Taking advantage of post reverse-split investor pessimism, is a VALID investing technique.

Altamira is developing and supplying peptide-based nanoparticle technologies for efficient RNA delivery to extrahepatic tissues (OligoPhore™ / SemaPhore™ platforms). The Company currently has two flagship siRNA programs using its proprietary delivery technology: AM-401 for KRAS driven cancer and AM-411 for rheumatoid arthritis, both in preclinical development beyond in vivo proof of concept. The versatile delivery platform is also suited for mRNA and other RNA modalities and made available to pharma or biotech companies through out-licensing.

“One key step is to develop platforms that use lower doses of mRNA…mRNA vaccines work through priming the body’s immune system to recognize and destroy a pathogen…although our bodies break down the vaccine’s mRNA very quickly, the antibodies linger so that we are protected should we contract the virus in the future.” (Well alrighty then, sounds logical.)

We’re not in it, but this could conceivably be a $50 stock after the jaw grinding 1:20 reverse split on December 13th of 2023. There’s simply no stock out there. So let the games begin..

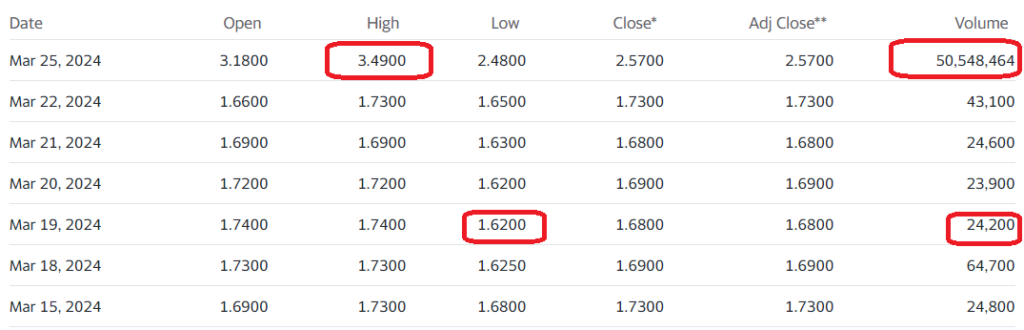

We’ll say at the onset, we feel bad for investors who ride these type of companies down after getting a deficiency notice from NASDAQ, and then sell at the all-time low, after the reverse split. Must be horrible to have sold CYTO in disgust at $1.62, days before this run, when it only traded 24,000 shares.

How something like this can trade $38,000 worth of stock, to $170 million in half a trading day — a couple days later, is fascinating. Makes us feel like a dinosaur, but if there is a way to take advantage of these ideas, we’ll find it (hopefully)!

The trick, if we may be so bold (after your understanding the fundamentals and potential of each post reverse-split company) is to try to acquire a large stake when nobody is watching slowly over time (days, weeks, or even months) when the negativity is the highest.

Our ‘staff’ overseas is compiling a list of all companies (100’s) that did a reverse split in the past year.

December 23rd. Altamira Therapeutics Regains Compliance with Nasdaq Minimum Bid Price Requirement

On June 26, 2023, the Company was notified by Nasdaq of its failure to maintain a minimum closing bid price of at least $1.00 per share for 30 consecutive trading days and was given 180 days, or until December 26, 2023, to regain compliance. 1-for-20, resulted in a total of 1,477,785 outstanding common shares. Wait, what…too funny. Except for earlier buyers..

On July of 2023, Altamira Therapeutics Announces Pricing of $5.0 Million Public Offering

…at a combined public offering price of $0.45 per share. So time 20x, that means they paid effectively paid $9.00 a share, so they got a little ways to go! Hopefully they doubled up after the reverse..with this type of volume, it should be easy to do – well sort of.

Long Term Chart

Short Term Chart

These type of stocks will be volatile until fundamentals (earnings, FDA approval, etc) kick in, then they can really explode, gaining 10-fold or even more. Then, even the investors who ‘took a double’ will be in the regret wading pool.

Can we think of any similar charts..hmm let’s see. Oh yes, GeoVax Labs (GOVX) whose fundamentals we love, and who has two drug candidates in Phase II.

BTW, for this and all future idea reverse-split opportunities, we are not intending to trade ahead of a ‘bounce’ and we’re out and and that’s it. We need to have good feelings towards the long-term.

GeoVax (GOVX) Live Quote, $1.87.

Long Term Chart

Shorter Term Chart

Killer, 44-Page Report on GeoVax (GOVX).

5 Wall Street Research Reports on GeoVax (GOVX).

Reverse Stock Splits News

Bigger picture, the key of course, is finding a company ahead of a major positive change in fundamentals – which could be earnings, a major contract, or an approval by the FDA. And that, of course, may never come. We’re just betting that if it does, look out. This technique is not for orphans and widows.

Polished (POL) for example went from under $1.00 and then to $12.00. Then they filed for BK a few months later, as in gameover. Zivo Bioscience (ZIVO) on the other hand went from $1.00 to $11.00 and it’s still near $10.

So have fun out there, but be cautious..and no margin trading!

Some of these ideas may jump from $1.00 to $4.00 and then drop back to $1.00, leaving the investor wishing he or she had taken the quick ‘pop.’ That of course is a valid technique. But the way we are looking at it, is that we are coming across some grossly-underperforming companies, primarily starting with the NASDAQ deficiency notice. And when that is combined with a ridiculously low outstanding share count (grossly-undervalued) – there will some companies that will go from $3.00 to $40 or even higher. In less than a year.

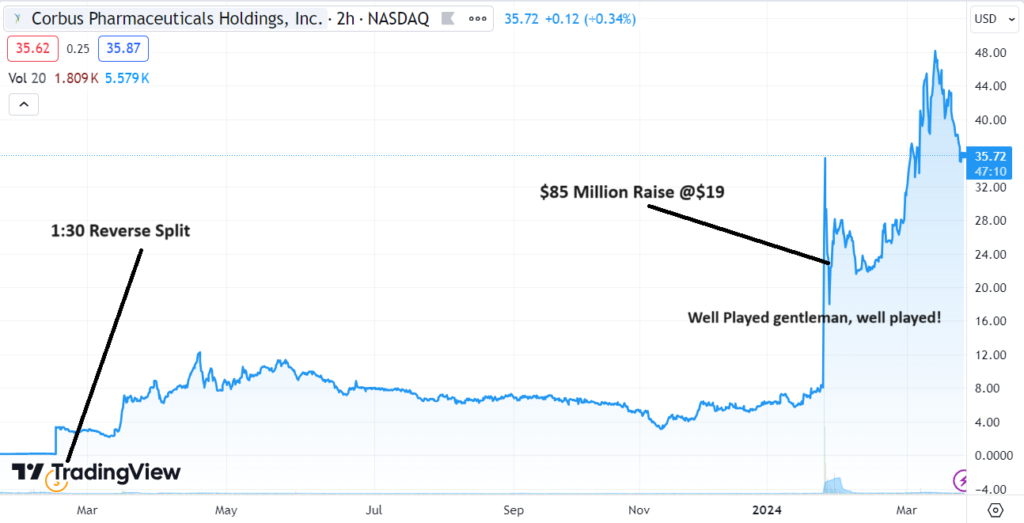

Corbus Pharma (CRBP) is a special performer to closely examine to see what we mean. After a brutal 1:30 reverse split, they went from $3.00 to $20 in a feeding frenzy, and then they wisely (amazingly, cleverly) took the advantage of the opportunity to raise $85 million at $19.00. Some investors cried of dilution, we wanted to give them the high-five.

H.C. Wainwright & Co. and Oppenheimer & Co. were acting as lead managers for the offering.

Then in three months after the ‘dilution,’ it went over $40.00. Hip hop hooray! When HC Wainwright speaks, people listen..

Reverse Split, February 14th, 2023. $3.11

Low, November 13th, 2023. $3.03

Feeding Frenzy Funding, January 14th, 2023. $19.00

High, March 13th, 2024. $49.87

POSTER CHILD OF BUYING REVERSE SPLIT STOCKS

Disclaimer: Geovax is a news and progress reporting client, see report(s) for disclaimer and disclosure details.