Research Report Archive

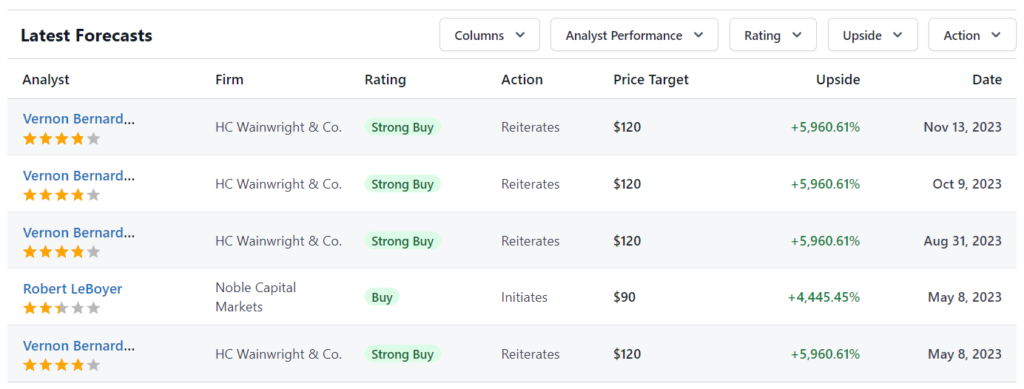

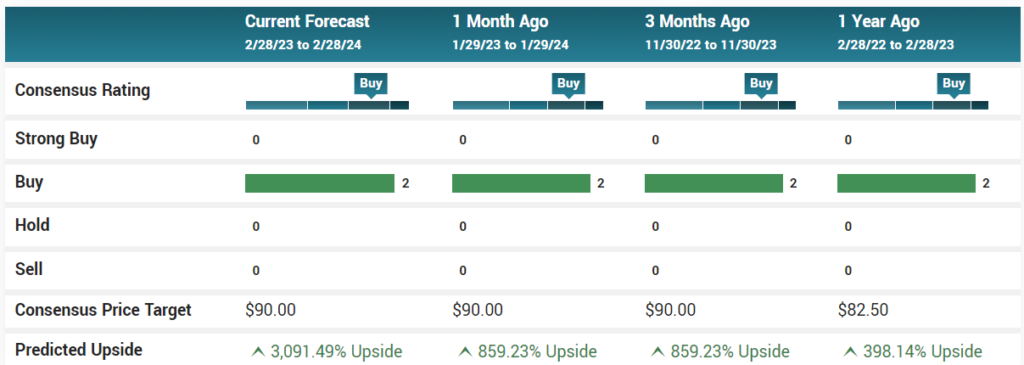

Reports from Robert LeBoyer at Noble Capital. Jeffrey Kraws and Karen Goldfarb at Crystal Research. Jason Kolbert at Dawson James Securities. Vernon Bernardino at H.C. Wainwright. Various price targets.

May 2024

1Q24 Reported With Clinical Milestones Later In FY2024

Clinical Trial Treatment Continues With Milestones Ahead. GeoVax reported a 1Q24 loss of $5.6 million or $(2.47) per share. The company gave updates for its three trials testing GM04S1 and its Phase 1/2 trial testing Gedeptin, including the expected announcement about future clinical development for Gedeptin. Cash on March 31, 2024 was $0.8 million.

Gedeptin Is Finishing Its Phase 1/2 Study. The Phase 1/2 trial testing Gedeptin in advanced head and neck cancer has completed enrollment, with the next steps of development in planning stages. The current plan is to continue development in head and neck cancer, with an announcement coming regarding future trials. This could include testing in combination with an immune checkpoint inhibitor (ICI). Trial data and development announcements are expected in 3Q24.

GM04S1 Booster Trial Data Could Be Announced Around

YE2024. CM04S1 is a MVA-based vaccine for protection from COVID-19. It was designed to stimulate both the humoral and cellular immune responses to provide effective and durable immunity. There are two Phase 2 clinical trials testing CM04S1 in immuno-compromised patients with hematological cancers or CLL. A separate Phase 2 trial testing CM04S1 as a booster in healthy volunteers closed enrollment in September 2023. Patients are nearing the 12-month treatment period, so that data could be available around year-end 2024.

The MVA Vaccine Manufacturing Facility Released Its First

Lot. GeoVax is developing a manufacturing facility to produce large quantities of vaccines using its MVA technology. The facility completed the transfer of manufacturing from the City of Hope where it was developed to the company’s manufacturing partner, Oxford Biomedica, and has released its first commercial-scale lot of GEO-CM04S1. The facility is also developing capacity to produce other MVA vaccines, including GeoVax’s MVA vaccine for smallpox and mpox.

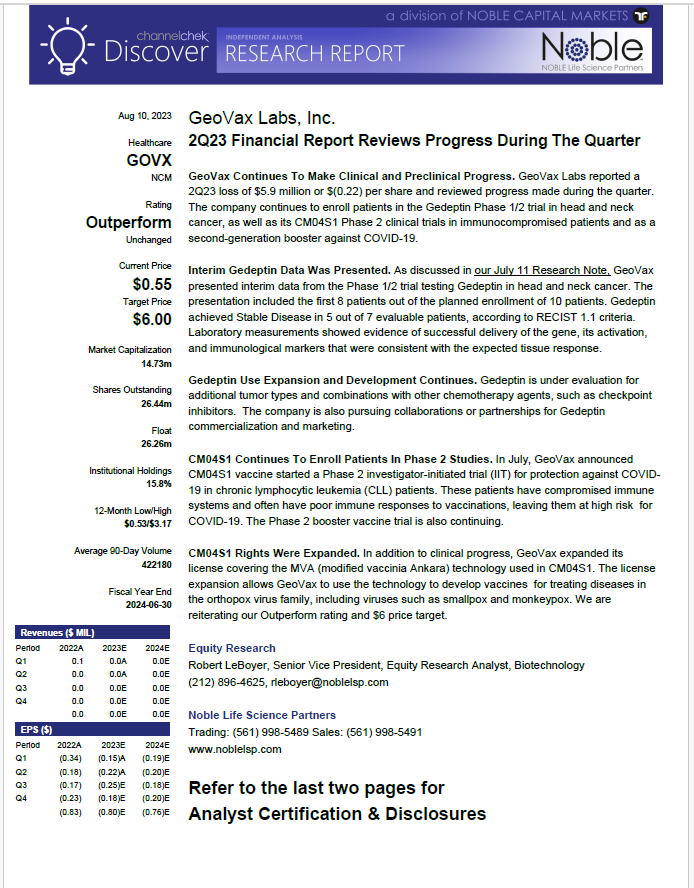

Conclusion. The company has made clinical trial progress with important near-term milestones for Gedeptin and the CM04S1 booster trial. Geovax also strengthened its intellectual property estate with 3 patents issued by the US Patent and Trademark Office and 1 patent allowance by the Japanese Patent Office. We are reiterating our Outperform rating and $6 price target.

Company Profile

GeoVax Labs is developing gene therapies, immunotherapies, and vaccines for cancer and infectious diseases. Gedeptin, its lead cancer product, is a gene-directed therapy for cancer. The treatment delivers a gene to the cancer cells that converts an inactive prodrug into an active cytotoxic drug within the tumor cells. GeoVax’s second technology platform is in vaccines against infectious diseases. CM04S1 is a next-generation COVID-19 vaccine.

Fundamental Analysis

In our assessment, we give GOVX a score of 4.0 out of 5.0, which falls within the upper half of the “Above Average” range of 3.0 to 4.0 and warrants 4.0 checks. Our positive fundamental rating is based on the company’s introduction of its gene therapy technology in development and the COVID-19 vaccine. We view the quality of management and the Board of Directors as above average due to extensive industry experience. For further explanation of our fundamental analysis, refer to the disclosures at the end of this report.

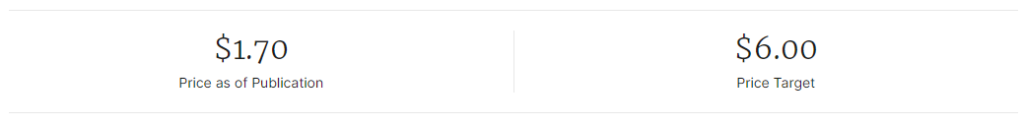

Valuation Summary

We value GEOX based on our estimated revenues from Gedeptin in the head and neck cancer indication. We anticipate the Phase 1/2 trial results in 1H24, followed by a Phase 2/3 trial beginning in late 2024, with product approval in 2026. Our price target is based on our estimated EPS of $1.10 per share in FY2027, the first full year of sales after product launch. We discount this estimate at 30% per year to allow for company risk, industry risk, and market risk. Our price target is $6 per share. Risk factors include regulatory obstacles, technology risk, clinical trial risk, and financial risks.

Killer, 44-Page Report on GeoVax (GOVX). March, 2024

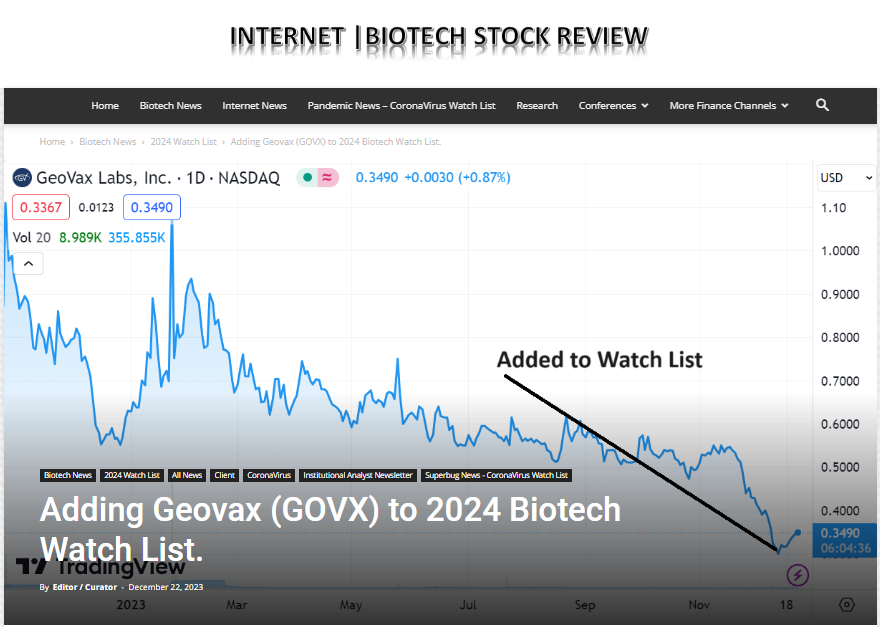

December 22nd, 2023 Biotech Stock Review.

Adding GeoVax (GOVX) to 2024 Biotech Watch List.

WALL STREET RESEARCH

(*Crystal Research’s reports are the most comprehensive)

CRYSTAL RESEARCH ASSOCIATES WEBSITE

August 19th, 2023 Noble Capital. $6 Price Target.

NOBLE CAPITAL MARKETS WEBSITE:

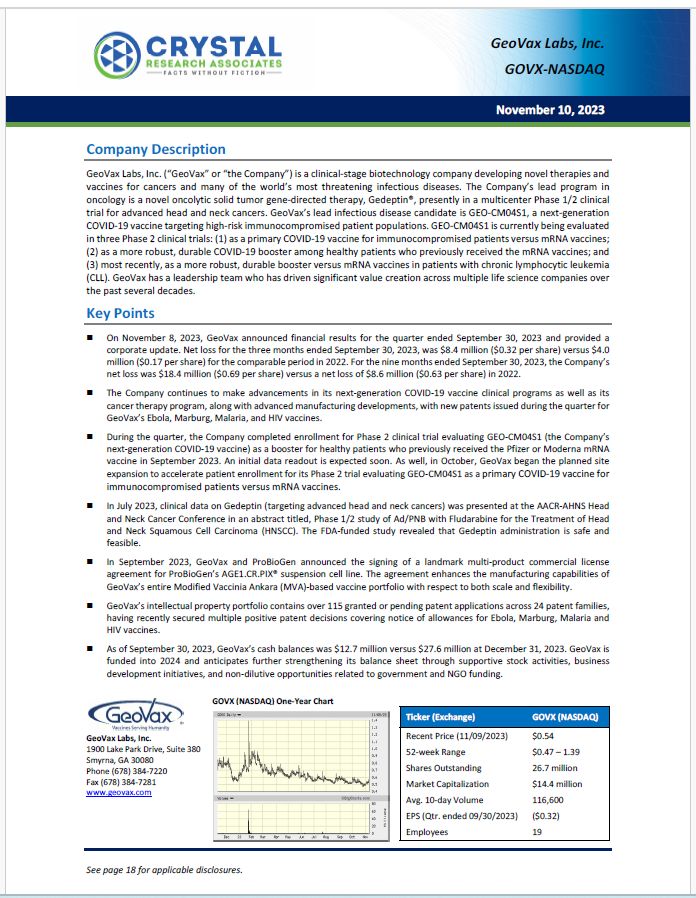

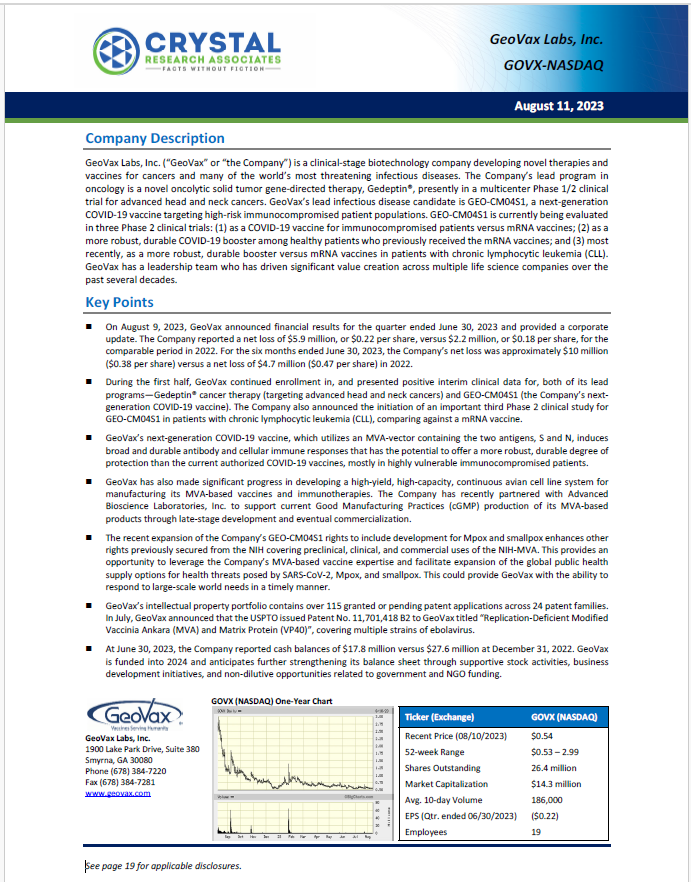

August 11th, 2023 Crystal Research.

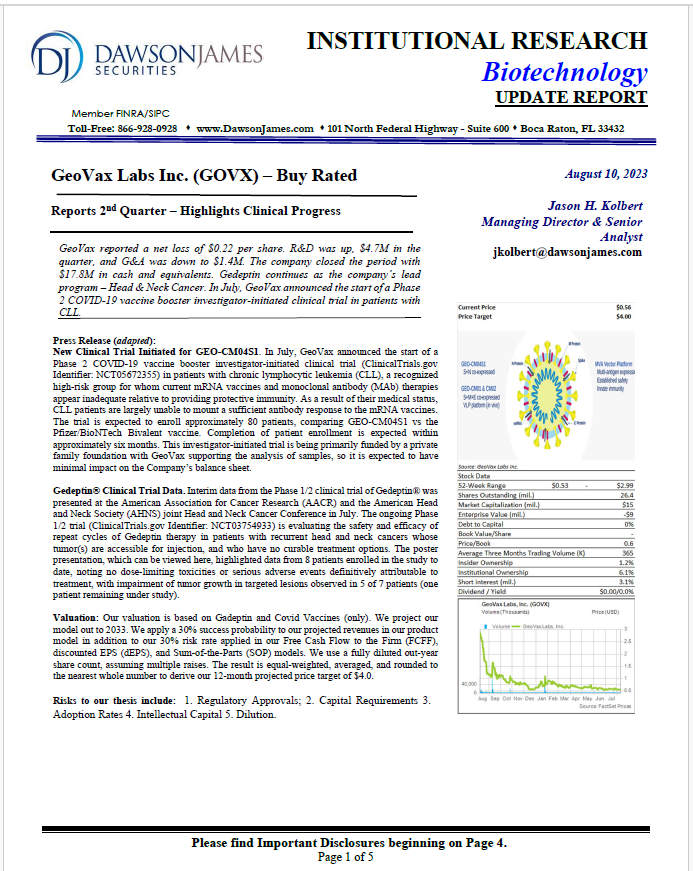

August 10th, 2023 Dawson James, $4.00 price target.

DAWSON JAMES SECURITIES WEBSITE

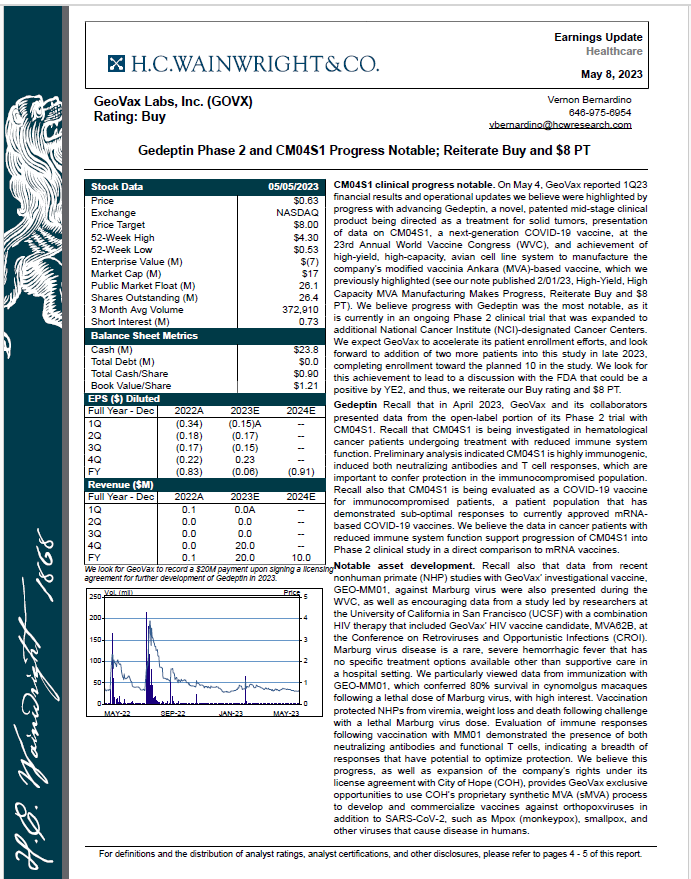

May 8th, 2023 HC Wainwright & Co. $8 Price Target.

H.C. WAINWRIGHT & CO. WEBSITE

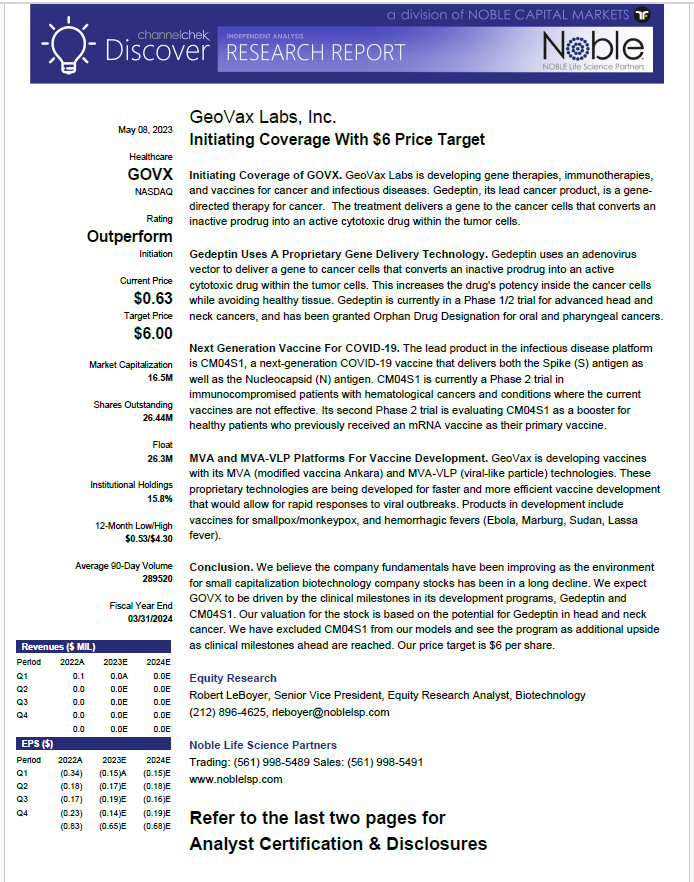

May 8th, 2023 Noble Capital.$6 Price Target.

March 3rd, 2023 Dawson James. $4 Price Target

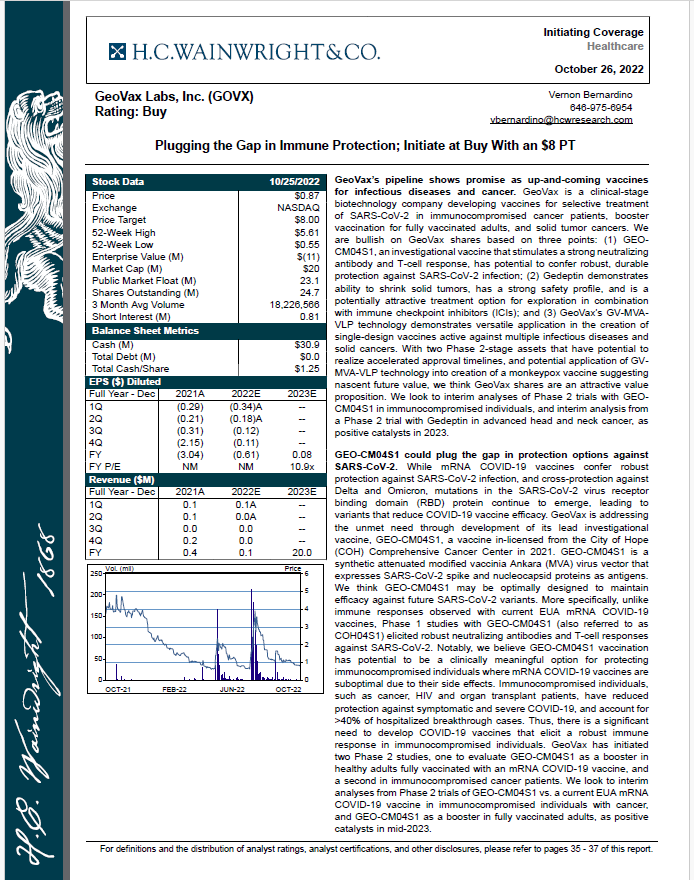

October 26th, 2022 HC Wainwright & Co. $8 Price Target.

Most recent S1-Filing, a mandatory read for investors conducting due diligence.

GeoVax Labs, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding GeoVax Labs, Inc.’s performance made by these analysts are theirs alone and do not represent opinions, forecasts or predictions of GeoVax Labs, Inc. or its management. GeoVax Labs, Inc. does not by its reference below or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations.

Disclaimer, neither the Company nor Institutional Analyst Inc. (IA) approve or disapprove of the findings or conclusions of the above reports, which are solely that of the respective author|analysts(s). Please see respective disclaimers of each report for disclosure and relationship details. Summary charts updated monthly. IA will make best effort to update and post new reports, but is under no obligation top do so.

Forward-Looking Statements

This post contains forward-looking statements regarding GeoVax’s business plans. The words “believe,” “look forward to,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Actual results may differ materially from those included in these statements due to a variety of factors, including whether: GeoVax is able to obtain acceptable results from ongoing or future clinical trials of its investigational products, GeoVax’s immuno-oncology products and preventative vaccines can provoke the desired responses, and those products or vaccines can be used effectively, GeoVax’s viral vector technology adequately amplifies immune responses to cancer antigens, GeoVax can develop and manufacture its immuno-oncology products and preventative vaccines with the desired characteristics in a timely manner, GeoVax’s immuno-oncology products and preventative vaccines will be safe for human use, GeoVax’s vaccines will effectively prevent targeted infections in humans, GeoVax’s immuno-oncology products and preventative vaccines will receive regulatory approvals necessary to be licensed and marketed, GeoVax raises required capital to complete development, there is development of competitive products that may be more effective or easier to use than GeoVax’s products, GeoVax will be able to enter into favorable manufacturing and distribution agreements, and other factors, over which GeoVax has no control.

Further information on our risk factors is contained in our periodic reports on Form 10-Q and Form 10-K that we have filed and will file with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. GOVX is a client of Institutional Analyst which receives a monthly retainer of five-thousand dollars for ongoing progress reporting and news coverage.