Institutional Gold Analyst

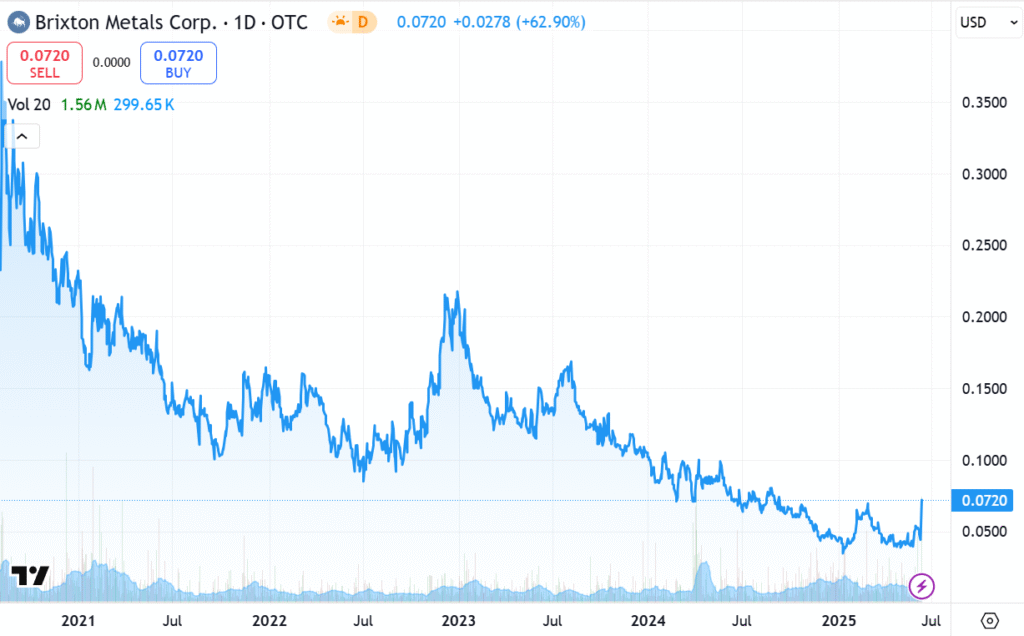

It’s always fun to decide on a single word, to describe a 62% single day price gain. Should we use “rose, surged, exploded, jumped?” We’ll go with Leaps – and “how sweet it is.”

Brixton Metals (BBBXF) had an intraday high of $0.09, or a gain of 80%. We had a couple of readers ask “Did you make that stock go up?” To which we always reply when asked that, “No, we do not ‘make’ stocks go up, we are not promoters, we ‘find’ stocks that go up,” so it was just coincidental that the very next day it nearly doubled.

Since their was no news, we’ll attribute it to a ‘delayed’ reaction to an announcement 15 days ago, that they started drilling at its Thorn Copper-Gold-Silver Project. That and earlier news, that this summers drilling program was fully funded with a modestly dilutive $6 million offering closed last November.

Brixton has a “Triassic to Eocene, volcano-plutonic complex,” to which we have to say “..wait, what, lol” Moving along…

We attended dinner and drinks with management last night, and while no news was highlighted that we didn’t already know, it was nice to hear the story in a very nice and easy to understand manner (no mention of volcano-plutonic complexes) from Michael Rapsch, a VP of the Company. Not much to add over what we wrote two days ago other than, in sum, we like the story enough that will continue to do our due diligence and you might want to do so yourself.

We’ll definitely invite them to our Gold-Silver Conference.

As a reminder BHP Group (BHP) owns 75,743,391 shares. Nice having a ‘rich relative’ – as shareholders are family, with annual revenues of $50 billion in the wings. It’s a good thing. Crescat Capital a Denver based hedge fund added 5,555,556 shares to its position the same day BHP bought, in 2022. Billionaire Eric Sprott, for those of you who know of him, is a large shareholder and thus a family member too.

Also just coincidentally: Who’s the next Eric Sprott,

SHORT TERM CHART

As nice as the move was and despite a seven-fold increase in shares trading hands, as compared to the previous day – it was less than $100,000 worth of trading. So let’s not get too excited. What we feel is a major potential positive, is that if the buyers in the secondary offering were waiting to sell (restriction came off March 23rd) the stock wouldn’t have nearly doubled. This means to us, if there were sellers, they may have already sold and a potential overhang may be gone, buh-bye.

Look at how the stock traded after March 23rd, on the ‘short-term’ chart in our initial write-up two days ago.

Post lock-up trading Adding Brixton Metals (BBBXF) $0.05 to the Watch List.

VOLUME

LONGER TERM CHART

COMING SOON

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.