We Think Yes..!

With the year just finished ringing in $17.8 million in revenues, versus a market capitalization of just $3 million – we actually think a resounding yes..

And to boot, management is sticking to their guns (goal) of being at a $100 million run rate in the next 12 months, and an eye-brow raising $300 million run rate by the end of 2026.

“Our goal is to be at a minimum of $100 million in annualized revenues in the next twelve months based on anticipated acquisitions and organic growth. While there are no assurances that we will close all the acquisitions in the pipeline, we are currently engaged in negotiation with four prospective transactions in various stages, representing approximately $75 million in additional revenue. Our objective is to achieve $300 million in revenues by the fourth quarter of 2026. Alan Bergman, Smart for Life’s Chief Financial Officer. Press Release related

Here’s another $10 million in revenues starring them in the eye, announced a few days ago.

Smart for Life Provides Update on Pending Acquisition

What makes this strategy work in small-cap bear markets like today, is the potential acquisitions can’t access the public markets, that they once could even just three years ago. The door has slammed shut.

While the door has closed to them, it has opened to Smart for Life and many other publicly traded acquirers. And good things can happen, if they can continue to accomplish what they have been accomplishing.

In fact we can envision a five to seven-fold increase in share price. Which assumes a market valuation of 20% of sales (it’s currently at 17% of sales) and an investor base which morphs from “show me first” to “wow, your really are at $100 million.”

Of course this brings up the dynamic of: Does and investor wait until they ring the $100 million bell, or buy ahead of increasingly strong numbers as each quarter passes as more accretive acquisitions are completed. Our answer, as usual, is it’s up to you. With over 40 years on Wall Street, we’re in the ‘ahead of news’ camp.

WHAT HAS TRANSPIRED

Our best explanation for the what has transpired since the IPO, is sh*t happens.

For whatever reason, the company never gained traction with investors from the day it went public, and it underwent a slow water-torture drop, from the equivalent of $120 a share under $5.00 per share ($0.10 pre-split) and then the brutal 50:1 reverse split. Which was the final nail in the coffin, which we are confident will prove to be a ‘self-disintegrating‘ nail, otherwise we wouldn’t be writing about this.

In essence we’re less concerned why sh*t happened and more interested in how we make money after sh*t happened, which is after-all what we do for a living.

We believe the coffin will re-open, and the dead (or left for dead) will rise. It will just take time, and continued good acquisitions by management. Management is very talented all things considered (we’ve known AJ Cervantes the Chairman for 20 years). He is a well-known mover and shaker.

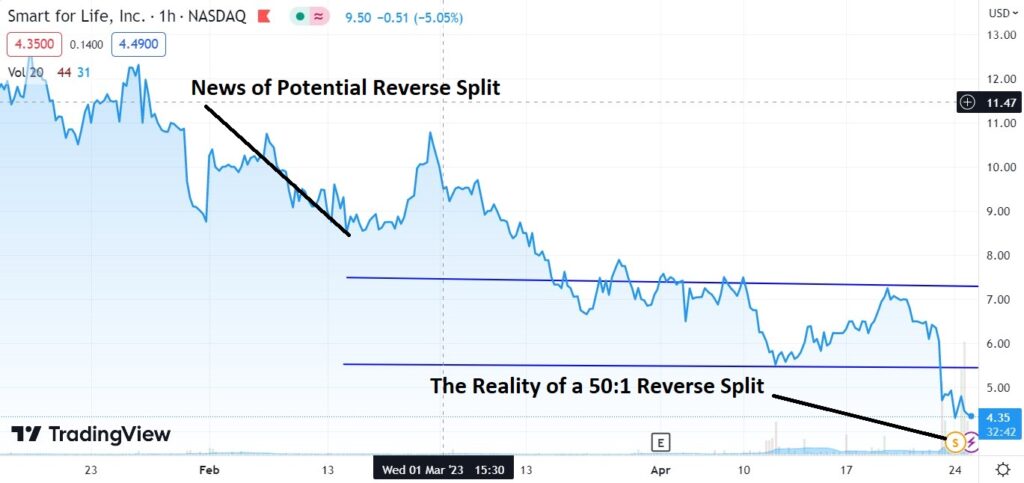

THE REVERSE SPLIT

News of a potential reverse split first came out in late February (the 23rd) and you can see investors started selling, taking it from $11 a share, to a range between $5.75 to $7.75, with some investors thinking “..it just can’t get any cheaper than this.”

Well it did get cheaper. As the chart below depicts, the trading range went from undervalued at $7 million, to grossly undervalued at $4.5 million, to today’s “this is just ridiculous” valuation of $3 million and change. No, you’re eyes do not deceive you. Yes you can buy $17 million in sales, for just $3 million.

Do that ever year for a decade, and you shall be a fat cat.

We think to keep for investors to keep their heads straight – it’s best to look at the entire market capitalization, versus the share price – at moments of distress, pessimism and confusion like this.

Think of the blood in the streets saying. Which in simple words, “when everyone else is selling, it’s a great time to purchase.”

How to play post reverse split companies like this (we keep learning..with so many this year) is to be patient. And while we’re hesitant to say this about situations like this — investing post-reverse is all about how to take advantage of the situation, where most investors (understandably) have lost view of the big picture, and given up.

Which of course brings up the dynamic exactly how does one patiently take advantage of down and out situations like these?

It’s a rather simple formula.

It’s to become the bid. Some investors who had 50,000 shares now have 1,000 shares, and they simply don’t care if they get $5.00 or $4.50 or $4.00. They just want to get rid of it and the memory of it. So trading trading around a reverse split takes finesse.

For an investor who is new to the idea, and who believes management can indeed get to $100 million, the strategy is to sit on the bid at $4.00 or $4.50, and take the disillusioned sellers stock. And then wait for another investor wanting to unload their shares to show up. And another and another.

Ultimately everyone who wants to sell at $4.00 will have sold. Ditto at $5.00 and at $6.00 with the patient acquiror slowly moving up the bid, until all the sellers are gone.

With some luck a patient, and aggressive (aka vulture) investor, can suck in a meaningful amount of shares.

REMEMBER with only 780,000 shares outstanding, the vulture investor DOES NOT try to acquire even 10,000 shares in a day or week, and run the stock back up to $11.00, with their own buying. This takes patience.

And then as the plan goes, when (if) Smart gets to the $100 million run rate, unload the shares for a five-to-ten-fold gain. They do this by selling to new investors, who suddenly become believers, when the proof is finally in the pudding. Been there, done that.

While $100 million in revenues is far from guaranteed, we can confidently say the market valuation will not remain at $3 million if they do hit that run rate. Real confident.

More to come..

In the meantime, read the 10K, look at the corporate presentation and watch Chairman’s message below. This isn’t a high-flying, high volume play, but for the patient, it can provide potentially high-flying returns.

INVESTOR PRESENTATION 2ND QUARTER 2023

10K

More to come.

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the SEC and other reports filed with the SEC thereafter. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

DISCLAIMER

The information provided in this press release is intended for general knowledge only and is not a substitute for professional medical advice or treatment for specific medical conditions. Always seek the advice of your physician or other qualified health care provider with any questions you may have regarding a medical condition. This information is not intended to diagnose, treat, cure or prevent any disease. Client, Institutional Analyst Inc., has been retained by SMFL to provide ongoing news coverage and reporting for six-thousand dollars per month for a period of six months. See report for full disclosure and disclaimer details.