Quite Simply, We’ve Found the Best Run Marijuana Grower, and it’s Profitable to Boot!

Based in Arizona, Our First Cannabis Play in Three Years*

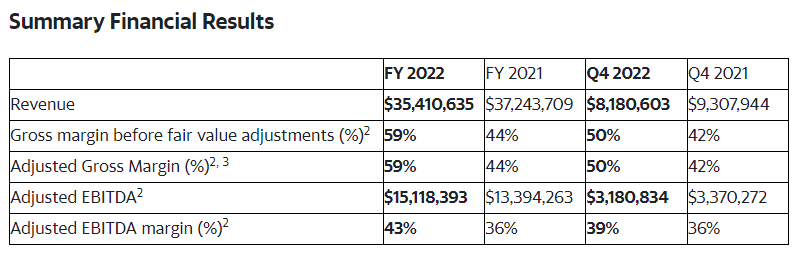

CEO and COO, Eric Offenberger: “First and foremost, we are operators. For the full-year 2022, Vext generated revenue of $35.4 million. Our proven experience continues to translate into the delivery of efficiencies. In 2022, we recorded adjusted EBITDA of $15.1 million, which is up 12.8% over 2021. Adjusted EBITDA margins were 43% in 2022, compared to 36% in 2021.”

Selling – Wait, What – Under Five Times Earnings

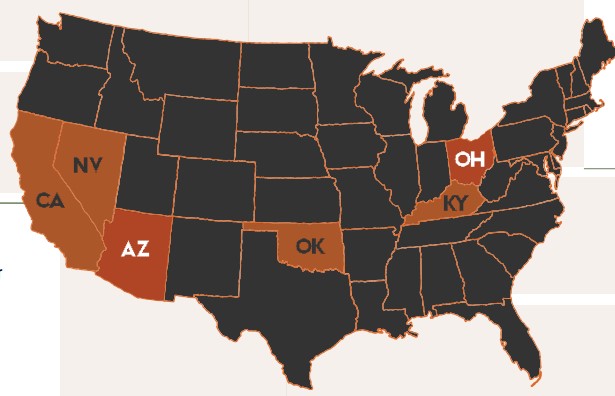

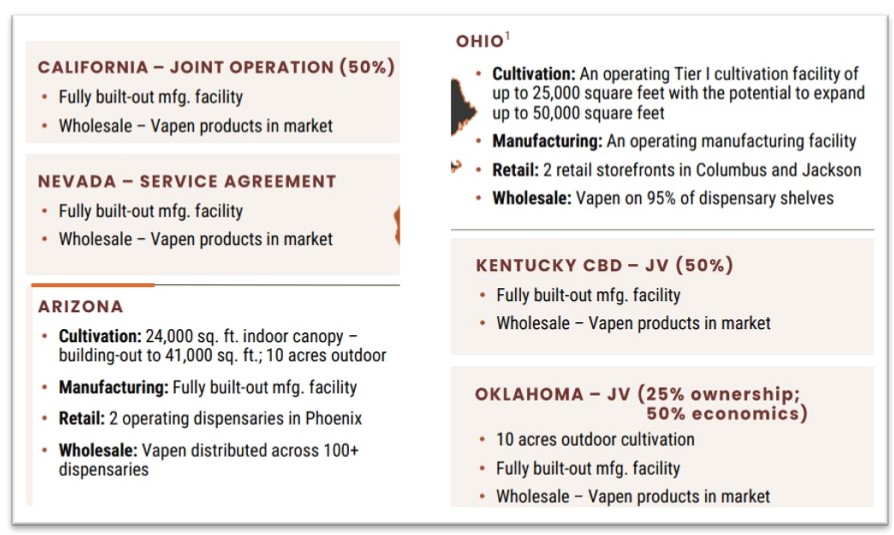

CURRENT FOOT PRINT

We’ll start with the investment thesis first (why we think investors should consider owning Vext), and then drill down to the remarkably conservative and business minded management at Vext Science (VEXTF, VEXT in Canada). This type of a quality management team, is both highly unusual and attractive in the cannabis sector.

At the end, this is simply a story about management. Management that knows what it’s doing, as proven by its results reported last week, with revenues at $35 million and earnings (ebitda) at an impressive $15 million!

Year Just Ended

Going Back to 2019

Note: Management in this sector by contrast, as you’re probably aware is loaded with CEO’s wearing ponytails, tie-dye shirts, and who simply do not know what they’re doing. It’s a breath of fresh air to see this performance.

The breath that comes out of the financials – will ultimately show up in the stock price.

We feel rather certain that Vext Science, which is just now turning the 2023 jets on via it’s acquisitions and partnerships formed in 2022, which will result in them reporting considerably higher revenues and in our opinion be trading considerably higher, at this same time next year. Considerably way higher!

Investment banking firm Haywood Capital Markets analyst Neal Gilmer, believes the Company will grow revenues to $52.7 million and EBITDA of $20.0 million in 2023.

Vext Science is a Triple, says Haywood

Investment research form Tickle Research analyst David Lavigne, “..in contrast, for fiscal 2024, when Ohio is fully integrated, we project fully taxed diluted eps of US$.11 which suggests a forward Price/Earnings ratio of 1.5X. We get it, cannabis is out of favor, but 1.5X projected 2024 earnings? Really?” Forecasts 2024 revenues of $48 million.

2-year price target of $1.35 or 690% higher.

Investment Thesis

As a sector player for well over 30 years, we are all to familiar with the fact that when the leaders (the largest market caps) in a sector are going up, so do the smaller players. The term for this is “..a rising tide lifts all boats.”

During times like this, meaning for example Tilray (TLRY), going from $3.00 to $63 in 2021, investors start to chase small cap stocks, which can go from $0.25 to $5.00, while $1.00 stocks can go to $10. Been there, seen that, as we all have.

Life is easy for everyone, including start-ups and their investment bankers, which have money thrown at them indiscriminately in hot, after hot IPO’s.

During these bull runs – fundamentals don’t matter. As long a Company has cannabis in their name, investors want to buy it, trade it, or own it for the long-term – until the over-valuation party gets so out of hand, a correction that was bound to happen, happens.

We’ve played these bull sector parties time after time, via half a dozen sectors. They’re great fun until the party begins to end, usually with the leader falling by 20%. Then we simply look for another party, which there always is – like electric vehicles, lithium, cooper, coronavirus, etc, etc..

Then the good times stop rolling!

When the party begins to end, it’s usually a 2-3 year unraveling process. So we are also well aware of the flipside, which is when the large cap leaders in a sector start tumbling DOWN, so do the smaller players with some losing 80-90% of their value.

The term for this is “..a falling tide lowers all ships.”

During times like this, using Tilray again as example, this time going from $63 to back to $3.00, investors start running from small cap companies with cannabis in their name, who now can go from $5.00 to $0.25, while $10.00 stocks go to $1.00. Fun while it lasted.

Life is hard for everyone, including start-ups and their formerly-formidable investment bankers, who can’t seem to be able to raise a penny, for even the best run and most attractive Company.

Note: It’s important for investors NOT to bargain hunt during the unraveling process. When things do eventually bottom, the price action indicating a bottom has been set, is usually pretty obvious.

Whereas stocks only a few years earlier were being bought indiscriminately, now they are being sold indiscriminately. The fundamentals don’t matter, if it has cannabis in the name, investors want to sell it – until the under-valuations become so ridiculous and a bottom forms.

During the dotcom bust, Amazon (AMZN) looked cheap at $50, down from $120. It taught the bargain hunters a thing or two, on its way to $5.00!

“The Baby Gets Thrown Out With the Bath Water.”

Again, as a long-term sector player we are also well aware of another fact, which is after a 2-3 year period of unraveling, there comes a point where we start looking at the sector again, because of numerous gross under-valuations. A bottoming evidenced by their trading flat for the prior year.

It’s arguable, but our opinion is we are in the midst of finding a bottom in the cannabis sector. It’s time to get the fishing gear out, put gas in the boat and head out to sea.

Keep in mind, we don’t expect the sector ‘re-ignite.’ But it is time to search with the expectation to find Companies which are grossly undervalued, on plain old fundamentals. The question is, than what do you do..

We very rarely see sector mania’s return. And since we’re not expecting the sector to re-ignite, investors can’t buy just ‘anything.’ And they shouldn’t buy what has fallen most. What they should only buy is the fundamental best.

We call this investment thesis “The Baby Bath” thesis. Meaning looking for companies which are down, despite great fundamentals – simply because investors have lost interest in the sector. They were thrown out with the bath water.

One thing to note in advance, if you decide play the baby bath game, is that the high volume trading days are a thing of the past So when you do find a great company at a great great price, you have to be patient to acquire a meaningful stake.

Where in the past you could typically buy $100,000 worth of most cannabis stocks in matter of minutes or hours, it can now take days or even a week. If you don’t have that kind of patience, post sector mania investing is not for you.

This is not a market for ‘traders and flippers’ who like to get in and out of a stock in the same day. If you’re investing in a undervalued stock, you should typically expect to be in these ideas for at least a year.

On the positive side for the patient, these are the type of stocks which can go up five-fold in a year or two (which is more our style). For us, it’s better than staring at the screen all day long flipping and flipping, for 5 or 10% gains (or losses) intraday. But to each his own.

A light trading, fundamentally superior and grossly undervalued stock is exactly what we have here with Vext Science Inc. (VEXTF).

Let’s first take a look at Vext’s chart, then we’ll look at how they performed (fundamentals) last year, and finally meet management – all below. The way we expect to make money on an idea like this is believing that fundamentals DO matter, and investors WILL warm up to the idea, as they continue to grow both organically and via smaller acquisitions of privately held growers. Or they end up getting acquired by a deeper pocketed cannabis company.

Here’s the list of potential acquiror’s. The 12 Largest Cannabis Companies in 2023,

The top 12 have market caps ranging from $280 million to $2.6 billion, compared Vext’s $85 million with 140 million shares outstanding. If Vext was acquired for three to five-times where it is currently trading, it’s still so small it would barely make the news – though it would certainly make current shareholders happy.

As you can see from the chart, the stock has drifted from over $1.00 to just under $0.20. A bargain we think you’ll agree at 5x earnings.*

FUNDAMENTALS

It’s doesn’t take a rocket scientist, a stock analyst or a degree in accounting to see CEO Eric Offenberger and his team are executing flawlessly on their business objectives. We attribute this in part to Midwestern values and sensibilities. We’re not for sure Ken is from the Midwest, but he comes off that way in his hype-free interviews and did attend Southern Illinois University (as did we including Loyola of Chicago and UCLA).

Vext first went profitable in 2016 and became publicly traded in January of 2020 raising $15 million. It traded straight down after the IPO, and saw a little love return, trading from $0.25 to $1.20, before running smack dab into the EPIC cannabis bear market bust.

Vext Science, Inc. Announces $15 Million Bought Deal Public Offering

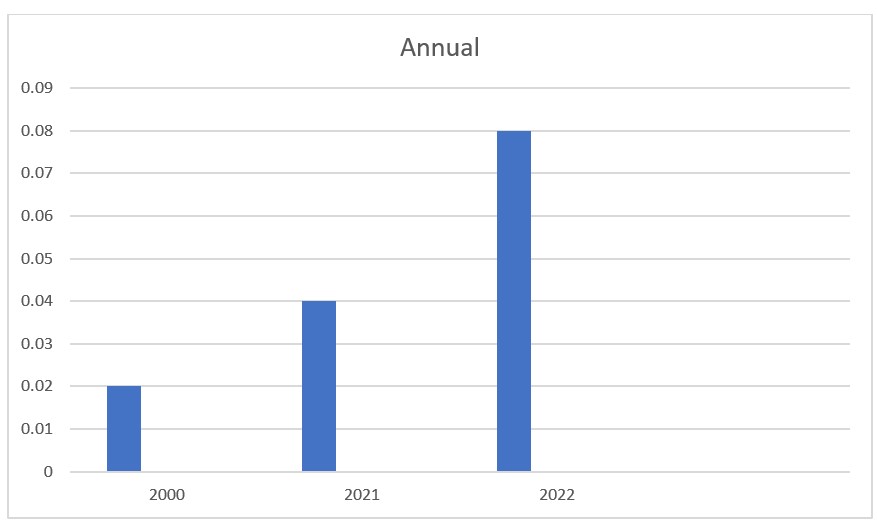

VEXT vs TILRAY

On March 22nd the Company reported full year 2022 results (shown above).

MANAGEMENT STATEMENT

“Our financial performance in 2022 reaffirms Vext’s track record as a profitable operator with a keen focus on driving efficiencies. With its significantly larger population, steady growth in patient count and potential for future adult-use transition, we expect Ohio to propel growth for Vext, contributing meaningfully towards revenue, profitability and cash flow over the next few years as we continue to focus on building value for our shareholders.”

They noted:

- On December 15, 2022, the Company announced that it has entered into definitive agreements to acquire an Ohio grower for $12.5 million.

- On February 21, 2023, the Company announced that an affiliated entity of the Company’s joint venture partner, achieved its first harvest.

- On February 23, 2023, opened another 17,000sf cultivation space in Eloy, AZ (now totaling 34,000sf). Planting expected in 2Q 2023, harvesting (aka revenues) in 3Q 2023.

- Arizona totals 58,000sf with 34,000 Eloy, 13,000 Phoenix and 11,000 Prescott Valley.

All of these chickens and more, are coming home to roost in 2023, including manufacturing facilities (for Vapen) in Nevada, Oklahoma, Kentucky and California.

While we call Vext Science the “best run grower,” it is much more than that with manufacturing (end products) and stores (dispensaries) to sell those products.

This is a just heads up report. Once we speak to management, they could potentially become a news coverage client, whereupon we would have a much lengthier and detailed report.

There is more than enough here though, along with conducting some of your own due diligence, to see how very attractive this company is. Might even be called a no-brainer, at this share price level.

Read 10K Here (must read, sweet)

MANAGEMENT

You should pretty much be able to see everything we see (conservative and sensible, trustworthy and hype-free) about management in this video interview.

VIDEO PRESENTATION

*Our First Cannabis Play in Three Years*. The last was Urban-Gro (UGRO) which traded from $7.50 to $17.00 a gain of 126% in four months and that ain’t bad.

urban-gro (UGRO) We Have Another Double!

Is urban-gro (UGRO) $7.50, the Most Undervalued Cannabis Play in the Market?

Disclaimers.

Forward-Looking Statements

This news release contains “forward-looking statements”. Wherever possible, words such as “may”, “would”, “could”, “should”, “will”, “anticipate”, “believe”, “plan”, “expect”, “intend”, “estimate”, “potential for” and similar expressions have been used to identify these forward-looking statements. These forward-looking statements reflect the current expectations of the Company’s management for future growth, results of operations, performance and business prospects and opportunities and involve significant known and unknown risks, uncertainties and assumptions, including, without limitation: the Company’s outlook for and expected operating margins, capital allocation and other financial results; statements relating to the business and future activities of, and developments related thereto, the Company after the date of this news release, including such things as future business strategy, competitive strengths, goals, expansion and growth of the Company’s business, operations and plans; expectations regarding cultivation and manufacturing capacity; expectations of market size and growth in the U.S. and the states in which the Company operates; inflation pressures; the timeline to buildout the Eloy cultivation facility; expectations for other economic business or competitive factors related to the Company; the Company’s business outlook, those listed in the Company’s filings with the Canadian securities regulatory authorities (which may be viewed at www.sedar.com). Should one or more of these risks or uncertainties materialize or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance or achievements may vary materially from those expressed or implied by the forward-looking statements contained in this news release. These factors should be considered carefully, and prospective investors should not place undue reliance on the forward-looking statements. The Company disclaims any intention or obligation to revise forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law. Not a current Institutional Analyst Inc., client.

The Canadian Securities Exchange has not reviewed, approved or disapproved the content of this news release.

Eric Offenberger

Chief Executive Officer

844-211-3725

For further information:

Jonathan Ross, Vext Investor Relations

jon.ross@loderockadvisors.com

416-244-9851

Non-IFRS Financial Measure

The Company has provided certain non-IFRS financial measures including “Gross margin”, “Adjusted Gross Margin”, “Adjusted EBITDA” and “Adjusted EBITDA margin”. These non-IFRS financial measures do not have a standardized definition under IFRS, nor are they calculated or presented in accordance with IFRS and may not be comparable to similar measures presented by other companies. The Company defines “Gross margin” as Gross Profit divided by Revenue. “Adjusted Gross Margin” is defined as Gross margin before the impact of biological assets, as adjusted for one-time inventory fair value adjustment, divided by Revenue. The Company defines “Adjusted EBITDA” as net income (loss) from operations, as reported, before interest and tax, adjusted to exclude extraordinary items, non-recurring items, other non-cash items, including stock-based compensation expense, depreciation and amortization, foreign exchange and acquisition related costs, if applicable. The Company defines “Adjusted EBITDA margin” as Adjusted EBITDA divided by Revenue.

The Company has provided these non-IFRS financial measures as supplemental information and in addition to the financial measures that are calculated and presented in accordance with IFRS. The Company believes that these supplemental non-IFRS financial measures provide a valuable additional measure to use when analyzing the operating performance of the business. These supplemental non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should only be considered in conjunction with, the IFRS financial measures presented herein.

The following information provides reconciliations of the supplemental non-IFRS financial measure presented herein to the most directly comparable financial measure calculated and presented in accordance with IFRS.

Gross Margin Before Impact of Biological Assets and Adjusted Gross Margin

Gross Margin Before Impact of Biological Assets is defined as: Gross Profit Before Impact of Biological Assets, divided by Revenue.

Adjusted Gross Margin is defined as: Gross Margin Before Impact of Biological Assets, adjusted for one-time inventory fair value adjustment, divided by Revenue.