Wall Street Cozy’s up to Ardelyx After New Guidance.

On January 8th, Mike Raab, President and Chief Executive Officer stated, “We consistently grew sales of IBSRELA quarter-over-quarter and finished 2023 with strong revenue performance. At the same time, we are seeing a positive initial response to XPHOZAH and are focused on driving awareness and adoption of this important, new medication.”

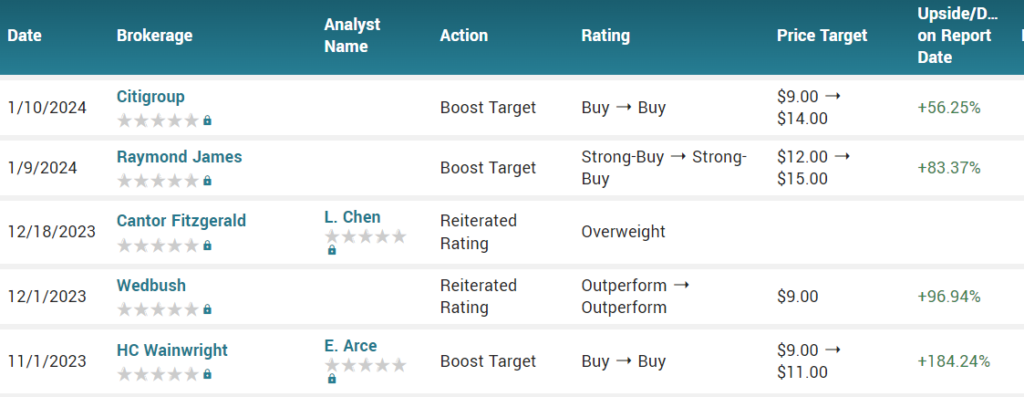

After the guidance on the 8th, Raymond James upped its target to $15 and Citigroup initiated coverage with a $14 price target. If RJ’s target is reached, we will be up ten-fold from where we found it. We think, given time, it works its way into the $20’s. And who ya gonna believe, us or Citi..

GUIDANCE

ISBRELA (Tenapanor)

U.S. net product sales revenue for the first full calendar year of commercialization of IBSRELA is expected to be approximately $80 million. Full-year 2024 U.S. net product sales revenue for IBSRELA to be between $140 and $150 million. They also stated it expects IBSRELA to achieve greater than ten percent market share at peak and generate more than $1.0 billion in annual U.S. net product sales revenue before patent term expiration.

That ain’t bad…

XPHOZAH (Tenepanor)

U.S. net product sales revenue for the first quarter of commercialization of XPHOZAH are expected to be approximately $2.5 million. XPHOZAH (and a cheap valuation) is what originally attracted us to Ardelyx in the first place.

One analyst we know of forecasted “..that 390,000 patients with uncontrolled hyperphosphatemia would benefit from using the drug and at $2,000 per month (cost of competing Renagel) Ardelyx could generate $750 million a month or $12 billion annually! Wait, what!

That ain’t bad.

One might even say “holy sh*t.” Of course his numbers could be way off, and the stock could still go way up, at even half that projection – assuming they aren’t taken over first.

Ardelyx had a market capitalization of $297 million when we added it to the Watch List, is now valued at $2.1 billion – so it is no longer the ‘cheap’ stock it once was. But what can happen in situations like this, is the shares go from the hands of speculators betting on a drug approval, to the speculators betting on future revenues. And the future revenue bettors control a massively larger pool of money. So while the stock is no longer cheap, this party is far from over!

Subscribe for updates on Ardelyx.

If you’re however looking for another ‘cheap’ pre-FDA approval stock, you might want to look at one of our most recent favorites and client, GeoVax (GOVX) which has a market value near $10 million. Wait what…

It’s assortment of vaccines and cancer treatments are addressing equally impressive billion dollar markets. It also has David Dodd at the helm, who in our opinion is every bit as talented as Mike Rabb from Ardelyx. Only time will tell, but we wouldn’t bet against him nor us.

Adding Ardelyx (ARDX) $1.57 to Watch List.

Adding Geovax (GOVX) to 2024 Biotech Watch List.

(GeoVax by the way is looking at half-a-dozen potential milestones in 2024, so we wouldn’t dilly-dally around with doing your due diligence. We can envision the shares trading above $0.60 before January is out. A break above $0.60 would attract momentum buyers and then a more significant move higher cutting through $1.00, like a knife through butter. In our opinion of course — call it a gut feel. Just saying.)

Price Targets from: Noble Securities $6.00, Crystal Research.

GeoVax Research Reports Archive

About Ardelyx, Inc.

Ardelyx was founded with a mission to discover, develop and commercialize innovative, first-in-class medicines that meet significant unmet medical needs. Ardelyx has two commercial products approved in the United States, IBSRELA® (tenapanor) and XPHOZAH® (tenapanor) as well as early-stage pipeline candidates. Ardelyx has agreements for the development and commercialization of tenapanor outside of the U.S. Kyowa Kirin has received approval for PHOZEVEL® (tenapanor) for hyperphosphatemia in Japan. A New Drug Application for tenapanor for hyperphosphatemia has been submitted in China with Fosun Pharma. Knight Therapeutics commercializes IBSRELA in Canada. For more information, please visit https://ardelyx.com/ and connect with us on X (formerly known as Twitter), LinkedIn and Facebook.

DISCLAIMERS

ARDX: To the extent that statements contained in this post are not descriptions of historical facts regarding Ardelyx, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor of the Private Securities Reform Act of 1995, including Ardelyx’s expectation regarding opportunities for continued IBSRELA adoption, the potential market share for IBSRELA and annual U.S. net product sales revenue at peak; Ardelyx’s current expectation for net product sales revenue for IBSRELA for full year 2023; projected net product sales revenue for IBSRELA for full year 2024; Ardelyx’s current expectation for net product sales revenue for XPHOZAH for the fourth quarter 2023; and Ardelyx’s current expectation regarding its cash position at December 31, 2023. Such forward-looking statements involve substantial risks and uncertainties that could cause Ardelyx’s future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, uncertainties associated with the development of, regulatory process for, and commercialization of drugs in the U.S. and internationally. Ardelyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to Ardelyx’s business in general, please refer to Ardelyx’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on October 31, 2023, and its future current and periodic reports to be filed with the Securities and Exchange Commission.

GOVX: This post contains forward-looking statements regarding GeoVax’s business plans. The words “believe,” “look forward to,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax is able to obtain acceptable results from ongoing or future clinical trials of its investigational products, GeoVax’s immuno-oncology products and preventative vaccines can provoke the desired responses, and those products or vaccines can be used effectively, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its immuno-oncology products and preventative vaccines with the desired characteristics in a timely manner, GeoVax’s immuno-oncology products and preventative vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s immuno-oncology products and preventative vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, and other factors, over which GeoVax has no control.

Further information on our risk factors is contained in our periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Client, Institutional Analyst is being retained for five-thousand per month for ongoing progress reporting and news coverage.