And we found another Incubator! This one acquiring stakes in technologies that support next-generation opportunities in traditional, renewable, and clean energy sectors as well as an investor in and acquirer and operator of undervalued petroleum-producing properties.

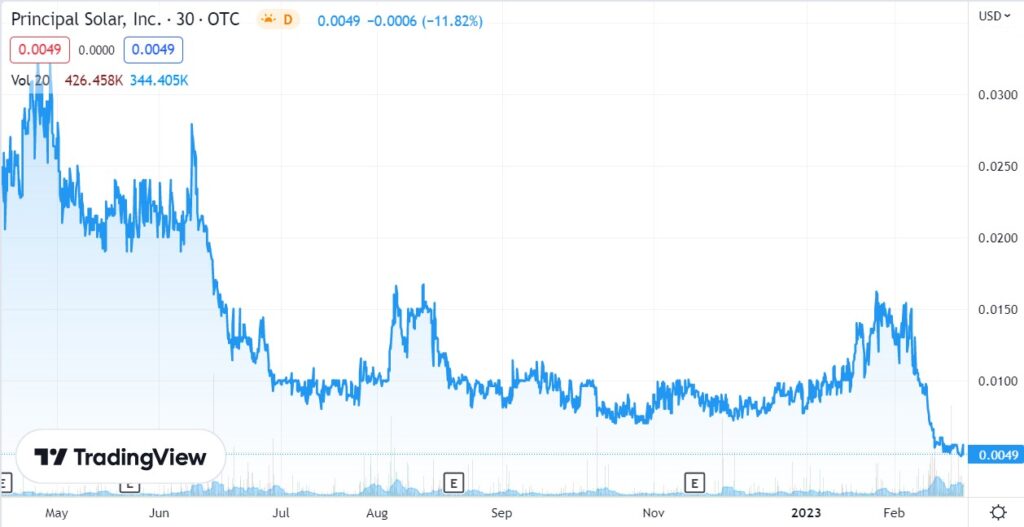

Looks attractively priced (on technicals), with recent dip.

RECENT HEADLINES:

December 15th, 2020. Principal Solar Announces Joint Venture With Executive Logistics & Transportation

July 12th, 2022. Principal Solar Provides Aramis Partnership Eight Well Rework Project Operational Update

Feb 20, 2021. Principal Solar Announces Successful Completion of $8.65 Million Regulation A Plus Equity Offering

Feb 9th, 2021. Principal Solar Issues Shareholder Update; Receives SEC Qualification to Commence Regulation A plus Offering

(The Offering, which commenced on November 25, 2020, and concluded on February 16, 2022, raised gross proceeds of roughly $8.65 million through sale of the shares of the Company’s common stock at $0.0895 per share.)

Principal Solar (PSWW) is run by K. Bryce “Rick” Toussaint who is both CPA and MBA. This is just a heads up, we like their ambitions enough to sign them as a news coverage client – and we expect there to be plenty of news in the coming months ahead – we are starting our due diligence now.

As his biography details, “Mr. Toussaint is a highly accomplished, results-driven Entrepreneur with more than 25 years of business and public accounting experience in a Big 4 environment. A consummate professional, Mr. Toussaint is highly adept in merger and acquisition consulting whereby he has proven effective in numerous aspects including: successfully raising capital (Equity and Debt); spearheading project and corporate finance initiatives; coordinating private equity due diligence efforts; and providing strategic advice on accounting systems integration projects. With a skill-set that is applicable and transferable across industries, Mr. Toussaint has in-depth expertise in Energy (Renewable, E&P, and Midstream), Manufacturing, Nutraceutical and Technology Industries.”

“As a highly experienced M&A Consultant, Mr. Toussaint has advised more than 20 companies, both domestic and international, to become, and remain, publicly listed on the NASDAQ, NYSE and OTC from 2006 to present. He has also advised on dozens of cross-border merger/acquisitions, PIPE transactions and joint ventures. Mr. Toussaint has worked in more than seven countries including the United Kingdom, Spain, France, and throughout Asia and Latin America.”

“Moreover, Mr. Toussaint is well versed in SEC rules and regulations as well as Generally Accepted Accounting Principles promulgated by the Financial Accounting Stands Board. Having owned and operated a private CPA practice, which was licensed by the Public Company Accounting Oversight Board (PCAOB), Mr. Toussaint brings forth a unique blend of strategic practical business acumen coupled with a robust comprehension of advance accounting and reporting concepts and considerations.”

From a corporate executive perspective, Mr. Toussaint formally served as Chief Executive Officer and Board Member of the NASDAQ listed Corporation MYOS-Rens from December 2015 until 2016. Most recently, Mr. Toussaint was nominated to the Board of Directors of a second NASDAQ listed Company – “China Xiangtai Food Co Ltd” (later named Bit Origin: BTOG). Now with two Board seats on NASDAQ listed Companies to his credit, Mr. Toussaint has joined the ranks of a small number of Black Americans to hold such a distinction.

Mr. Toussaint obtained both a Bachelor of Science degree in Accounting as well as his Master of Business Administration degree from Louisiana State in Baton Rouge, Louisiana. Mr. Toussaint is certified public accountant in the State of Texas and is also bi-lingual with a working proficiency in Spanish.

Mr. Toussaint is a highly accomplished, results-driven Entrepreneur with more than 25 years of business and public accounting experience in a Big 4 environment.

May 27, 2022 Offering Circular

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

The statements contained in this news release which are not historical facts may be “forward-looking statements” that involve risks and uncertainties which could cause actual results to differ materially from those currently anticipated. For example, statements that describe PSWW’s hopes, plans, objectives, goals, intentions, or expectations are forward-looking statements. The forward-looking statements made herein are only made as of the date of this news release. Numerous factors, many of which are beyond PSWW’s control, will affect actual results. PSWW undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. This news release should be read in conjunction with PSWW’s most recent financial reports and other filings posted with the OTC Markets and/or the U. S. Securities and Exchange Commission by PSWW. Institutional Analyst has been retained for ongoing news coverage services for ten thousand dollars.

*For tax purposes, a stripper well is defined as any oil or natural gas well property whose maximum daily average oil production does not exceed 15 BBLS of oil, or any natural gas well whose maximum daily average gas production does not exceed 90 MCF per day, during any 12-month consecutive time period.

Principal Solar Contact

K. Bryce “Rick” Toussaint, CPA, MBA

Chairman and Chief Executive Officer

[email protected]

214-885-0032

Investor Relations Contact

Michael Briola

[email protected]

$PSWW, #PSWW