Okay, that’s it. We are officially enamored with post reverse split trading!

First, there was our client, LQR House (LQR), then Polished (POL) and now Zivo Bioscience (ZIVO), which all screamed massively higher POST reverse split. Soundly, and we do mean soundly, dispelling the common notion to hightail it, the moment a company says they’re contemplating a reverse split.

Most investors have never owned a stock that went up 2,608%, much less one that had that type of gain, in less than six months. Combined, the gains from low to high in these three stocks averaged 1,395%, in a matter of months. Hello!

Here’s their charts, charts don’t lie..and for sure you didn’t see any of these stories on CNBC.

THREE THAT DID REVERSE SPLITS AND SOARED..

LQR HOUSE (LQR) | +447% GAIN

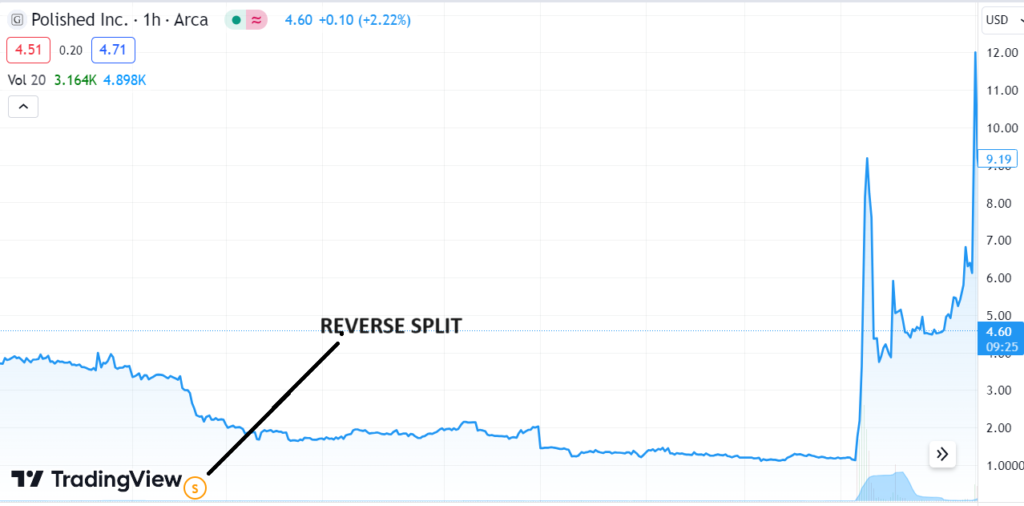

POLISHED (POL) | +GAIN 1,126%

ZIVO BIOSCIENCES (ZIVO) | +GAIN 2,608%

ZIVO BIOSCIENCES

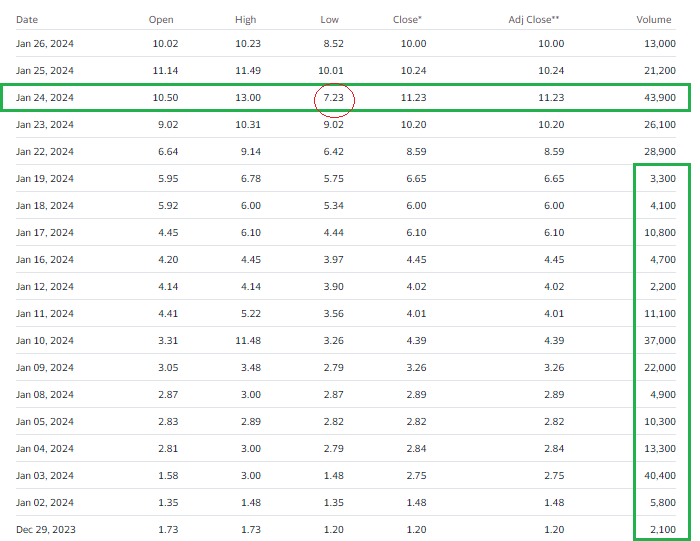

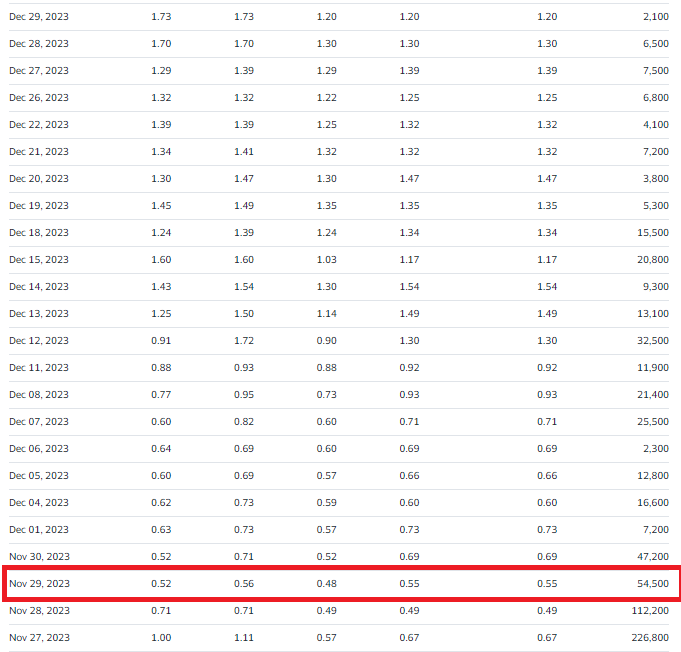

Let’s assume some bold speculator was lucky enough to account for all of the buying (55,000 shares) on the day of the post-reverse bottom on November 29th at $0.48 – he would have invested $26,400.

All previous efforts to call a ‘bottom’ in Zivo had proven fruitless, as the shares had fallen from $25 (post-split) in the prior year. So to call it a bold move is an understatement. Pre-split the shares fell from $4.60 to $0.08. Buying instead of just watching from the safety of the sidelines, was indeed a bold move!

If he or she was also later bold enough (and crazy enough) to ignore a double and hold on until last Friday, that stake would be worth $631,950. In two months no less!

Wait, what – don’t they say you’Fre supposed to stay clear from companies that do a reverse split?

For that investor, Zivo is a story to tell the Grand kids. Of course there will be a lot of untold stories, from people who owned Zivo and who live by the age old policy – sell anything that is about to do, or just did a reverse split and who sold. Meaning some sorry bastard took a loss and sold 55,000 shares that day at $0.48 – feeling enough is enough.

As we recently said in an article we wrote a month ago “Reverse Split Mania,’ something is going on here!

RELATED: Reverse Split Mania.

REVERSE SPLIT STRATEGY

With what just happened at Zivo Bioscience, we are now convinced something is going on, so we are officially devising (trying to at least) a post reverse-split-strategy. We are now hunting and seeking the next big mover. Of course we could get our heads handed to us, so we’ll try to be cautious (somewhat).

The trickiest part will be trying to figure out getting in just before, the day of or sometime shortly after the reverse. Trading volume will also be tricky. While it might not seem wise to buy before the reverse, sometimes that is when there is the most volume (and value), and possibly your only chance to acquire a meaningful stake. A clever investor could become “the bid” the day of a reverse and suck in a lot of stock from the “just get me out at any price” sellers.

One might call that, taking advantage of panicked sellers.

Our first three candidates for consideration which have been beaten down unmercifully and in our opinion unjustifiably – are GeoVax (GOVX) and Zomedica (ZOM) with potential reverse splits ahead of them. Plus BORQS Technologies (BRQSF) with a reverse behind it.

While we love and currently follow both GeoVax and LQR House (they’re news coverage clients), we’ll devise and come back to with some ‘reverse-split’ related strategy on all three.

If you have a favorite reverse split company which has sufficient cash in the bank, please send it along, to Roland at InstitutionalAnalyst.com

At risk of oversimplification, the day a company announces (or sneaks it out an 8k) that they got a deficiency notice from NASDAQ, which says unless the company does ‘something’ to get the share price back over $1.00, they are going to get delisted is when things can get dicey.

We can probably and safely say, that deficiency notification day does not seem to be the best time to step up to the plate! It addition it can also sometimes take months, with NASDAQ having hearings and granting extensions, before the ‘delisted’ gavel slams down.

The deficiency notice day, is often the start of a wave of indiscriminate selling. Indiscriminate because it typically has nothing to do with fundamentals, and nothing to do with the current valuation.

Investors just don’t want to risk facing a potential wave of indiscriminate selling, as perception becomes reality. It’s a ‘better safe than sorry’ attitude as some companies can get knocked down to ridiculous valuations – sometimes even below the cash on their balance sheet. However, as the three charts above prove, this can open the door to a huge upcoming opportunity.

Nobody of course, has to walk through that door. We’re just saying recognize that it is a door and that in fact that door is open. And since so few other people are willing to walk through it, great bargains at times can be created and had for the taking.

After the reverse and at $1.00, Zivo for example was valued at just $2.7 million. Say what! In our opinion any biotech worth their salt, could or should be valued at between $50 to $100 million. Zivo has a product to keep chickens parasite free and off antibiotics. Farmers spend more than $1.7 billion annually to keep their chickens from getting sick, so if approved, it could be a blockbuster drug.

Let’s look at the market valuation chart in Zivo. We just discovered this ‘market-cap’ chart at StockAnalysis.com, it’s quite the eye-opening and nifty visual tool.

So here’s our simple version of the story (for educational purposes) that continued on at Zivo. Someone did some research, believed Zivo’s chicken solution could ‘make bank’ if approved, but then discovered there are only 2.7 million shares outstanding.

How can he or she buy a meaningful stake, when there simply aren’t enough shares to go around after the reverse! Institutions can’t buy any, no matter how impressed they are with the chicken juice, Because both the share count and float got decimated.

Answer is, they can’t, so they have to pay up. And Zivo thus goes to $10 and a more realistic $18 million dollar valuation in matter of weeks. Sellers at a $1.00 looked at the run up in total dismay.

Take a look at the volume chart below on Zivo, in the green boxes highlighted.

Let’s say you wanted to buy 100,000 shares on January 2nd at $1.50 and you only get filled on 5,800. So you think you’ll try to buy some more the next day. Nuh-uh, ain’t gonna happen. It opens at $1.58 and quickly trades to $3.00, with only 40,000 shares traded. You get a sinking feeling you missed it..

DAILY TRADING

Not for orphan’s and widows. This is for aggressive speculators only. And pirates.

Subscribe to see what we can come up with, in our upcoming reverse split strategy. Again be forewarned, this is as risky as it comes.

We’ve seen some companies do three reverse splits in a single year, in a desperate bid to stay listed on NASDAQ.

RELATED

As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data. The majority of these stocks—464 of them—are listed on the Nasdaq Stock Market, whose rules require companies to maintain a minimum share price of $1 or risk being delisted.

REVERSE SPLITS TABLE 2024 LIVE DATA

Hundreds of Stocks Have Fallen Below $1. They’re Still Listed on Nasdaq (Wall Street Journal)

The Impact of Reverse Splits on Low-Priced Stocks (NASDAQ)

Nasdaq Delisting Threat Is Tricky for Companies Trading Below $1 (Bloomberg)

How To Avoid Getting Delisted From Nasdaq (Investopedia)

Lawful But Awful: The Small Cap IPO Cycle (OTCMarkets)