Large Stake Held by Paulson Capital, run by Billionaire Investor John Paulson.

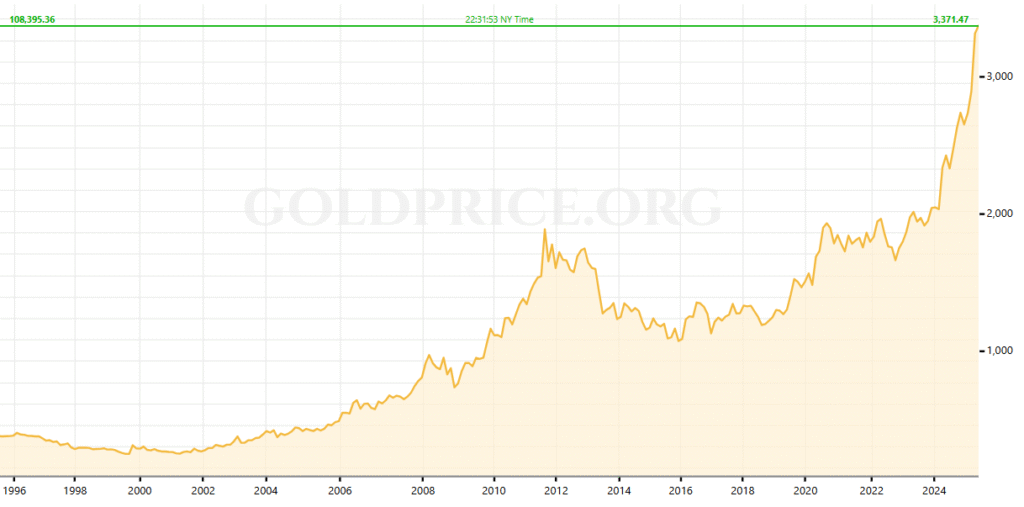

CHART

See initial writeup on Perpetua (PPTA) below.

We Are Getting Back Into the Gold and Precious Metals Business.

We launched Institutional Gold Research in 2019 on the heels of news that billionaires, Stanley Drukenmiller, David Einhorn, Paul Singer, and George Soros – who invested $246 million in Barrick Gold (B) were all taking big stakes in Gold. Our thinking was, “..good enough for them, good enough for us.

In a June article, with Gold at $1,300, we wrote a newsletter highlighting their new interest.

Gold 2019, Here Comes the Smart Money! George Soros in the House!

The next day we wrote another newsletter about the ‘magic’ of breaking the $1,400 level, a high last seen five years earlier.

Is Gold ($1,330) About to Cross the Magic Five Year High of $1,400?

We told everybody to load up on Gold, but nobody listened (and we do mean nobody). We have 10’s of thousands who read our newsletters on Technology, Biotechnology, Beverages and Psychedelics. But the Gold letter peaked at 800 readers. Not thousand, but 800, as in ‘crickets.’ Nobody cared.

So we sidelined our usual business (Company research for hire) until now, that is. We’ve also changed the name of our website (soon to launch) to Institutional Gold Analyst.

Unlike 2019, this time we are having hedge funds call us, asking to “find us some good names.” Hmm, crickets gone, replaced by the distant sound of hoofs, from a heard of fast approaching bulls. $10,000 gold is not a joke. Listen carefully and you can hear the low thunder.

From this level $10,000 is only a 3-fold increase. Gold miners are minting Gold right now, no pun intended. Imagine the impossible to ignore revenues miners and producers will report, at $5,000 Gold.

The all-in sustaining cost (global average 2023-2024) for gold mining was around $1,276 per ounce (U.S. average costs hover around $850 per ounce).

Our big picture theme, as we like to keep things simple (vs calling Gold a hedge against world debt, central bank buying, a collapsing dollar, etc.) is our feeling that the arrival of the retail momentum investors, is right around the corner. Soon, we believe they will come down with a bout of FOMO, (fear of missing out).

We believe a portion of their portfolio will find gold. The US market is stock market is currently worth $52 trillion, and they (retail) comprise of 15% of the markets trading ($4.7 billion in a typical day). That’s $7.8 trillion controlled by retail.

If they see Gold at $5,000 (maybe $7,500) we believe fear of missing out, will force them to invest 15% of their portfolio into Gold and Gold related stocks. And folks, there just ain’t enough gold and gold stocks to go around – which can create even more fear of missing out.

This ‘more money than available assets’ to invest, started the Cannabis bull market in 2017 (plus hype) and with Crypto during its run from $13,000 to over $100,000. We missed both, but we won’t miss Gold.

The value of the top ten Gold stocks combined, is only $232 billion (see chart above). That’s combined. And YouTube (their favorite news source) is filled with commentators saying the world as we know it is over soon, and that Gold is headed to $10,000 plus. So plenty of encouragement to buy Gold, from 100’s of commentors (soon to be 1,000’s of commentors like Bitcoin) – yelling “save yourself, save your soul, debt explosion and reset is coming.” Yes, plenty of fuel to feed the FOMO that is coming.

Our List of YouTube Experts..

By comparison Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia combined are worth $16.7 trillion. Nvidia alone is worth $3.4 trillion. It alone is 14 times the value of Gold’s Top 10 largest cap stocks combined.

Can you spell feeding frenzy? We can…

Lastly we believe it will take time for the world to fix it’s debt problems and for the stock market to turn up again, after it’s upcoming tumble. We’re guessing 5-10 years when we’re 77 years old (yikes) in ten years.

Are you wondering how Gold did during the last stock market rout? Glad you asked. We did our research. Gold gained 6-fold from $314 to $1,827 from the dotcom crash in 2000 to 2012. A similar gain for the upcoming rout (assuming it’s coming) would move the price of Gold from $3,300 to $19,800. The question isn’t can it happen? The question is can it happen again?

We wrote in 2019: Will a Collapse in the Stock Market Spark a Run in the Price of Gold?

We’ll never retire, but we don’t want to end up unable to continue our epic bar tabs, at our local ocean-front Tiki Hut the Sand Bar in Delray Beach.

We’ve been in the bear markets of 1973 (lost our college tuition), 1987 (we moved to Florida from Chicago the day of the crash) and every bear market since. They are easy to avoid getting hurt in by moving to the sidelines (called a stop loss), but this time we’d like to benefit from the next bear market – instead of watching from the sidelines. We believe precious metals will be our answer.

(Our goal is to also introduce the trillions that US Investors have, to the world of precious metal opportunities, many which are listed on the Canadian and Australian exchanges) See InteractiveBrokers.

Perpetua Resources (PPTA)

FINDING PRECIOUS METALS ‘SUBSECTORS.’

Back in 2019, we decided to zone in on a subsector of Gold. We selected Gold Miners who could benefit from a geopolitical change (to pro-drilling) in Ecuador. We had a few big Ecuadorian winners such as Lundin Gold (LUGDF), which traded from $4.15 to $50 and a $12 billion market, Fortescue (FSUMF) $5.50 to a $19 peak value – a $30 billion market cap, and Anglo American (NGLOY) $12 to a peak of $27 and a monstrous $70 billion market cap. Good times.

We published on June 14th, 2019: Ecuador’s Upcoming Gold Rush

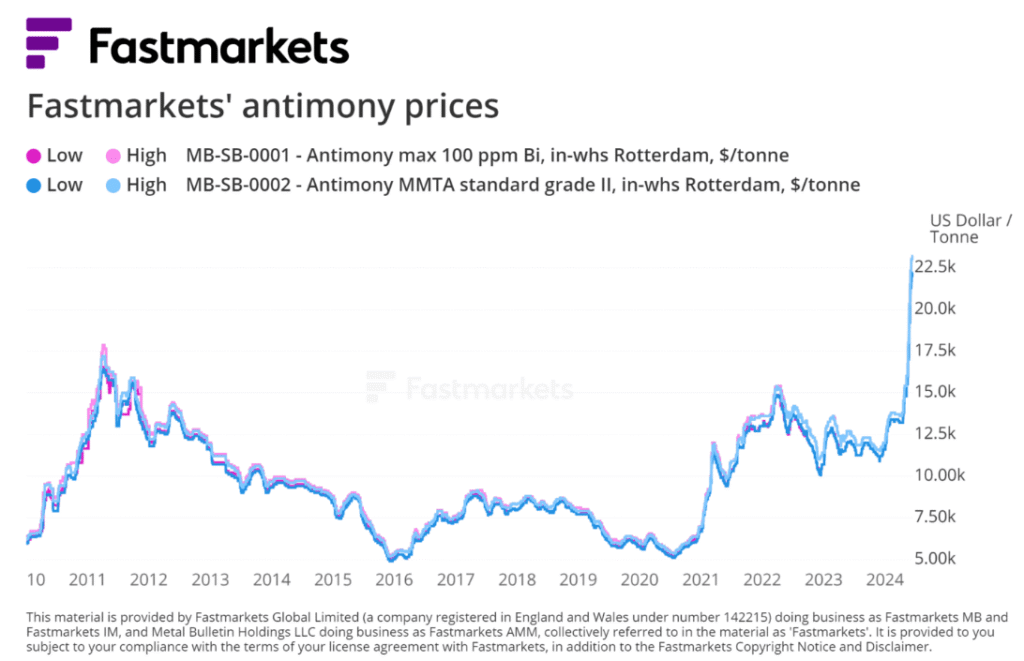

This time we zoning in on Antimony. You probably haven’t heard of it, but the price of Antimony and the Miners looking for it, are on a tear. We will put out a detailed separate piece on Antimony, in the near future.

We are also getting into the investment conference business. We initially look to sponsor four conferences a year. We’ll call them the Gold Investment Conferences (we still can’t believe that URL was available). Our first conference will be this summer, and the main theme will be Antimony stocks (seven companies and experts). We will additionally have separate conferences on Large Caps, Small Caps, and Silver & Platinum.

Except for small caps, for the most part these are smaller, by invitation only conferences, though there will be a video archive of each presentation. We hand pick the presenters. This is not one of those 300 presenter conferences like they have in Canada. We’ve been to over 100 conferences and the mega-conferences are like going to a Tequila tasting event, where you can sample 50 different Tequilas. After a dozen shots (sips) you can’t remember anything about the 3rd, 7th or 9th one. Same thing happens at stock conferences. What was the name of that company? No idea.

Our Antimony Universe

So Back to Perpetua

There are two things to research here with Perpetua, to keep things simple. By simple we mean in plain English, so that US investors who haven’t invested in precious metals before, can understand. The mining industry tends to love spewing out ridiculously overly-technical jargon.

As an example we recived this yesterday from an IR firm: “The geology comprises oceanic ophiolites thrust over Tertiary-aged volcanics, volcanoclastic, and limestones—an analogous setting to the 4+ million oz Zod (Sokt) deposit located ~100 km to the southeast along the same regional-scale lineament.” Are you kidding me? Seriously?

As you are aware, we have been deeply involved in the Biotech sector for over two decades and that sector can make the same mistake, when communicating with investors. Some address the audience in a way that would require a medical degree from John Hopkins to understand. Big mistake. Investors just want to know IF the drug gets approved (we never bet on approval), how much the treatment would cost and how many people would use it. Is that so hard? Like exploring for metals and minerals, these Biotech companies never knows what they will find until their done exploring.

There are the two items to follow and do research on with Perpetua. This is a LONG TERM idea (five years), not a trade. The first is item to research is management and insiders. The second item is that they are hunting for Antimony and what is it?

Item #1. Management and Majority Shareholders. John Paulson, Jonathan Cherry (John and Jon) and fund managers Eric Sprott, Peter Palmedo and David Iben. This is the dream team of “if they’re involved, we want to be involved.”

Major Shareholders

John Paulson, Paulson Capital

First there’s billionaire John Paulson. More importantly than his wealth, is he’s proven time and time again to be one smart cookie. He thinks Gold’s next stop is $5,000, though we doubt his Gold price prediction alone, is what motivated him to first invest in Perpetua.

His first purchase was in 2016, so we’re nearing a decade of his involvement. .

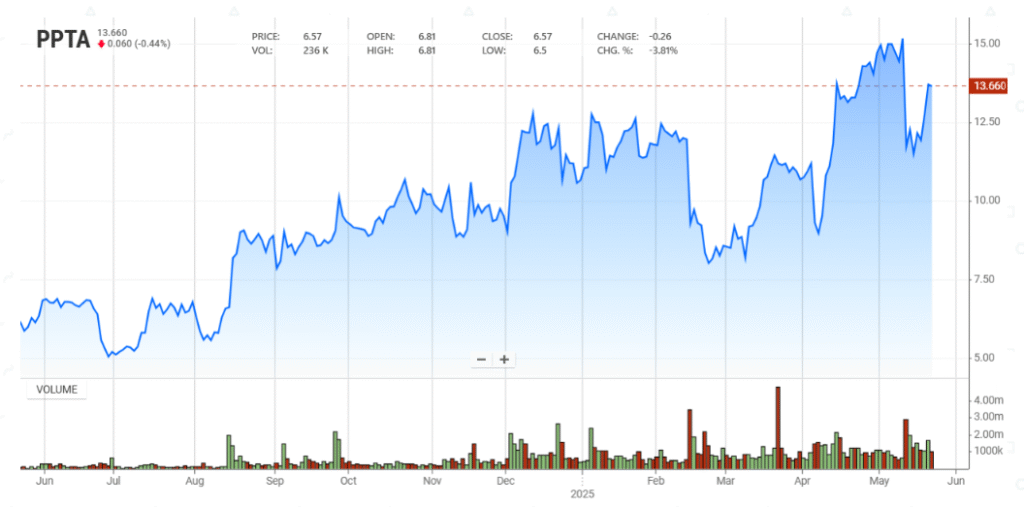

How often, outside of the tech industry, do you see the largest shareholder purchase and hold, what now amounts to $408 million worth of stock. Note we will not be updating changes in ownership on any insiders or institutions. On August 17th of 2021 upped his position by 960,000 shares. The stock traded for an average price of $5.34 per share on the day of the transaction.

We could stop right there (in terms of deciding to becoming a shareholder), but it gets better as you read more about Mr. Paulson. Back in 1994, he founded his own hedge fund, Paulson & Co., with $2 million and one employee, located in office space rented from Bear Stearns. The firm moved to 57th and Madison in 2001. By 2003, his fund had grown to $300 million in assets.

He acquired much of his fortune in 2007 when he earned almost $4 billion and was transformed “from an obscure money manager into a financial legend” by using credit default swaps to effectively bet against the U.S. subprime mortgage lending market.

Video: Investors Are Betting on a U.S. Default – Here’s Why

In 2010, he set another hedge fund record by making nearly $5 billion in a single year, primarily investing in the Gold sector.

Read more about Palm Beach based John Paulson and his other Gold holdings on our website: Precious Metal Experts

Eric Sprott, Sprott Asset Management. 3,395,395 Shares (worth $57 million).

Founded in 1981 by Eric Sprott, Sprott Asset Management has grown steadily over the past four decades. The firm has broadened its investment strategies while maintaining a focus on its core strengths. Today, Sprott is a global asset manager providing over 250,000 clients with access to precious metals and critical materials investment strategies, managing approximately US$29.4 billion in assets as of March 31, 2024.

As of March 2024, Sprott manages discretionary assets for three clients. Their last reported 13F filing for Q1 2024 included $1,387,198,868 in managed 13F securities with a top 10 holdings concentration of 41.19%. The firm’s largest holding is Sprott Focus Trust Inc., with 14,203,600 shares.

This is his 16th largest holding.

Peter Palmedo, Sun Valley Capital. 2,966,508 Shares (worth $50.4 million).

Peter Palmedo founded Sun Valley Gold LLC in December 1998, establishing the Idaho-based (where Perpetua is located) hedge fund manager specializing in investments primarily focused on precious metals.

Previously, he served as Chairman of American Gold Capital Corp. and as an Independent Director at Chesapeake Gold Corp. from 2011 to 2013. His earlier experience includes a principal position at Morgan Stanley & Co. LLC from 1981 to 1989.

As of March 19, 2024, SUN Valley Gold manages assets for three clients, with discretionary assets under management (AUM) totaling $99.85 million.

David Iben, Kopernik Global Investors, 1,104,398 Shares.

Kopernik Global Investors, established by David Iben on July 1, 2013, is a Tampa-based hedge fund manager with numerous Gold holdings. The firm, named after astronomer Nicolaus Copernicus, emphasizes independent thinking akin to Copernicus’s reliance on observations rather than prevailing belief.

Kopernik Global Investors, a hedge fund managing discretionary assets totaling $5,490,380,153 as of their Form ADV dated March 2024, serves 13 clients.

Video Interview with David Iben. Gold, Platinum and Why Everyone Has it Wrong

Management

Jon Cherry came out of retirement and was appointed President and CEO of Perpetua Resources and joined the Board of Directors effective March 14, 2024.

With over 33 years of extensive mining industry experience including permitting, capital raising, project development, joint venture formation, and operations. He most recently served as Chairman, President, and CEO of PolyMet Mining. During his tenure at PolyMet, the NorthMet project received the highest rating the Environmental Protection Agency has ever given to a mining project. Additionally, Mr. Cherry played a leading role in negotiating a joint venture with Teck Resources before PolyMet’s sale to Glencore. Before Polymet, Mr. Cherry served as a senior leader for the multi-billion dollar Resolution Copper JV Project (owned by Rio Tinto and BHP), General Manager of Rio Tinto’s Eagle Mine (the United States of America’s only primary nickel-copper mine) and Senior Project Engineer at Rio Tinto Kennecott Utah Copper. Mr. Cherry will lead the Perpetua Resources team as the Stibnite Gold Project completes permitting and transitions into development and operations.

“One of the primary reasons I was drawn to Perpetua Resources is that the team has clearly focused on doing business the right way,” said Mr. Cherry. “I look forward to advancing Perpetua’s vision to restore an abandoned legacy mine site, responsibly develop one of the highest grade open-pit gold mines in the United States and support national security and the energy transition by becoming the only domestically mined source of the critical mineral antimony.

CEO Jonathan Cherry Video Presentation

(Must Watch)

Item #2. Prices on Antimony.

While the critical minerals narrative revolves largely around battery and energy commodities like lithium, copper and uranium, Antimony, a by-product metal, is on the critical radar of a growing number of countries.

In fact, antimony is included on critical minerals lists in Canada, the US, the EU, the UK and Australia. Antimony is traditionally used as a fire retardant, an application that accounts for 60 percent of annual demand, as well as in alloys to enhance end products such as munitions and lead-acid batteries. Antimony is also critical to many clean energy technologies like solar panels, wind turbines, energy storage and liquid metal batteries.

What is Antimony?

Antimony is a semi-metallic element with a silvery blue hue and flaky texture. While antimony occurs in the form of more than a hundred different minerals, the most important of these is stibnite.

After falling slightly in 2023, the antimony price had risen in 2024 to reach a high of US$34,200 per metric ton in mid-December. Antimony’s price is up significantly since 2020, when it averaged about US$7,000. With demand outpacing supply, the antimony outlook is robust.

Antimony is a by-product asset mined in conjunction with gold, silver and copper. When alloyed to other metals such as lead, it provides strength, hardness and corrosion resistance.

Despite it being lesser known than many metals, antimony is included on critical minerals lists around the globe due to its importance for a variety of applications, including emerging cleantech and battery applications, as well as its use in military applications.

S&P Global notes that recent record-setting prices for antimony are being driven in part by increasing applications for the semimetal in the making of ammunition for the defense industry. Antimony alloys are used in munitions, enhancing lead-based ammunition and explosives by increasing their strength and hardness. This improves accuracy and effectiveness in bullets and shells. Beyond bullets, antimony is used in night vision googles, flares, explosives, laser sighting, communications equipment and flame retardants for military uniforms, equipment and vehicles.

For a long time, people didn’t worry about the military usage because bullets were stored up for a war that was to come. The war has now come.

Like rare earths and graphite, most Antimony is mined in China. The country hosts five of the the world’s 10 largest active mining operations with antimony deposits. In 2022 and 2023, China accounted for almost half of global antimony supply, producing 40,000 metric tons of the material in both calendar years. Heading into 2025, antimony is seemingly caught up in the ongoing trade war between China and the United States. Back in August, in response to US restrictions on components used for artificial intelligence technology and chips, China placed a partial ban on exports of antimony materials.

The world’s leading antimony-producing mine was a gold-antimony mine with 23,000-ton per-year capacity in Russia.

Antimony’s inclusion in the trade war also has implications for western militaries. “The military uses of Sb (Antimony) are now the tail that wags the dog. Everyone needs it for armaments, so it is better to hang onto it than sell it. This will put a real squeeze on the U.S. and European militaries,” said Christopher Ecclestone, a principal and mining strategist at Hallgarten & Company in London.

Without a physical metals market, Antimony investors must place their bets on antimony mining stocks. The growing demand/supply imbalance in the antimony market represents an appealing opportunity for ex-China antimony mining companies and their investors.

We’ll add these circumstances are the perfect ingredients for the MEME stock crowd.

Consider this. Robinhood had 25 million accounts. If one million decided to each buy just $1,000 worth of Perpetua, that would be a buy order valued at $1 billion. If all 25 million decided to devote just $10,000 of their portfolio into all Gold stocks, we’re looking at buy orders of $250 billion or five times (500%) the value of the top 10 Gold Stocks are valued at combined. So don’t chuckle when you hear $10,000 or $20,000 Gold. It could happen fast, Gamestop fast.

A Little History

Perpetua, formerly known as Midas Gold was incorporated on February 22, 2011. The Corporation was organized to hold shares in wholly owned subsidiaries that locate, acquire, develop and restore mineral properties located

principally in the Stibnite – Yellow Pine mining district in Valley County, Idaho, USA.

On August 26, 2020, Paulson & Co., Inc., (not to be confused with Paulson the broker/dealer in Oregon) on behalf of the several investment and accounts managed by it (“Paulson”),exercised the conversion feature on the convertible notes they held in the aggregate principal amount of C$82,102,500 (the “Notes”) for a total of 199,692,804 common shares (before 1:10 reverse split) of Midas Gold, resulting in Paulson holding approximately 44.12% of the Company’s outstanding common shares. The Notes were purchased by Paulson in two separate financings completed on March 17, 2016 and March 17, 2020 with conversion prices of $0.3541 and $0.4655, respectively ($3.0 and $4.60 post split).

On January 29th, 2021 the company did a 1:10 reverse split. Shares currently issued and outstanding are now down to 71 million. Down from – let’s just call it – hundreds of millions.

A few weeks later on February 15th they changed their name from Midas Gold to Perpetua Resources.

And again, on August 17th of 2021 Paulson upped his position by 960,000 shares. The stock traded for an average price of $5.34 per share on the day of the transaction. In total, the company raised $50 million that day with additional investors.

PERPETUA RESOURCES ANNOUNCES CLOSING OF US$50 MILLION PUBLIC OFFERING

Description

Perpetua Resources Corp., (PPTA) is a development-stage company, engages in the acquisition of mining properties in the United States.

The company explores for gold, silver, and antimony deposits. Its principal mineral project is the 100% owned Stibnite Gold project, which includes 1,674 unpatented lode claims, mill sites, and patented land holdings covering an area of approximately 11,548 hectares located in Valley County, Idaho.

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project.

The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of Antimony in the United States. Perpetua Resources has been awarded a Technology Investment Agreement (“TIA”) of $59.2 million in Defense Production Act Title III (“DPA”) funding to advance construction readiness and permitting of the Project.

Antimony trisulfide from Stibnite is the only known domestic source of antimony that can meet U.S. defense needs for many small arms, munitions, and missile types. Hmmm.

Recent News

Perpetua Resources Receives Final Federal Permit for Stibnite Gold Project PR NEWSWIRE | 05/19/2025

Perpetua Resources Reports Results of 2025 Annual Meeting PR NEWSWIRE | 05/16/2025

Perpetua Resources Announces First Quarter 2025 and Recent Highlights PR NEWSWIRE | 05/12/2025

Presentation

Website

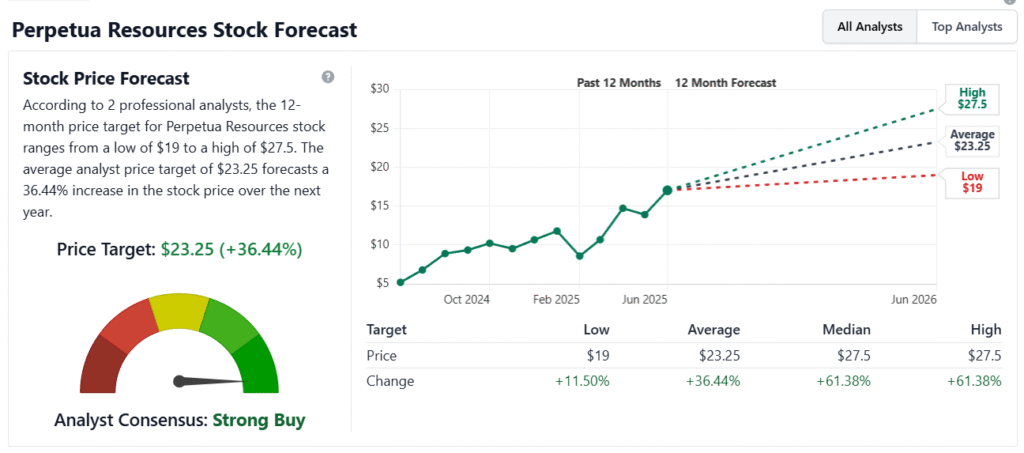

Wall Street & Bay Street

HC Wainwright & Co. upped their price target to $28 on May 13th, Roth up graded its target to $19 in January.

Contacts

CHRIS FOGG

Investor Relations Manager

T: 208-901-3049

Disclaimer

Investors should be aware that the Project’s inclusion as a Transparency Project on the Permitting Dashboard does not imply endorsement of or support for the project by the federal government, or create a presumption that the Project will be approved, favorably reviewed by any agency, or receive federal funding. The inclusion of a project on the Permitting Dashboard may be reconsidered based on updated information. Additionally, investors should be aware that the Executive Order does not indicate any commitments on the part of the government or any government agency with regard to the applicability of any programs to the Project, or the timing or outcome of any such initiative that may be applicable to the Project.

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action; the anticipated outcomes from the Executive Order and the Transparency Projects list for the Company or the mining industry; our ability to comply with, obtain and defend permits related to the Project; our ability to successfully implement and fund the Project and the occurrence of the expected benefits from the Project; and our and Ambri Inc.’s ability to perform under the supply agreement. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “anticipate”, “expect”, “plan”, “likely”, “believe”, “intend”, “forecast”, “project”, “estimate”, “potential”, “could”, “may”, “will”, “would” or “should”. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that that the remaining permits will be reviewed, issued in a timely manner and as expected; that the initiatives outlined in the Executive Order, and the intended goals of the Transparency Projects list, will be implemented as proposed; that we will be able to successfully secure financing to finance permitting, pre-construction and construction of the Project; that the current exploration, development, environmental and other objectives concerning the Project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner and that permitting and operations costs will not materially increase; and that we will be able to discharge our liabilities as they become due and continue as a going concern. Forward-Looking Information are based on certain material assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among other things, risks related to unforeseen delays in the review and permitting process, including as a result of legal challenges to the ROD or other permits; risks related to opposition to the Project; risks related to increased or unexpected costs in operations or the permitting process; risks that necessary financing will be unavailable when needed on acceptable terms, or at all, as well as those factors discussed in Perpetua Resources’ public filings with the U.S. Securities and Exchange Commission (the “SEC”) and its Canadian disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. For further information on these and other risks and uncertainties that may affect the Company’s business and liquidity, see the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s filings with the SEC, which are available at www.sec.gov and with the Canadian securities regulators, which are available at www.sedar.com. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Not a client, yet.