Ardelyx Enters the Danger Zone* With Tenapanor.

The company produced favorable (albeit very technical) information (data) at the National Kidney Foundation 2023 Spring Clinical Meetings on April 12th.

April 12th: Ardelyx Presents Positive Data Further Supporting Efficacy and Safety

Tenapanor is a phosphate absorption inhibitor (binder for short) for adult patients with chronic kidney disease (CKD) on maintenance dialysis, seeking to control their serum (blood) phosphate.

Read here for more details on phosphate binders and who needs them: Ardelyx News Archive

As is typical, we are less interested in the odds of a drug getting approved, and more interested in what type of revenues a drug can generate, AFTER it gets approved. But that’s just us, though we are in close contact with analysts who have excellent track records of predicting, what will ultimately get approved.

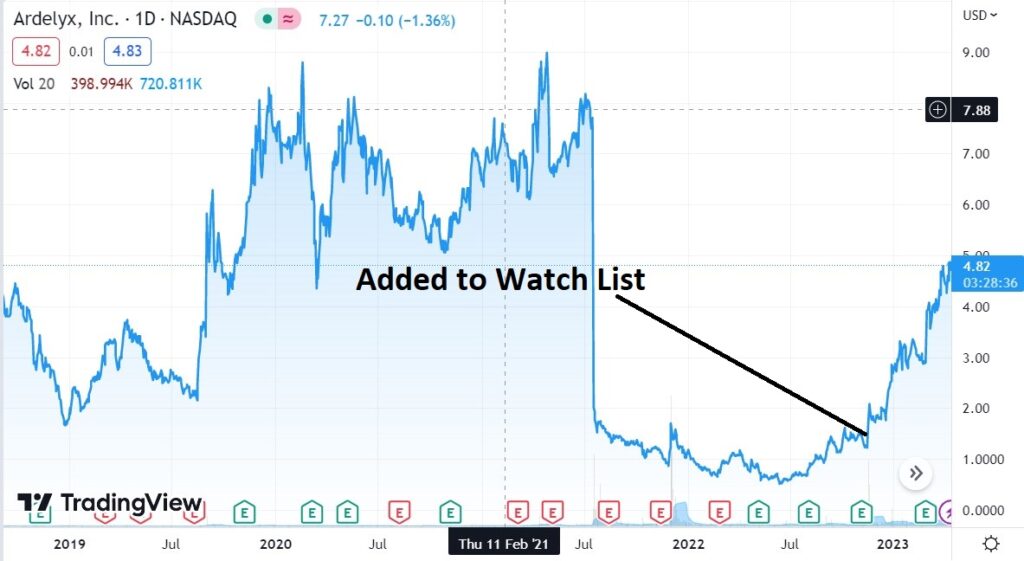

We added Ardelyx to the Watch List at $1.57 on the second round of positive FDA news (though not approval) on Tenapanor.

The danger zone this time (its third), is Ardelyx’s intention to resubmit the Tenapanor new drug application (“NDA”) with the FDA, sometime this month after being granted an appeal to do so last year.

So considering that, the revenue outlook was well laid out by an analyst and pharmacist at Clinically Sound Investor:

“Once approved, the total addressable market in the U.S. alone is immense, and the recommendation timeframe changes accordingly. Of the 786,000 people in with end-stage CKD, 71% are on dialysis, meaning 390,000 have uncontrolled hyperphosphatemia while on best care and would need Tanapanor. Using a price point of $2,000 per month (a 270-pill bottle of Renagel still costs that much) suggests around $750 million per month or $9 billion in annual revenues.”

PS Market cap is near $1 billion as in WHOAH!

“XPHOZAH will get there because in my opinion every nephrologist will prescribe it (no safety issues), every insurance company will cover it to extend patient lives, and there is no competition on the horizon for at least 5 years. Even if the drug is priced conservatively, Ardelyx appears to be an easy potential multi-bagger of several magnitudes if investors can hold on to it for a decade.”

Doesn’t sound like the type of stock we’d ‘flip’ for the easy triple, that we already have. Yes, it’s always fun putting some black ink on the books…but come on folks, have some patience here – like years worth.

As usual, we offer no advice, “flip, hold or buy more” – we’re just sharing an interesting long-term story.

Three That Doubled, Three More That May Double.

*Danger slash opportunity zone.

Forward Looking Statements

To the extent that statements contained in this press release are not descriptions of historical facts regarding Ardelyx, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor of the Private Securities Reform Act of 1995, including the potential role that tenapanor can play in offering new treatment options for patients with hyperphosphatemia. Such forward-looking statements involve substantial risks and uncertainties that could cause Ardelyx’s future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, uncertainties associated with the process for drug development, regulatory approval and commercialization. Ardelyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to Ardelyx’s business in general, please refer to Ardelyx’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 2, 2023, and its future current and periodic reports to be filed with the Securities and Exchange Commission.