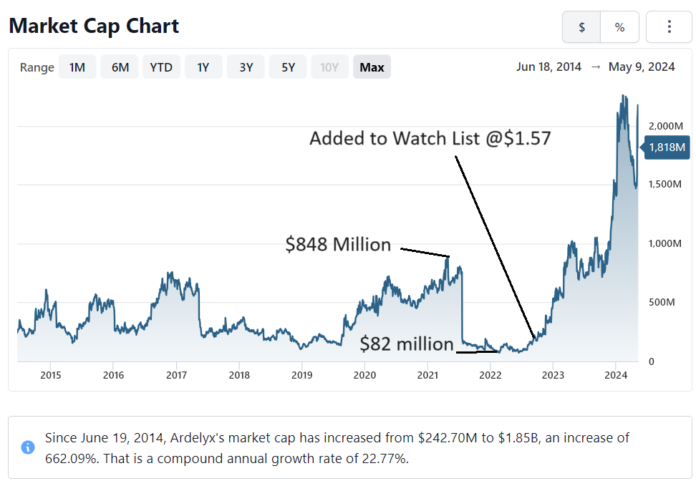

When we added Ardelyx (ARDX) to the Watch List in November of 2022, the market cap near $80 million. Now it’s approaching $2 billion after some ‘dilution,’ which didn’t prevent it from gaining 507%.

Adding Ardelyx (ARDX) $1.57 to Watch List.

Of course there were plenty of detractors (bruised and battered) when the stock fell from $30 in 2014 to under $3.00 in 2022! They were calling the company a scam and a fraud and the management incompetent. Where in fact it was run by Mike Rabb, a genius and the son of Kirk Rabb who founded Genentech.

Ardlyx’s Long and Arduous Trip

While volatile, we see shares moving 2-3x higher over the next 5 years, assuming it doesn’t get acquired, like three of our other micro-cap winners.

Three Watch List companies, each acquired for over $1 billion. And We Have a $26.4 Billion Winning Trifecta!

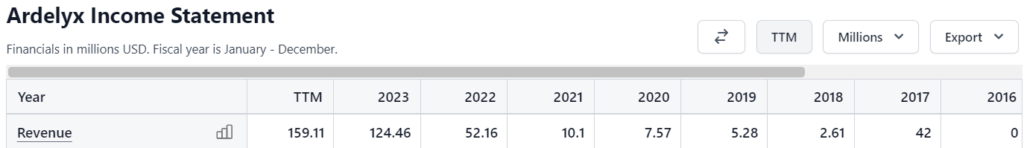

Ardelyx Financials

Get this straight. ALL biotech’s dilute, we don’t care about dilution. It’s the fuel to drive the race car. If your not comfortable with companies constantly raising money, don’t invest in biotech.

On its journey to greatness (though they’re not there yet) the shares in Ardelyx grew from 40 million to over 233 million.

GeoVax: $1.60. Killer, 44-Page Report on GeoVax (GOVX).

Ardelyx Reports First Quarter 2024 Financial Results and Provides Business Update

Company reports $45.6 million in Q1 product-related revenue, including $28.4 million in net product sales revenue for IBSRELA and $15.2 million in net product sales revenue for XPHOZAH

Company ends Q1 with approximately $203 million in cash and investments

Conference call scheduled for 4:30 PM Eastern Time

WALTHAM, Mass., May 02, 2024 (GLOBE NEWSWIRE) — Ardelyx, Inc. (Nasdaq: ARDX), a biopharmaceutical company founded with a mission to discover, develop and commercialize innovative, first-in-class medicines that meet significant unmet medical needs, today reported financial results for the first quarter ended March 31, 2024 and provided a business update.

“The first quarter of 2024 marked an important milestone for Ardelyx as a commercial company. We continued to execute our disruptive approach to commercializing IBSRELA and XPHOZAH by targeting patients in established therapeutic areas who continue to have unmet treatment needs that can be addressed with our first-in-class medicines,” said Mike Raab, president and chief executive officer of Ardelyx. “We drove substantial topline growth as a result of the continued commercial performance of IBSRELA and the incredibly strong launch of XPHOZAH. At the same time, we thoughtfully managed our expenses, ending the quarter with a strong cash position, enabling us to invest in expanding our market position.”

IBSRELA® (tenapanor) records $28.4 million in net product sales revenue in Q1 2024

U.S. net product sales revenue for IBSRELA during the first quarter of 2024 was $28.4 million, reflecting significant year-over-year growth as well as quarter-over-quarter growth. Demand for IBSRELA continued during the quarter, including new and refill prescription growth along with expansion of new and repeat writing healthcare providers.

Ardelyx currently expects full-year 2024 U.S. net product sales revenue for IBSRELA to be between $140.0 and $150.0 million.

XPHOZAH® (tenapanor) launch progresses, records $15.2 million net product sales revenue during Q1 2024

Following approval by the U.S. Food and Drug Administration of XPHOZAH in October 2023, Ardelyx continued to see a strong response from the nephrology community. U.S. net product sales revenue during Q1 2024 was $15.2 million, the first full quarter of sales following the product’s launch in November 2023. Spherix Global Insights, a premier market research firm that publishes independent, syndicated monthly tracking research, reports high levels of awareness, intent to adopt and satisfaction with XPHOZAH in the April 2024 LaunchDynamix report. Among the 77 nephrologists surveyed, 98% rate XPHOZAH as an advance over currently available hyperphosphatemia therapies. 56% of surveyed nephrologists report initiating a patient on XPHOZAH, and among those reported users, 98% report satisfaction with treatment.

Other Corporate Developments

- In March, the company announced the appointment of veteran biopharma executive Mike Kelliher as Executive Vice President, Corporate Development and Strategy.

First Quarter 2024 Financial Results

- Cash Position: As of March 31, 2024, the company had total cash, cash equivalents and short-term investments of $202.6 million, as compared to total cash, cash equivalents and short-term investments of $184.3 million as of December 31, 2023. During the quarter ended March 31, 2024, the company drew $49.8 million in net proceeds under its term loan with SLR Investment Corp.

- Revenues: Total revenue for the quarter ended March 31, 2024 was $46.0 million, compared to $11.4 million in total revenue during the quarter ended March 31, 2023, primarily reflecting increased net product sales and product supply revenue.

- IBSRELA U.S. net product sales revenue was $28.4 million, compared to $11.4 million during the same period of 2023.

- XPHOZAH U.S. net product sales revenue was $15.2 million, with no comparable revenue during the same period of 2023.

- Product supply revenue was $2.1 million, compared to $2 thousand during the same period of 2023.

- Licensing revenue was $17 thousand, compared to $12 thousand during the same period of 2023.

- Non-cash royalty revenue related to the sale of future royalties was $0.4 million, with no comparable revenue during the same period of 2023.

- R&D Expenses: Research and development expenses were $10.6 million for the quarter ended March 31, 2024, compared to $9.1 million for the quarter ended March 31, 2023.

- SG&A Expenses: Selling, general and administrative expenses were $53.0 million for the quarter ended March 31, 2024, an increase of $26.2 million compared to $26.8 million for the quarter ended March 31, 2023. The increase in selling, general and administrative expenses was primarily due to increased costs associated with the ongoing commercialization of IBSRELA and XPHOZAH.

- Net Loss: Net loss for the quarter ended March 31, 2024 was $26.5 million, or $(0.11) per share, compared to net loss of $26.8 million, or $(0.13) per share, for the quarter ended March 31, 2023. The net loss for the first quarter of 2024 included share-based compensation expense of $7.6 million and non-cash interest expense related to the sale of future royalties of $1.7 million.

Conference Call Details

The company will host a conference call today, May 2, 2024, at 4:30 PM ET to discuss today’s announcement. To participate in the conference call, please dial (844) 481-2838 (domestic) or (412) 317-1858 (international) and ask to be joined into the Ardelyx call. A webcast of the call can also be accessed by visiting the Investor page of the company’s website, www.ardelyx.com, and will be available on the website for 30 days following the call.