The Past Year’s Biggest Losers!

Here’s an interesting look at the biggest losers over the past year. It’s a jungle (polar cap?) out there. Even a portfolio ‘diversified’ with ten issues can spell disaster..with the wrong picks.

But then out of the ashes..ya never know.

Globus Maritime Limited (GLBS) | Down 93% But Not Out!

Unlike many biotech and/or internet technology companies, investors in the marine industry do look at things like day rates and a loss of $36 million in 2019 and another loss of $17 million last year – showed up in the stock price. A 100:1 reverse split in October did little to stem the price drop.

But wait, there’s more! They did a direct registered offering via Maxim Group LLC for $30 million to help buy more ships – which they may be getting at a bargain – but we don’t have time to study. They also closed a $34 million loan and stated “Upon the completion of this transaction our bank debt stands at around $34 million, compared to total assets of the Company of around $144 million adjusted to reflect the market value of the six vessels.” Hmmm. NEWS

BiondVax Pharmaceuticals Ltd. (BVXV) | $50 to $3.00 – Can’t Hurt to Look.

We’ve found countless interesting ideas that fell from $20 to $2 or $3 and later rebounded bigtime. So nature tells us to look into this (later). Israeli based “BeyondVax” had its day of reckoning last October 23rd when the FDA took a dump on its universal influenza vaccine. Oh well. But wait, there’s more! Prior to, it had run from $5 to $50.

This is a tiny company with minimal resources, but they are staying in the game (what game, we don’t know lol) after raising $13 million in February. Aegis Capital Corp. acted as Sole Bookrunner. Their new mission (not kidding) stated in a press release was “..to help build a healthier and happier world by developing, manufacturing and ultimately commercializing products for the prevention and treatment of infectious diseases and related illnesses.” Awe, lovely. They also mentioned they have a “..highly advanced GMP vaccine manufacturing facility in Jerusalem is being maintained by its highly experienced staff as it seeks to expand its product asset pipeline in the coming quarters.” Okay, value there.

The new CEO Amir Reichman was Head of Global Vaccines Engineering, Core Technologies, and Asset Management at GSK (Glaxo) Vaccines headquarters in Belgium. And he has a crack team of advisors. So maybe it’s a new day and the market cap is nothing. Hmm. Liked it at $40, love it at $4? NEWS

Aprea Therapeutics, Inc. (APRE) | Another Biotech Bomb – $40 to $4.00

Biotech lives by the sword. Dropped 78% in one trading day. Now that we think about it, we’ve rarely played the late-stage FDA approval game (aside from IMMU, CTXR and most recently PRVB). Even though it is of course riskier getting in the “pre-clinical” stage plays – with dozens and dozens of biotech plays under our belt – we’ve luckily never had one of these single-day 80% plunges happen to us. Their “..failed to meet its predefined primary endpoint” came in December also referred to as “…didn’t reach statistical significance.” Something we can’t put our finger on that makes these lab coats, just not interesting.

ChemoCentryx, Inc. (CCXI) | Just Blew Up on Split Panel Decision. Yikes.

Yikes just blew up on a split panel decision. Still sports a $700 million market cap. The FDA’s Arthritis Advisory Committee on Thursday voted 10 for and 8 against the approval of ChemoCentryx’s investigational drug avacopan as a treatment for adults with a rare and serious disease. Liver problems, potentially.

The vote on whether the FDA should approve the drug was preceded by a split vote of 9 to 9 on whether the efficacy data support approval, and 10 to 8 that the safety profile of avacopan is adequate enough to support approval. NEWS

We have to throw in the full chart.

Various Stocks On the Move.

Internet | Biotech | Beverage Stock Review:

Citius (CTXR) up 19%, Draganfly (DFLYF) UP 31%, urban-gro (UGRO) up 37%, Provention (PVRB) flip-flopping, Hapbee Technologies (HAPBF) up 26% and the Alkaline Water Company up 26%.

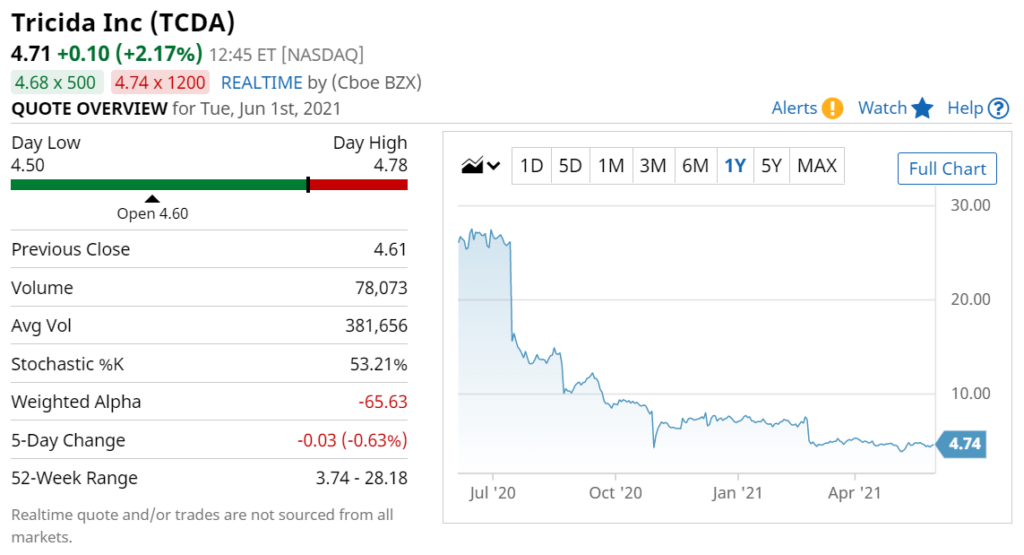

Tricida, Inc. (TCDA) | Hot IPO Turns Cold. Very Cold. Dead Fish Cold.

Tricida IPO opened 32% higher in its 2018 pricing 0f 11.7 shares of its common stock at $19. What could go wrong, right? Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC and Cowen and Company, LLC are acting as joint book-running managers for the offering.

Tricida, Inc., is focused on the development and commercialization of TRC101, a non-absorbed, orally-dosed polymer drug designed to treat metabolic acidosis in patients with chronic kidney disease. The FDA denied them in August and then got an Appeal Denied Letter (ADL), from the FDA in response to its Formal Dispute Resolution Request (FDRR) submitted in December 2020. A left and a right, and man down! $200 million left in the bank though and they are still continue execution of the ongoing VALOR-CKD renal outcomes trial. “Ref, stop the fight – oh the humanity!” NEWS

Adverum Biotechnologies, Inc. (ADVM) | Something We Like About This One.

Okay, okay. We know there are some serious side effects – like BLINDNESS. But it’s trading at cash. (30 minutes later). Nah we’ll pass. The chart looked good at first blush, oh well. NEWS.

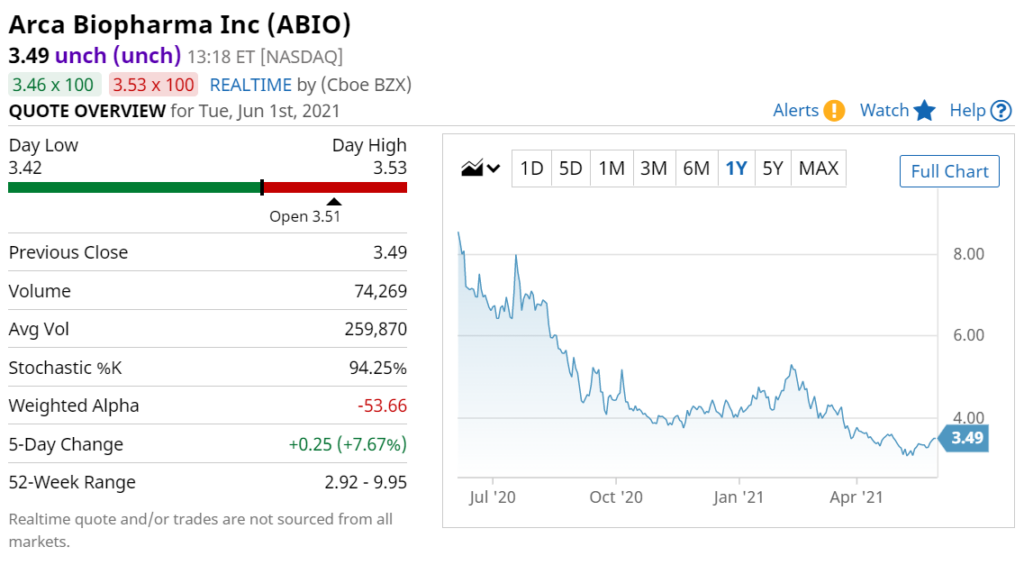

ARCA Biopharma, Inc. (ABIO)| A COVID Play and More!

Hmm, what do we have here?? Finally something worth studying? And with $66 million in the bank! And Covid? And an upcoming catalyst. Think we owned this in the past.

“We are continuing to advance the Phase 2b clinical trial evaluating rNAPc2 as a potential treatment for patients hospitalized with COVID-19, actively enrolling patients at 7 clinical trial sites in the United States. We look forward to sharing the trial results early in the third quarter of this year. As a therapeutic aimed at a host response to a disease syndrome, we believe rNAPc2 has therapeutic potential for future viral outbreaks beyond the current pandemic, even after safe and effective vaccines for SARS-CoV-2 are successfully deployed.” (Nicely worded as Covid loses its luster on Wall Street!)

We’ll read up on it tonight. NEWS