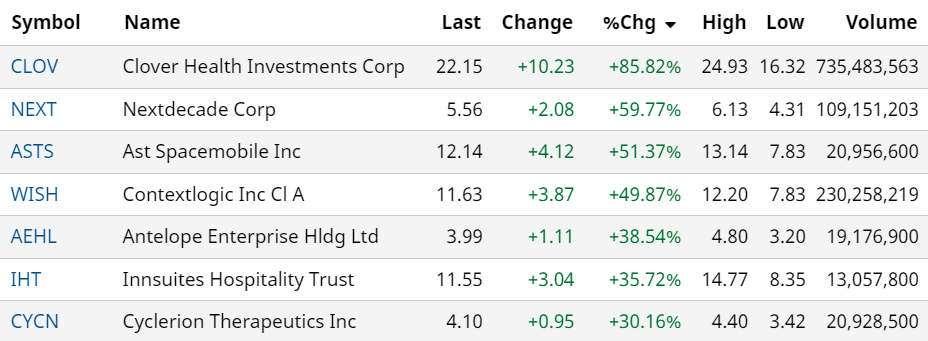

THE TIKI HUT FUND | YESTERDAY’S BIGGEST MOVERS

A Meme Powered Day!

Clover Health Investments Corp (CLOV) | Up 85%!

Truly staggering volume and in the news all day, Clover Health went public on Jan. 8 by merging with a special-purpose acquisition company, or SPAC, run by venture capitalist Chamath Palihapitiya. Founded in 2013 by healthcare entrepreneur Vivek Garipalli and based in Nashville, Tenn., it provides private health insurance and Medicare plans in eight U.S. states. The firm came under pressure several weeks later after Hindenburg Research put out a report alleging that it misled investors. Hindenberg noted, “Chamath’s firm received over 20 million “founders shares” (worth ~$290 million at current prices) in exchange for $25,000 and for promoting the Clover Health SPAC. News

Nextdecade Corp (NEXT) | Powerful 51% Move.

Nice back to back move. Shares of NextDecade Corp. liquified gas company skyrocketed 56.0% in morning trading, putting them on track to break the record one-day gain that was set the previous session, after Evercore ISI analyst Sean Morgan turned bullish on the liquefied natural-gas (LNG) company and tripled the price target. Trading volume ballooned to 42.4 million shares, compared with the full-day average of about 1.3 million shares. NEWS

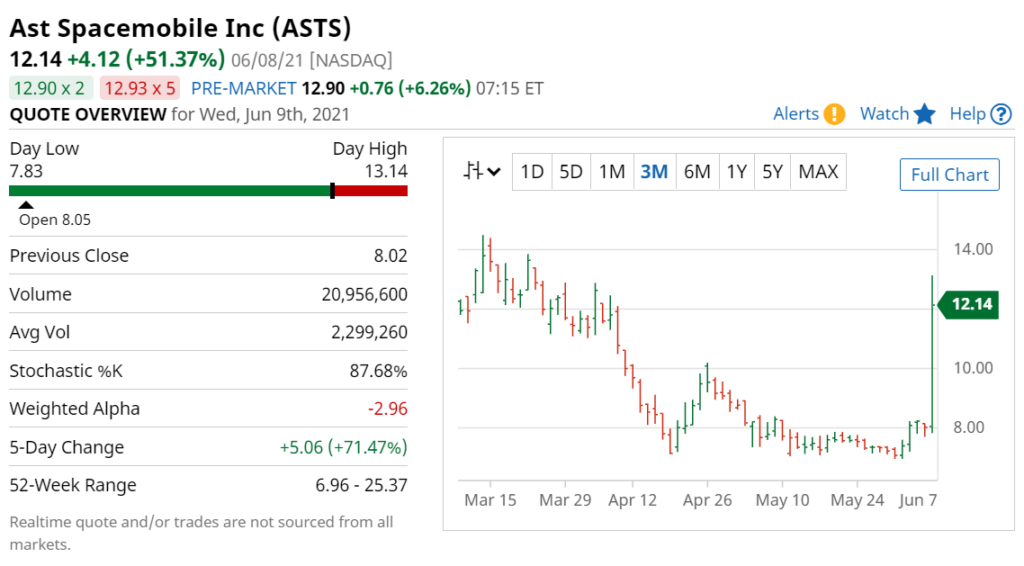

Ast Spacemobile Inc (ASTS) | Gains 51% on no News.

Who needs news these days. Up 71% in the last five days with 10 times daily volume to 20 million shares yesterday. To the moon, literally?

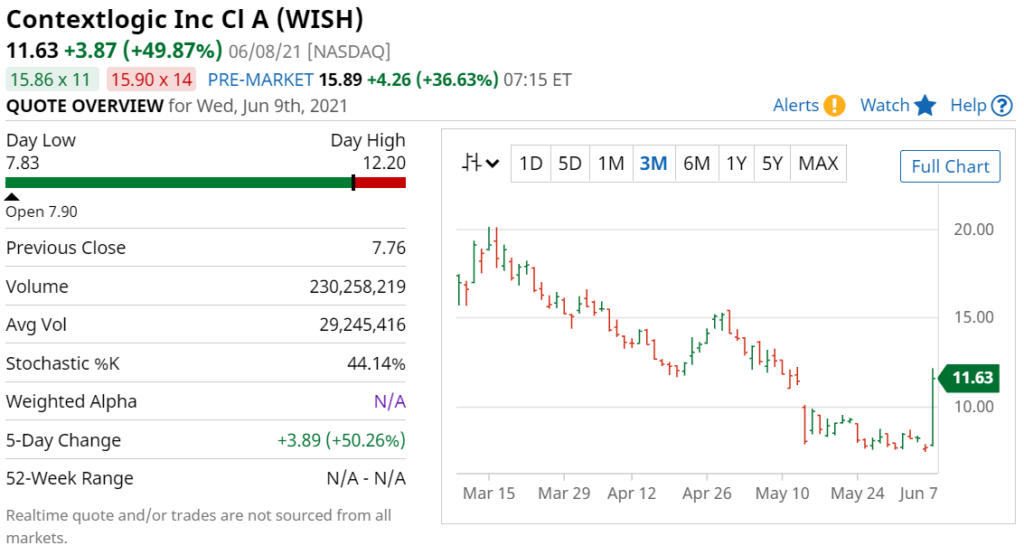

Contextlogic Inc Cl A (WISH) | Another MEME Trade up 49%.

$7 to $12 on a whopping 230 million shares traded. It’s a whole new world. Pre-market looks like $15. Bloomberg says there’s no sign of the mania slowing as members of Reddit’s WallStreetBets forum egg on retail traders to take on professional short-sellers. Contextlogix is an operator of discount online retailer Wish.com NEWS.

Adding GBT Technologies (GTCH) to the Watch List.

After gaining 600% in early 2021, is GBT ready for another run?

Antelope Enterprise Hldg Ltd (AEHL) | Houdini Would be Proud

Chinese ceramics? News in April reported revenue was $21.1 million as compared to $21.4 million for the same period of 2019. CEO didn’t try to deny, everything is pretty much just awful. NEWS

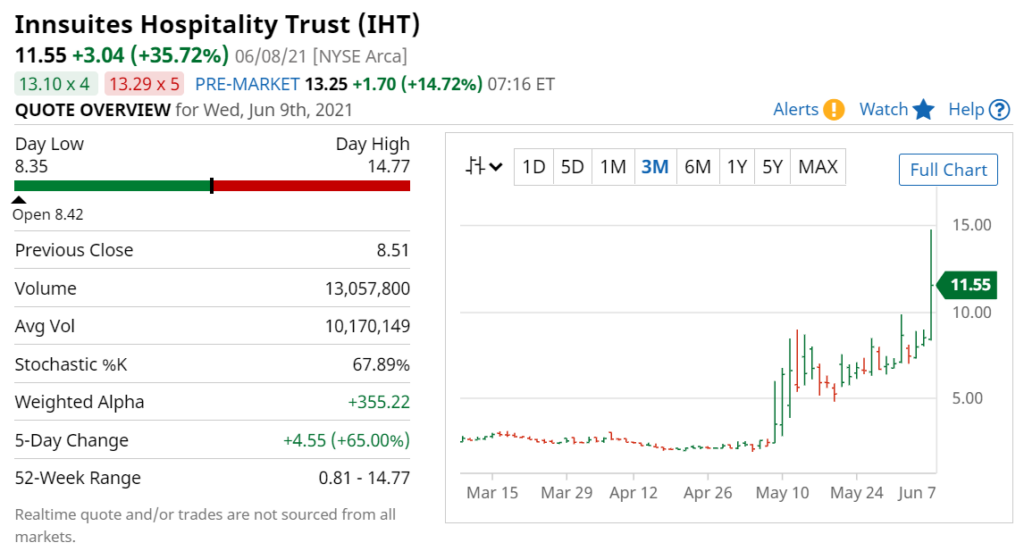

Innsuites Hospitality Trust (IHT) | Makes Big Mover List, a Second Time

The first time Innsuites may the Big Mover up list was in April when it was up 56% to $3.50. Now it even 328% higher. go figure. This was $1.00 per share this time last year. Fantastic. Sales $6 million to $4 million, maybe speculators are playing its stake in UniGen Power, Inc., “..a company developing a patented high-profit potential efficient clean energy generation innovation.” Otherwise, it’s three cheesy hotels. NEWS

Cyclerion Therapeutics Inc (CYCN) | And We Have Deal, Up 30%.

It’s always nice to see a small biotech-startup announce a partnership deal. It’s pretty much what we live and die for, over the past decade. While it’s been sporadic trading for the past year, it’s doubled in the past month, a $70 million gain in market cap. Running low on cash and still early in FDA trial work, Cyclerion got a lifebuoy thrown to them by Akebia Therapeutics Inc (NASDAQ: AKBA) for the development and commercialization of praliciguat.

Interestingly the company, announced the failure of its drug candidate praliciguat in meeting the primary endpoints in two separate clinical studies in November which crashed the stock from $8 to $2. This is worth studying, they have another drug olinciguat for the treatment of patients with sickle cell disease a $5 billion market.

Cyclerion is eligible to receive up to $225 million in pre-commercial milestones, including up to $15 million in the first 18 months. Total potential future milestone payments could result in up to $585M. Remembering, this is NOT an approved drug. Just an approved partner! They also just announced a direct private sale of approximately $18 million (@$3.12) of Cyclerion shares of common stock to EcoR1 Capital, LLC, Slate Path Capital LP, MFN Partners, LP, Invus, Peter Hecht, Ph.D., Lincoln Park Capital Fund, LLC and Polaris Partners. Nice crowd. In fact, we think we’ll add it to the Biotech Stock Review Watch List at today’s open of $3.75.