Can These Stocks Double in Value, and Still be 70% off Their Recent High?

Read More and Decide.

Point #1. We’ve been playing turnaround situations since the late 70’s, sometimes (though not always of course) with simply incredible results.

Point #2. We’ve traditionally defined ‘turnaround situations’ as Companies that hit a bump in the road (business wise), the stock price collapses and then (if) they recover business wise…the stock zooms higher.

Point #3. The ideas presented today are not traditional turnaround plays. These are Companies where the stock price has collapsed (really collapsed), but as relatively new startups – they haven’t hit a bump in the road yet. Primarily because they haven’t gotten far enough down the road, to hit a bump! In sum, if there is a turnaround, it would be a turnaround in investor opinion or sentiment, as they say on Wall Street. And this change can create powerful moves (see Carvana below).

Point #4. While these can be very profitable ‘trading’ ideas for the fleet footed, we believe the maximum return potential will be in years, not weeks. We’re not looking for mere doubles HERE, we’re looking for ten-baggers. And those take time. Nothing worse (in our mind) than flipping a double and then seeing it go five or ten-fold higher (see Immunomedics below*).

Point #5. Good luck. It’s hard finding big movers, but even harder holding on to them when they move big. If an investor holds on to their losers (somewhat typical) and sells their winners (also somewhat typical) speculating in these stocks will be an exercise in futility. In the big picture we’re bearish on the market (for large caps), however these price drops are EPIC and as if we were in the midst of a brutal bear market. In many cases we believe these price drops will prove to be unwarranted.

Current example: Carvana (CVNA) which we did not play, fell from $370 to $3.70 and appeared to be on deaths door just before Christmas, with customer complaints making front page news. Closing out the year with a book value of negative -$2.74, and a loss of $2.3 billion for 2022, what was to love?

Try explaining to the investment committee (or wife) why this was a good idea at the time!

Then this..six months later

Were going to guess the majority of speculators who bought at $3.00 in December, sold at $6.00 in January, danced a jig and bought a round of drinks for the house.

While turning $30,000 into $60,000 in a month is certainly cause to celebrate, that same stake was worth $550,000 in late July. For bigger investors that’s $300,000 into $5.5 million. Imagine that party (or regret)!

So yes, turnarounds can be good trades. While no one expected Crazevana to increase 10-fold in six months, we think it’s a good idea to look at the group with a 2-3 year outlook.

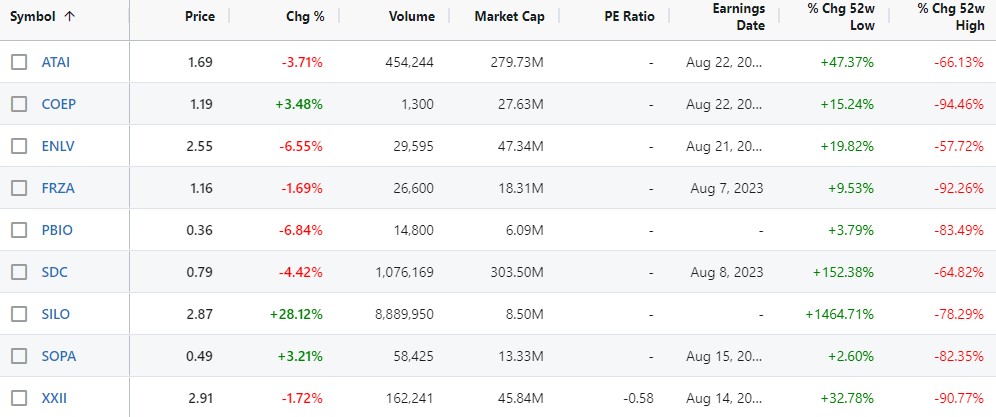

10 Top Turnaround Situations (closing highs from 2020)

Psychedelic: ATAI Life Sciences (ATAI) $23 to $1.75

Biotech: Coeptis Therapeutics (COEP) $10 to $1.15

Biotech: EnliveX (ENLV) $24 to $2.73

Electric Vehicle: Forza X1 Electric Boats (FRZA) $8.00 to $1.20

Consumer Services: SmileDirectClub (SDC) $15 to $0.83

Internet: The Society Pass (SOPA) $55 to $0.48

Psychedelic: Psycheceutical Biosciences (BWVI) $0.75 to $0.13

Medtech: Pressure BioSciences (PBIO) $4.50 to $0.37

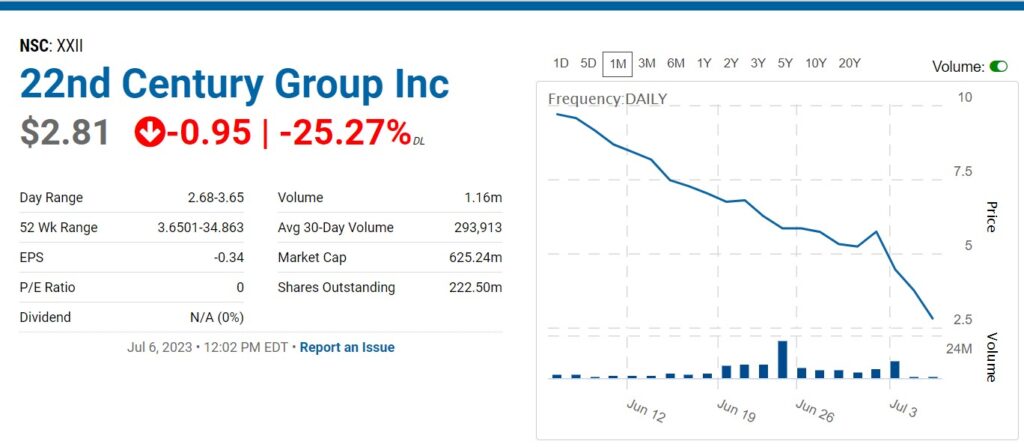

MedTech: 22nd Century Group (XXII) $84 to $3.00

Psychedelic: SILO Pharma (SILO) $20 to $2.25

Yes, it can be a jungle out there!

There are literally 1000’s of Companies down well over 50% since 2020.

We didn’t run a filter to select any of these names. They are simply exciting stories we once heard, that we didn’t buy but made a note of, and then after they subsequently fell 70% or more, suddenly, we’re interested!

Funny how that works. Like it at $20, love it at $1.00. Some we loved so much (Psycheceutical Bio (BWVI), Pressure Bio (PBIO), Society Pass (SOPA), SILO Pharma (SILO), we signed them as news reporting clients.

Each one of these companies have ten-fold potential (read up on them), if business progresses as they forecast, and as we hope. There are certainly no guarantees, but if just a couple (2) go up ten-fold, and the rest remain unchanged, an equal weighted portfolio would increase by 180%.

Here’s the math:

Sample starting portfolio, 10 issuers x $10,000 = $100,000 value.

Eight unchanged = $80,000. Two up ten-fold = $200,000. Total value $280,000 or a gain of 180%. And our feelings are there will be more than a few doubles amongst the other eight.

Here’s our last broad idea list: 2020 Biotech Portfolio Soars 55%, We’re Amazed.

In alphabetical order…

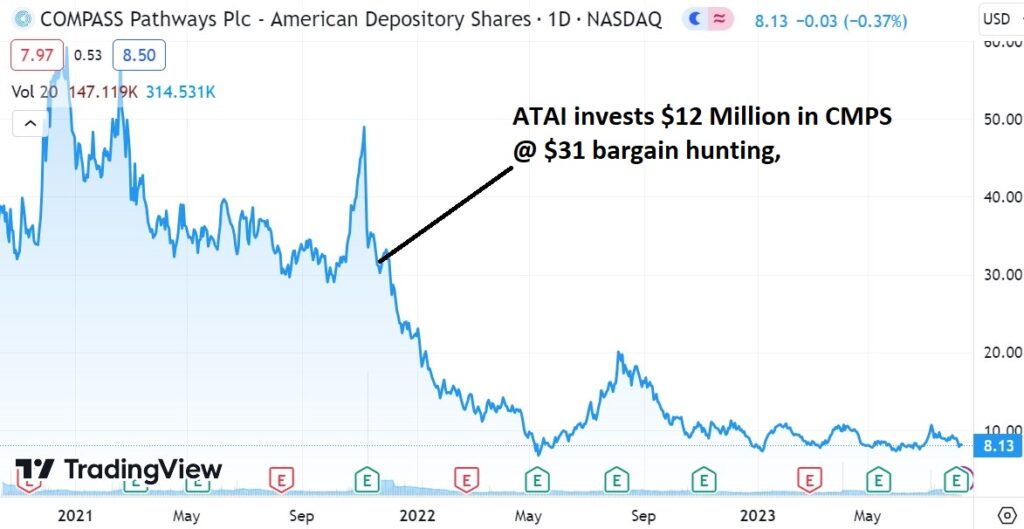

We believe we are less than half a year from something psychedelic treatment getting approved, by somebody.

MAPS (private) and Compass Pathways (CMPS) are in the pole position for product approval. Atai which has Peter Thiel as an early backer went public at $15 and despite the crash in share price, is one of the best financed and most diversified plays in the sector.

Atai owns 20% of Compass after bought an additional 690,000 shares at $31 in November of 2021, when it was down from $60 – in an attempt at bargain hunting.

This is right around the same time we paused the Psychedelic Stock Review, simply due to plunging prices. Had they waited like we did, they could have bought 1.5 million shares for $8.00 yesterday. Liked it at $31…got to love it at $8, we assume.

After adding to his stake, Christian Angermayer, the founder and chairman of Atai, told CNBC that he believes Compass Pathways is “..one of the most undervalued and impactful biotech stocks.” Well alrighty then.

Atai listed on the Nasdaq in June of 2021, raising $225 million at a valuation of $2.3 billion. The stock immediately popped 40%. The current market cap is around $280 million.

Don’t ignore this “blood on the streets” story. It could easily be ten-fold higher in 2026 or 2027.

We have been studying ‘broken’ SPACS for a few months now. There are some crazy valuations – as in crazy undervaluations. In many cases post merger, a huge number of these otherwise well run companies were simply orphaned.

We think Coeptis is just such a Company. With these opportunities, an investor will have to draw a line in the sand, get involved and have patience. Then just wait for news – which at the end of the day is what ultimately propels all stocks higher. Good news that is, of course.

Coeptis is working on cell therapy platforms for cancer, that have the potential to disrupt conventional treatment paradigms. So says the company.

In our opinion, had the Company gone public in a more traditional manner, versus merging with a SPAC, we could envision a valuation five time higher than where it currently trades today.

Coeptis’ business model is designed around maximizing the value of its current product portfolio and rights through in-license agreements, out-license agreements and co-development relationships, as well as entering into strategic partnerships. Nothing ground-breaking there, but we think we discovered their secret sauce.

Secret Sauce: The product portfolio and rights are highlighted by a universal, multi-antigen CAR T technology licensed from the University of Pittsburgh (SNAP-CAR), and intellectual property and knowhow related to the GEAR™ cell therapy and companion diagnostic platforms, which Coeptis is developing with VyGen-Bio and leading medical researchers at the Karolinska Institutet.

The goal is to protect CD38+ Natural Killer (NK) cells so that functional disease-targeting NK cells will not be eradicated, enabling their co-existence with CD38 targeting therapies.

Coeptis Gear Cell Therapy backgrounder

Here are the SEC filings.

We think it’s time to sort through the SPAC rubble.

If this was 2020, the EnliveX’s recent news about its lead candidate, Allocetra,™ would have powered the shares $20.

Maybe even $200 during the Covid stock mania.

The news reported relates to data on patients treated with Acute Respiratory Distress Syndrome (ARDS). Covid may be gone as a play on Wall Street, but ARDS is still a problem which won’t go away. ARDS can still happen and be fatal, after an everyday flu infection. ARDS for those who might not remember, is one step from away from a ventilator.

Here is the data.

- Allocetra-treated patients (17/19) exhibited rapid resolution from their ARDS.

- Allocetra-treated patients (N=21) had a mortality rate of 0% with complete recovery of 19/21 patients at the end of the study’s 28-day follow-up period, compared to a mortality rate of 3.8%−8.9% for age- and gender-severe COVID-19-matched patients, and 39%−55% for critical patients.

- Average duration of hospitalization post-administration of Allocetra TM for discharged patients was 5.6 days

- All patients had elevated pro- and anti-inflammatory cytokines, chemokines, and additional immune modulators that steadily decreased following Allocetra TM treatment.

- No serious related adverse events were reported with Allocetra TM treatment with an overall favorable safety profile.

What we saw in the press release that apparently no one else has (except Carl one of our favorite investors), is that the therapy worked, which is our first hint that it could work on additional indications such as for Sepsis and Cancer. Hmm.

This IS NOT an easy story. Maybe this video below will help, though we doubt it. ENLV has a $46 million market cap, while the global ARDS market size is estimated at approximately $1 billion, and is expected to reach more than $2 billion by 2030.

If you’re the scientific type, visit their website. Enlivex. Here are the SEC filings.

If your looking for sexy, look no further than Forza X1. The picture below alone has future investor mania written all over it, if they get ANY traction at all selling their electric boats.

We met management at a recent investor presentation in West Palm Beach at the Ben Hotel, where about 80 people showed up. So the investor interest is evident. They may not be investing now (just watching) but as we mentioned, if they get some serious traction, or name recognition from boaters who “know” what a Forza boat is without telling them, look out.

A long lasting feeding frenzy could develop as investors think they found the “next” Tesla or Rivian.

We recently did a study of the electric car market, and despite not seeing one recognizable name — valuations of the no-names were in the $100 of millions. like who the heck is Workhorse (WKHS) valued at $230 million with $3 million in sales.

RECENT HEADLINES:

Launches F22 Center Console at Forza Electrified Event Held at The Ben Hotel

Receives 100 Boat Order Potentially Worth $12 Million

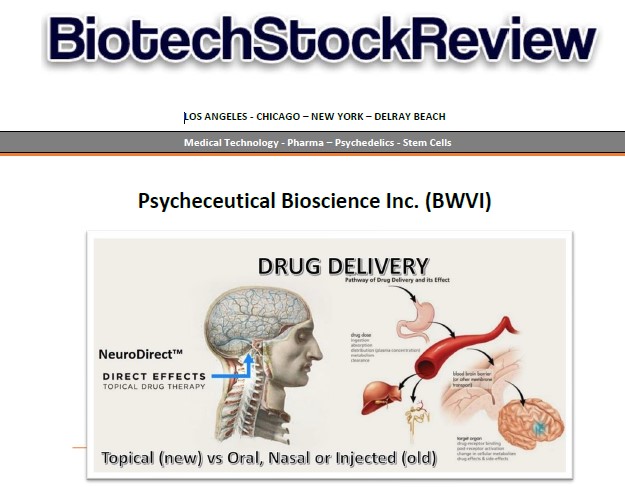

Psycheceutical Biosciences (BWVI)

This by and far our favorite Psychedelic company. High risk and high potential reward. What we like is that they have a topical formulation of Ketamine called NeuroDirect™ in Phase I trials, which is been indicated in recent observational trials to be non-hallucinogenic and effective in 80% of the patients treated (link to observational trial below).

Current delivery methods conducted at over 1,000 practitioner offices include nasally, orally and intravenously. All are considerably more complicated to administer versus topically.

Since they’re using Ketamine which has already been approved by the FDA, the risk is considerably lessened. We know Ketamine works (JNJ sold $131 million worth in the last quarter) and that it is safe enough to get approval. What Psycheceutical needs to prove is that it works and is safe when applied topically.

So what were talking about here is a potentially new and improved DELIVERY method. Simple story really.

Where it really gets good, is if it get’s approved from the FDA, it opens a huge opportunity to use the same delivery method for other psychedelics — as well as psychedelics made by others. Under those circumstances tiny Psycheceutical becomes defacto the most important company in the sector. So say we.

Many of the current risks can be viewed as potential benefits. The risk that they are modestly financed could become a benefit, if they find financing, which more and more psychedelic companies are getting since the 4th quarter of 2022 (Lusaris Lands $60 Million).

Then there is the risk in that they merged with a public company that was listed on the pink sheets, a ‘no-no’ for most investors, even though they are current with their filings. It would be a significant benefit when they officially change their name, complete their audits going back two years (a huge undertaking) and become fully reported and listed on the OTCBB and off the pink sheets.

Last week they announced they just finished the audits for their financial statements – so we are very close to game on. Financing is extremely difficult if not impossible for companies with non-audited financials.

Read our 20 page report on the company:

Report: One of the Most Important Companies in the Psychedelic Sector.

And these articles..

Psycheceutical Bioscience Announces Completion of PCAOB Audit and Future Corporation Action Strategy

Important Observational Study (must read)

Pressure BioSciences (PBIO)

Pressure Biosciences (PBIO) has been quietly minding its own business, tolling away generating a couple million dollars a year in sales for over 20 years, selling an instrument called PCT to names like Merck, Pfizer and Genentech.

Run by true rocket scientists, the PCT instrument is used by major drug development companies using high-pressure, to control bio-molecular interactions such as cell-lysis and biomolecule extraction.

Okay, big words and not sexy, but in essence it’s a tool used for biomarkers, target discovery, drug design and development. They are installed in over 300 pharmaceutical plants both here and internationally.

In short the instrument can exert pressure up to 60,000psi. By comparison a tire is 30psi, and at deep depths, submarines (and humans in them) can implode at 16,000psi.

Here’s a video of how it works. Again, nothing sexy, but don’t leave yet. The story is about to get good.

Public since 2005, they decided to pivot in 2021 by repurposing the PCT instrument to also serve the nutraceutical, cosmeceutical, agrochemical, and food and beverage manufacturing sectors – which represents $100’s of millions in potential revenues. The repurposed instrument is called UltraShear.™

The simple story is UltraShear’s reducing the particle size of ingredients so small (nano-size), that they become (and stay) water soluble. Sounds simple, but this really is huge, in so many ways to so many industries. If you believe they can do that (mix oil and water), investors have to be interested. And there is plenty of high-level proof and studies, that it can perform as promised.

And if you don’t believe us, believe that Merck, Pfizer and Genentech rigorously tested every aspect of the instruments and their reliability, before shelling out millions to the company.

We are wildly optimistic about UltraShear and its prospects, despite the falling share price.

News in June of 2021 of UltraShear caught the eyes of traders and flippers and the stock surged to over $4.00. But as flippers come, they also go, and they left in unison starting shortly after the spike to $4.00.

..and again shortly after the spike to $2.15 last January, after news that Pressure Bio began targeting the CBD market with its UltraShear device.

The short (but viable and doable) story is the pressure exerted on CBD oil can make the CBD truly water-soluble greatly increasing it’s effectiveness.

The company believes it’s instruments can provide both CBD or THC producers (and vitamin makers) the ability to have THE most effective version of their product in the world.

We’d liken this to various computer makers with the ‘Intel Inside’ sticker. Intel doesn’t make computers, it makes the computers from others better.

Yes the ‘world’s best’ is a big statement, but if you take an hour to study the science, you can see how they do it. We have dozens of articles to read, that we we placed together in a collection – including how the University of Ohio has proven the water solubility claim to be fact, as it relates to food and beverages. Nothing works as good as UltraShear for creating nano-emulsions.

So where does that leave us? We think it gets to the point where every seller who is going to sell, has sold. Are we there today? We can only say it feels like this is the bottom, and that the last towel has been thrown in.

It could go lower, it could go higher — and even easily double in a matter of weeks. But we are looking a few years out for the elusive 10-bagger and Pressure’s move into everyday consumer products such as CBD and beverages (making ingredients into beverages – truly water soluble) offers plenty of fuel for the fire. It just don’t expect it to happen overnight.

Due to its modest financial position, Pressure Bio has wisely decided to go target the low-hanging fruit first, namely the CDB producer market.

Once consumers find out on their own that “UltraSheared CBD Inside” (or however they decide to market it) is the fastest acting and best performing CBD for pain relief, and that they’ll only buy UltraSheared CBD, they’ll be no reason for ALL CBD producers to fall in line.

Ditto for THC as the fastest acting and best performing (buzz onset) THC.

Is Ultra-Shear’s™ Nano-THC the Most Powerful and Fast-Acting THC in the World?

They are picking up new clients everyday, as detailed in press releases that can be read here.

We added it to the regular Watch List as a “if you liked it at $160 (in 2005) you have to love it at $0.80” play, and we feel highly confident this will work for us. As a client we have 75,000 shares – which we’re thinking could buy us a 60 foot yacht named Pier Pressure (used of course) in 2027 – so patience is our middle name.

This is really not a complex story. UltaShear is a best in class product, the only question is can they effectively market it. Will it lead to $10 or $20 million in annual sales, or $100 to $200 million. Marketing is the key and time will tell. At $0.35 we feel we can be patient.

Going with Topical as our favorite method of administering psychedelics, SILO Pharma (SILO), like Psycheceutical (BWVI) is topical too, but using an entirely different method to apply topically.

If we can attribute anything in particular to the prolonged price weakness, it would be the 50:1 reverse split to get uplisted to Nasdaq in September of 2022 (and raise $5 million). In short, if an investor owned 100,000 shares at $0.14 before the split, he or she probably had a dream that it goes to $1.00 (it happens) and they could make $100,000.

Then they wake up one day and discover they have 2,000 shares at $7.00. It’s still worth the same $14,000, but the dream has been modified. Now to make $100,000 the stock would have to rise from $7 to $50. They think $0.14 to $1.00 is possible. $7 to $50, well not so likely. So they just bail. Whether its $7, $5 or $3.00 – the dream is gone, so they just sell indiscriminately, regardless of fundamentals or news reported.

Ditto for someone who owned 10,000 shares with the dream to make $10,000. They’re left with 200 shares – it’s not even a block. So they’ll sell at any price, just to get rid of the dream interrupted.

And as we mentioned once before, this indiscriminate type of selling can continue until everyone who wants to sell, has sold. And again, it’s just a gut feel, but we think we’re there.

As for buyers (as in buying today) due to the greatly reduced amount of shares outstanding, liquidity has been reduced, so it’s difficult to buy a significant stake without moving the price up. Just as easily as a small amount of selling can move it down. But if an investor believes in the story long-term like we do, they can sit on the bid or become the bid. Patience getting in and patience getting out is key, until good news arrives.

Like all biotech companies, the company has to work it’s way through the laborious FDA process, but they have been making excellent progress and in particular, we like their SP 26 Ketamine which is targeted at patients suffering from fibromyalgia.

For the estimated four million Americans with fibromyalgia, the chronic condition causes episodes of widespread pain throughout the body that have no specific cause.

Researchers have found consistent evidence that intravenous ketamine infusions for patients with fibromyalgia, could relieve pain. However studies faced a key challenge: in that the pain relief was typically short-term, wearing off a few hours after the infusion.

For consistent pain management, patients would need frequent ketamine infusions for the duration of a flare-up, which can last anywhere from a few days to a few weeks.

That’s why Silo is working on a time-release implant. An implant that could deliver a steady, low dose of ketamine that could be a more viable alternative to repeated visits to a clinic to receive IV infusions.

In addition, in March, Silo announced results from a preclinical study that demonstrated SP-26 was safe and well-tolerated. The drug candidate used Zylo Therapeutics‘ Z-pod technology to package ketamine in tiny silica particles that allow the developers, to better control the dosage and release of the pain-relieving treatment.

Preclinical efficacy studies are already underway for the novel topical ketamine treatment, with data expected in September or October of this year. Those results should help bolster Silo’s application to begin human trials under the Food and Drug Administration’s streamlined 505(b)(2) pathway.

The 505 approval pathway is intended for treatments where there is already published research on a treatment’s safety or efficacy (such as Johnson and Johnsons approval).

RECENT HEADLINES

Systematic Review of the Use of Intravenous Ketamine for Fibromyalgia

Oh how some of the high and mighty have fallen. This was one of those impossible to get IPO’s. It was priced at $23 in late 2019 and hello, valued at $8.1 billion.

The start-up, founded in 2014, sells teeth aligners directly to consumers on its website and in its ‘SmileShops’ starting at $1,895 for a two-year plan. Founders Alex Fenkell and Jordan Katzman want to disrupt the orthodontics industry with less expensive teeth-straightening treatments, convenience, and splashy television and social media advertisements.

They raised $1.3 billion which is a good thing (for them, not investors) as they spent $289.3 million on marketing and general expenses last year. Whoa.

Can it get back to $8.00 for a ten-bagger..only time will tell. We wonder if any dentists own shares. Now might not be a bad time. If they liked it at $21 and an $8 billion value they should to love it at $0.80 and a $280 million valuation. It could be a good hedge against Smile Direct actually disrupting their business. Own shares in the enemy? That would be like a NY taxi driver selling their medallion to buy Uber stock.

The whole offering, which takes place without the need for X-rays or regular visits to an orthodontist, costs about $1,895, compared to traditional solutions that go for $5,000 to $8,000.

Note (as reported by our short-seller friends) most of the $1.3 billion in IPO proceeds didn’t actually go back to the company: About $700 million was used to pay off insiders and other pre-IPO investors, almost $400 million of which went to the three Katzmans.

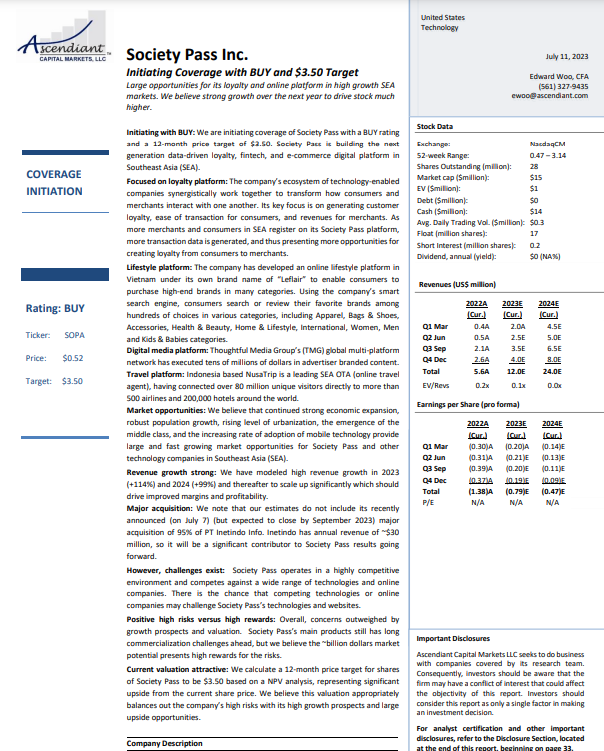

This is by and far our favorite ‘internet’ technology play. We liked it at $0.95, and we love it at $0.50.

IPO at $9.00 raised $26 million in November of 2021. Within weeks it ran to $77 with a closing high of $52 – in an EPIC feeding frenzy. We have a new report in the works, in the meantime you can find five reports from four firms here:

Society Pass (SOPA) Research Reports

The most recent and well written report from Ascendiant Capital Markets comes with a $3.50 12 month price target, or up nearly 10-fold. As we used to say at Drexel Burnham in the 80’s, we feel “highly confident” this will achieve ten-fold status, given time!

We love the technology incubator model, and one of the most exciting holdings in its portfolio is Thoughtful Media.

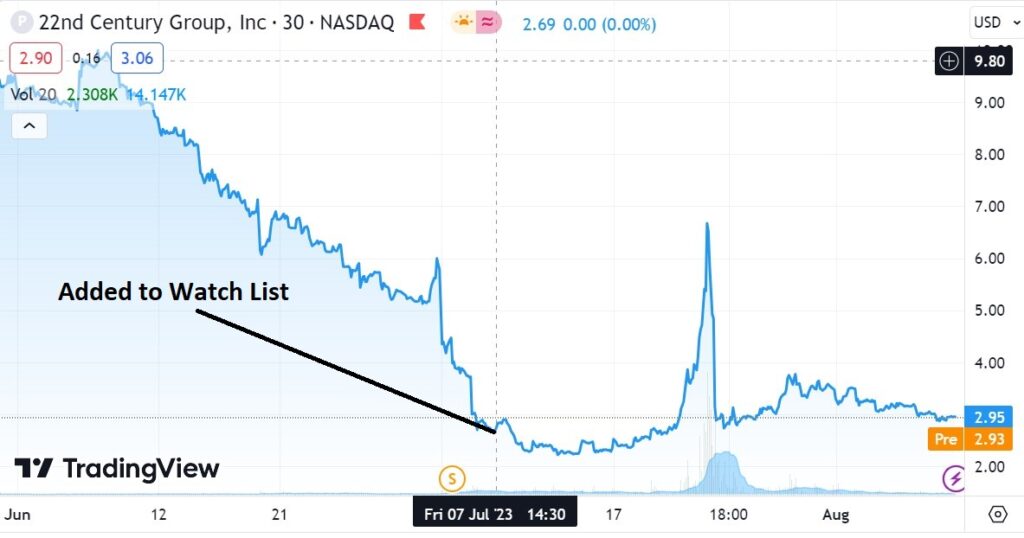

SHORT TERM POST REVERSE CHART

We were extremely impressed at managements presentation at the Think-Equity Investor conference last October.

We added it to the Watch List shortly after a reverse stock split on July 6th.

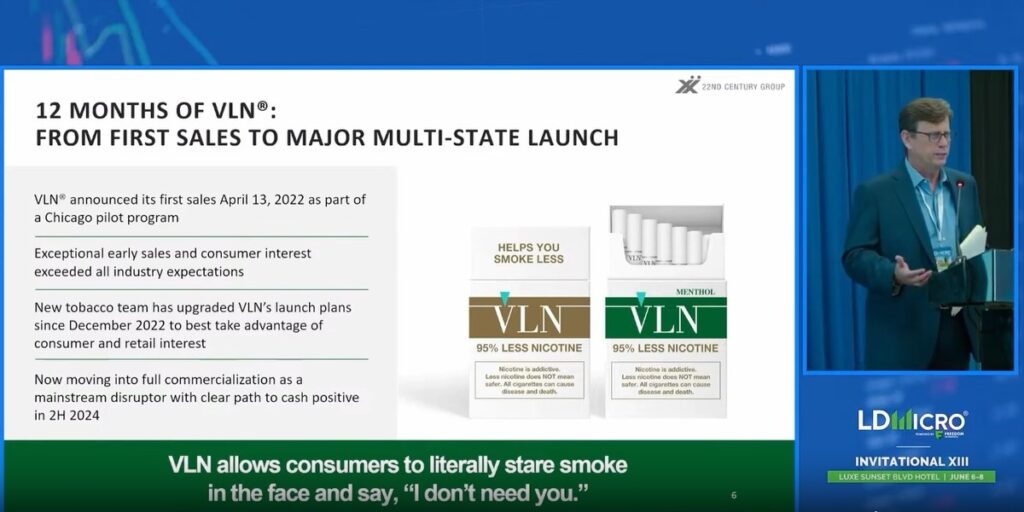

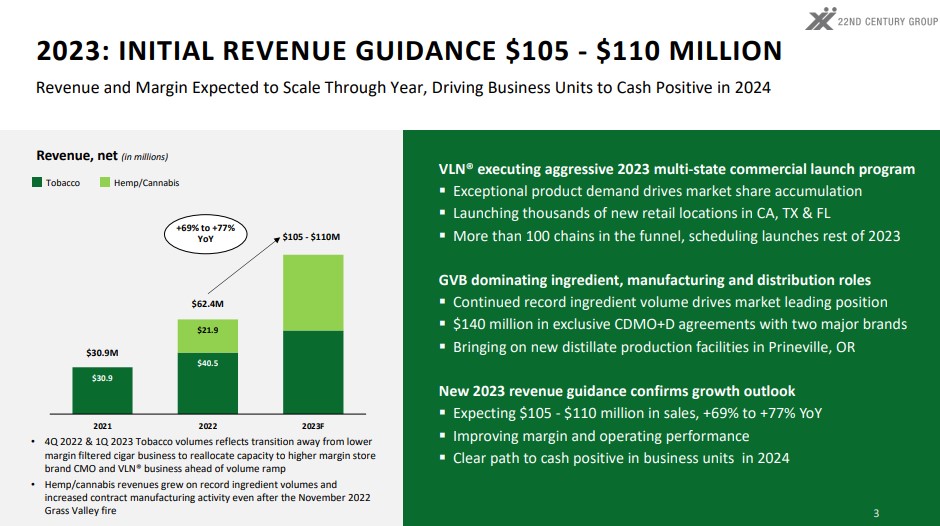

This is probably the simplest story to follow and invest in. They have a ‘new’ cigarette they are rolling out. There’s the story.

The stock got crushed for arguable reasons, most that we don’t agree with (aside for the 15:1 reverse).

All an investor has to do is buy – and then read the quarterly sales reports. If they’re good, hang in there. If instead sales plateau and it seems like consumers are trying them once, and then going back to their Marlboros or Newports, think about an exit strategy.

This reminds us of Carvana in some ways. Except in this instance, there hasn’t been any terrible news related to their low nicotine cigarettes. If they were working on “developing the cigarette,” we’d probably be watching from the sidelines. But the product is out, it is selling well and distributors are signing up.

Will it sell well long-term, nobody knows for sure.

We enjoy nicotine (ecigs, lozenges and gum) so really don’t get the ‘minimal’ nicotine proposition, but:

#1. Tobacco remains a multi-billion dollar market. They have separated their marketing efforts into two geographic sector. CA, FL, IL etc has tobacco sales of $20.2 billion. GA, IN, MI, NY etc has tobacco sales of $43 billion.

#2. The government is gunning after combustible cigs. Biden Administration Targets Removal of Most Nicotine From Cigarettes

The Company received the first and only FDA Modified Risk Tobacco Product (MRTP) authorization of a combustible cigarette in December 2021.

You can watch the video presentation here. 25 minutes, you have to register, but it is free.

Powerpoint

OTHER NEWS: Nasdaq proposes listing rule changes related to reverse stock splits (a good thing).

*Immunomedics (IMMU). Immunomedics (IMMU) $3.00 to $88, Up 29-fold, Our Second Best Idea Ever.

AI disclaimer: Where in the past we went to filings for financials, we now rely on AI search engines, which may be inaccurate. As example, Bard replied “As of August 8, 2023, atai Life Sciences owns 22.0% of Compass Pathways. This makes atai the largest shareholder of Compass Pathways. atai has been increasing its ownership of Compass Pathways since 2021, when it acquired a 19.4% stake in the company.

Going concern disclaimer: Many of these companies (let’s just say all) have substantial doubts regarding their ability to continue as a going concern. The well publicized slow down in IPO’s has also affected secondaries and the like, for companies which are already publicly traded needing growth capital.

Newsletter Disclaimer: Every Company mentioned in our newsletter is a client, has been a client or may become a client. Institutional Analyst Inc., has opted to exclude specific disclaimers at the bottom of every newsletter we publish as it often exceeded the length of our letters by 4-fold. Our company client disclaimers can now be found on every report or progress update report we author – at the bottom of the report in a readable sized font. Required reading, we play nice with nearly every company we report on, because they are either client or we would like them to be a client, so impartial we are not. Clients in the letter include BWVI, PBIO, SOPA SILO.