By George, they did it.

Many companies public or private fall short of their ambitious plans. They either kick the can, modify plans or just give up and pivot. ‘Pivot’ in the past five years – has become the politically correct way to say FAIL – LOSER. No, everyone does not get a medal on Wall Street!

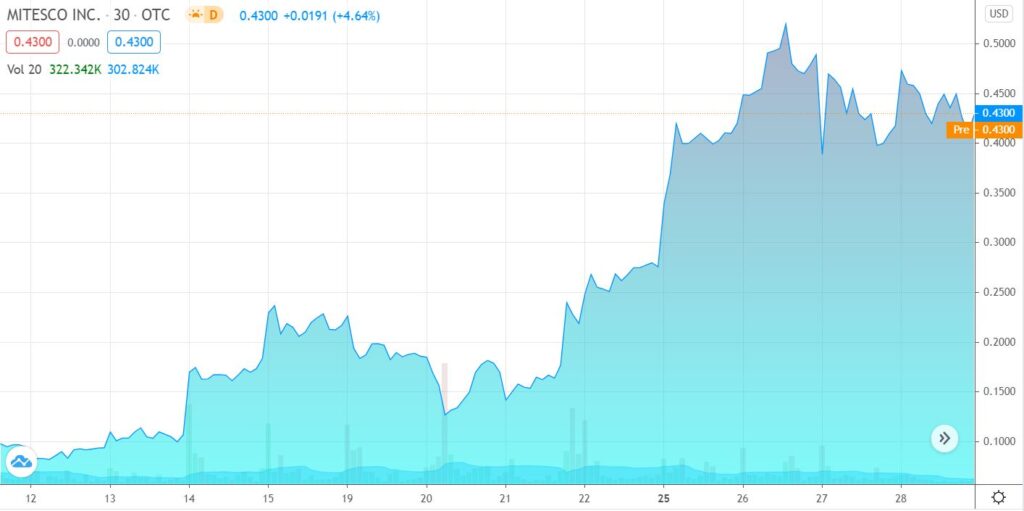

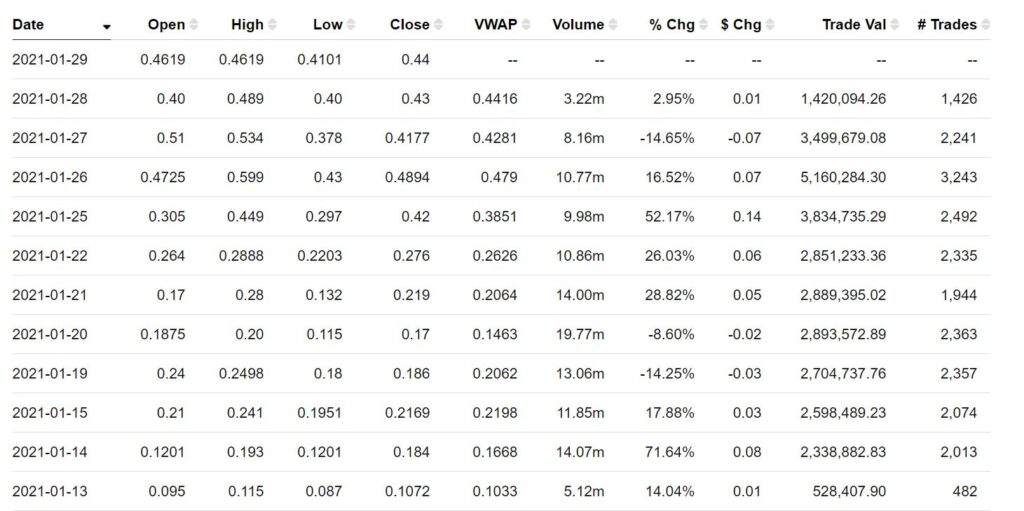

Mitesco (MITI) has not failed, as it will open its first clinic next Tuesday.

When we first discovered Mitesco (then known as True Nature) at $0.02 as a start-up, it was just an idea incubator. The risk of them finding and incubating something worthwhile was about as high as it gets. Investing at that level was suitable only for the most venturesome (aka having balls) type investor, willing to take on maximum risk for maximum reward.

Initiating Coverage on True Nature Holdings (TNTY) $0.02. Adding to Watch List.

Now, while still risky – Mitesco’s opening of an actual facility, that will be seeing actual patients, drops it a few notches on the risk/reward scale. Investing in anything in the stock market is risky (from Kellogg: K, to Tesla: TLSA) and should of course be first filtered, by one’s own risk/reward profile. Always.

Along the way we have posted or mentioned Mitesco 28 times – with news of progress, links to interviews with management, and more (so you can’t say we didn’t tell you):

True Nature (TNTY) Readies Launch of Mitesco: “The Medtech Incubator”

True Nature|Mitesco (TNTY). Coverage Report Issued.

Is True Nature (TNTY) $0.04, Nearing a Breakout?

Our Favorite Incubator, Incubates! Telehealth in its Future?

Press Release: Biotech Stock Review: Mitesco to Launch Telehealth Enabled Primary Care Clinic Business

So Where is Mitesco Today?

Mitesco Announces Opening of The Good Clinic at Nordhaus, Minneapolis; Expands Investment Outlook and Rollout Strategy

MINNEAPOLIS, MN, Jan. 21, 2021 (GLOBE NEWSWIRE) — via NewMediaWire — Mitesco, Inc. (OTCQB: MITI) today announced that its new clinic subsidiary “The Good Clinic TM ” expects to open its flagship unit in Minneapolis on February 1, 2021. The new clinic is located in the Nordhaus apartment complex, one of 52 multi-unit properties nationwide developed by Lennar Corporation. It houses 600 apartments with a target population of approximately 1,000 individuals.

Larry Diamond, CEO of Mitesco, said, “While the opening of this first unit is exciting, more meaningful is the enthusiasm with which the market has embraced our direction, as demonstrated by a substantial increase in our shareholder base and market capitalization. This increased level has shown that the commitment of our early investors, and their insight, were well founded. We have new investment banking relations as a result of the market support, and with their contribution we expect to be able to affect our expansion plans which call for 50 units over the next 2-3 years nationwide, as always, subject to suitable financing and market conditions.”

“We are extremely pleased with The Nordhaus,” added Michael Howe, The Good Clinic CEO. “The facility design is welcoming, relaxing, and will provide a redefined primary care experience. Our unique approach will establish The Good Clinic as an innovative healthcare organization. Lennar management is an enthusiastic and supportive landlord that we expect to be a key player in our national expansion.” Kevin Smith, DNP, Chief Nursing Officer, shared, “Our concept is grounded in the advantages of utilizing the professional expertise and empathy of Nurse Practitioners. Our focus is to provide the systemic support that will facilitate the rapid expansion of independent practice for this segment of Healthcare Providers.”

The Company has previously announced that it signed two (2) letters of intent providing for its expansion into the Denver, Colorado marketplace in conjunction with Lennar. Agreements with other developers in Minneapolis are underway, as is planning to open units in Florida and New York.

Separately, the Company noted that its relationships now including investment banking firms whose operations include both institutional and retail investors. Diamond noted, “We believe our base of individual investors may have doubled in the last month, and we believe a number of institutional investors may have established significant positions in our common stock. We expect that trend to continue as we prepare to up-list our stock from the OTC market to a major exchange. Upon completion we believe further expansion through acquisition may allow us to increase the rate at which we may expand our footprint, both in the US and with a view toward international markets.” Parties who wish to be considered as expansion situations should contact Larry Diamond at 1-844-383-8689 (x1), or by email at: LDiamond@MitescoInc.com .

Our Operations and Subsidiaries: The Good Clinic, LLC, and Acelerar Healthcare Holdings, LTD.

The Good Clinic, LLC is a wholly-owned subsidiary of MitescoNA LLC, the holding company for North American operations. The Good Clinic is building out a network of clinics using the latest telehealth technology with the nurse practitioner operating as its primary healthcare provider. It will begin in Minneapolis and expand nationwide. Today, 23 states facilitate nurse practitioners practicing to the full scope of their skills and training. The executive team at The Good Clinic™ includes several of the key executives who brought Minute Clinic (previously known as Quickmedix) to scale, which was acquired by CVS for $170 million in 2006.

Acelerar Healthcare Holdings, LTD. is the Company’s wholly-owned, Dublin, Ireland based entity for its European operations. There are several targets in Europe under evaluation and management believes cross-border expansion for these new, proven healthcare technology solutions may prove a profitable opportunity.

The Mission of Mitesco, Inc. formerly known as True Nature Holding, Inc.

We have in development a suite of offerings aimed at enhancing healthcare throughout the supply chain and to end-users. We intend to acquire and implement technologies and services to improve the quality of care, reduce cost, and enhance consumer convenience. We are focused on developing a portfolio of companies that provide healthcare technology solutions and the team is adept at deal structures supportive of long-term organizational value. The holding company structure facilitates profitable growth and enables the acquired business to focus on scale. The MITI portfolio of companies will apply leading-edge solutions that emphasize stakeholder value and leverages distinct sector trends.

Contact: Mr. Larry Diamond

844-383-8689 x1

ldiamond@MitescoInc.com

Please read most recent filings with the SEC. SEC FILINGS

2021 Omnibus Securities and Incentive Plan

DISCLAIMER: Information above, past and future typically contain time-sensitive information. The information contained therein is only accurate as of the date thereof. Neither Institutional Analyst Inc., (IA) or Mitesco, Inc. will not be reviewing or updating the material that is contained in these items after the date thereof. The information contained therein may be updated, amended, supplemented or otherwise altered by subsequent presentations, reports and/or filings by Mitesco, Inc. The newsletter and this press release do not constitute an offer to sell nor a solicitation of an offer to purchase any securities in any jurisdiction in which such an offer or solicitation is not authorized and does not constitute an offer within any jurisdiction to any person to whom such offer would be unlawful. Mitesco Inc. is an investor and public relations client of Institutional Analyst Inc., please see the report for disclosure and disclaimer details. In the past year, IA has been compensated by the company for providing progress reporting with five-thousand dollars per month, one hundred thousand shares and owns or controls an additional three hundred thousand shares.