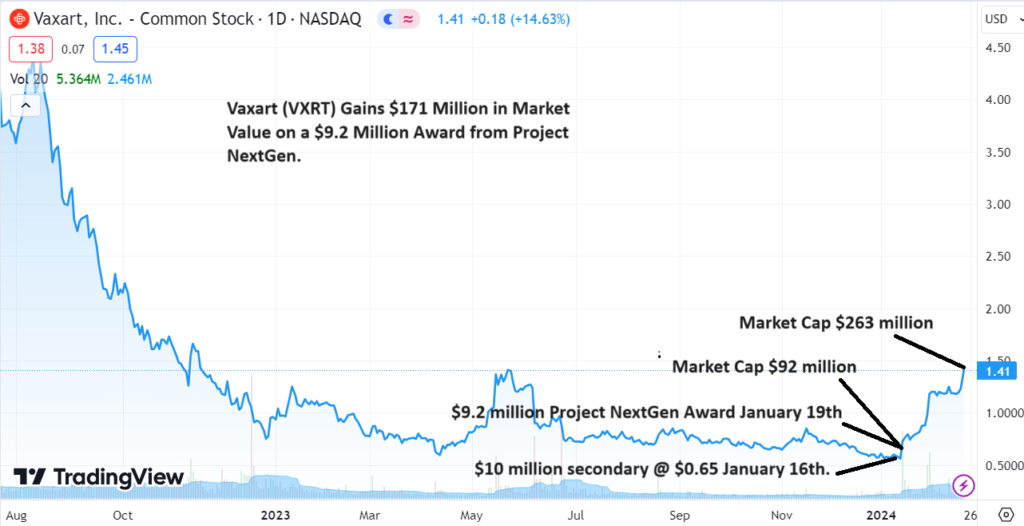

- Vaxart Closes $10 Million Secondary on January 16th @0.65.

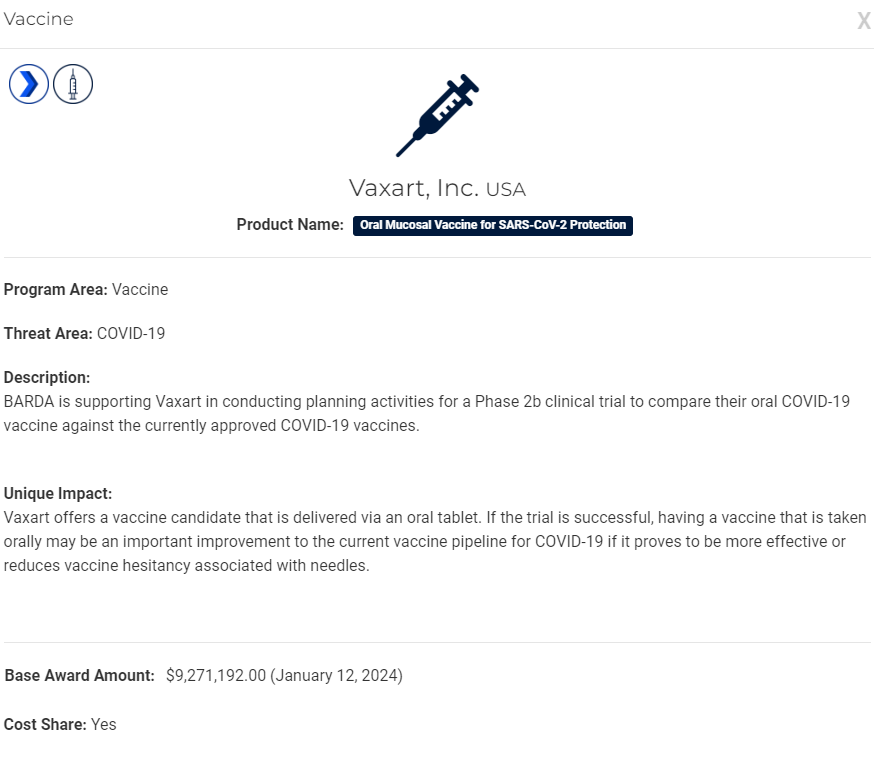

- Vaxart Receives $9 Million Award from Barda on January 19th.

- Shares trades From a Low of $0.55 to $1.41.

- Market Cap Goes from $93 Million to $263 Million.

Amazing timing from RA Capital who bought 15,384,615 shares in a registered direct offering at $0.65, three days before a BARDA Project NextGen award. The investors $10 million stake, is worth $21.6 million at today’s close. Some investors complained of ‘dilution’ doing the offering near a five year low – ‘not so bad’ we say!

It’s been a rough couple years for Vaxart (VXRT) having fallen from $10 per share in late 2021 to a recent low of $0.55 in late December. Things started getting real ugly with shareholders jumping ship, in May of 2023, when they got hit with a deficiency notice from NASDAQ for being under $1.00, signaling the potential reverse split. Looks like they were saved at the bell!

Interesting, with our recent interest in companies post-reverse split, we wondered how the shares would have traded the past month had they done a 1:10 reverse. Here’s the math. If they did the reverse from their low of $0.55, the stock would have opened at $5.50. If it had an identical percentage move, Vaxart would have traded from $5.50 to $14.00. Same percentage move but, with 33 million shares outstanding, instead of 168 million (now with 187 million after the secondary).

While the move from $0.55 to $1.41 is impressive, what’s really eyebrow raising, is the gain from a $92 million valuation to $263 million. It’s not so much the $9 million award Vaxart got that moved the stock. What the excitement is about is the fact that the FDA took a deep dive into the technology and liked it enough to award a grant. That and investors are wondering what could be behind the $9 million. Project NextGen has some $3 billion left the last time we checked, remaining to be doled out. Hmm.

Vaxart stated the award would be used to fund ‘preparation‘ for subject Phase 2b clinical study.

Are we looking for additional publicly traded companies which could potentially win a another Project NextGen award from BARDA? Of course you know the answer to that. Our database has a dozen candidates.

Have we found one we like yet? Of course you know the answer to that!

We are just about finished on a 20 page report on GeoVax (GOVX) which should be out by Friday with all of the details. We sliced and diced this one every way we could think, and the more we read about it and their Phase II progress, the more we like it. Two of CEO David Dodd’s past turnaround situations increased in value from $100 million to $2.5 billion (Solvay Pharma) and from $85 million to $1.4 billion (Serologicals) so he has an absolute fantastic track record at working with turnarounds like GeoVax.

Best part of the story, is they got a deficiency notice like Vaxart, but Geovax did do a 1:15 reverse a few weeks ago and now there are only two million shares outstanding, and a market cap near $6 million. A $200 million market cap like Vaxart which is also in Phase II, would put the share price at $100, excluding warrant exercises.

You can get a jump on the report by going through our GeoVax News Archive or by reading the four Wall Street Research Report Archive posted on our site.

List of Project NextGen Award Winners.

Vaxart Receives $9.27 Million BARDA Project NextGen Award

Vaxart Announces $10.0 Million Registered Direct Offering with RA Capital Management

Fact Sheet: HHS Details $5 Billion ‘Project NextGen’ Initiative to Stay Ahead of COVID-19

Vaxart NASDAQ Deficiency Notice

This is What a Award Letter from NextGen Looks Like (kinda boring, doesn’t even say congrats (lol).

Subscribe to receive our upcoming report on GeoVax.

LONG TERM CHART

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this press release regarding Vaxart’s strategy, prospects, plans and objectives, results from preclinical and clinical trials and the timing of such results, vaccine efficacy and safety, commercialization agreements and licenses, and beliefs and expectations of management are forward-looking statements. These forward-looking statements may be accompanied by such words as “should,” “believe,” “could,” “potential,” “will,” “expected,” “anticipate,” “plan,” and other words and terms of similar meaning. Examples of such statements include, but are not limited to, statements relating to Vaxart’s ability to develop and commercialize its product candidates, including its vaccine booster products; Vaxart’s expectations regarding clinical results and trial data, and the timing of receiving and reporting such clinical results and trial data; and Vaxart’s expectations with respect to the effectiveness of its product candidates. Vaxart may not actually achieve the plans, carry out the intentions, or meet the expectations or projections disclosed in the forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions, expectations, and projections disclosed in the forward-looking statements. Various important factors could cause actual results or events to differ materially from the forward-looking statements that Vaxart makes, including uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement, and/or completion dates for clinical trials, regulatory submission dates, regulatory approval dates, and/or launch dates, as well as the possibility of unfavorable new clinical data and further analyses of existing clinical data; the risk that clinical trial data are subject to differing interpretations and assessments by regulatory authorities; whether regulatory authorities will be satisfied with the design of and results from the clinical studies; decisions by regulatory authorities impacting labeling, manufacturing processes, and safety that could affect the availability or commercial potential of any product candidate, including the possibility that Vaxart’s product candidates may not be approved by the FDA or non-U.S. regulatory authorities; that, even if approved by the FDA or non-U.S. regulatory authorities, Vaxart’s product candidates may not achieve broad market acceptance; that a Vaxart collaborator may not attain development and commercial milestones; that Vaxart or its partners may experience manufacturing issues and delays due to events within, or outside of, Vaxart’s or its partners’ control; difficulties in production, particularly in scaling up initial production, including difficulties with production costs and yields, quality control, including stability of the product candidate and quality assurance testing, shortages of qualified personnel or key raw materials, and compliance with strictly enforced federal, state, and foreign regulations; that Vaxart may not be able to obtain, maintain, and enforce necessary patent and other intellectual property protection; that Vaxart’s capital resources may be inadequate; Vaxart’s ability to resolve pending legal matters; Vaxart’s ability to obtain sufficient capital to fund its operations on terms acceptable to Vaxart, if at all; the impact of government healthcare proposals and policies; competitive factors; and other risks described in the “Risk Factors” sections of Vaxart’s Quarterly and Annual Reports filed with the SEC. Vaxart does not assume any obligation to update any forward-looking statements, except as required by law. GeoVax is an Institutional Analyst Inc., client, see report for disclosure and disclaimer details.

Contacts

Vaxart Media Relations:

Mark Herr

Vaxart, Inc

mherr@vaxart.com

(203) 517-8957

Investor Relations:

Andrew Blazier

FINN Partners

IR@vaxart.com

(646) 871-8486

#VXRT, #GOVX