Simply Incredible! 2024 Will be the Year of Post Reverse Split Revenge!

Taking advantage of post reverse-split investor pessimism, is a VALID investing technique.

IMAC owns and manages health and wellness centers that deliver sports medicine, orthopedic care, and restorative joint and tissue therapies. They are also in the evaluation stage (Phase I) of a mesenchymal stem cell therapy candidate for bradykinesia due to Parkinson’s disease. Other than that, we don’t know much else and would bet investors trading it know even less!

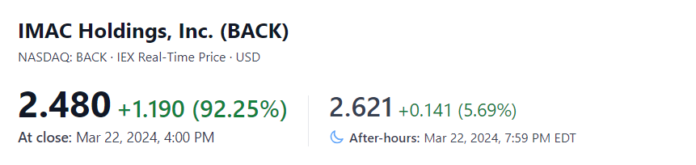

We’re not in it, but this could conceivably be a $50 stock after the painful 1:30 reverse split last September. There’s simply no stock out there. So let the games begin..

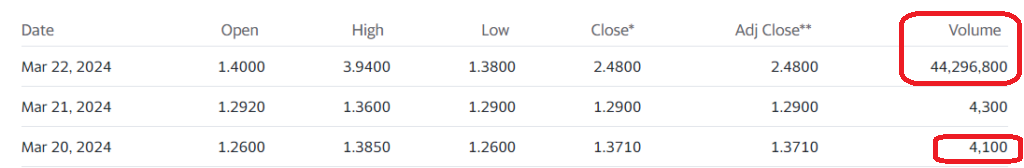

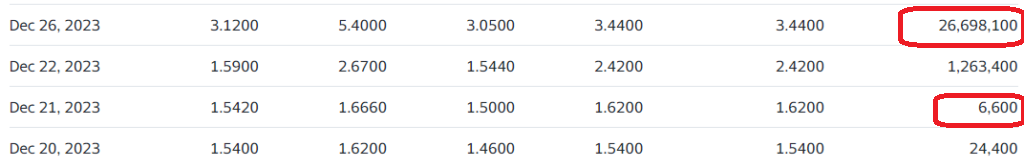

We’ll say at the onset, we feel bad for investors who ride these type of companies down after getting a deficiency notice from NASDAQ, and then sell at the all-time low, after the reverse split. Must be horrible to have sold IMAC in disgust at $1.27, the day before this run, when it only traded 4,300 shares. So sorry, they have no departing gifts for you.

These type of stocks will be volatile until fundamentals (earnings, FDA approval, etc) kick in, then they can really explode, gaining 10-fold or even more. Then even the investors who ‘took a double’ yesterday will be in the regret wading pool.

This is by the way, is the second post-reverse run for IMAC. Someone sold 6,600 shares for $9,900 to take a tax loss (and buy some last minute presents), five days before Christmas last year. The stake was worth $53,460 the day after Christmas. Doh!

The trick, if we may be so bold (after your understanding the fundamentals and potential of each company) is to try to acquire a large stake when nobody is watching slowly over time (days, weeks, or even months) when the negativity is the highest. This is usually the same time the uninformed posters on the message boards (who unfortunately lost a fortune pre-split), are calling these types of companies a “fraud, POS, hahaha, shitty stock, dead money” and then BOOM.

Don’t be that angry guy!

Negative posters on Twitter, Investors Hub and StockTwits are a good contraindicator. They rarely offer anything of value in their posts, other than to know that their negativity itself – is a good sign of investor pessimism, suggesting under-valuation.

IMAC Holdings, Inc. Regains Compliance with Nasdaq Listing Requirements

IMAC Holdings, Inc. Announces 1-for-30 Reverse Stock Split

Long Term Chart

Short Term Chart

Can we think of any similar charts..hmm let’s see. Oh yes, GeoVax (GOVX) whose fundamentals we love, with two drug candidates in Phase II.

Long Term Chart

Shorter Term Chart

Killer, 44-Page Report on GeoVax (GOVX).

5 Wall Street Research Reports on GeoVax (GOVX).

Reverse Stock Splits News

Geovax is a news and progress reporting client, see report for disclaimer and disclosure details.