THE TIKI HUT FUND | BIGGEST MOVERS – 3 YEARS

TURNING $175,000 INTO $4,005,000

Sometimes a percentage gain of 4,008% can get lost in the translation. So we’ll translate the percentage change into dollars and sense – assuming a small $25,000 speculative bet into each one of these ideas.

All told a $25,000 bet on each of these stocks for a total of $175,000 three years ago, would be worth $4,005,000 today. Assuming you held and didn’t take any doubles or triples along the way!

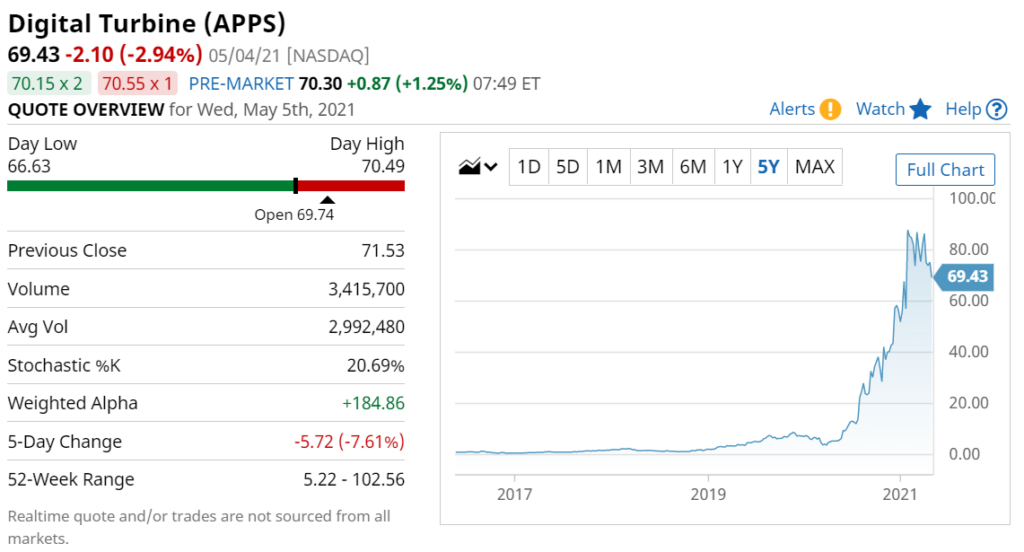

Digital Turbine (APPS)| $25,000 to $1,002,000

Holy shiatt. Look at that chart. They not only knocked it out of the ballpark, they knocked it into another state – trading from less than $1.00 to over $80 at its recent peak. That’s $6 billion in gains for shareholders. With $250 million in sales, up from $25 million in 2016 – these folks know how to run a business! No, they don’t make engines, they’re into mobile apps. Digital Turbine’s technology platform has been adopted by more than 40 mobile operators and OEMs worldwide and has delivered more than three billion app preloads for tens of thousands of advertising campaigns. News

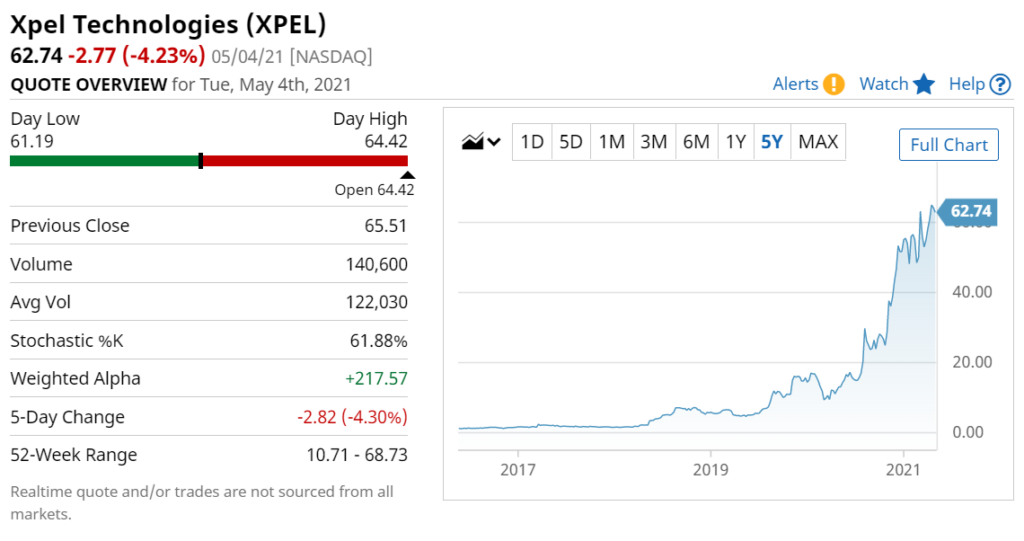

XPEL, Inc. (XPEL) | $25,000 to $741,000

OMG, former client eons ago – that we (whoops) lost track of. No, not a bitcoin or corona play. They simply make ‘stuff’ to protect the front of your car from scratches and knicks. Go figure. News.

Enphase Energy, Inc. (ENPH) | $25,000 to $610,000

Beam me up, Scotty! The U.S. Energy Information Administration predicts that solar energy’s share in global electricity generation may rise to 20% by 2050 from just 3% right now. As a top supplier of products that enhance power generation from solar panels, Enphase Energy stands to benefit from this expected growth. You could have bought all you wanted at $2.00 a share three years ago. News.

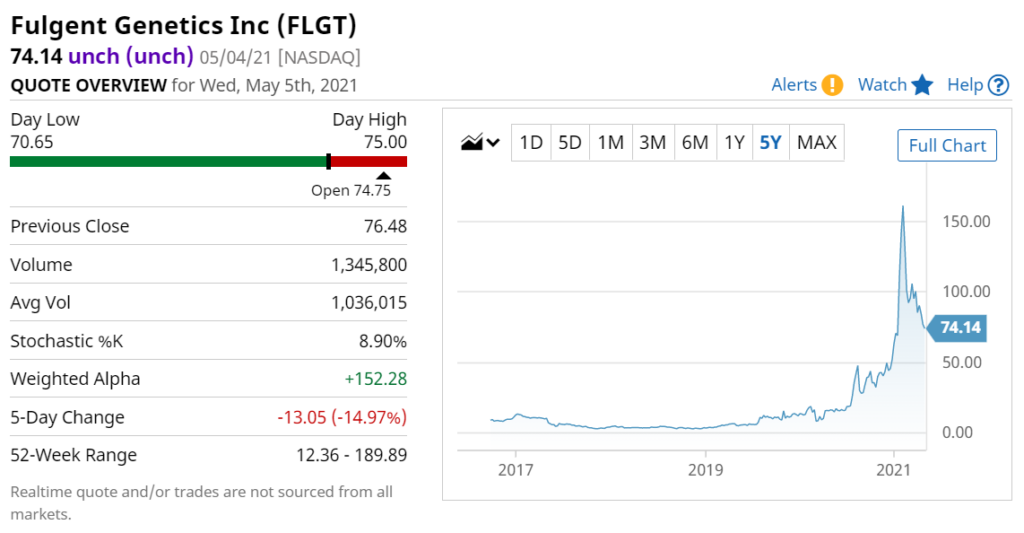

Fulgent Genetics, Inc. (FLGT) | $25,000 to $462,000

Hmmm, very interesting. Fulgent Genetics is offering perhaps the most extensive lineup of genetic testing with unmatched customization. It is also using technology to drive down costs. Over time, this could give the company the best (and cheapest) offerings. So far, Fulgent is following a path that in the past has made a lot of shareholders rich. News.

Tinley Beverages | TNYBF (client): Pabst Labs Joins Forces with Tinley’s to Manufacture Cannabis-Infused “Not Your Father’s” Root Beer in California

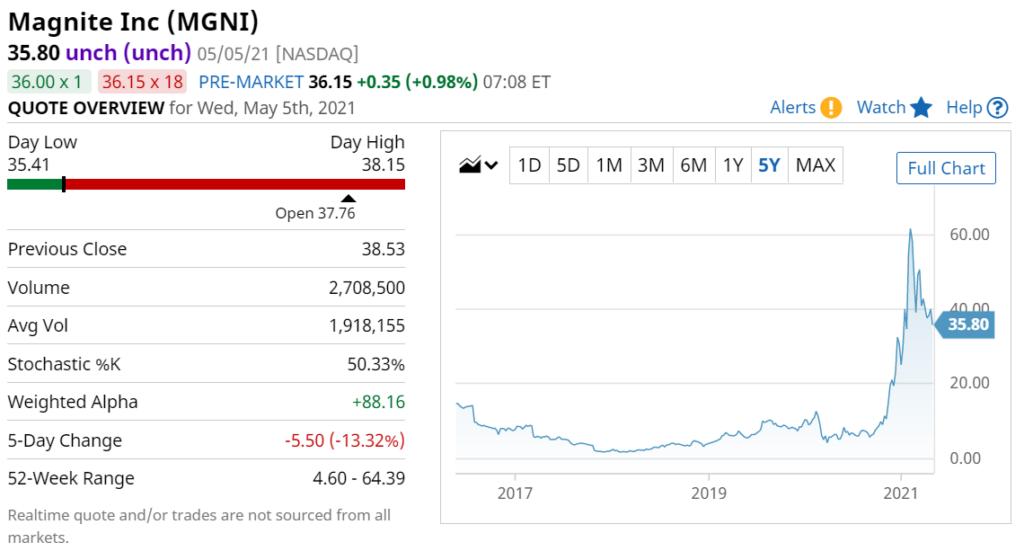

Magnite, Inc. (MGNI) | $25,000 to $402,000

Just admit it, you’ve never heard of Magnite. We haven’t. They’re the world’s largest independent sell-side advertising platform. Publishers use their technology to monetize their content across all screens and formats—including desktop, mobile, audio and CTV. And the world’s leading agencies and brands trust their platform to access brand-safe, high-quality ad inventory and execute billions of advertising transactions each month. News.

Axsome Therapeutics, Inc. (AXSM) | $25,000 to $395,000

Axsome Therapeutics may be down since the beginning of the year, but its stock is starting to show signs of life. The company was recently granted priority review by the U.S. Food and Drug Administration (FDA) for its drug to combat major depressive disorder (MDD). The agency previously granted the drug breakthrough therapy designation for both MDD and Alzheimer’s Disease. About one-third of the 17 million adults in the U.S. who experience a major depressive episode each year are deemed treatment-resistant. News.

Atlanticus Holdings Corporation (ATLC) | $25,000 to $393,000

Lord, I promise to be patient next time, if you just give me one more of these! Trading from $1.00 to $32 Atlanticus a, credit card company, now sports a market cap of $531,000,000. “Our response to the pandemic, including $1.4 billion in purchases funded for consumers in their greatest time of need, assisting over 67,000 customers with pandemic-related hardships, and shifting our servicing infrastructure to a remote workforce without missing a single day of our exceptional service level standards.” No balls, no baskets. News