Adding Revive Therapeutics (RVVTF, RVV.CN) to the “2022, Biotech 12 Pack, 12 Biotech Stocks We Expect to Double” Watch List*.

If not our best ever, certainly one of the best, and definitely the best for 2022, despite it only being January. It’s rare we come across an idea with all the stars aligned like this. Start your due diligence now.

Revive Therapeutics is a life sciences incubator focused on the research and development of therapeutics for rare disorders and infectious diseases.

The development pipeline consists of three main projects:

• An anti-inflammatory agent Bucillamine. The drug has historically (30 years) been used to treat arthritis. Revive has been working on potential new applications (Influenza, Covid) for Bucillamine, and has obtained permission from the FDA to start Phase III trials, of which they are nearing completion.

• Psilocybin is a psychedelic compound derived from fungi popularly known as magic mushrooms. Revive is exploring various pharmaceutical applications based on Psilocybin.

• Cannabidiol (CBD) is a non-psychoactive derivative of cannabis that is widely marketed as a consumer health product. In recent years pharmaceutical drugs derived from CBD have been approved for various applications. Revive plans to pursue a CBD-derived treatment for autoimmune hepatitis and methamphetamine.

We’ve done a deep dive on Revive Therapeutics (RVVTF): Verdict 10:1 risk to reward ratio. Reward being the ten.

Probability of desired outcome (FDA approval) unknown, but with this type of risk/reward – it’s not an issue with us. We generally take interest in all 10:1 ideas. Ecstatic when we win, “oh well it was worth a shot” when we lose.

Their biotech initiative (Bucillamine or ‘Bucilly’) is furthest advanced. News related to Bucilly is due out in months not years. Read the all the headlines, stories and regulatory filings and decide for yourself.

Michael Frank, CEO of the Company commented, “We are now in the final stages in our Phase III study and we are focused on completing enrollment, preparing the regulatory packages for the FDA and international health authorities, and negotiating manufacturing and marketing agreements with pharmaceutical companies for commercialization.”

The Company is on-track to complete study enrollment in Q1-2022. Also, the Company is preparing its regulatory package for submission to the FDA and international regulatory authorities for drug approvals thereafter.

Bullet points:

Bucilly has been in safe use for over 30 years (Japan and Korea), prescribed for arthritis. Now being ‘repurposed’ to potentially reduce lung inflammation. The FDA allowed them to skip phase II and jump right to Phase III, savings $10’s of millions and 2-3 years that we don’t have to wait (like anyone waits these days).

They raised $26 million last year (ending 6/21) including $23 million via Canaccord and Leede Jones at $0.50/unit last February. They’ve budgeted $21 million, to complete the Phase III trial.

If the Phase III trial fails to significantly reduce lung inflammation, it could go from $0.25 to – let’s just call it zero, just to be dramatic and to make a point. Can we live with that? Yes.

The science (unlike mRNA) isn’t overly complex here. Bucilly acts as a ‘donor’ of thiols (google that) to produce antioxidants and increase glutathione activity (google that) to lessen the destructive consequences of a SARS CoV2 infection in the lungs. Basically, your own body helping you.

While Covid garners the headlines, Bucilly could treat other lung diseases too. Influenzas alone is a bonanza of potential patients. Bo-Nan-Za.

We wrote this after Covid arrived: Flu Season Coming Up Next. What to Expect.

With regards to headlines noting Revive’s progress in general, there have only been a few. With increased general media headlines – we believe the share price could be substantially higher. So, for now we can enjoy the low share price anonymity.

If it is successful in the trials, it could move substantially higher, possibly in a feeding frenzy – when compared to moves made by other FDA/Covid related stocks we have reported on.

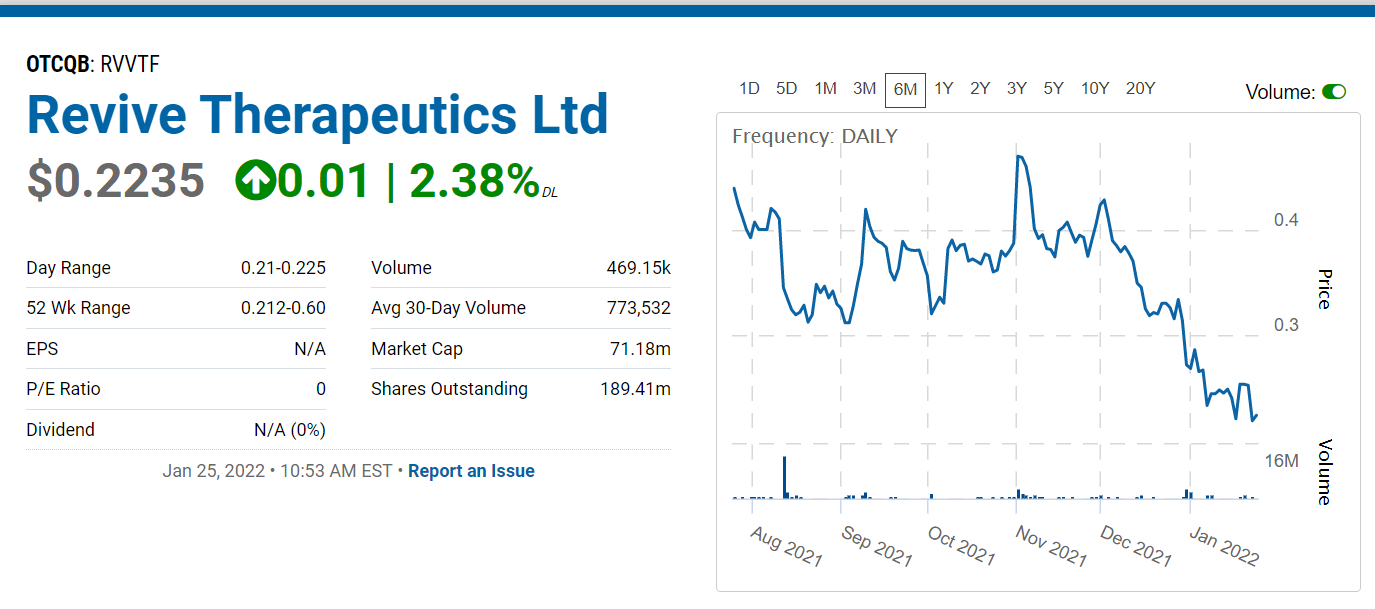

With 330 million shares out, the market cap at $0.21 is near $70 million. At $2.10 (10x) the market cap would approach $700 million.

52 Week Range 0.21 – 0.60

The simple drug marketing pitch in our opinion is if you test positive, you take their pill. Like right away – before it finding out if the virus is going to fade or gets much worse. That’s potentially millions and millions of doses. We know if we tested positive, we’d take it, if it gets approved.

Many people use NAC (google it) for the similar effect. Bucilly is 16 times more potent (NIH site)!

It’s not a vaccine, so it doesn’t prevent infection. It’s not an anti-viral, so it doesn’t kill the virus (or you). What Bucilly seeks to do is protect you (your immunity system) from you. Specifically, your lungs. Triggered by Covid or the everyday influenza.

We can also hypothesize if approved, it being a ‘combination’ treatment. Meaning taking both Bucilly and Pfizer’s Paxlovid or Merck’s Molnupiravir. Possible? Anything’s possible in the fight for survival.

How can I get Paxlovid, the COVID-19 pill? Access to COVID treatments remains a challenge (CBS News)

So there you have it, don’t say we didn’t tell you.

Most Recent News

Bucillamine as Potential Inhibitor of SARS-CoV-2 Infection Delta Variant

University of California, San Francisco, showing that potent thiol drugs, like Bucillamine, inhibit SARS-CoV-2 infection in vitro, specifically the Delta variant (B.1.617.2)

In addition to its antioxidant and anti-inflammatory properties that could limit lung injury in COVID-19, thiol drugs have promising antiviral effects.

For Updates and progress reports, subscribe.

The Company is not making any express or implied claims that its product has the ability to eliminate or cure COVID-19 (SARS-2 Coronavirus) at this time.

Client, see report for full disclosure and disclaimer details.

*As we stated in our 2020 announcement, “By ‘expect’ as used in the headline, what we really mean is have ‘potential,’ if everything goes right, which they rarely do – along with a continued robust stock market. Expect just sounds better! But in the legal world, ‘hope’ is more applicable and accurate than expect.”

Biotech 5 Pack. 5 Biotech Stocks We Expect to Double in 2020.