We are up 234% in Ardelyx (ARDX) $5.23 since adding it to Watch List a year ago and up 71% in Cardiol Therapeutics (CRDL) $0.96, since adding it to the Watch List last April.

Now we have our target on Geovax Labs (GOVX) $0.33, as our next turnaround idea and hopefully our next Trifecta!

Our last trifecta the ‘billion-dollar trifecta’ included Immunomedics (IMMU) at $3 acquired by Gilad Sciences at $87, Dicerna (DRNA) at $3 acquired by Novo Nordisk at $28.25 and Provention Bio (PRVB) at $4.60 acquired at $25 by Sanofi. Combined gains for shareholders $26.4 billion. Not bad!

And We Have a $26.4 Billion Trifecta!

ARDELYX (ARDX) $5.23

Adding Ardelyx (ARDX) $1.57 to Watch List.

Ardelyx (ARDX) $3.40, Receives FDA Approval.

Not a price target, but we can envision Ardelyx trading over $20.

CARDIOL (CRDL) $0.97

Adding Cardiol Therapeutics (CRDL) $0.59 to Watch List.

Cardiol Therapeutics Announces Harvard’s Mass General in Pericarditis Phase II Study.

We met with management at an investor dinner in Boca Raton last week and were unduly impressed. We’ll have an update published soon. We love their medicine and the market they are targeting – myocarditis, pericarditis, and heart failure.

The number of patients seeking and receiving treatment for recurrent pericarditis annually in the United States is estimated at 38,000. Hospitalization due to recurrent pericarditis is often associated with a 6-8-day length of stay and cost per stay is estimated to range between $20,000 and $30,000 in the United States.

Not a price target, but we can envision Cardiol trading over $4.00.

GEOVAX (GOVX) $0.32

We are adding GeoVax to the 2024 Biotech Watch List, our first addition at $0.32 to both date and price stamp, our latest interest. We are highly confident, as we used to say at Drexel Burnham back in the 80’s.

Let’s take a look at two stock charts below.

Despite an very exciting and diversified pipeline with many shots on goal. Any, which we believe could send the stock up ten-fold higher, along with ‘statistically-significant’ (love that term) success in front of the FDA – as the current market cap is only $9.4 million.

While the share count will undoubtedly increase with the passage of time as with all biotechs (via equity offerings or warrant exercises), there are currently only 29.6 million shares outstanding.

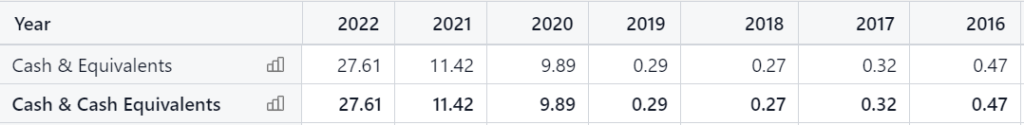

They’re not rich, but over the years (founded in 2001) they have been very adept at tapping Wall Street, to fund their clinical trials as needed. At the most recent quarter ended, they had $12 million in cash and equivalents versus a market capitalization of $9.4 million.

Annual Cash Balances

As the charts below show, they’ve been having a difficult time keeping investors entertained both longer term and short term. We have been following the company for over a decade and we would attribute the current weakness to investor boredom and tax loss selling. There has been no bad news, only good and promising news.

Not a price target but we can envision GeoVax trading over $3.00 or near ten-fold higher and a market value still under $100 million*.

So hoping it becoming our next double, could be a cake-walk. And then we’ll have our Trifecta!

Looking at the short-term chart, investors should be able to envision this back to $0.60 to $0.70 and possibly higher, depending on interim data in January and an end to tax-loss selling as quickly as it started. Only time will tell.

We should have a full report out, digging into their full pipeline and technology, before Christmas.

Longer-Term Chart

Short-Term Chart

NEAR TERM CATALYST

COVID VACCINE NEWS

What currently excites us most about GeoVax is any news related to their next-generation COVID-19 vaccine for immunocompromised patients. The key word here being ‘immunocompromised.’

We know what you’re thinking. Covid is so ‘2000.’ No one gets vaccinated, wears a mask or even uses hand sanitizers anymore. We thought the same thing, until we sat down with management for half-an-hour at an investor conference in October.

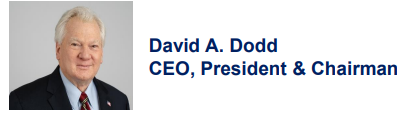

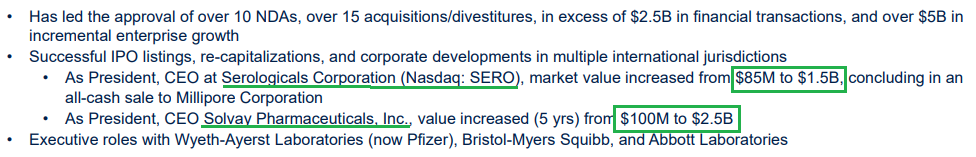

A lot what David Dodd the CEO shared and explained to us was way above our paygrade. However he did take the time to enlighten us that for millions of people with cancer, diabetes, kidney or liver issues to mention a few, getting vaccinated is not an option. It’s not even a choice. They are getting vaccinated.

David Dodd, been there done that..

The entire management team is stellar, and not something you’d expect see for a company with a market cap of $10 million and a $0.32 share price.

There are 15 million immunocompromised patients in the U.S. and 240 million worldwide.

Despite Dodd enlightening us about the immunocompromised, we were still unconvinced and said, “..sounds great David but what attracted us to Covid stocks as a subsector as it went crazy in 2000, was the fact that the government was writing billion dollar checks. But now they’re gone. Are you planning on developing or hiring a sales force to get your vaccine to the Doctors of the Immuno’s?”

He replied, “Guess you haven’t heard of Project NextGen.” No we hadn’t.

Project NextGen

At the top of our list of good things that can happen to GeoVax out of the blue, that could potentially send the share price ten-fold higher – even more than FDA related data news – is news related to Project NextGen.

It appears the government is writing checks again! And to companies we’ve never heard of, not Pfizer or Moderna.

An award is a potential powder-keg for investor enthusiasm. While we can’t guarantee they’ll be a beneficiary of Project NextGen, we can near guarantee that it would be better to be a shareholder before such news rather than after.

Yeah, oh my…

$4 million to BioInfoExperts

$8.5 million to CastleVax

$10 million to Codagenix

$10 million to Gritstone Bio

$20 million to Evidation

$23.2 million to Meso Scale Diagnostics

$59 million to ModeX Therapeutics

$87 million to American Type Culture Collection

$100 million to Luminary Labs

$126.5 million to PPD

In case you’ve forgotten, GeoVax has market capitalization of just $9.4 million. Oh my, again. Come to us lady luck!

HHS: Project NextGen Selects Initial Vaccine Candidates and Awards Over $500 Million

Washington Post: White House Launching $5 billion Program to Speed Coronavirus Vaccines

USA Today: White House to invest $5 billion in next-generation COVID vaccines. Here’s why we need new ones.

Other Covid Related News

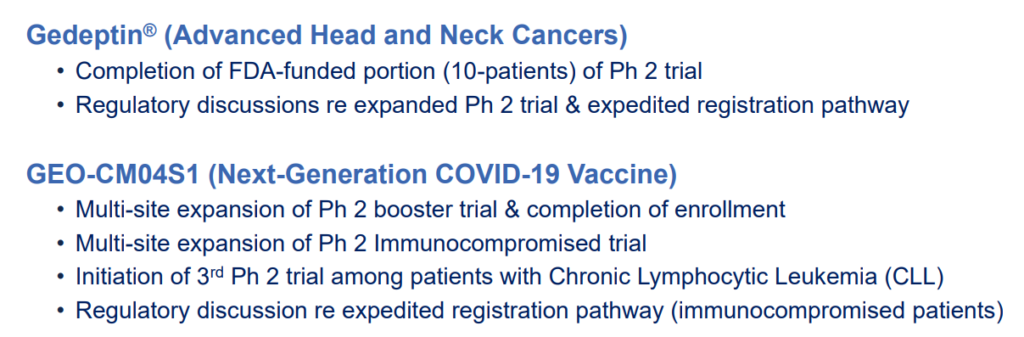

Coming soon from GeoVax, in months not years, will be interim data from a Covid trial for patients with Chronic Lymphocytic Leukemia, in contrast to the Pfizer-BioNtech’s treatment.

Coming soon from GeoVax will also be interim data from a Covid trial that completed enrollment for healthy patients, who had previously received the Pfizer or Moderna mRNA Vaccine. As opposed to treating the immunocompromised as the primary vaccine, this use case is as a booster and substitute for the Pfizer and Moderna treatments.

Already published in Vaccines Journal (warning highly technical) and the Keystone Symposia Conference was Covid related data, detailing the safety and immunogenicity of the GeoVax vaccine. And additionally data detailing that the GeoVax vaccine induced immune responses that were efficacious against the original Wuhan strain and the Delta and Omicron variants with a single dose.

The important thing to note or hypothesize about that, is that if it is effective against all three of those, it may also be effective in future yet to be named variants – and that would be huge.

GEDEPTIN AND CANCER

GeoVax’s lead program in oncology is a novel oncolytic solid tumor gene-directed therapy, Gedeptin®, presently in a multicenter Phase 1/2 clinical trial for advanced head and neck cancers.

We’ll go into details in how early data on treatment suggests the mechanism of action to be solid tumor agnostic, and therefore offers the potential as a therapeutic option for multiple cancer types in our upcoming report.

Wall Street loves multiple indications (multiple types of ailments to treat) which they typically describe as a platform. Platforms are widely recognized of being able to power near unlimited potential, because some data (in particular safety) can be shared in new trials. Trials need to conducted for every other indication candidate, thereby potentially saving platform companies millions and years in the approval process for the new indications.

For more about pipeline timelines, and what’s happening when and where (pre-clinical, phase I, II or III) with the various treatments in clinical trials, scroll through powerpoint below.

Upcoming Trials

In addition to Gedeptin® and the Covid vaccines, GeoVax has IP Applications related to Hemorrhagic fever (Ebola, Marburg, Sudan, Lassa), Zika and Malaria.

Disclaimer

Forward-Looking Statements

This newsletter contains forward-looking statements regarding GeoVax’s business plans. The words “believe,” “look forward to,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax is able to obtain acceptable results from ongoing or future clinical trials of its investigational products, GeoVax’s immuno-oncology products and preventative vaccines can provoke the desired responses, and those products or vaccines can be used effectively, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its immuno-oncology products and preventative vaccines with the desired characteristics in a timely manner, GeoVax’s immuno-oncology products and preventative vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s immuno-oncology products and preventative vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, and other factors, over which GeoVax has no control.

Further information on our risk factors is contained in our periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

*Assuming no additional equity raises or warrant conversion into shares.