Amazing Fast Grower, in the Asian Silicon Valley.

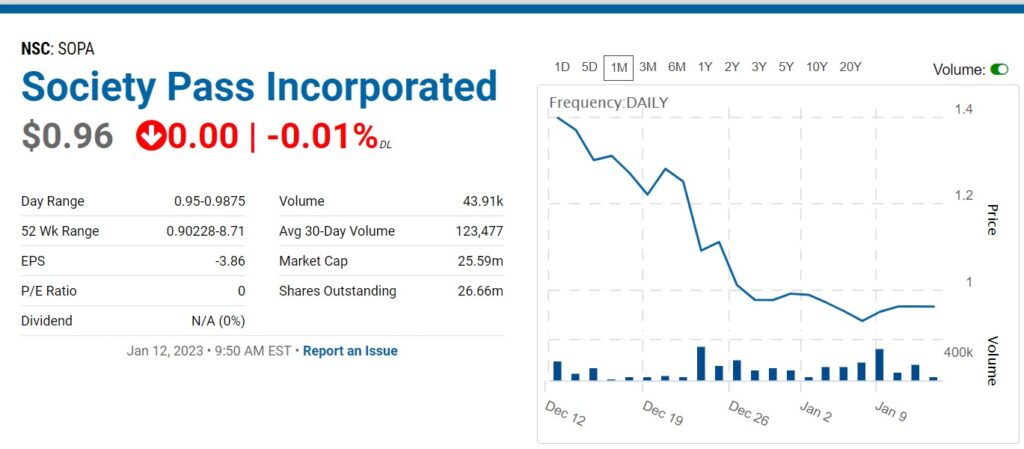

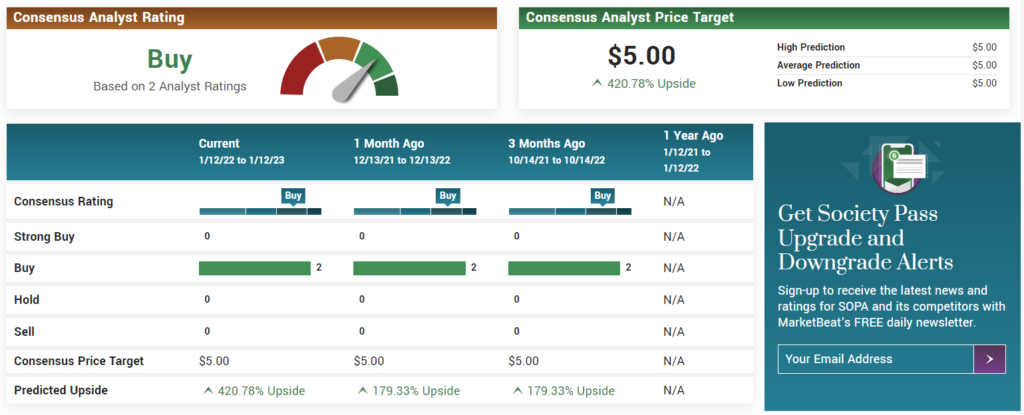

After a wildly successful IPO debut and subsequent tumble, Society Pass (SOPA) in our opinion is attractive on both a short and long-term basis. Street targets are over $5.00 per share. SOPA owns 8 portfolio companies food/beverage delivery (like Doordash: DASH), luxury goods (like Tapestry: TPR), telecoms, digital media, travel (like Expedia: EXPE) and merchant software. Doing due diligence now.

We attended a recent Wall Street investor conference and were blown away by the management presentation, of this acquirer and accelerator of Asian based ecommerce start-ups.

Shooting ducks (or is it fish) in a barrel, comes to mind. In our opinion it would be a mistake to get out early, if it achieves the Wall Street price targets. We would expect this to be one of our best performing ideas for the year. Though we would view this initially, as a 3-year play.

They’ll be presenting at the Sidoti Investor Conference in NY if you’re around (definitely worth attending). Society Pass (Nasdaq: SOPA) to Present at Sidoti Virtual Investor Conference 18-19 January 2023

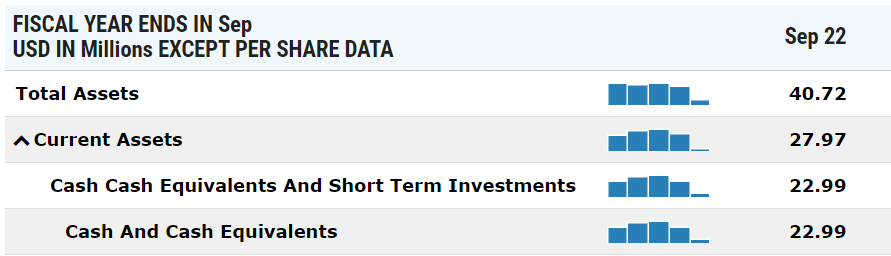

Healthy looking balance sheet. Near $20 million in cash, last we checked! Market cap of only $28 million.

We are confident that corporate performance will come (earnings and revenues), and equally confident that speculators waiting for that ink to dry, would result in a huge opportunity mistake for them at these price levels. Conservative investors can wait, while aggressive investors should want to get in ahead of the ‘proof in the pudding. Just saying.

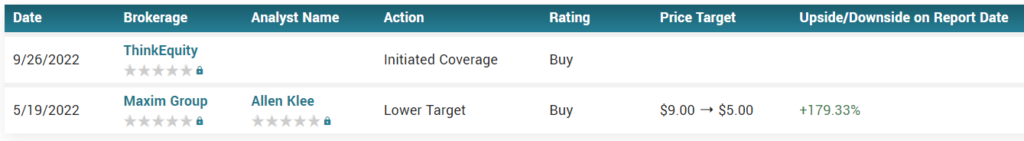

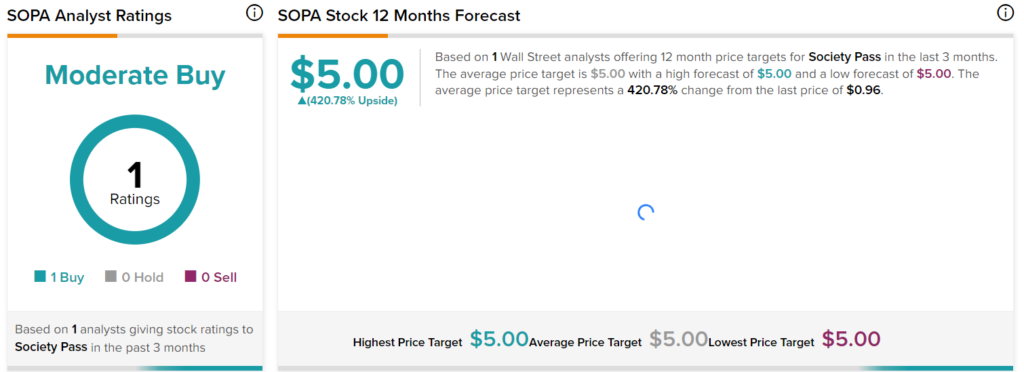

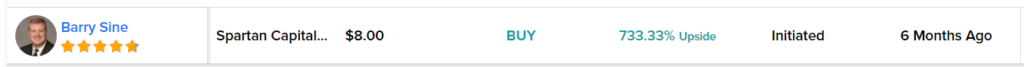

STREET TARGETS

IPO

Society Pass Raises $26 Million @ $9.00 per Share.

Society Pass Incorporated (Nasdaq: SOPA), a leading Southeast Asian data-driven loyalty platform, today announced the pricing of its initial public offering of 2,888,889 shares of common stock at a price of US$9.00 per share. The shares have been approved for listing on the Nasdaq Capital Market and will trade under the ticker symbol “SOPA” beginning November 9, 2021.

It reached its all-time high of nearly $52 per share ($77 intraday), on Nov. 15, a week after the IPO up more than 470%. Will investors bought at $77 ever reach breakeven? Sorry, probably not…

On the other hand had an investor bought Netflix after the dot-com crash, those investors could have turned $1,000 into over half a million dollars in profit. Just saying.

Society Pass (SoPa) Announces Pricing of US$26 Million Initial Public Offering

According to a 2021 market research report by eMarketer, the market for ecommerce activity in Southeast Asia is expected to grow by 14.3% in 2021. The report estimated that ecommerce grew by a hefty 35.2% in 2020

Long-Term Chart

Short-Term Chart

KEY MANAGEMENT

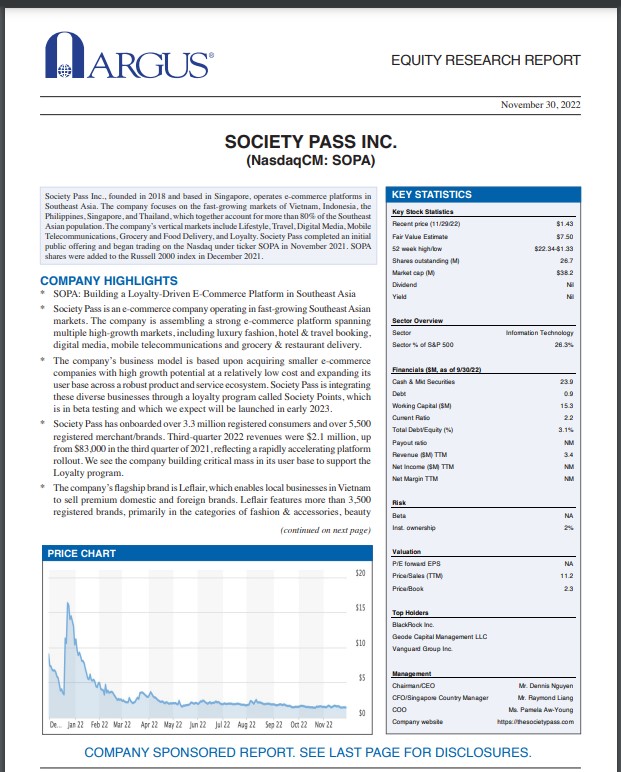

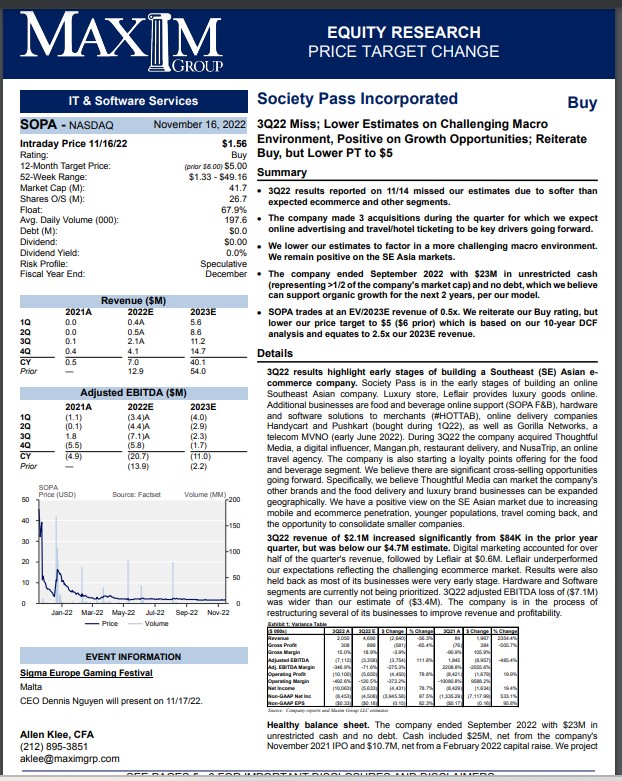

RESEARCH REPORTS

NEW YORK, NY, Dec. 01, 2022 (GLOBE NEWSWIRE) — via NewMediaWire – Argus Research Co (“Argus”) issues Equity Research Report on Society Pass Incorporated (Nasdaq: SOPA), SEA’s leading data-driven loyalty, fintech and e-commerce ecosystem. Press Release.

New York, NY, Nov. 17, 2022 (GLOBE NEWSWIRE) — via NewMediaWire – Maxim Group LLC (“Maxim”) issues Equity Research Report on Society Pass Incorporated (“SoPa”) (Nasdaq: SOPA), SEA’s leading data-driven loyalty, fintech and e-commerce ecosystem. Press Release.

Spartan Capital Investment Bankers

New York, NY, July 26, 2022 (GLOBE NEWSWIRE) — via NewMediaWire — Spartan Capital Securities LLC (“Spartan Capital”) issues Equity Research Report on Society Pass Inc. (Nasdaq: SOPA) (“SoPa”). Press Release.

About Society Pass Inc.

Founded in 2018 as a next generation, data-driven, loyalty, fintech and e-commerce ecosystem in the fast-growing markets of Vietnam, Indonesia, Philippines, Singapore and Thailand, which account for more than 80% of the SEA population, and with offices located in Angeles, Bangkok, Ho Chi Minh City, Jakarta, Manila, and Singapore, Society Pass Incorporated ( Nasdaq: SOPA ) is an acquisition-focused holding company operating 6 interconnected verticals (loyalty, digital media, travel, telecoms, lifestyle, and F&B), which seamlessly connects millions of registered consumers and hundreds of thousands of registered merchants/brands across multiple product and service categories throughout SEA.

Society Pass completed an initial public offering and began trading on the Nasdaq under the ticker SOPA in November 2021. SOPA shares were added to the Russell 2000 index in December 2021.

SoPa acquires fast growing e-commerce companies and expands its user base across a robust product and service ecosystem. SoPa integrates these complementary businesses through its signature Society Pass fintech platform and circulation of its universal loyalty points or Society Points, which has entered beta testing and is expected to launch broadly at the beginning of 2023. Society Pass loyalty program members earn and redeem Society Points and receive personalised promotions based on SoPa’s data capabilities and understanding of consumer shopping behaviour. SoPa has amassed more than 3.3 million registered consumers and over 205,000 registered merchants and brands. It has invested 2+ years building proprietary IT architecture to effectively scale and support its consumers, merchants, and acquisitions.

Society Pass leverages technology to tailor a more personalised experience for customers in the purchase journey and to transform the entire retail value chain in SEA. SoPa operates Thoughtful Media Group , a Thailand-based, a social commerce-focused, premium digital advertising network; NusaTrip , a leading Indonesia-based Online Travel Agency; Gorilla Networks , a Singapore-based, web3-enabled mobile blockchain network operator; Leflair.com , Vietnam’s leading lifestyle e-commerce platform; Pushkart.ph , a popular grocery delivery company in Philippines; Handycart.vn , a premier online restaurant delivery service based in Vietnam; and Mangan.ph , a leading local restaurant delivery service in Philippines.

For more information on Society Pass, please review the following online information which is not part of this press release:

Website at https://www.thesocietypass.com or

LinkedIn at https://www.linkedin.com/company/societypass or

Facebook at https://www.facebook.com/thesocietypass or

Twitter at https://twitter.com/society_pass or

Instagram at https://www.instagram.com/societypass/ .

Cautionary Note Concerning Forward-Looking Statements

This press release may include “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this press release are forward-looking statements. When used in this press release, words such as “anticipate”, “believe”, “estimate”, “expect”, “intend” and similar expressions, as they relate to us or our management team, identify forward-looking statements. Such forward-looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, the Company’s management. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors detailed in the Company’s filings with the SEC. All subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by this paragraph. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company’s registration statement and prospectus relating to the Company’s initial public offering filed with the SEC. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. Hoping to sign as news coverage client.

Media Contacts:

PRecious Communications

[email protected]

$SOPA, #SOPA