Massive Potential From California Based Technology Think Tank.

Yes, risky – as in not for orphans and widows of course, but the upside potential is simply enormous. We liked it so much, we signed them as a client.

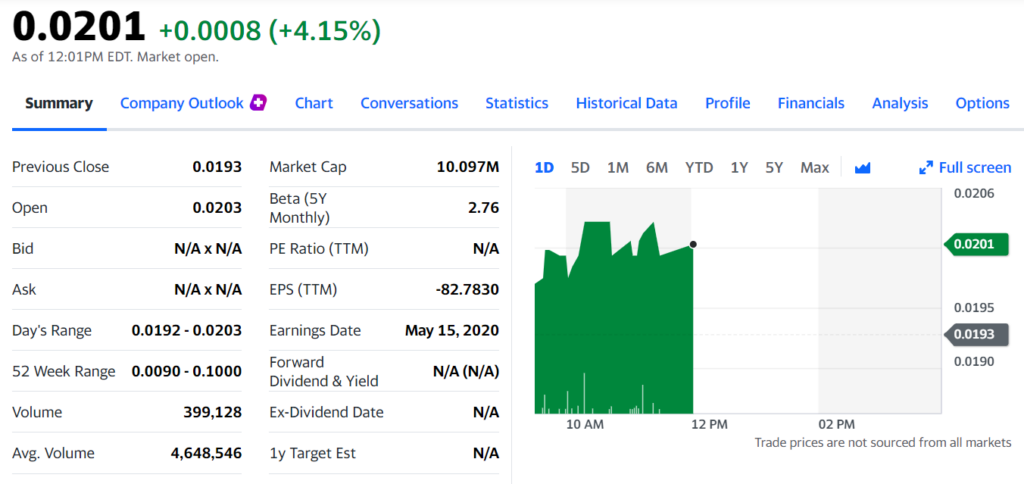

This is our second stab at a $0.02 stock – which just trading at that price, poses a whole set of risks*. But if they can pull off what they are working on – lookout above.

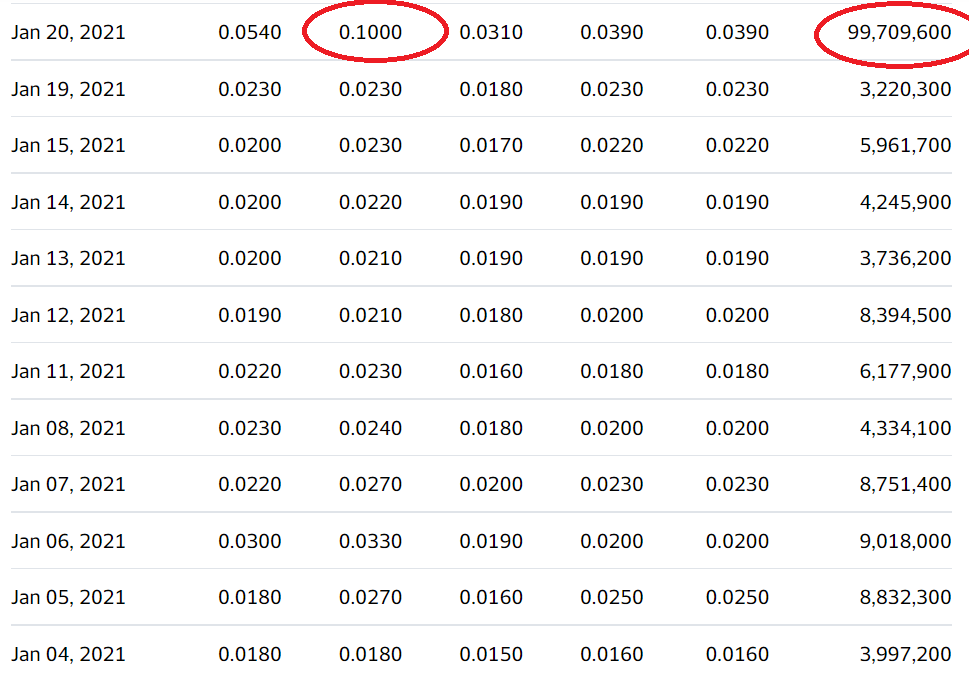

Our previous $0.02 stock Mitesco (MITI)** increased to a peak of $0.65 from November of 2019 to January of 2021.

This can be a ‘trade’ or a trade that turns into an investment – depending on how successful they are at getting a product to market, or more importantly getting a partner to advance one of their technologies to market and the eventual goal line.

When she runs, she runs. Therein lies something of a problem.

If it trades up three or even four hundred percent – then what do you do? The only answer is “play it by ear.”

If you’re accustomed to trading or investing in Biotech stocks – this quandary may be familiar. Small-cap Biotechs – in a very real sense, are think tanks incubating ideas. Their run by extremely bright ‘lab-coats’ working and refining and experimenting.

And while many succeed – such as Biogen (BIIB) experimenting until they found a therapy for Alzheimer’s, Biogen and many others are just experimenting. There was no guarantee of success – which led to the stock gaining $19 billion in value in a single month.

There also are no revenues or earnings with Think Tanks to count on. And often there aren’t enough financial resources to get the ball to the goal line. As such many, if not most think tank start-ups have a game-plan to advance the technology, to a point where deeper pockets get interested.

Large technology companies get larger doing this nearly every day. They sit on the sidelines watching the technology being developed. Then they step up by acquiring the company or acquiring the technology or by partnering with the think-tank and funding the final development. Similarly, Investment Banks often sit on the sidelines monitoring the progress of think tanks.

And that’s when sparks fly.

As an example we added Dicerna Pharma to the Watch List at $3.30 in July of 2017 – the stock had fallen from $40, and they were out of money. Things looked grim. Then Bain Capital who was watching from the sidelines, stepped up to the plate with a $70 million injection to further fund their experimenting. And did the sparks ever fly! At the time Dicerna was valued at $68 million – excluding Bain’s stake. Today at $33.00 it’s valued at $2.5 billion.

Internet of Things (IoT), Artificial Intelligence and Wireless Mesh Networks. Massive Microchip Markets.

This is an extremely complex story, run by technology geniuses who have (after reading their press releases) a rather difficult time explaining their technology. We will attempt to break down their initiatives, into a more understandable level in a follow-up report. For now, here are the basics.

Initiatives in IoT, AI and Wireless mesh networks.

GBT’s software and microchip technology are what ties these three together. Microchip technology is the essential story here. The continually developing software is available for license to microchip design houses in order to help them meet or exceed their market schedules and significantly improve their designs and flow.

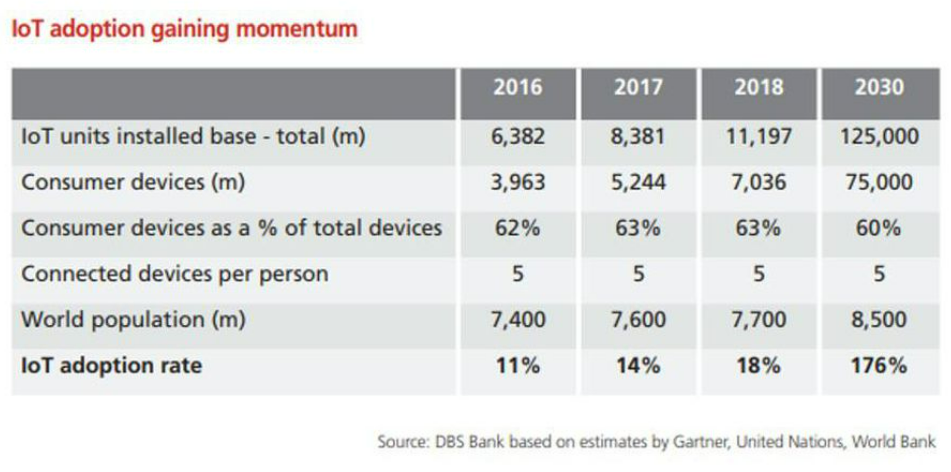

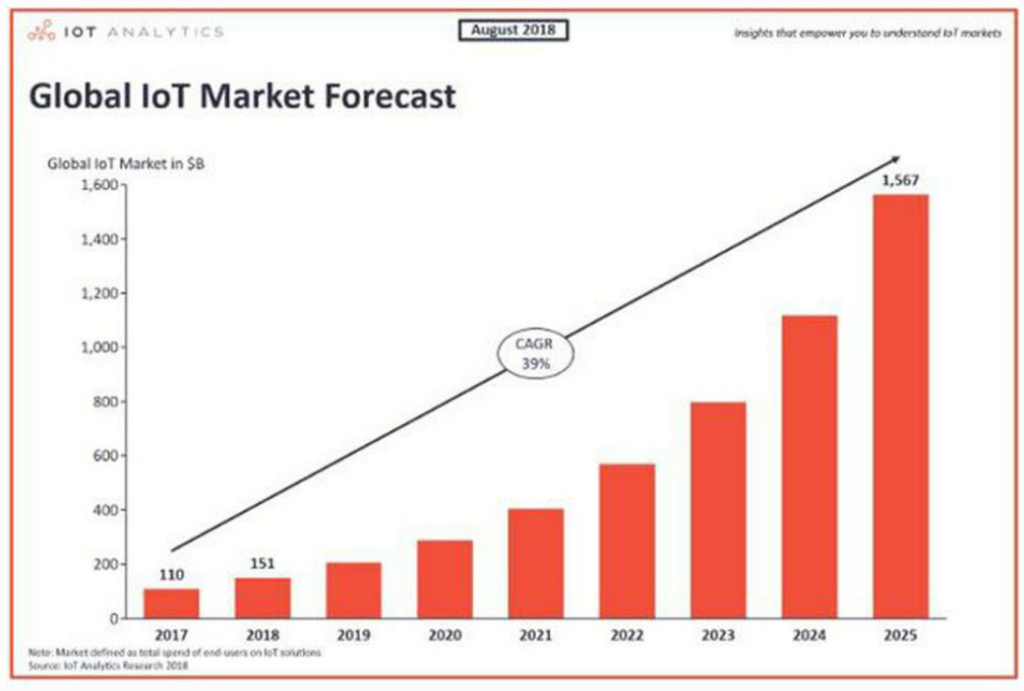

The combination of AI, machine learning and contextually rich, real-time data streams delivered by IoT sensors and networks is going to make IoT business cases compelling from here to 2030 and beyond. We’re actually talking Trillions!

Bain predicts the combined markets of the Internet of Things will grow to about $520B in 2021.

Something is Brewing.

On March 6, 2020, GBT Technologies Inc., (GTCH) entered into a Joint Venture with Tokenize-It, S.A., and formed GBT Tokenize Corp.

This is in our opinion, where the sparks could eventually fly from.

The purpose of forming GBT Tokenize is to develop, maintain and support source codes for its proprietary technologies including advanced mobile chip technologies, tracking, radio technologies, AI core engine, electronic design automation, mesh, games, data storage, networking and more.

Through this Joint Venture the parties commenced the development of an intelligent human vital signs’ device, which we currently refer to as the qTerm Medical Device. A provisional patent application for the qTerm was filed on March 30, 2020 with the USPTO. The application has been assigned serial number 63001564.

Initially, GBT Technologies contributed 100,000,000 shares of common stock of GBT Technologies to GBT Tokenize. Tokenize SA and GTCH each own 50% of GBT Tokenize. Then on May 28, 2021 GTCH agreed to issue GBT Tokenize an additional seven hundred million shares of GTCH.

Following the issuance of the shares of common stock, GBT Tokenize holds eight hundred million shares of common stock representing 66.54% of the GTCH’s outstanding shares of common stock. SEC Filing.

Hmmm, what’s going on here? Keep in mind this is only a $0.02 stock, so while it sounds like a lot of shares – it represents $16 million dollars. But at the same time since it represents 66% of the shares, something big is indeed brewing and it looks like ducks getting in order.

In our opinion, the qTerm product with a second fully working prototype available is the type of product that can be marketed and shown to major technology companies to elicit partnership discussions and/or discussions with an Investment Banker or Venture Capital firm.

This is why we agreed to work with GBT Technologies – after years of research, they are just now entering the stage where partnership news could be released. This, also in our opinion, where we mentioned sparks could fly.

If news of a partnership is announced, the shares could be rapidly revalued higher. And far in excess of the previous moves demonstrated earlier in the year. Now may be the time to establish positions. Ahead of such a news related move.

GBT Tokenize.

We don’t want to get too heavily into the technology, but…

GBT’s software is an integral part (brain) of its overall systems. Their chipset and supporting software are constantly working together within an entire family of software, based on artificial intelligence algorithms.

Their goal is to equip a large part of the 50 billion mobile devices (worldwide) with their mobile chip technology, creating the largest private network ever made. Their microchip technology is based on a mathematical mesh model to work efficiently, around the globe network.

GBT Seeking to Adapt xCalibre Pattern Recognition Technology for Medical Imaging Analytics

Today GBT announced its Think Tank was is hard at work with plans to adapt its xCalibre image analysis to post-process health related imaging data with the goal of detecting potential issues and providing higher accuracy diagnostics.

xCalibre imaging algorithms has the capability of processing high resolution images and videos detecting wide variety of pre-defined irregular objects.

Using GBT’s proprietary neural network technology along with its computational geometry algorithms, GBT is seeking to adapt xCalibre to analyze post-processed imaging of CT, Ultrasound, MRI, and X-RAY. The goal will be to identify abnormalities and alert medical professionals for further investigation.

More to come..

*The risk to low priced stocks is getting financing on favorable terms or at all. **Formerly True Nature. Past performance of Watch List companies provides zero indication of future performance of new Watch List companies.

Disclaimer: Certain statements contained in this press release may constitute “forward-looking statements”. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors as disclosed in our filings with the Securities and Exchange Commission located at their website ( http://www.sec.gov). In addition to these factors, actual future performance, outcomes, and results may differ materially because of more general factors including (without limitation) general industry and market conditions and growth rates, economic conditions, governmental and public policy changes, the Company’s ability to raise capital on acceptable terms, if at all, the Company’s successful development of its products and the integration into its existing products and the commercial acceptance of the Company’s products. The forward-looking statements included in this press release represent the Company’s views as of the date of this press release and these views could change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of the press release. Institutional Analyst along with Revelers.IO Media have been compensated ten-thousand dollars to initiate and provide ongoing coverage by an investor relations firm.