Formerly Surna (SRNA), Name Changed, Symbol Changed and $24 Million Raised.

A number of new issues have been tumbling after their IPO or Secondary during 2022. The most dramatic drop we’ve seen so far was Smart for Life (SMFL) which was priced at $7.00, raising $14 million, twenty days ago. It opened $2.90 and closed at $2.68 and sent our bargain hunting heart fluttering. Then it was $1.84 Two days after that $1.09. And two days ago, it hit $0.82. As is ready, aim, deer in the headlights.

It’s hard to pick an entry point in these types of situations (as Smart for Life shows), but trading at a valuation near the level of cash it raised, we have to take a stab at CEA and are adding it to the Watch List.

It is a small but excellent team of design engineers who specialize in indoor growing. Since founding they have been involved in over 200 projects. We noticed upsized ‘major-contracts’ awarded in the past couple of years for $2.1 million (1/13/22), $3.4 million (1/4/22), and $2.8 million (8/7/2020).

So, they are doing something right. The simple story is getting awarded more and more larger contracts and with the recent funding, they should be able to put the growth pedal to the metal. More to follow.

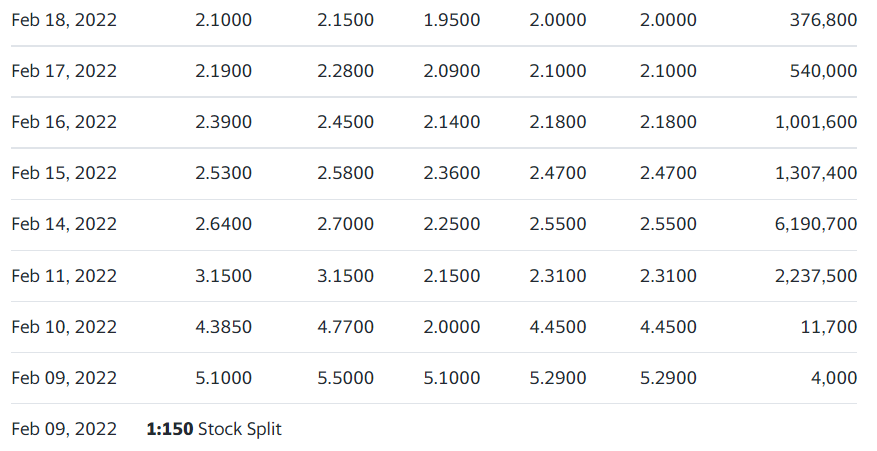

Here’s the week of trading post raise and a 150:1 reverse split.

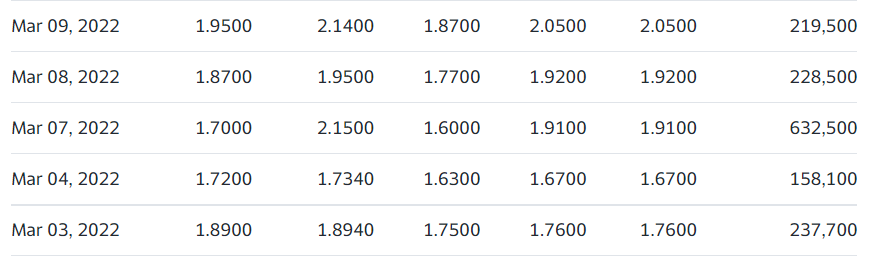

Here’s the prior week’s trading.

As we mentioned picking a bottom in these types of situations is difficult at best, but if you visit the company website, we think you’ll like what your read.

February 2, 2022, Presentation

Market Cap: $17 million. (Wait, what?)

CEA Industries Announces Closing of $24 Million Public Offering.

Louisville, Colorado, Feb. 15, 2022 (GLOBE NEWSWIRE) — CEA Industries Inc. (NASDAQ: CEAD, CEADW) (the “Company”), a leader in controlled environment agriculture (CEA) systems engineering and technologies, today announced the closing of its previously announced underwritten public offering of 5,811,138 shares of the Company’s common stock and warrants to purchase up to 5,811,138 shares of the Company’s commons stock at a combined public offering price of $4.13 per share and warrant. The gross proceeds from the offering were $24,000,000 prior to deducting underwriting discounts, commissions, and other offering expenses. The warrants have a per share exercise price of $5.00, are exercisable immediately, and expire five years from the date of issuance.

The shares and warrants began trading on The Nasdaq Capital Market on February 11, 2022, under the ticker symbols “CEAD” and “CEADW,” respectively.

In addition, the Company has granted the underwriter a 45-day option to purchase up to an additional 871,670 shares of common stock and/or up to 871,670 additional warrants to cover over-allotments, if any. In connection with the closing of the offering, the underwriter has exercised its over-allotment option to purchase an additional 761,670 warrants. The underwriter has retained the right to exercise the balance of its over-allotment option within the 45-day period.

ThinkEquity acted as sole book-running manager for the offering.

The net proceeds from the offering will be used to advance the Company’s organic growth and new product initiatives, to pursue select acquisitions, and for general corporate and working capital purposes.

The registration statement on Form S-1 (File No. 333-261648) relating to the shares being sold in this offering has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and became effective on February 10, 2022, and an additional registration statement on Form S-1 relating to the offering was filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, which became effective upon filing. A final prospectus related to the offering has been filed and is available on the SEC’s website at https://www.sec.gov. The offering is being made only by means of a prospectus. Electronic copies of the final prospectus may be obtained from ThinkEquity, 17 State Street, 22nd Floor, New York, New York 10004, by telephone at (877) 436-3673 and by email at [email protected].

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About CEA Industries Inc.

CEA Industries Inc. (www.ceaindustries.com), is home to industry leaders in controlled environment agriculture, with complementary and adjacent companies added to its portfolio when aligned with the company’s growth initiatives. As the global environment for indoor cultivation continues to grow, CEA Industries was formed to embrace companies that support these ecosystems.

Headquartered in Louisville, Colorado, CEA Industries knows that growth is a team sport. Through future partnerships and mergers and acquisitions, both financial and strategic, CEA Industries will continue its pursuit of companies that bring accretive value to its customers and investors.

Safe Harbor Statement

This press release contains statements of a forward-looking nature relating to future events. For example, when we discuss the expected use of proceeds, we are using forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect our current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this press release, including the factors set forth in “Risk Factors” set forth in our annual and quarterly reports and prospectus filed with the Securities and Exchange Commission (“SEC”), and subsequent filings with the SEC. Please refer to our SEC filings for a more detailed discussion of the risks and uncertainties associated with our business, including but not limited to the risks and uncertainties associated with our business prospects and the prospects of our existing and prospective customers; the inherent uncertainty of product development; regulatory, legislative and judicial developments, especially those related to changes in, and the enforcement of, cannabis laws; increasing competitive pressures in our industry; and relationships with our customers and suppliers. Except as required by the federal securities laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. The reference to CEA Industries Inc.’s website has been provided as a convenience, and the information contained on such website is not incorporated by reference into this press release.

Jamie English

Vice President, Marketing Communications

[email protected]

(303) 993-5271