Internet | Biotech | Beverages | Marijuana | Blockchain

The Institutional Analyst newsletter aggregates headlines from all our actively covered market sector newsletters. After a subscriber to the Internet Stock Review missed the EPIC run in Immunomedics (IMMU), which traded from $3 to $26 (2016-2018) in Biotech Stock Review newsletter, we decided to have a mega-letter.

Hotel Communication Network | Redify |

Hotel Communication Network

HCN Network. Like Investing in Uber or Lyft, When They Only had 9,000 Drivers?

Open only to high-net worth and institutional investors, the HCN Communications Network has the most exciting Internet Advertising Platform we’ve seen since eUniverse (MySpace – past client – 2002) before it was acquired for $580 Million by NewsCorp.

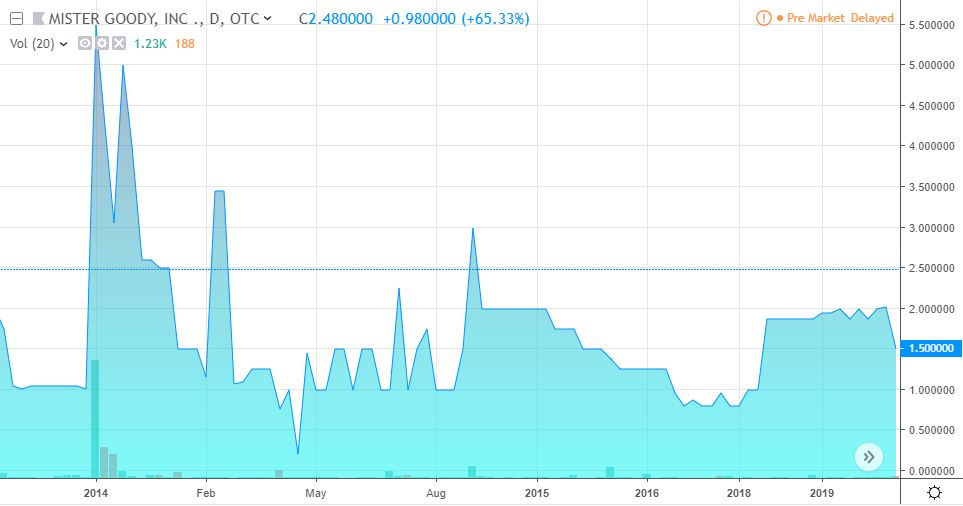

Redify Holdings (MSGOD) $1.50

Real Estate Wonder Redefy to go Public. Full-Service Real Estate Transactions for $3,500 Flat fee!

Redify enters into a definitive share exchange agreement with Mister Goody, Inc. (OTC Pink: MSGOD), a non-reporting publicly traded management consulting services firm. The transaction, which is expected to close in the second quarter of 2019, is subject to customary closing conditions, as well as the completion of at least $1.5 million in financing.

The Alkaline Water Co (WTER) | Life On Earth Beverages (LFER) | New Age Beverages (NBEV) |

Top 25 Beverage Stocks for 2019.

Last year our Top two picks gained in excess of 100% and over $400 Million in market value. Can we strike twice, or find something even better?

Boater’s & Drinkers. 2019 Palm Beach International Boat Show March 28 – March 31.

The Alkaline Water Co. (WTER) $2.85.

The Alkaline Water Co., (WTER) Picks Up Another $11.5 Million From Investors!

Additional shares issued at a purchase price of US$2.50 per share, for total gross proceeds to the Company of US$11,500,000. The additional 600,000 shares issued pursuant to the exercise, in full, of the option to purchase additional shares granted to the underwriters in connection with the offering.

Imagine if one year ago when The Alkaline Water Company was selling at just under $1.00 per share and barely trading, if we said that we thought it could better than double in price, get NASDAQ listed and could magically raise $10 million at $2.50, what would you have said?

Alkaline Water (WTER) Lands Jetro a Huge Restaurant and Grocer Distributor.

Billionaire Nathan Kirsh had a 63% stake in Jetro Holdings, a holding company that owns 86 Restaurant Depot stores plus 10 Jetro Cash & Carry stores. It is believed that the company earned $6.5 billion in revenue in 2011.

Life On Earth Beverages (LFER) $0.37.

Here We Go! Just Chill® Ruffling Feathers in Monterrey County.

Life On Earth has been acquiring hot “under the radar” brands and now they’re getting it on the shelves. Nothing happens overnight, but we can’t think of a better place to start than Northern Cally.

Sit Back Stock Market Guy and Chill With a Just Chill® CBD Infused Relaxation Drink!

Life On

Report Update: Life On Earth (LFER) Leaps 62% on Friday. Breakout Time?

After Tripling in Price in 2017 – Life on Earth Share Price Consolidated for a Year and is Poised for an Exciting 2019, as it Begins to Actively Market and Distribute Two High-Potential Brands. While Continued Volatility is Expected, the Sub $0.30 Days May

New Age Beverages (NBEV) $5.47.

New Age Beverages (NBEV) Guides Higher.

NBEV Guides Higher, Like Way Higher. Can You Say $320 Million? Can they get there? Only time will tell, but they had $5 Million in revenues when we first found them near $0.35 in 2015. Pays to be early sometimes! Roth Presentation link.

Crop Corp Infrastructure (CRXPF) | Biome Grow (BIOIF) | Tinley Beverages (TNYBF) |

Is Sex Better After Marijuana or a Pitcher of Vodka Lemonade?

Cannabis Smoking Cafes in Alaska. The Nations First!

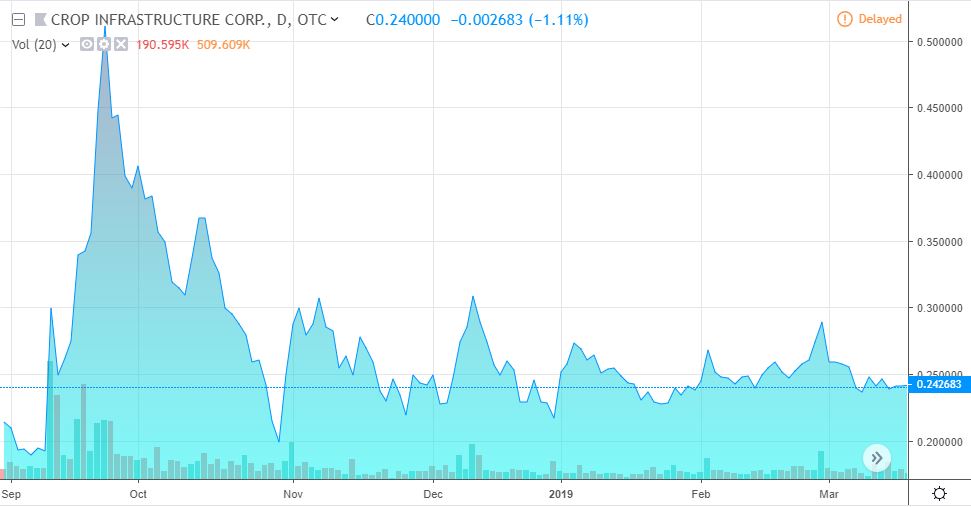

Crop Infrastructure Corp (CRXPF) $0.24.

Crop Touches the Plant, Flower, Packaging, Distribution – They Touch Everything.

While many Publicly Traded Cannabis Companies Love to Claim “They Don’t Touch the Plant,” Crop Corp Plays a

Crop Corp (CRXPF) Flips Jamaica & Italy Project for $2 Million, a 2000% Gain!

CROP Infrastructure (CROP.C) announced that it is divesting its interests in CROP Jamaica and XHemplar in Italy for $2 million worth of equity in World Farms Corp (WFC). CROP invested about $100,000 between the Italy and Jamaican projects

Cowen & Co. Looking for $16 Billion US Cannabis Market in 2025!

Some of

Crop Infrastructure Corp (CRXPF) Updates Two Nevada Properties.

CROP’s portfolio of projects includes cultivation properties in California, two in Washington State, a 1,000-acre Nevada cannabis farm, 2,115 acres of Hemp CBD farms, and a growing portfolio of common share equity in upcoming listings within the cannabis space.

Crop Corp, (CRXPF) All Signs Poised to Massive Revenue Gains in 2019. Report Update $0.24.

After Crop Corp begins selling their recent harvests, as we believe they will soon announce, the more conservative can initiate positions. It will be like a wind tunnel at their back.

Biome Grow (BIOIF) $0.52.

Former Ontario Minister of Health Geoge Smitherman Joins Biome Grow.

Nice when a political big-wig and former Minister of Health to drive a company though the maze of rules and regulations.

Biome Grow’s $100 Million Annual Contract?

Newfoundland and Labrador under a contract that is projected to generate about $100 million in annual revenue by 2020. Investors may want to take a closer look at the stock given these developments and its near-term path towards commercialization.

Biome Grow Up 25%, New Report Out.

Milestones, milestones, milestones. Biome Grow ranks as the top small cap company we follow, for potential milestones achievements for 2019. It should be a news-packed year ahead.

Tinley Beverage Company (TNYBF) $0.44

President of $3 Billion Liquor Distributor, Joins Tinley Beverage (TNYBF) as President/CA.

Richard Gillis was previously the President of Young’s Market Company, one of the USA’s largest beverage alcohol distributors, with a presence in virtually every market in the Western United States. Based in Southern California, Young’s is a Forbes 200 private company, with

Tinley Beverage Corporate Presentation Deck.

Studying now, a potential client. While numerous companies are touting CBD or Hemp infused beverages, Tinley is the only publicly traded company we know of that is launching a THC infused beverage (alcohol-free). Study while we study and remember, sometimes it’s good to be early!

Bitcoin Bottom @$3,880? Our Favorite Technical Analyst Says Yes.

Hard to ignore this analyst. $150,000 target.

“Now, I understand where price is going again, and I am more bullish than I have ever been on any other market in my eleven years as an analyst. In my view, this next bull market is likely to rally to around $150,000, by approximately August of 2023.”

Disclaimer: Every Company mentioned in this letter is a client, has been a client or may become a client. Institutional Analyst Inc., has opted to exclude specific disclaimers at the bottom of every newsletter we publish as it often exceeded the length of our letters by 4X. Our company client disclaimers can now be found on every report or progress update report we author – at the bottom of the report in a readable sized font. Required reading, we play nice with nearly every company we report on, because they are either client or we would like them to be a client, so impartial we are not.

NOTHING on this website, in our emails or at our conferences should be construed as financial advice or a solicitation of investment. Small cap companies with emerging technologies carry inherent risks of high volatility. We strongly recommend that you consult your financial advisor before investing, speculating or trading in anything we are following.

Decisions based on information contained in our newsletters and on this site or linked to from this website are the sole responsibility of the user, and in exchange for using this site, you agree to hold Revelers.IO Media Group Inc., (web design and public relations) and/or Institutional Analyst Inc., (investment research for hire) and its partners, owners, authors, and affiliates harmless against any claims for damages arising from any decision you make based on such information. Beyond not investing with money you can’t afford to lose, do not invest money you don’t expect to lose.

Similar to VC investing, where one extremely successful investment can make up for a portfolio of losers, not finding that big winner can result in the complete loss of your entire portfolio regardless of how well diversified.