Ever get really, really bearish and really, really wish you could find a simple way to make money in a bear market?

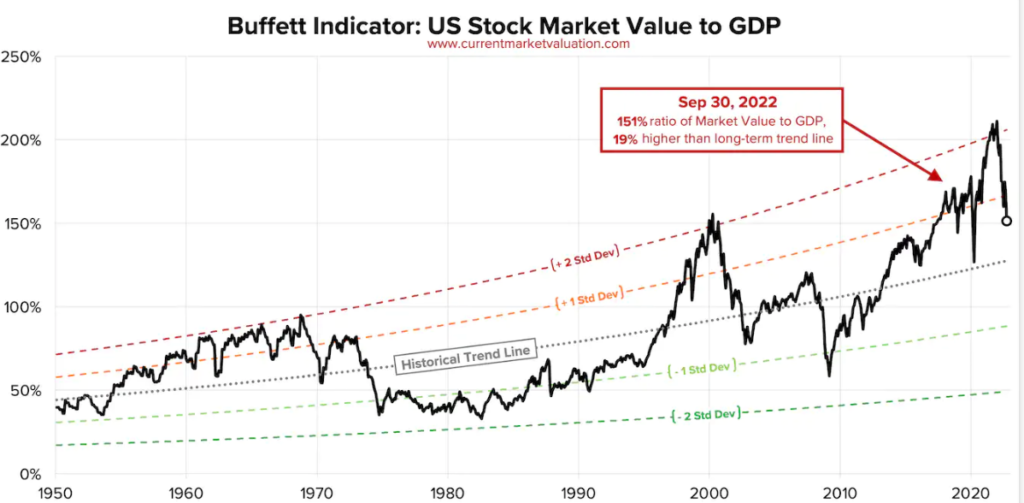

For a good part of 2022 and today with NASDAQ down 30% (10/22), some of Wall Street’s brightest billionaire investors are still calling this market, the biggest bubble in history – which will be followed by the biggest bear market in history.

You probably know their names. Jeremy Grantham who says the next crash will rival 1929, 2000.

Michael Burry (the Big Short), says “ALL the silliness must go.”

Carl Ichan, is certain the “worst is yet to come.”

Stanley Druckenmiller says “this is the biggest bubble I have ever seen in my career. I’m taking a break.”

Jim Rogers, is expecting the “worst bear market in my lifetime.”

Marc Faber, is convinced “a lot of people will lose all of their money.”

Many more simply say “this will end in tears.” But then they leave the listeners hanging, at the end of the interview. Like “that’s it, now what?”

We think this market could end in tears too, but tears of joy.

The joy from making bank in a bear market.

With Wall Street’s Inverse ETFs, investors today, unlike previous bear markets, can make as much money (or more) with the Dow Jones Industrial Average going from 30,000 to 10,000 – as they did when it went from 10,000 to 30,000. And just as easily.

So, the next time you hear some expert like David Hunter on CNBC saying the market will drop 80%, don’t get scared, get excited. Investors no longer have to sit on the sidelines, saying “I knew this market was going to crash” and not benefit from their correct call.

If an investor believes or believes an expert who says a 50% move is coming, it doesn’t matter which direction, up or down. What matters is the size of the move. If above experts are right, more wealth can be made than at any time in history. Generational wealth, that can be passed down from one family generation to another.

Imagine this conversation. Someone asks your college son where he got all his wealth, and he says, “my Dad (or Mom) made it in the stock market, back in 2000.” Then when asked “Oh during the dotcom boom?” And he replies, “No during the dotcom bust, when the NASDAQ dropped 75%. They felt it was a bubble, so they went short. My parents love telling that story.”

Massive moves only come a few times in an investor’s life, and the experts are saying another may be upon us. Are you ready?

Introducing “ARK versus SARK.” A simpler and safer way to make (and/or lose) money in bull and bear markets using ARK Innovation ETF in bull markets and ARK Short Innovation ETF, in bear markets.

Our first ‘market-timing’ service since we launched in the 90’s, ARK versus SARK will seek to benefit in both bull and bear markets – assuming prescient market calls, which is of course far from guaranteed. While we’ve successfully dodged many a bear market (and we’re still here) since 1973, we have yet to benefit from a bear market.

So, we thought, wouldn’t it be nice to be making money when all hell breaks loose, rather sitting at some beach Tiki bar waiting for our next drink and for a re-entry point into the market? Sometimes for a couple years.

And so here we are. A potential solution. We can go long ARK when we are bullish and/or go long SARK when we are bearish. And when we have no clue, go neutral with no position.

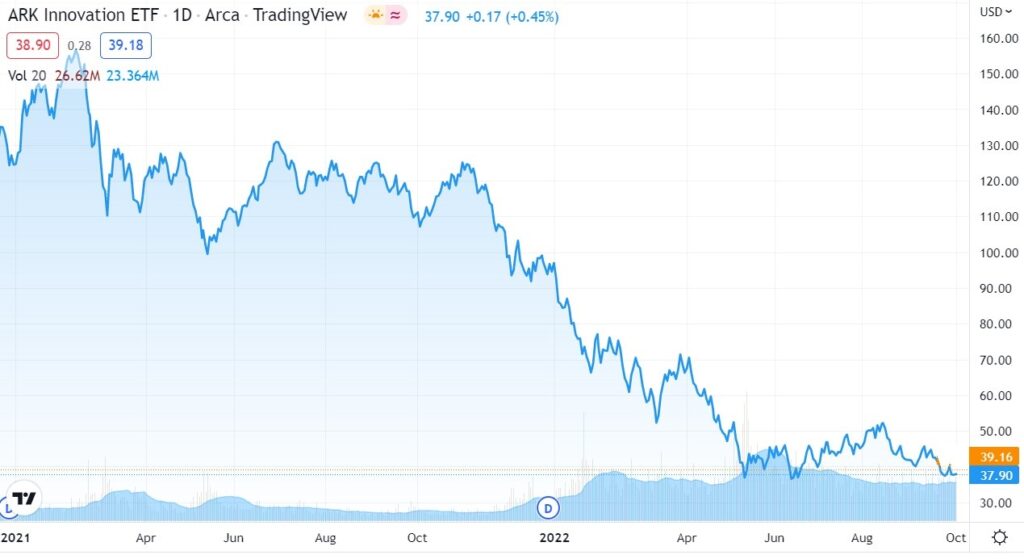

We selected the ARK Innovation Fund because to date ARK has greatly outperformed the market (S&P 500) in bull markets and SARK has greatly outperformed in bear markets, aka “how far can you stretch a rubber band?”

The Ark Innovation ETF (ARKK) defines ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that potentially changes the way the world works. Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of:

- DNA Technologies and the “Genomic Revolution”

- Automation, Robotics, and Energy Storage

- Artificial Intelligence and the “Next Generation Internet”

- Fintech Innovation

Versus:

The Tuttle Short Innovation ETF‘s (SARK) distinctive exposure allows investors to potentially profit from a decline in a portfolio of companies involved in disruptive industries such as electric vehicles, next-gen internet, genomics and fintech.

Ark Innovation ETF (ARKK) Versus AXS Short Innovation ETF (SARK).

We have ‘three’ stances in “ARK versus SARK:” LONG, NEUTRAL or SHORT*

Neutral means we have no position in either ARK or SARK. We anticipate stance changes to occur over intermediate and longer-term time periods.

*Short is being long SARK, so you can go short by going long, and avoid traditional margin call risk, where investors can lose more than all of their money. Trading alongside ARK vs SARK can result in an investor losing all of their money, via consistently wrong call stances (long when we should have been short and short when we should have long).

To repeat, our stance could end up long in a bear market and short in a bull market, and lose money both ways, even with the market unchanged for the year! Yup, welcome to Wall Street where the seemingly safe and simple is anything but.

We have been approached by a number of short-term market timers and may launch the short-term ARK vs SARK.

We launch with LONG ARK!

CURRENT STANCE:

LONG ARK (ARKK) $37.90

10/3/2022

SARK (SARK)

NO POSITION

Bet Right, You’re up 89%. Bet Wrong, You’re Down 66%!

ARK in Blue, SARK in Orange.

Subscribe to our free newsletter to receive ‘stance’ changes via email.

ARK NEWS

May 2022: Inflation or Deflation? | ITK with Cathie Wood

SARK NEWS

November 2021: Tuttle Capital Short Innovation ETF Launches on Nasdaq

MARKET GUAGES

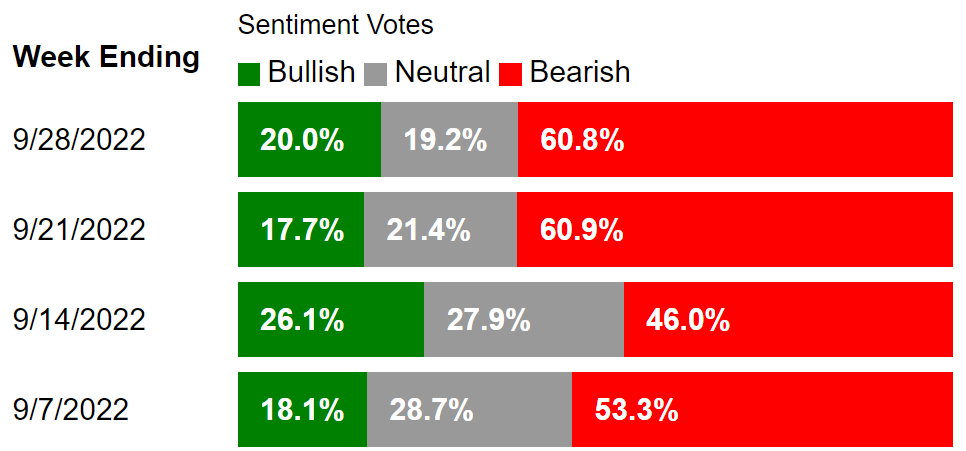

INVESTOR SENTIMENT (LIVE)

BUFFETT INDEX (LIVE)

HMMM!

#ARK, #ARKK, #SARK