And the Day-Traders Say, I’ll Drink to That!

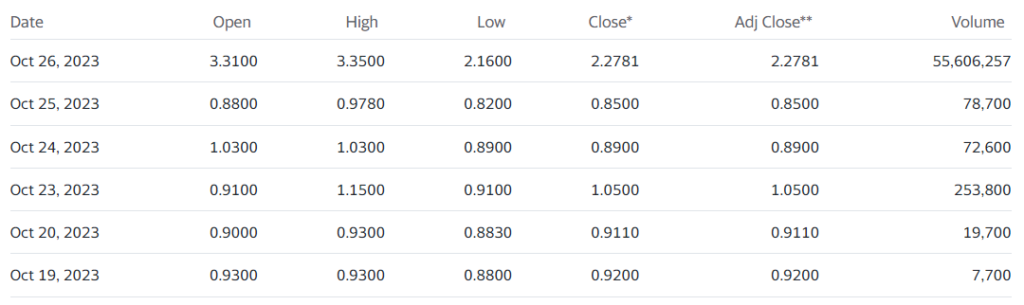

Can never figure these ‘events’ out. 54 Million shares traded before 12:00. Traded 7,000 (seven-thousand) shares a week ago. Past client, with a revolutionary vitreous substitute (eyeball fluid) called Vitargus®. Didn’t work out to well for us. Guess you can’t kiss all the pretty girls.

Took a nice run the year after we added it to the Watch List, but now it’s at $2.00, so a 160% gain is kind of meaningless. Well, alrighty then.

2020 CHART

ABVC BioPharma (ABVC) announced they entered into a term sheet at a valuation of $667 Million. No, we have no idea what that means! While current management has some impressive resumes, previous management is long gone.

Adding American BriVision (ABVC) $2.00 to Watch List.

And they didn’t even bother to tell us tell us they were leaving!

PRESS RELEASE

ABVC BioPharma Entered Into a Term Sheet to License Global Rights of CNS Drugs with the Indications of MDD and ADHD to AiBtl BioPharma at the Valuation of $667 Million.

FREMONT, CA, Oct. 26, 2023 (GLOBE NEWSWIRE) — via NewMediaWire– ABVC BioPharma, Inc. (NASDAQ: ABVC) (“Company”), a clinical-stage biopharmaceutical company developing therapeutic solutions in ophthalmology, CNS (central nervous systems), and oncology/hematology, announced today that it entered into a legal binding term sheet regarding a multi-year, global licensing agreement with AiBtl BioPharma (AiBtl) for the Company’s CNS drugs with the indications of MDD (Major Depressive Disorder) and ADHD (Attention Deficit Hyperactivity Disorder) (the “Licensed Products”). The potential license will cover the Licensed Products’ clinical trial, registration, manufacturing, supply, and distribution rights.

The Licensed Products for MDD and ADHD, owned by ABVC and its subsidiary BioLite, Inc., were valued at $667M by a third-party evaluation. ABVC and AiBtl are determined to collaborate on the global development of the Licensed Products. They are also working to strengthen their new drug development and business collaboration, including technology, interoperability, and standards development. In this legally binding term sheet, ABVC’s licensing revenues for ABVC and its subsidiary BioLite, Inc. include the AiBtl stock of 46 million shares (57% of AiBtl) and milestone cash payments of $7M with the royalties of 5% of net sales, up to $200 million, after the product’s launch.

AiBtl is a US company registered in Delaware that owns 51% of Jeremy Group Co, LTD. (JEREMY), an Asian company with assets valued at $32M. JEREMY develops and constructs 607,000 square meters of land in the Asia Economic Development Zone. One of the objectives of AiBtl’s collaboration is to integrate the health and resort industries. Additionally, the venture will capitalize on development revenues within the Asia Economic Development Zone, primarily through land lease income. “AiBtl aims at going IPO and getting listed on NASDAQ in 2024,” said AiBtl Chief Executive Officer Russman Jaimes.

“AiBtl has a strong capability in its global business development. We believe partnering with AiBtl will allow us to secure international pharmaceutical companies to develop the Licensed Products and bring the CNS drugs to the market,” said Dr. Uttam Patil, ABVC Chief Executive Officer. “This will allow ABVC to continue to focus on bringing its other proprietary patented products, such as ophthalmology medical devices, Vitargus, and oncology drugs, to the global market.”

We believe the Company’s pipeline products have great market potential. As per the Future Market Insights report, the MDD market was valued at $11.51 billion in 2022 and is expected to reach $14.96 billion by 2032 with a CAGR of 2.8% over the forecast period[1]. According to the Polaris market research report, the global ADHD treatment market was valued at $15.23 billion in 2022 and is expected to grow at a CAGR of 7.3% over the forecast period between 2023-2032.[2]

About ABVC BioPharma & Its Industry

ABVC BioPharma is a clinical-stage biopharmaceutical company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development. For its drug products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct proof-of-concept trials through Phase II of clinical development. The Company’s network of research institutions includes Stanford University, University of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends to conduct global clinical trials through Phase III.

Forward-Looking Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size and nature of our competition; (iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval to proceed to the next level of the clinical trials or to market our product candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy any of the Company’s securities, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

Contact:

Tom Masterson

Email: tmasterson@allelecomms.com