Internet Stock Review Report on Hotel Communications Network.

HCN Communication Network has the most exciting Internet Advertising Platform we’ve seen since eUniverse (MySpace – past client) before it was acquired for $580 Million by NewsCorp.

Let’s start with that headline, because if someone sent us an email like that, we’d probably feel they just insulted our intelligence We get that. So read closely.

We are really good at what we do, and when we met management six weeks ago at the Noble Institutional Investor Conference, we were blown away by the concept, the scalabilty, the multi-billion dollar early client list and the valuation..

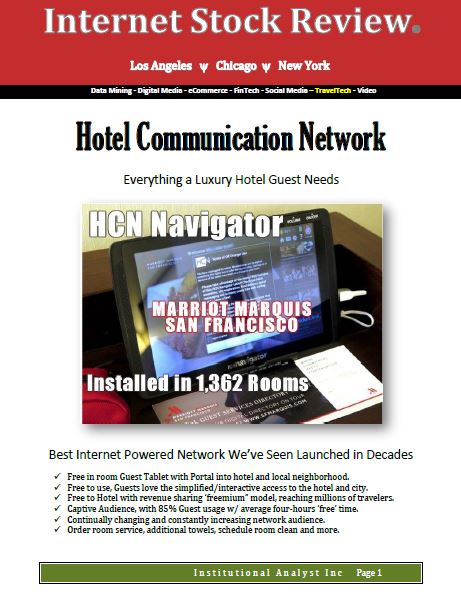

The short story is HCN has created an advertising network that operates within hotel rooms, via a free to use tablet that replaces the in-room hotel phone to order room service, talk to the front desk, order towels and more. It essentially replaces the hotel phone with all the service buttons and its functions. It’s a third party tablet and free to the hotel via a revenue-sharing agreement. HCN is tablet agnostic, it’s not a hardware

Why is that a big deal? HCN has its foot in the door (9,650 tablets/rooms) in Accor, Hilton, Hyatt and the Marriott. Those are the four top hotels chains on the planet (and near impossible to get into) and combined the four own 12,320 hotels and get this: 2,865,913 rooms. Yeah, OMG.

(Note

We are not ‘selling’ the idea. All we’re selling is ‘read the report’ and if you like what we found, get on the Company mailing list so you can be first in line for future financings. That simple. They just closed a funding and a competitor took in $44 million from one

We actually have two simple investment theme analogies (Uber/Facebook) to encourage you to read the report, which goes into the CONCEPT. The operational details are light; like what they do and how they landed four of the top hotel chains in the world – should be enough for most investors to get the concept. The next report will crunch the numbers. While the technology may be complex, the business model and potential are VERY easy to understand.

START-UP ANALOGIES. UBER/FACEBOOK

UBER ANALOGY.

Uber/Lyft. Okay, totally different business models of course, but what is similar is an investor could have chosen to invest in Uber (had they known it existed) when it was a just a business plan with zero drivers (highest risk/highest reward) or at various higher and higher driver count milestones. If they didn’t want to invest at zero or nine drivers, they may have at 900 or 9,000 drivers. But they would have needed to be on the investor mailing list to know the growth!

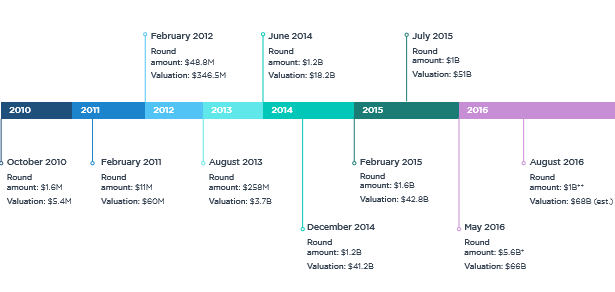

HCN is well past the zero client ‘business plan’ stage for over three years now. Now they are a reality. At one point Uber had zero drivers, then nine drivers, then 90 – then 900 – then 9,000 – then 90,000. First San Francisco, then Chicago. Now they have more than one million drivers and are valued at near $100 billion. You could have bought into Uber in 2010 when it was valued at $5.4 million. But you would have had been out of your mind to invest then, right? UberCab?

Right now HCN has over 9,000 rooms (a solid number) with tablets happily being enjoyed by 100’s of thousands of hotel guests.

HCN doesn’t have drivers of course. Its metrics are rooms. And if you’re wondering if the tablets are gathering dust, real-time data tells HCN (Hilton San Francisco for example) that tablet usage is at 83.2%. That’s like knowing 84% of Uber’s drivers are driving, not sitting at home. HCN is driving like mad. HCN again has 9,650 rooms. What lies ahead? 90,000 rooms? 900,000 rooms? Remember, just in HCN’s current network alone, there are 2,865,913 rooms. And like Uber, HCN is scalable. Uber didn’t have to build cars and HCN doesn’t have to build hotels.

Investors have (and had in the past) the choice to invest in HCN when it was a business plan, or invest when it signed the first hotel the Hilton in 2015 with 1,639 tablets, or invest today when it has near 10,000 rooms, or wait and invest some time in the future if or when they have 90,000 rooms. Unlike Uber, (odds are you didn’t know they existed when they had 9,000 drivers) – you NOW know HCN exists and you know they have 9,000 rooms. What we urge you to do is get on their mailing list so if the next stop is 25,000 rooms – you’ll know you better pay close attention.

FACEBOOK ANALOGY.

Adoption and scalability is the analogy, not the technology.

HCN is a consumer (hotel guest) to business network (the hotel itself and advertisers) whereas Facebook was a consumer to consumer (student) network. But follow this analogy, as it does make sense.

Facebook started at Harvard started in 2003 and was initially limited to Harvard students. Word spread, not all joined – but a base of 22,000 students was a good start. Then it arrived on the campuses of Columbia, Stanford and Yale.

Instead of starting on a SINGLE campus, HCN instead started in a SINGLE hotel in Chicago. First the massive Chicago Hilton Palmer House with 1,650 rooms and then the Chicago Hilton Towers with 1,550 rooms. If Facebook didn’t make it at Harvard, they would have never made it to Stanford. If HCN didn’t make it at the Palmer House, they never would have made it to Hilton Towers.

Word did not have to spread from hotel guest to guest, because the Navigator is in every room, and if you need to order more towels or order something to eat, it’s right there in front of the guest. The value proposition is insane. Want food, pick up

So, the big question is can HCN continue to move from city to city, like Harvard did and can HCN move from hotel to hotel like Facebook moving from campus to campus to campus? Can HCN grow within the Hilton, Hyatt and Marriot umbrella?

We think they can, click on the report to learn more.

Investor mailing list: Contact Kevin Bidner CEO, 312-416-7622 x 6222 or Richard Carruthers COO for additional information.

(Client, see report for the disclosure and disclaimer details.)