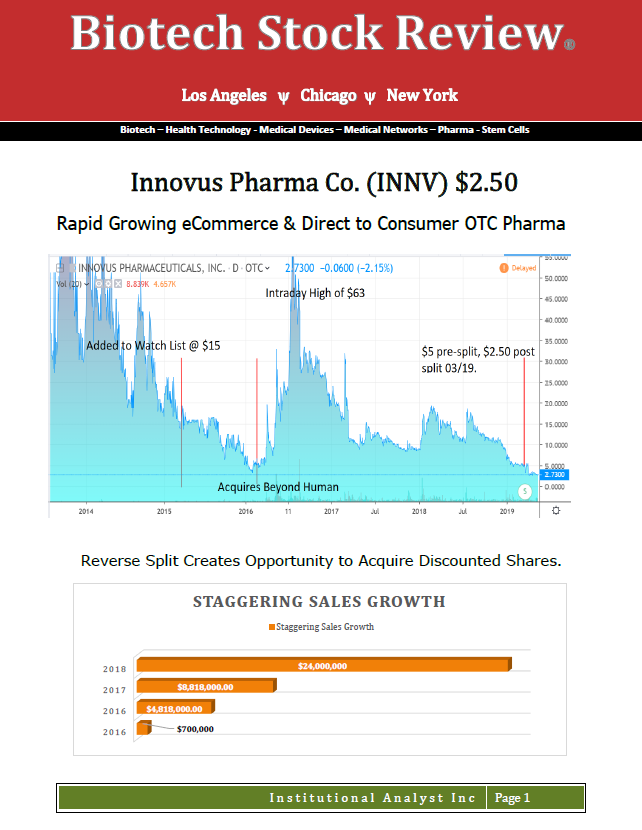

Fast Growing eCommerce and Direct to Consumer Pharma Company Announces 1st Foray into CBD and 2nd Major Off-Patent Blockbuster Drug to its lineup.

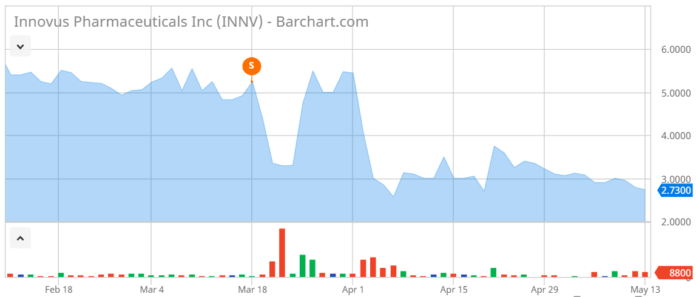

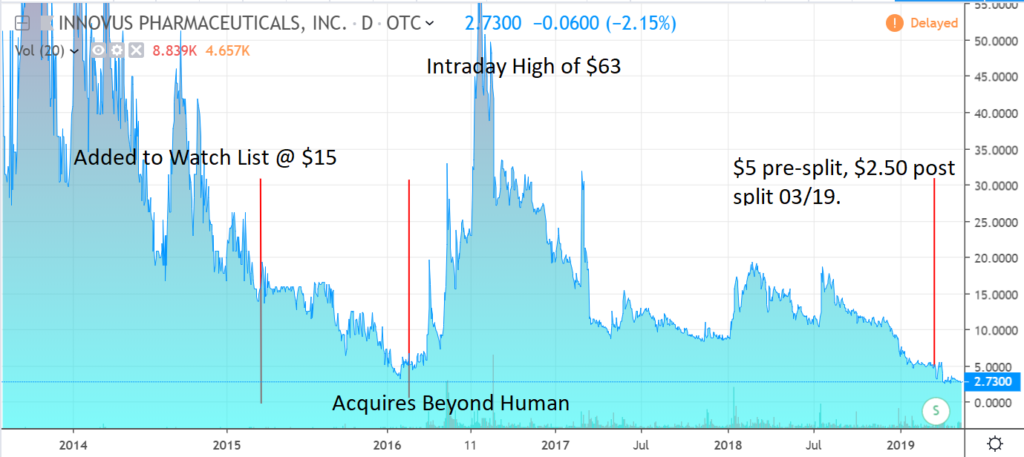

We’re adding Innovus to the Watch List for the second time, after a post-reverse split of 105:1, which sent the shares reeling to a level which we feel is grossly undervalued and a keen opportunity for aggressive long-term investors – as the chart below depicts.

While trading will in all likelihood be volatile in the coming months, the reverse split has provided an opportunity to acquire a meaningful stake in the shares at near 1/2 the pre-split price of $5.00. Admittedly unfortunate for legacy shareholders, it is an opportunity for new shareholders (including legacy holders seeking to average down).

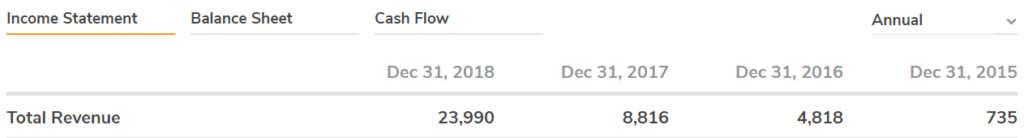

With 2,395,000 shares outstanding, the Company is valued at a ridiculous valuation of only $5.7 million versus trailing 12-month sales near $24 million! The well known Chicago based Zacks Investment Research estimates sales of $30 million in 2019, $38 million in 2020 and $47 million in 2021. With the potential ‘pruning’ of less-profitable lines, the Company could additionally achieve overall profitability in 2020.

Under these type of trying circumstances, we recommend past shareholders analyze as if that today is the first day they ever heard of the company (mentally wiping the slate clean), look at the sales, look at the current product line-up, think of how an expanding portfolio of CBD infused products would be looked at by new investors, and then finally look at the total market capitalization. It’s a practice easier said than done, but proven to be of great value in the past.

Related News: Conference Call May 15, 2019 at 4:15 p.m. ET

We first started coverage of Innovus in 2015 after determining it had put together one of the best all-around marketing teams (e-commerce, print, direct mailing, magazine, and social media) to market OTC compounds (think products like Solarcaine, Sleeping aids, Pain relief, Dayquil, Heartburn relief and Laxatives), blockbuster compounds coming off patent and/or compounds going from prescription-only to OTC (meaning no script). These type of OTC products (just stroll down any CVS aisle) generate billions and billions in sales annually. These types of products are also ideal to be marketed direct to consumer with all the margin related benefits.

Make no bones about it, while the name is Innovus Pharma, this isn’t a drug manufacturer. It is a marketing machine which seeks out innovative compounds and products (to acquire or partner with) and then super-charges their sales efforts. This is an important distinction to remember when you think of the 100’s if not 1000’s of CBD products which are being (or will be) created in the decade to come. Many of these small inventor/ manufacturers lack marketing savvy and/or budgets and are in essence an enormous ‘farm team’ for Innovus saving the Company untold millions in research and development.

Through a multi-pronged approach of combining print, direct mailing, magazine, online and data buy, Innovus reaches over 30 million potential consumers monthly. With over 100,000 followers on social media, 2.5 million email letter subscribers and 160 websites, their platform has been successfully used to launch multiple unknown brands to become recognized, multi-million-dollar sellers. This is key to the Innovus future as smaller product manufacturers look to Innovus as a “Shark Tank” without the cameras and without revealing their company secrets to a nationwide audience of potential ‘why didn’t I think of that’ competitors.

Trading at the pre-split equivalent of $11 in 2015, the first time we added it to the Watch List, within a year Innovus traded to over $63 on news of the acquisition of Beyond Human a top tier Internet sales and marketing platform which serves to introduce the Innovus portfolio of products to a truly worldwide audience and the acquisition of Novalere the manufacturer of FlutiCare®.

Read our initial ‘heads-up report here.

(Client, see report for disclaimer details)