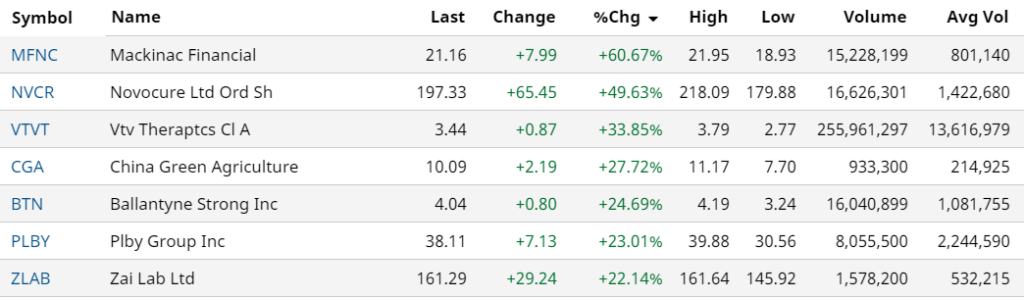

THE TIKI HUT FUND | TODAY’S 7 BIGGEST MOVERS

Mackinac Financial (MFNC) $21.16, +60%

Mackinac screamed 60% higher on news that Nicolet Bancshares (NCBS) would acquire them. The 80% stock and 20% cash deal equates to $23.31 per share. Mackinac has assets in excess of $1.5 billion, is best known for mBank has 28 branch locations; ten in the Upper Peninsula, ten in the Northern Lower Peninsula, one in Oakland County, Michigan, and seven in Northern Wisconsin. News

Novocure (NVCR), $197 +49%

Novocure surged 81% premarket and closed up $65 or 49%. The surge came after receiving the go-ahead from an independent data-monitoring committee (“DMC”) on Apr 13 for the company’s LUNAR trial of tumor-treating fields in non-small cell lung cancer. The DMC found no evidence of increased systemic toxicity, and accordingly recommended the company to test 276 patients with 12 months of follow-up time instead of 534 patients with 18 months of follow-up. News

VTVT Therapeutics (VTVT) $3.44, +33%

“Vitey-Vitey” proved the critics wrong when the FDA granted VTVT Breakthrough Therapy designation for TTP399 as an adjunctive therapy to insulin for the treatment of type 1 diabetes. TTP399 is a novel, oral, investigational once-daily glucokinase activator. After a difficult 2019-2020, VTVT is looking strong, up 84% YTD. Breakthrough Therapy designation is based on FDA’s determination that preliminary clinical evidence indicates that an investigational therapy may demonstrate substantial improvement on one or more significant endpoints relative to available therapies for a serious or life-threatening condition. News

China Green Agriculture (CGA) $10.09 up 33%.

No news to attribute yesterday’s 30% plus jump, nor news to attribute its gain from $2.00 last Christmas a five-bagger!. Wild and fun from a company that competes with sh*t — literally. The company produces and distributes humic acid-based compound fertilizers, other varieties of compound fertilizers, and agricultural products. The last news we saw was they ‘didn’t’ get booted off the NYSE. Isn’t it fun (nerve-wracking) to make money when you have no idea why you’re making money! News

Ballantyne Strong (BTN) $4.04, up 24%.

STRONG day and KILLER week for Ballantyne Strong near doubling in April. Kind of all over the place (we’ll call it an incubator), this gets a Tiki Fund thumbs up. Look how they describe themselves:

Ballantyne Strong holds a $13 million preferred investment along with Google Ventures in privately held Firefly Systems, Inc., which is rolling out a digital mobile advertising network on rideshare and taxi fleets. Finally, the Company holds a 30% ownership position in GreenFirst Forest Products Inc. (TSX: GFP) which has recently completed an investment in a sawmill and related assets and a 21% ownership position in FG Financial Group, Inc. (Nasdaq: FGF) which is a reinsurance and investment management holding company focused on opportunistic collateralized and loss capped reinsurance, while allocating capital to SPAC and SPAC sponsor-related businesses. Yowsa! News

PLBY Group (PLBY) $38, up 23%.

If you were guessing PLBY was Playboy, you guessed right! Up 4-fold in 2021 and tripling in the last two months, the bunnies are on a tear!

In March they reported fourth-quarter revenue of $46 million, a 118% year-over-year increase, and full-year revenue of $148 million, an 89% year-over-year increase! Yeah, baby. They went public via a merger with a SPAC PLBY and listed on NASDAQ on February 11, 2021 and held more than $100 million of unrestricted cash. How did we miss this one?

ZAI Labs (ZLAB) $161 up 29%.

Almost as impressive as Novocure’s $65 one day jump, ZAI gained $29 on news of their joint effort with Novocure! Seamus Fernandez from Guggenheim Securities raised his price target to $250 – oh boy.

Seeking Alpha contributor Peter F. Way called Zai Lab ‘the most attractive biotech developer for near-term capital gain. ** NEWS

OTHER NEWS