Having Dinner With Management Tomorrow, We’ll be Back With What we Learn.

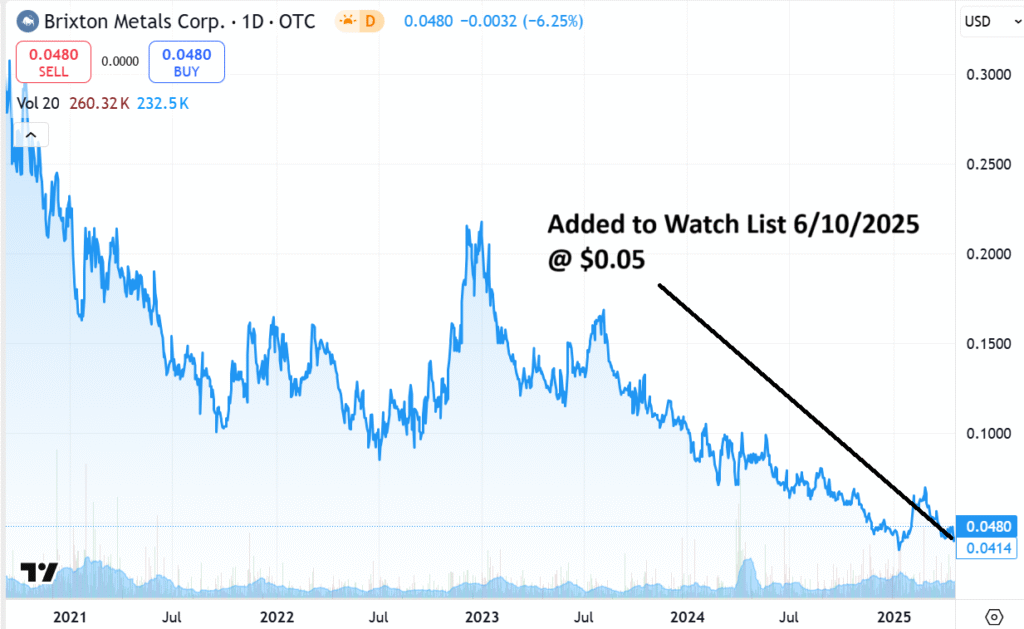

In the meantime, we are adding Brixton Metals (BBBXF) to the Watch List @ $0.05, primarily for technical reasons (chart looks like it bottomed). Also because they are funded for their next drill program, and lastly – because they just started drilling!

CHART

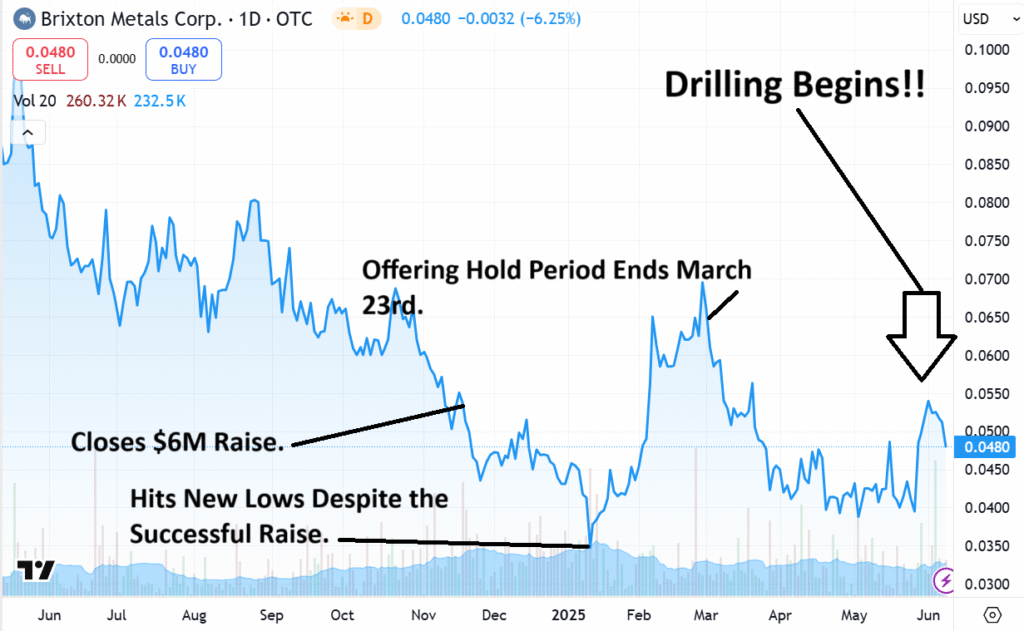

On November 14th, they announced a non-brokered private placement offering of up to 66,666,667 flow-through units of the Company at a price of $0.09 per FT Unit for gross proceeds of up to $6,000,000.

On November 25th, they announced that it completed (never guaranteed) the non-brokered private placement for total gross proceeds of $5,983,796.87.

Hold Period for Offering Ends.

The securities issued to subscribers of the FT Units are subject to a hold period until March 23, 2025, pursuant to applicable Canadian securities laws.

On May 6th they announced they are ready to rock. Or at least drill rock!

Chairman and CEO, Gary R. Thompson, stated, “We are excited to open camp and commence the 2025 exploration season at the Thorn Project. The plan is to split our budget 50/50 between gold/copper targets this year. The plan is to be drilling by the 25th of May, with a focus on high impact, near surface targets. We are especially motivated to continue drilling the Trapper Gold Target following up on the previous year’s successful campaigns and given the recent record-breaking gold price. I continue to be amazed with the high number of exploration targets that this project holds. The 2024 exploration season generated several new, large-scale copper-gold targets that have never been drilled; they offer potential for new discoveries.”

Aside from that, the press release was pretty much impossible to understand, unless you’re a geologist with terms like:

“Hole 307 returned 26m of 1.89 g/t gold, 74.8 g/t silver, 0.28% copper from 172m depth including 8.00m of 4.52 g/t gold, 148.6 g/t silver, 0.54% copper. 600m south from hole 307, is a similar northeast trending high-sulphidation vein feeder structure that outcrops known as the Glenfiddich zone.”

Wait, what? Sulphidation in my single malt Scotch?

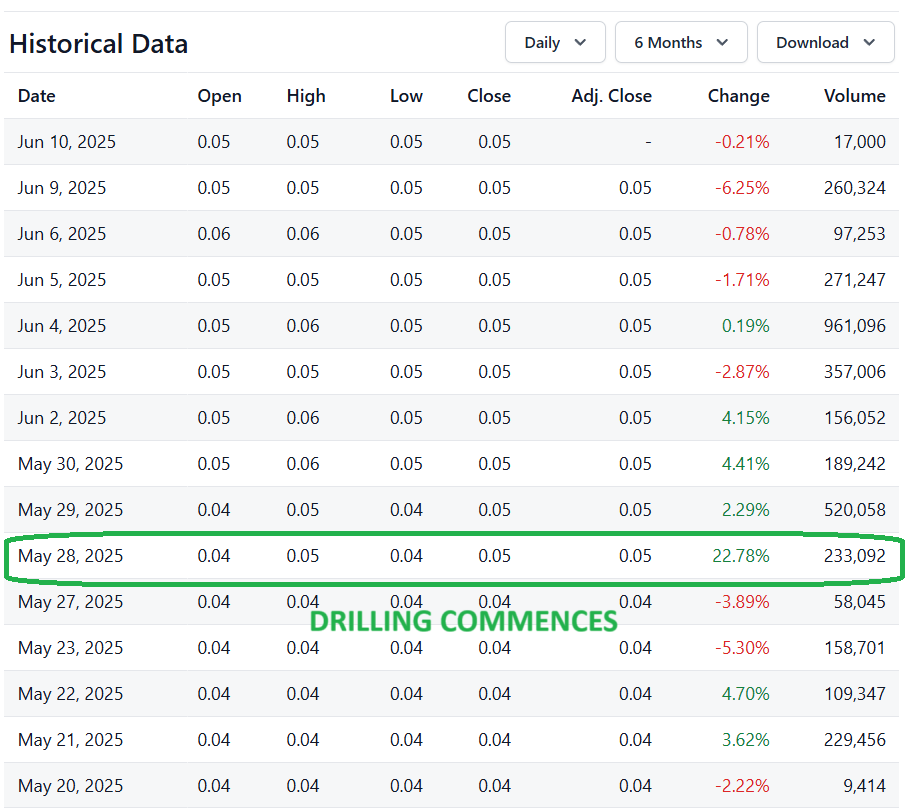

On May 28th, they announce that its Thorn exploration camp is now open for the season and drilling has commenced. Brixton is fully funded for the 2025 exploration program with plans to expand near surface gold mineralization within the Camp Creek Corridor and at the Trapper Gold Target, and to drill test new, near surface copper mineralization at Catalyst Target.

Chairman and CEO Gary R. Thompson stated, “We are excited to have the drills turning again at the Thorn Project. Between the new gold mineralization and copper discovery potential, we are in for an interesting exploration season.”

And that’s pretty much all we needed to hear.

They got money to drill, they started drilling, and the stock is near an all-time low. We’ll be back later to share what we learned at the dinner presentation tomorrow tonight. If it’s great as it seems on the drill surface, we’ll invite them to our upcoming Gold Investment Conference.

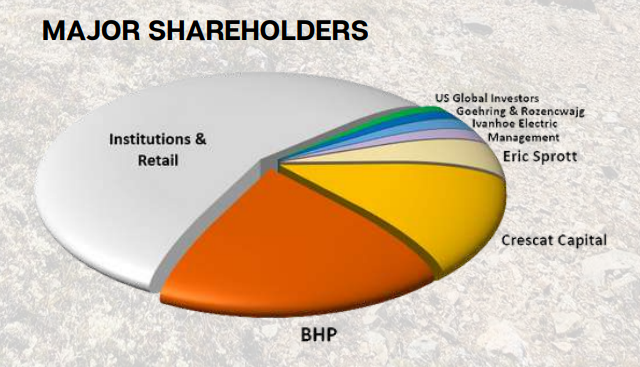

Oh, sorry did we forget to mention BHP is a Major Shareholder?

3D Map. Only a geologist could understand this, but cool anyway.

SHORT TEM CHART

TRADING VOLUME

COMING SOON

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, including statements that address potential quantity and/or grade of minerals, potential size and expansion of a mineralized zone, proposed timing of exploration and development plans, or other similar expressions. All statements, other than statements of historical fact included herein including, without limitation, statements regarding the use of proceeds. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; and the additional risks identified in the annual information form of the Company or other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.