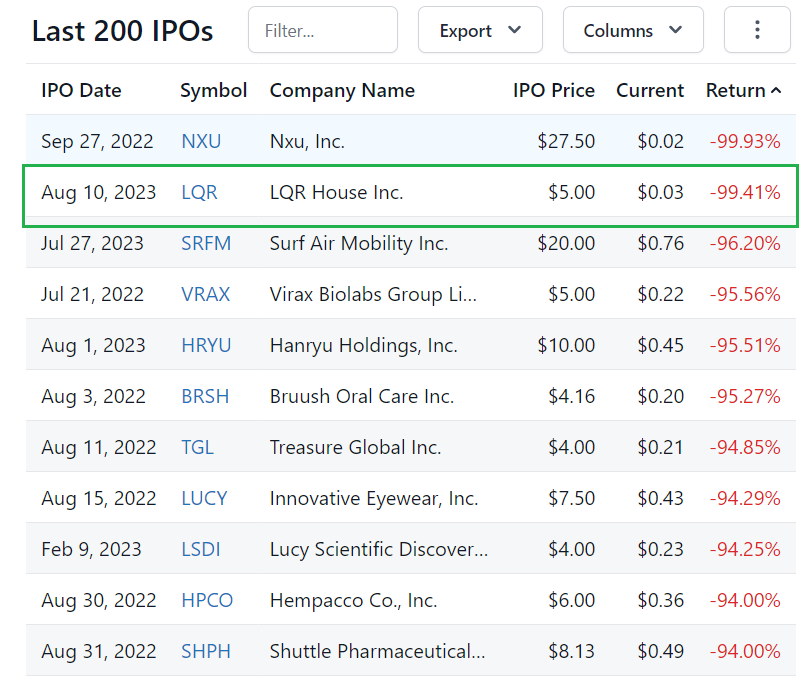

If You’re a Sophisticated Speculator, and we do Mean Sophisticated, Study LQR House (LQR) or ‘the Liquor House’ Story.

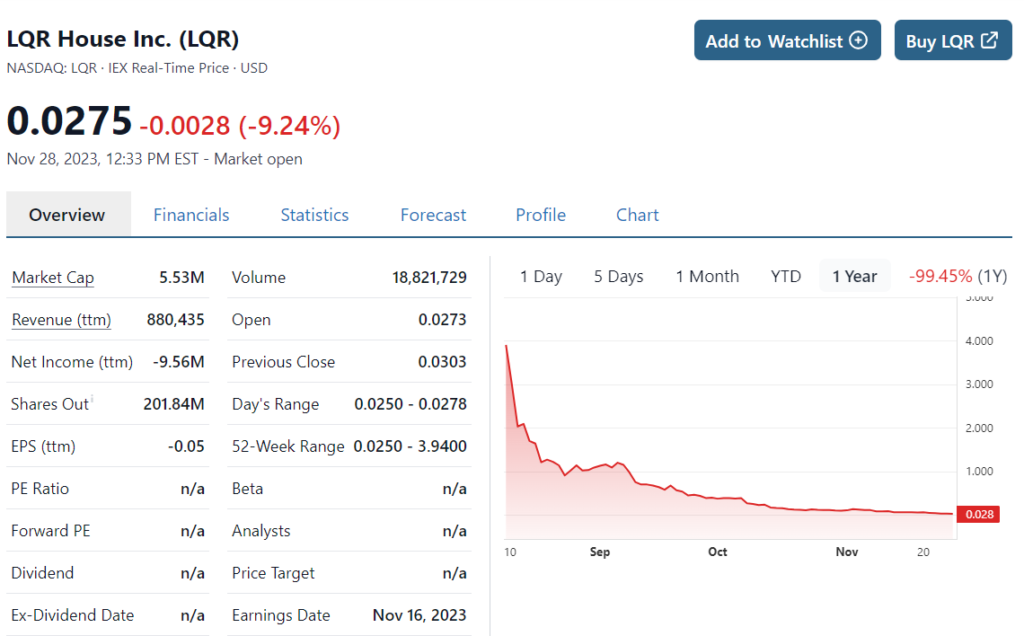

After two down rounds since going public on NASDAQ at $5.00 in August, this digital advertising agency for the liquor and beverage industry, has descended to below cash in the bank (over $10 million), in a manner that we’ve never witnessed before.

PROSPECTUS: On November 13, 2023 aggregate gross proceeds from the closing were $11,000,000.00. The Company received net proceeds of approximately $10.1 million.

With an estimated 201 million shares outstanding, the current market value is drum roll: $5.5 million. Wait, what?

Analogies that come to mind:

- Fallen angel

- Falling knife

- Mid-air explosion ala Space Shuttle Challenger

- Hindenburg Express

- the Sinking of the Titanic

We’ll call this the story of the year, so come watch with us!

It will be interesting to see how this continues to unfold with lessons learned, and lessons to be learned. This would include lessons for IPO investors, small companies wanting to go public and even for investment bankers.

While the above analogies were for fun, except for the IPO investors at $5.00, LQR is not a space shuttle, it did not explode mid-air and it is not a 52 ton ocean liner sitting in 12,000 feet of ocean, that just hit an iceberg. They just raised $10 million.

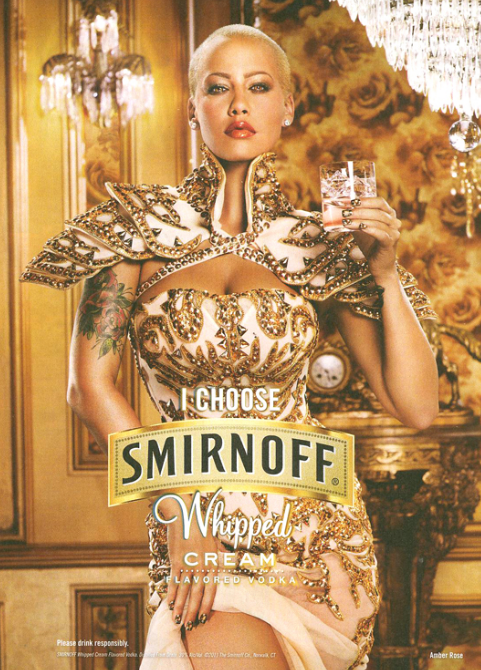

What this is, is a small publicly traded company that has (not ‘had’ as in past tense) a rather genius idea of bringing modern day advertising strategies to the billion dollar alcohol industry. An industry where Smirnoff alone, reportedly spent close to nearly $100 million last year.

Smirnoff invests in premium ad units and has advertised on over 250 different Media Properties in the last year, across multiple Media formats.

Some might say LQR has, and we would agree, a well conceived business strategy. “Go where the money is.” And the alcohol industry advertising has always been on the leading edge of advertising content and exploring new platforms is where the money is. Which in our opinion should bode well for the LQR House ‘digital’ advertising plans.

This is not a biotech, or maker of specialty chips for quantum computing. It is a very simple business.

Afterall, if Smirnoff is going to promote a new ‘Whipped Cream’ flavored Vodka, the best place to reach their audience is on the internet, because their target market does not watch TV and they don’t even know what ‘print’ is. A magazine, a newspaper, what’s that?

According to Zenith’s Business Intelligence, “Over 2,200 alcohol advertisers invested nearly $7.3 billion on 3,300 beer, wine and spirits brands during 2022, compared to 2,400 advertisers that spent over $8.3 billion the previous year.”

While alcohol companies devoted half (49%) of their budgets to television last year, Zenith predicts that brands will boost their digital advertising to support alcohol e-commerce due to increased consumer awareness of online alcohol purchasing.

Zenith estimates a 9.2% annual growth in digital ad spend between 2019 and 2023, when online advertising will account for 30% of alcohol brands’ marketing budgets. The report also notes a 2.4% annual reduction in TV advertising by 2023.

Surely LQR should be able to grab some of that digital pie.

If they could wrangle $10,000 a month from each of the 2,200 alcohol advertisers, they would be looking at a total addressable market of $22 million per month or $264 million a year. 10% of that is $26.4 million a year and when you combine with LQR’s market value of $5.1 million – well you do the math.

Overall Top Alcohol Brands on Social

Will sanity prevail? Will LQR House land some major advertising accounts (or even one Smirnoff or Bacardi) that despite the falling share price, show to investors that it is actually open for and doing business? Only time will tell.

We’ve not played with (or taken on as clients) very many stocks selling under $0.03 – and to honest, it all looks like some sort of surrealistic illusion!

It’s like seeing a basketball one foot under water and you think “that’s impossible, it’s supposed to float on top of the water” (cash in bank), and then suddenly it goes two feet underwater! Wait, huh?

Right now the shares appear to be in the hands of day-traders who may buy at $0.03 to sell at $0.04. Though most recently they’ve bought at $0.05 to sell at $0.04 and then bought at $0.04 to sell at $0.03.

We did see that the CEO Sean Dollinger bought 660,851 shares at $0.0756. It always nice to see a little insider nibbling.

Maybe there’s a few investors (speculators) looking to buy at $0.03, hoping to sell at $0.30 for the illusive ten-bagger, a year from now. But truth be told, we have no idea where all this volume is coming from, or what their motivations are. Not a clue.

Under $0.03, Are You Kidding Me!

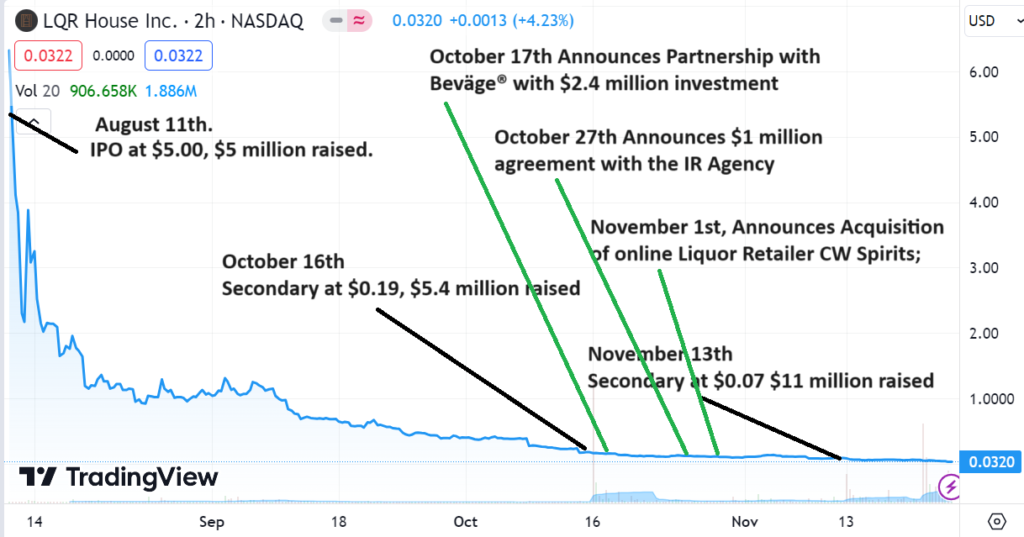

Here’s what has transpired since August, that would be close to four months ago. A lifetime in daytrader years.

We’ll use two charts for illustrative purposes.

LONG TERM CHART

SHORT TERM CHART

Reverse Split.

We could be wrong, because none of the recent weakness makes sense to us (aka panic selling) but the big gorilla (or is it elephant) came into the room when it was selling at $0.07. So let’s dissect that.

- There are 201 million shares outstanding*.

- After a 60:1 reverse split there would be 3,350,000 shares outstanding.

- At $0.03 (could be higher or lower) the stock would be at $1.80.

- Cash in bank was near $10 million.

- Market value would be near $6 million.

So despite that we all have observed that reversed stocks have not done well this year, the spread between the market value and the cash value is far too great for us to ignore. Again, we’re long term people. We’re looking out a year from now..

Get it, got it, we’re gone.

What to study.

They have three major initiatives. We’ll go into all three in greater detail in an upcoming report, this week.

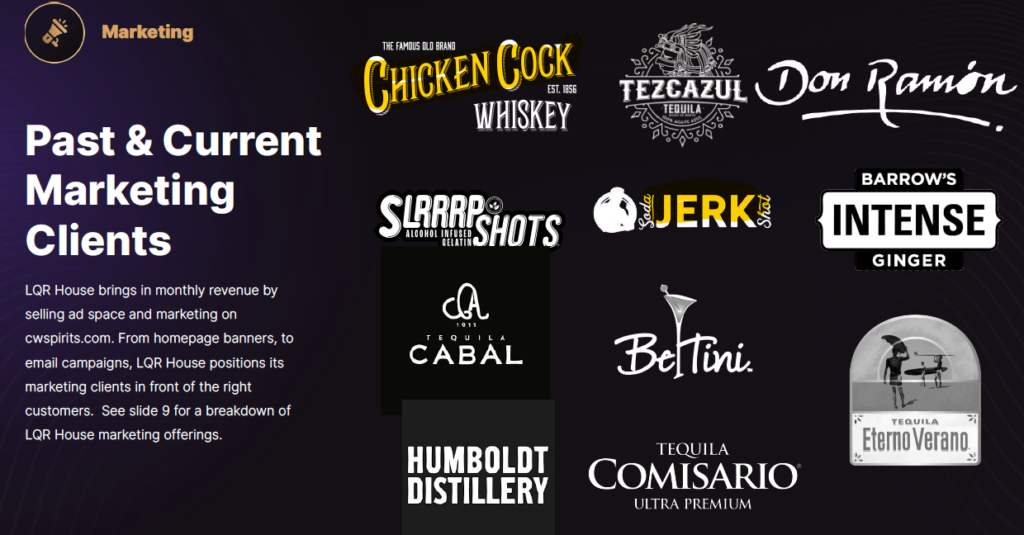

This is, at the end of the day, their digital advertising focus. The first is CWSpirits.com an online liquor retailer. Then there’s the Liquor House Influencer Network which seeks $5,000 – $10,000 per month per brand. And finally they’re building via a revenue sharing agreement, the Brevage wine enhancer’s online presence.

What to follow.

These (their progress) are all relatively easy to follow.

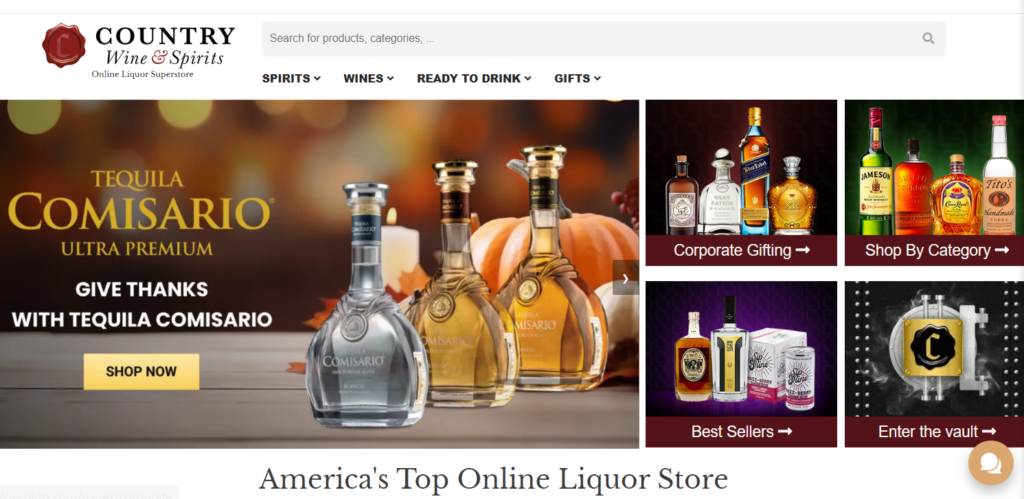

Country Wine & Spirits

CWSpirits.com. How are sales growing and what is the monthly user count. CWS additional generates revenues by offering advertising for brands on the CWS site.

Liquor Influencer Network

The Liquor House Influencer Network. There are three things to follow in this unit. Each or any, could propel the stock significantly higher, depending on execution. One is the number of Influencers, currently there are near 500. With everyone and their poodle in the influencer business these days, this number could grow into the 1000’s and conceivably into the tens of thousands.

The second number to follow is the “collective” number of followers of all the influencers combined. Currently they have 38 million followers who produced 559 million likes. In the old days, we would call them clicks.

This number could reach one billion likes..on sites like TikTok, Facebook, Instagram and YouTube.

Note, the collective number can be grow by having thousands of more influencers with thousands of followers, or grow by having a few dozen influencers, who have millions of followers. This is what will attract liquor brands to the Liquor House network. Advertisers would prefer to write a check to one network producing 500 million likes, versus paying and dealing with thousands of smaller individual influencers.

Here are some mind-boggling numbers.

- Cristiano Ronaldo – 886 million followers.

- Selena Gomez – 688.8 million followers.

- Justin Bieber – 594.1 million followers.

- Taylor Swift – 526.9 million followers.

- Ariana Grande – 508.1 million followers.

Of course brands will generally go directly, to someone with 100 million followers. But there is a lot of influencers between one million and one hundred million, that could join the network.

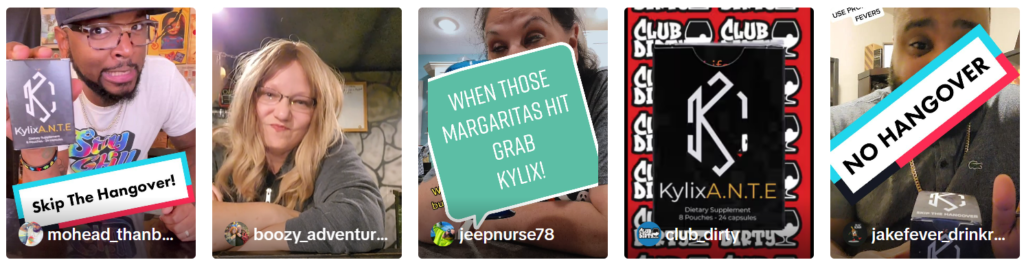

Liquor House influencers.

KYLIX Joins Liquor House Influencer Network

Beväge™

Bevage. This could be a MAJOR contributor to future revenues. LQR House has invested $2.4 million with X-Media Inc. to bring this product to its full potential which could be in the tens of millions. The number to follow, of course, is sales. Not next week, not next month, but next year and the year after that..

The product will sell for $249. If they sell one million of them, once again, you do the math.

…and all this for a $6 million market cap!

Beväge™ Wine Enhancer

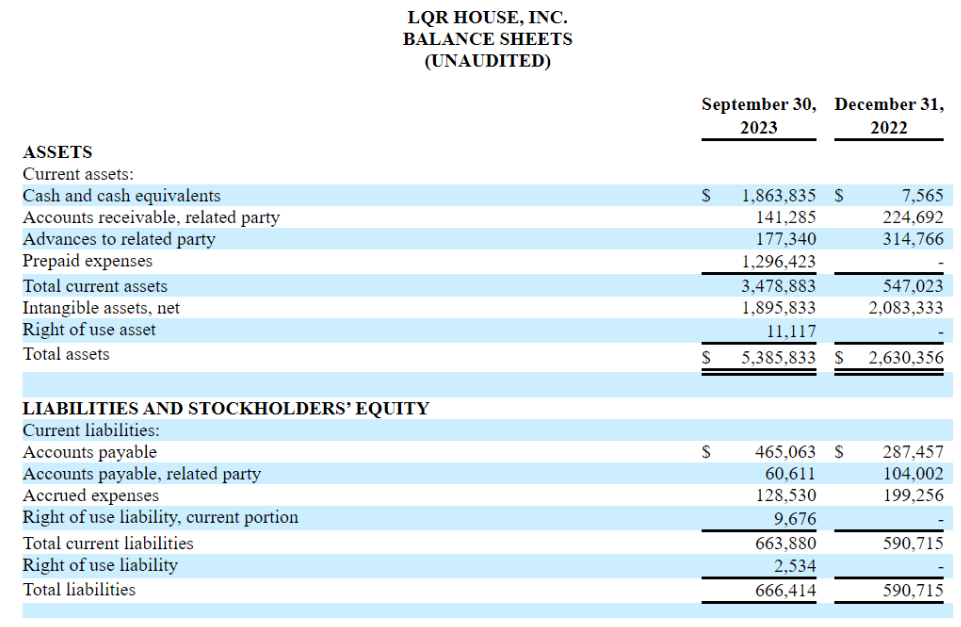

*Shares outstanding. We count 201 million from last 10Q.

*Cash in the bank: As of September 30th they had $1.8 million in the bank. After an offering that took place on November 13, 2023, they netted $10,120,000, let’s call it $10.1 million. With 202 million shares outstanding the market capitalization is $6 million.

So add $10.1 million to what’s left of the $1.8 million they had, and we have trading, for what looks like less than cash to us!

As a side note, we wish all public companies would post their daily cash balances. They know what’s in the bank, you can’t run a business without knowing. Why can’t they post the daily balance sheet on their websites?

Why should we wait three + months? The SEC should mandate it in the name of investor protection.

Subscribe to follow LQR House and more..

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Shareholders can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations that arise after the date hereof, except as may be required by law. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed in the “Risk Factors” section of the registration statement on Form S-1 filed with the SEC. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement on Form S-1 and other filings with the SEC. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. Additional disclaimer. The information presented in the above-referenced report is based on the research and analysis of the publisher. The publisher is solely responsible for the accuracy and completeness of the information and the opinions expressed in the report. The views expressed therein are the personal views of the publisher and are not endorsed by or representative of the company. Client we are being compensated with five thousand dollars per month, for providing ongoing news reporting and coverage.

Investor and Media Contact:

Roland Rick Perry, Editor 310-594-8062

roland@institutionalanalyst.com