We’re up 160% ($579 million) in Ardelyx since adding it to the Watch List about ten months ago in November, but we feel the real action is just about to begin.

Adding Ardelyx (ARDX) $1.57 to Watch List.

Looking at the chart alone, we think it’s ready to rock.

Looking at the news alone, we think it’s ready to rock and roll!

As a reminder, this is a real easy story to understand, product wise. It is also a real easy story to understand, investment wise.

Once approved in the U.S. investors will simply multiply the number of patients on dialysis and then multiply the cost of the treatment, and then presumably, line-up to become shareholders. No rocket science here. Hopefully they’ll stay for the long-term and not just for an approval flip.

NEWS

SEPTEMBER 25th. Ardelyx to receive $30 million from Kyowa Kirin in milestone and license amendment payments and $5 million from HealthCare Royalty Partners.

Ardelyx announced that its collaboration partner in Japan, Kyowa Kirin Co., Ltd., has received approval from the Japanese Ministry of Health, Labour and Welfare for the New Drug Application (NDA) for Tenapanor for the improvement in adult patients with chronic kidney disease (CKD) on dialysis. Tenapanor will be marketed with the brand name PHOZEVEL ® in Japan.

“The approval of tenapanor in Japan is a historic moment for Ardelyx and CKD patients on dialysis. The Japanese approval marks the very first regulatory approval of tenapanor for hyperphosphatemia, a drug discovered and developed by Ardelyx, which we and Kyowa Kirin believe can have a meaningful benefit for the patients we serve.” said Mike Raab, Ardelyx president and CEO.

(f you’re the type who likes to bet on the horse, Mike was the GM of the renal division at Genzyme Corporation, a Sanofi company. He launched and oversaw the sales growth of Sevelamer, the leading phosphate binder for the treatment of hyperphosphatemia, with over $1.0 billion in worldwide sales in 2013)

In the U.S., Ardelyx is pursuing approval of Tenapanor for the treatment of hyperphosphatemia in adult patients with CKD on dialysis who have had an inadequate response or intolerance to phosphate binder therapy. Pending approval, Ardelyx expects to launch XPHOZAH in the U.S. in the fourth quarter of 2023.

There is NO guarantee of approval, even with Japan’s approval. Just saying.

As is typical, we are less interested in betting on the odds of a drug getting approved, and more interested in what type of revenues a drug can generate, AFTER it gets approved. But that’s just us, though we are in close contact with analysts who have excellent track records of predicting, what ultimately may get approved though.

Our technical analysts (chartists), who we rely on to tell us what we already know (when were in agreement that is) feel it’s all blue skies ahead with a break above $5.00.

BLUE SKIES AHEAD..?

LONG, LONG TERM CHART.

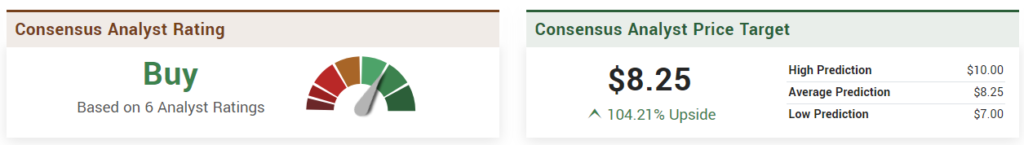

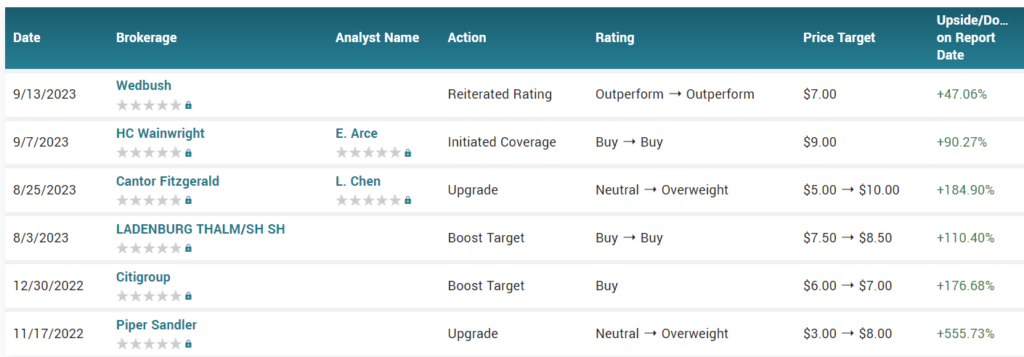

WHAT OTHERS THINK..

Similarly to not making FDA approval predictions, we don’t make revenue or earnings projections, but we are surrounded by a reams of analysts who love to. Here’s just one:

The revenue outlook was well laid out by an analyst and pharmacist at Clinically Sound Investor:

“Once approved, the total addressable market in the U.S. alone is immense, and the recommendation timeframe changes accordingly. Of the 786,000 people in with end-stage CKD, 71% are on dialysis, meaning 390,000 have uncontrolled hyperphosphatemia while on best care and would need Tanapanor. Using a price point of $2,000 per month (a 270-pill bottle of Renagel still costs that much) suggests around $750 million per month or $9 billion in annual revenues.”

PS Market cap is near ‘only’ $900 million – as in WHOAH! Do you smell upside?

The market cap has risen from $297 million when we added it to the Watch List to $876 million a gain of $579 million and that ain’t bad!

“XPHOZAH will get there because in my opinion every nephrologist will prescribe it (no safety issues), every insurance company will cover it to extend patient lives, and there is no competition on the horizon for at least 5 years. Even if the drug is priced conservatively, Ardelyx appears to be an easy potential multi-bagger of several magnitudes if investors can hold on to it for a decade.”

WALL STREET TARGETS

Happy Hunting…

For updates on Ardelyx and more, live a little and subscribe. We got a pretty good track record. And it’s free, just saying.

Forward Looking Statements

To the extent that statements contained in this press release are not descriptions of historical facts regarding Ardelyx, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor of the Private Securities Reform Act of 1995, including the potential for tenapanor to provide a meaningful benefit to patients and the potential for U.S. regulatory approval for tenapanor for the treatment of hyperphosphatemia in adult patients with CKD on dialysis who have had an inadequate response or intolerance to phosphate binder therapy to follow shortly from the regulatory approval of tenapanor in Japan. Such forward-looking statements involve substantial risks and uncertainties that could cause Ardelyx’s future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, uncertainties associated with the regulatory process for, and the commercialization of drugs in the U.S. and internationally. Ardelyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to Ardelyx’s business in general, please refer to Ardelyx’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 2, 2023, and its future current and periodic reports to be filed with the Securities and Exchange Commission. Not a client, associated funds own shares.

Investor and Media Contacts:

Caitlin Lowie

[email protected]

Kimia Keshtbod

[email protected]

#ARDX, $ARDX