech graveyard, when they can’t get further funding to advance the science in trials. Sometimes investors stop funding trials because of poor interim FDA data, and sometimes the investors simply lose patience and get bored. Then it’s game over.

Combined shareholder gains from our Trifecta, $26.4 billion. Not bad for a free newsletter..

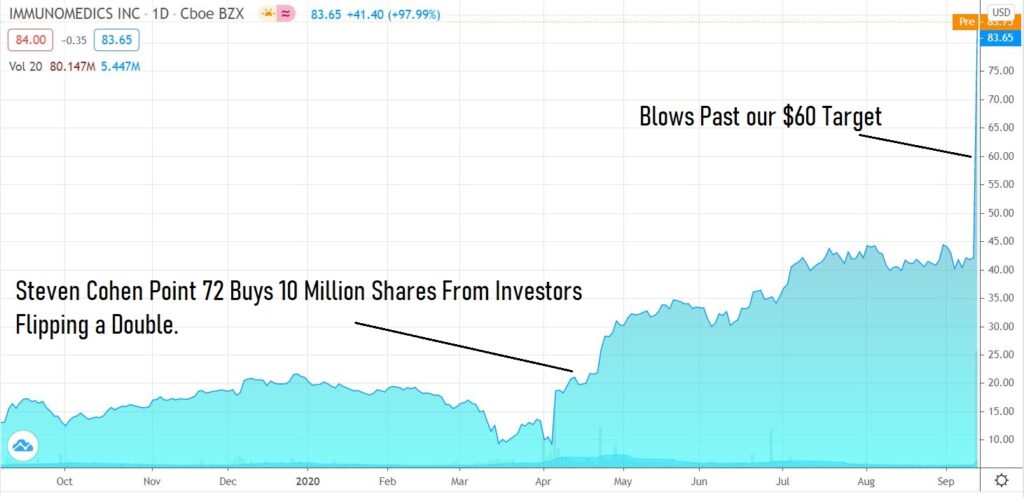

IMMUNOMEDICS

Immunomedics (IMMU) had fallen from $28 to $3.00 when we added it to the Watch List and had a market cap of $288 million in 2016. It also traded from $3.00 the day we added it, to $2.00 in the following month. That challenged our conviction, as it was being heavily shorted by some very intelligent and very vocal short sellers. We beat the shorts including Martin Shkreli the pharma bro, who we know well and is a genius, despite his issues.

Shareholders gain: $20.7 billion after being acquired by Gilead Sciences (GILD) six years after we added it to the Watch List.

Adding Immunomedics (IMMU) $3.00 to Watch List.

VenBio’s Behzad Aghazadeh in Line for a Whopping $2.35 Billion Payout.

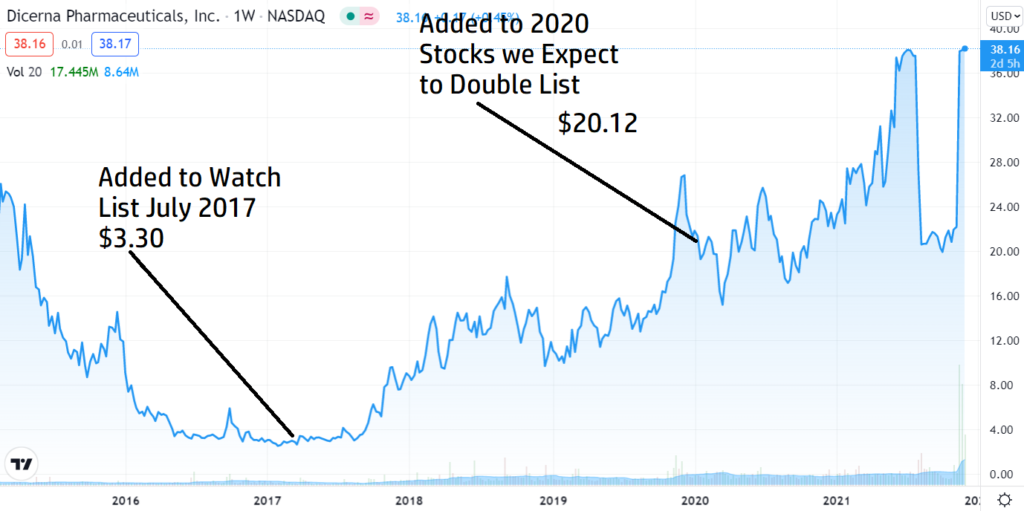

DICERNA

Dicerna (DRNA) up 78% Today. Being Acquired by Novo Nordisk (NVO) for $38.00.

Dicerna (DRNA) was down from $24 to $3.00 and looked left for dead, with minimal cash to fund further clinical trial work. Then they pulled off a $70 million convertible funding at the last very minute.

Of course the ‘all dilution is bad’ crowd complained loudly. In our opinion, dilution doesn’t kill companies, it can save them. Assuming of course, they put the funding to good use. Which will only be known in hindsight.

Dicerna had a $68 million market cap, or $138 million when you include the convert, when we added it to the Watch List.

Shareholders gain: $2.9 billion after being acquired by Novo Nordisk (NVO) three years after we added it to the Watch List.

Adding Dicerna (DRNA) $3.30 to Watch List.

Dicerna Announces Closing of $70 Million Convertible Preferred Stock Financing

He Shoots and He Scores. Dicerna (DRNA) up 78%.

(Interestingly, had DRNA had been acquired for stock by NVO instead of cash, in November of 2021, shareholders would be up $5.8 billion. Oh well.)

PROVENTION BIO

Sanofi (SNY) to Acquire Provention Bio (PRVB) for $25 a Share. Gains 243%.

Provention Bio (PBIO) was down from $20 and easily one of the most volatile ideas we’ve ever come across, including AFTER getting FDA approval, when it dropped from $10 to $6.75. We still don’t know why Sanofi (SNY) paid $2.9 billion for Provention Bio last March, as we never saw their math. But guess it doesn’t matter, since Sanofi did!

Added to the 2022 Watch List at $4.60 when it was valued at $289 million, it drifted up to near $10 pre-approval, then down to $6.75 the week after approval. There was a mass panic after it didn’t pop on approval.

A few weeks later Sanofi steps up with a $25 per share offer, which for everyone who didn’t sell after the post-FDA approval dump, gladly accepted. Feel sorry for the ‘traders’ who sold at $6.00.

Shareholder gain: $2.8 billion after being acquired by Sanofi (SNY).

Adding Provention Bio (PRVB) $4.60 to 2022 Biotech Watch List.

We’re Bearish, But We’re up 243% in Provention Bio (PRVB) Today.

WHAT’S NEW…

For above news coverage and progress reporting clients, see prior reports for disclosure and disclaimer details.

*Past performance is no indication or even an inkling to future performance, in new ideas.