From a Low of $2.11 Just Shy of a Year Ago, to an Intraday High of $29.30. A Ten Bagger in Less Than a Year!

That’s a Gain of 1,288% Boo-Ya!

“A round of drinks for the house, on us. With reverse splits who needs AI stocks!.”

Dear reverse split doubters…

And it wasn’t on earnings: In November the Company reported a net loss of approximately $10.1 million, or a net loss per diluted share of $2.27, for the three months ended September 30, 2023, compared to a net loss of approximately $8.8 million, or a net loss per diluted share of $2.11, for the same period in 2022. At that rate, they had less than 9 months of cash left, with $28.7 million of cash, cash equivalents and investments on hand.

The news that propelled the share price higher was that the company announced positive results from its drug candidate CRB-701. They said the first-in-human clinical study of their antibody drug yielded strong efficacy and safety results. The drug is among three on the Corbus pipeline in advanced clinical trials.

That’s it folks. Early, early trial news. And the trial is being conducted in China. Really..not even big news in our opinion, but there you go. A ten-bagger in under a year for some lucky bastards. Or should we say for some astute and aggressive investors, who took the plunge when everyone else was saying “stay away from reverse splits.”

In our opinion what happened here is there was only 4.4 million shares outstanding after the brutal 1:30 reverse valuing the company at a mere $8.8 million at its low! So any news, with so little shares available, can send puppies like this higher. Much higher.

Hmm. Adding GeoVax (GOVX) $3.32 to Reverse Split Watch List.

And now that some semblance of reality has returned to the valuation, they announced the sale of 4,325,000 shares of its common stock at $19.00 per share, for a total public offering size of approximately $82.2 million. Via H.C. Wainwright & Co. and Oppenheimer & Co. who were acting as lead managers for the offering. You go Wainwright, “show me the money” LOL

Lack of cash problem gone! Just like that! You have to love America.

POST REVERSE SPLIT HIGH $29.30

REVERSE SPLIT LOW $2.11

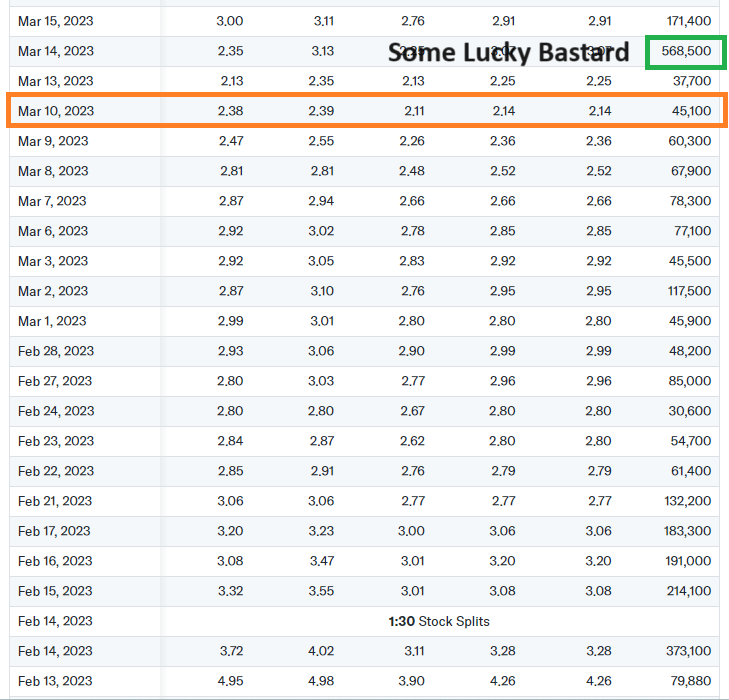

You could have bought all you wanted at $2.00. The lucky bastards who bought 568,000 shares for $1.3 million last March 10th, are looking at a value of $16.6 million today!

In less than a year.

We’re telling you, we are onto something here!

Reverse Stock Split

Concurrent with the licensing agreement, Corbus also announced a 1-for-30 reverse stock split of its common stock, effective on February 14, 2023. Beginning on February 14, 2023, the Company’s common stock will continue to trade on The Nasdaq Capital Market on a reverse split adjusted basis under the trading symbol ‘CRBP’. The reverse stock split was approved by Corbus stockholders on December 20th and is intended to increase the Company’s stock price to regain compliance with the $1.00 minimum bid price requirement of The NASDAQ Capital Market. Upon effectiveness of the reverse stock split, every thirty shares of common stock issued and outstanding will be automatically converted into one share of Corbus common stock, with no corresponding reduction in the number of authorized shares of the common stock.

That’s all she wrote folks.

Subscribe to see what other reverse split stocks we will be following.

Forward-Looking Statements

Statements in this press release that are not statements of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, without limitation, statements about Corbus’ expectations regarding the completion of its public offering and the anticipated use of proceeds therefrom. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “may,” “goal,” “potential” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements necessarily contain these identifying words. Among the factors that could cause actual results to differ materially from those indicated in the forward-looking statements are risks and uncertainties associated with market conditions and the satisfaction of customary closing conditions related to the offering, as well as risks and uncertainties associated with Corbus’ business and finances in general, including the risks and uncertainties in the section captioned “Risk Factors” in the final prospectus supplement related to the public offering that will be filed with the SEC and the Company’s most recently filed Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q. There can be no assurances that we will be able to complete the offering on the anticipated terms, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. All forward-looking statements are qualified in their entirety by this cautionary statement, and Corbus undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date of this press release.