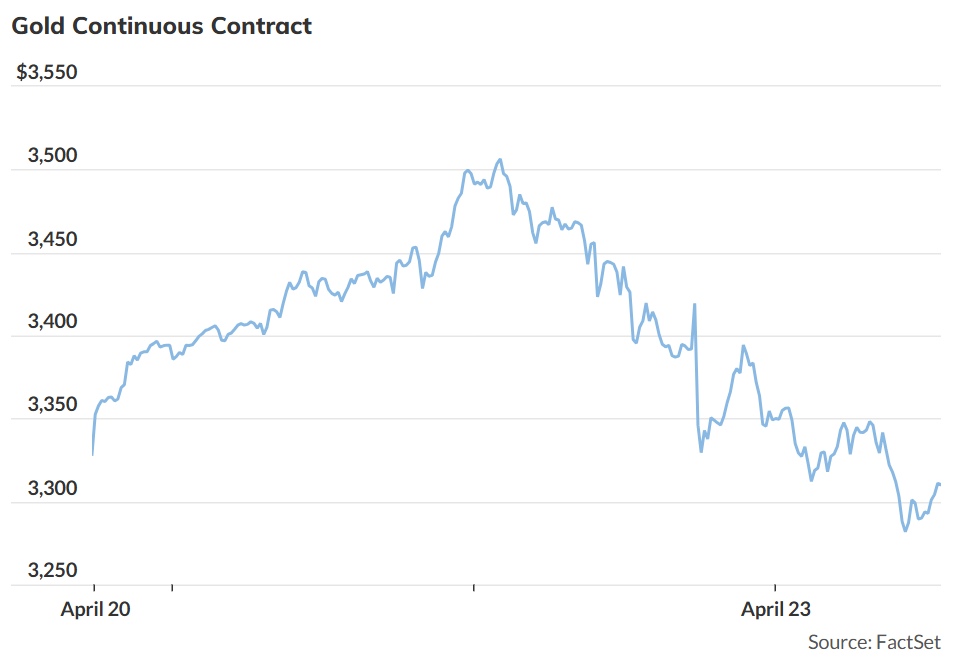

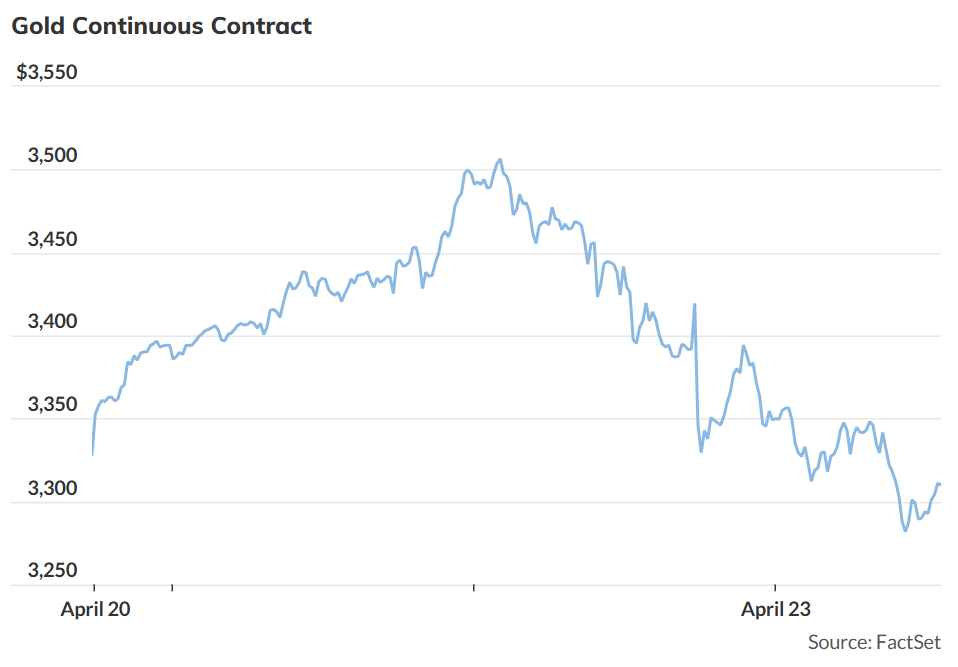

Easing anxieties over Trump’s tariff policies and the Fed chair’s fate spark gold’s worst daily decline since 2021

Gold suffered its biggest one-day drop in nearly four years Wednesday, raising questions about whether a torrid rally driven by anxiety over President Trump’s trade policies can continue as the administration appeared to take a more conciliatory approach.

The precious metal had climbed in grand scale this year, culminating in a rise past $3,500 an ounce this week, before support for prices appeared to suddenly give way.

That raised questions over whether gold has exhausted its run to record highs. That may be the case for now, and there’s more room for prices to fall, analysts said — though adding that the hard stop in the rally does not mark a top for gold.

“There is nothing telling us that $3,500 is a top for gold,” said Michael Armbruster, co-founder and managing partner at futures brokerage Altavest. “The trend is still up and we are now experiencing a normal correction in a bull market.”

In the short run, however, gold may see another “$100 more to [the] downside,” he told MarketWatch.