This is a great long-term story. We’re telling you.

(March 2024) When we finished writing our earlier 44-page report, we printed it out and we took it to the beach with a cooler full of hard seltzers. It took us about 40 minutes to read it, even though we wrote it!

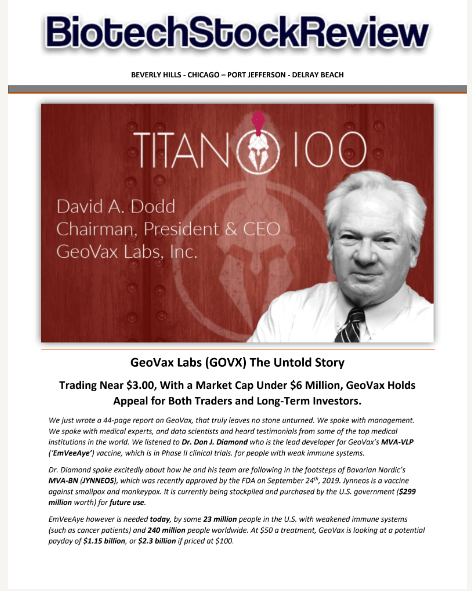

Oh did we mention GeoVax has a market cap under $10 million. Unbelievable.

CHART FROM MARCH REPORT DATE

GO! EmVeeAye (MVA). We should make that our rebel yell. Shareholders should stand up every morning for the next year, and yell “GO! EmVeeAye, GO! EmVeeAye, GO! EmVeeAye!”

If your wife (or husband) questions your rebel yell, just tell her to pray EmVeeAye gets approved by the FDA a year from now, and you’ll take her on the trip of her dreams.

We wrote this summary report in Marh, BEFORE the incredible BARDA news involving non-dilutive funding in excess of $300 million. It covers Covid, Mpox, Gedeptin and the MVA production plans.

GeoVax Receives Massive $300+ Million BARDA Project NextGen Award!

Wait, what?

SUBSCRIBE FOR FREE UPCOMING AUGUST REPORT

We’ve already had our Biotech Trifecta with three separate ideas, each individually gaining over $1 billion in valuation. Fingers crossed for us having a Superfecta someday, if the clinical trials prove successive.

Three, Billion Dollar Gainers: And We Have a $26.4 Billion Winning Trifecta!**

Note, Immunomedics went from $3 to $87, Dicerna went from $3.30 to $38.25 and Provention Bio from $4.60 to $25. They were all acquired.

We know of a lot of investors who bought Immunomedics at $3.00 when things were looking grim and then sold at $5.00 and were giggly happy and took us out for cocktails. The traders weren’t happy when when it jumped to $21 on FDA approval. Then lot of investors sold the day of FDA approval, and were giggly happy. Then it got acquired for $87 by Gilead Sciences for $87. Giggles gone.

In our opinion, GeoVax is now on the radar of every vaccine maker like Pfizer $PFE, Moderna $MRNA, Novavax $NVAX , and Sanofi $SNY who have billions to invest, and assist start-ups finish clinical trials. Just saying.

Moral of the story, don’t sell your lotto ticket.. for a 100% gain. Of course approval could be denied, which has happened to us many times in the past, and the stock drops 80%. But that’s life in the biotech lane. If you can’t handle the heat, don’t even open the door to the kitchen.

Stay away!

If you like what you read in the summary report and can handle volatility, we would highly recommend reading our “killer” 44-page report on GeoVax. It’s like a shareholder manual for long-term investors. The report is not for traders or pump and dump flippers. Personally we wouldn’t even consider selling GeoVax (under most circumstances), before data from the $300 million dollar BARDA funded clinical trial is completed.

Killer, 44-Page Report on GeoVax (GOVX).

Forward-Looking Statements This post contains forward-looking statements regarding GeoVax’s business plans. The words “believe,” “look forward to,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax is able to obtain acceptable results from ongoing or future clinical trials of its investigational products, GeoVax’s immuno-oncology products and preventative vaccines can provoke the desired responses, and those products or vaccines can be used effectively, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its immuno-oncology products and preventative vaccines with the desired characteristics in a timely manner, GeoVax’s immuno-oncology products and preventative vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s immuno-oncology products and preventative vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, and other factors, over which GeoVax has no control. Further information on our risk factors is contained in our periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. GOVX is a client of Institutional Analyst, publisher of the Biotech Stock Review, which receives a monthly retainer of five-thousand dollars for ongoing progress reporting and news coverage.

*GeoVax Labs, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding GeoVax Labs, Inc.’s performance made by these analysts (including us) are theirs alone and do not represent opinions, forecasts or predictions of GeoVax Labs, Inc. or its management. GeoVax Labs, Inc. does not by its reference or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

**Past performance is not an indication, or even an inkling to future performance.

#GOVX, $GOVX