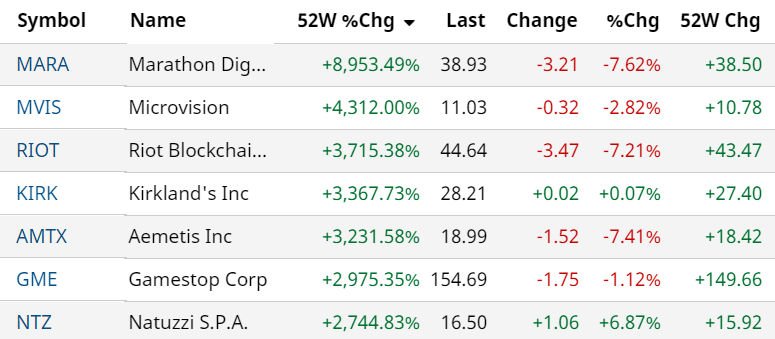

THE TIKI HUT FUND | THIS YEAR’S 7 BIGGEST MOVERS

Marathon Digital Holdings Inc. (MARA) up 8,953%

As crypto mining stocks have grabbed increasing attention from institutional and retail investors in recent months, shares of RIOT Blockchain Inc. (RIOT) and Marathon Digital Holding (MARA), two of the largest crypto mining companies, have logged huge price gains year to date. While crypto mining companies are a great proxy for BTC and other cryptocurrencies, both RIOT and MARA have sky-high valuations currently, and if crypto prices retreat, these two stocks could tumble too. So, which of these two stocks is a better investment now? Read on. Let’s evaluate. News

MicroVision Inc. (MVIS) up 4,312%

On the price chart MVIS’ recent and dizzying rally was among the best in a market with no shortage of unproven winners. I won’t bore you with the percent run-up given the incredibly low bar set for the stock’s launch pad. But the stock run-up did bring real value to the table with shares valued at nearly $4 billion at the height of the feeding frenzy. Chalk it up to short squeezes, electric-vehicle themed enthusiasm and what have you, Microvision had a piece of the action. News

Riot Blockchain Inc (RIOT) up 3,715%

In March 2021, Riot produced 187 BTC, an increase of 80% over its pre-halving March 2020 production of 104 BTC. In Q1 2021, the Company produced 491 BTC, an increase of 75% over its pre-halving Q1 2020 production of 281 BTC. As of March 31, 2021, Riot holds over 1,565 BTC on its balance sheet, all of which was produced by its mining operations. On April 8, 2021, Riot announced that it had signed a definitive agreement to acquire Whinstone US, Inc. (“Whinstone”), creating a US-based industry leader in Bitcoin mining. The Company plans to continue to provide monthly operational updates and unaudited production results through the end of 2021. These updates are intended to keep shareholders informed of Riot’s substantial growth as it continues to deploy its expanding mining fleet. News

Kirkland’s Inc. (KIRK) up 3,367%

E-commerce comp increased ~36% benefitting from an increase in website traffic and higher average ticket size. KIRK noted that the third-party dropship revenue was up 111% and its own products shipped directly to customers was up 45%. E-commerce accounted for 24% of overall Q4:20 sales versus 17% in the prior-year quarter. Strong liquidity. KIRK ended Q4:20 with total cash & cash equivalents of ~$100.3 million and no debt. Combined with availability on its revolving credit facility, KIRK had total liquidity of $139.8 million. KIRK ended Q4 with a higher cash balance than expected due to a lower inventory position. Management anticipates a use of cash of $30 to $35 million in H1:21 to ramp up inventory levels. News

Aemetis Inc (AMTX) up 3,231%

Aemetis Inc is an international renewable fuel and biochemicals company focused on the production of renewable fuels and chemicals through the acquisition, development and commercialization of technologies that replace traditional petroleum-based products through the conversion of first-generation ethanol and biodiesel plants into advanced biorefineries. It owns and operates an approximately 65 million gallon per year ethanol production facility located in Keyes, California. In addition to low carbon renewable fuel ethanol, the Keyes Plant produces Wet Distillers Grains, Distillers Corn Oil, and Condensed Distillers Solubles

GameStop Corporation (GME) up 2,975%

GameStop, a Fortune 500 company headquartered in Grapevine, Texas, is a leading specialty retailer offering games and entertainment products through its E-Commerce properties and thousands of stores. Visit www.GameStop.com to explore our products and offerings. Follow @GameStop and @GameStopCorp on Twitter and find us on Facebook at www.facebook.com/GameStop

Natuzzi S.P.A. (NTZ) up 2,744%

Furniture, really? Up 2,700%! Natuzzi SPA is an Italian firm that designs, manufactures, and sells contemporary and traditional leather and fabric-upholstered furniture. Its product portfolio including sofas, loveseats, armchairs, sectional furniture, motion furniture and sofa beds, living room furnishings, and accessories. The company markets its products under several brands such as Natuzzi Italia, Private label, and Natuzzi Editions. Geographically, it derives a majority of revenue from the United States of America and also has an international presence.

OTHER NEWS