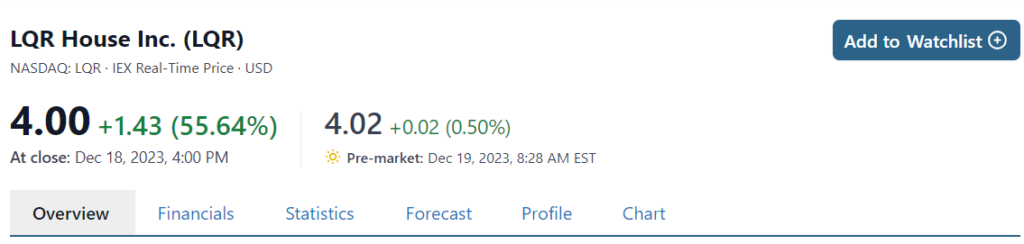

Like a Surprise Christmas Gift, LQR House has Gained Nearly Four-Fold (330%) Post Split. New Report out Tomorrow.

Well, this will have investors rethinking their reverse split strategy. True it is has been a horrific year for the post reverse trading pattern of most companies, but when they get battered to the point that they’re trading below cash (like LQR was), investors need to take an unbiased look, or at least try.

LONGER-TERM LQR CHART

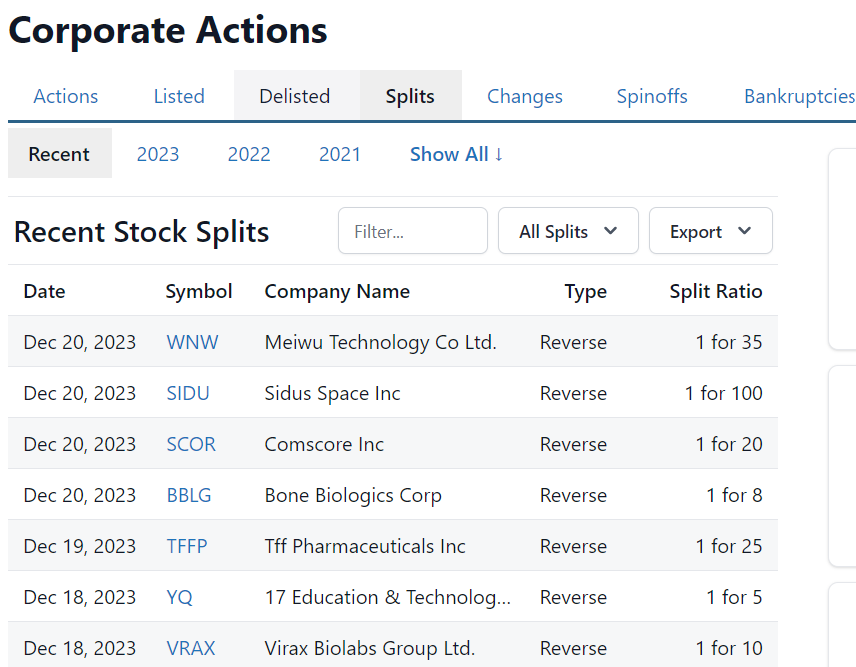

We use StockAnalysis.com to follow the ‘sub-sector’ is we want to call it that, for new opportunities. We’ve never seen so many reverse splits, as in this year. Only time will tell, but buying the sub-sector may prove to be a viable strategy for 2024.

MarketBeat.com has a ‘split-coming’ list complied daily.

Certainty there is a lot to choose from

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Shareholders can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations that arise after the date hereof, except as may be required by law. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement on Form S-1 filed with the SEC. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement on Form S-1 and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. Additional disclaimer. The information presented in the above-referenced report is based on the research and analysis of the publisher. The publisher is solely responsible for the accuracy and completeness of the information and the opinions expressed in the report. The views expressed therein are the personal views of the publisher and are not endorsed by or representative of the company. Client we are being compensated with five thousand dollars per month, for providing ongoing news reporting and coverage.

Investor and Media Contact:

Roland Rick Perry, Editor 310-594-8062

[email protected]