GeoVax (GOVX) $1.64. Recent High $11.18 (BiotechStockReview)

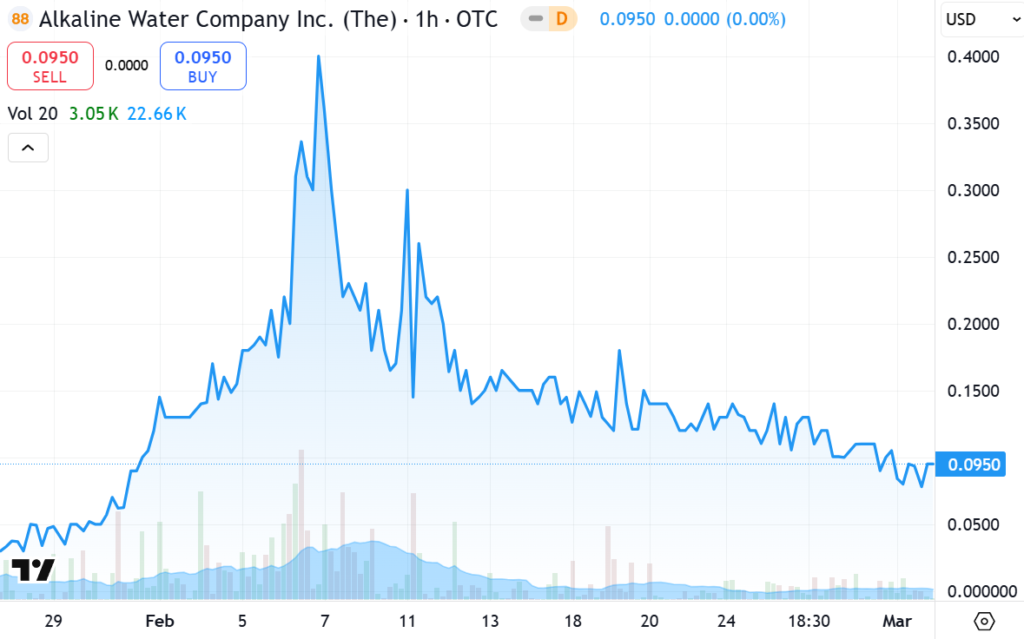

The Alkaline Water Co. (WTER) $0.09. Recent High $0.48 (BeverageStockReview)

Society Pass (SOPA) $1.27. Recent High $6.75. (InternetStockReview)

Okay we’re back, after health issues with a couple of family members (who are no longer with us) about seven months ago. It resulted in us kind of losing all interest in the stock market, despite having a fantastic time over the past year and past five years, with some EPIC huge gains. But the stock market was never been about making money for us (it was just a side benefit). The market, since 1973, has always been about entertaining others, being entertained and having fun!

But now we’re back. Ready to entertain, ready to be entertained and most of all to have fun. We are back behind the ‘quote machine,’ as we used to call it — and back on our bar stool minutes if not moments, after the market closes everyday. Ah, the good life. Stocks and Tiki-Huts.

So here we go again. All three issuers are past clients which provided plenty of entertainment and plenty of potential profits for both us and subscribers. They also look better to us now, than they did before their recent (52 week) runs. Way, way better .. just saying.

Subscribe to receive upcoming reports on GeoVax, Alkaine Water and Society Pass.

GeoVax Labs is our current Biotech favorite, by a long shot. And we follow hundreds. We also purchased shares in the open market recently. Enormous potential to put it mildly, GeoVax (GOVX) in our opinion is totally, totally misunderstood.

Recent news related to monkey-pox, which is not the biggest opportunity in their pipeline, resulted in the shares trading from $1.70 to over $10 (intraday high), a gain of 500+% in a matter of weeks.

From our past experience, the best companies to make money from are companies that are misunderstood. While we are long-term players, we have not played with widely understood companies whose shares keep hitting new highs — month after month (think NVIDIA), as long as earnings and revenues keep hitting new highs.

On the other hand, where we have had great success in the past, is with companies hitting new lows, that are totally misunderstood. We might say we had these great gains, BECAUSE they were so misunderstood. The latest wrinkle in our unloved category, are additionally companies which did a reverse split. They often have so few shares outstanding, even a breath of good news can send them soaring up 5X to 10X.

No big report on any of these companies today. Just a ‘heads up.’ Give us a week or so. We just believe the prices and timing (for long term investors) is ideal for all three of these stocks at this very moment. All the stars as they say, in our opinion, are aligned. While we are not traders, and don’t share ideas for short term gains – we think all three, are like rubber bands stretched so tight, that any good news related to their fundamentals or prospects, can send the issuers share price up three-fold, five-fold or more.

As they have proven in the past.

We have for decades used ‘heads up,’ as our way to officially mark both the date and price, of our interest, for our track record. Which is as long-term subscribers know (including losers), is simply stellar.

Short-term we don’t have a clue where these issuers can trade. Long term, we can imagine (not price targets) seeing GeoVax trading in excess of $25, The Alkaline Water Company trading in excess of $1.00 and Society Pass trading near $10. So, plenty of entertaiment potential, over the next couple years. We are locked and loaded. Come grow with us (First Jersey -1986) lol.

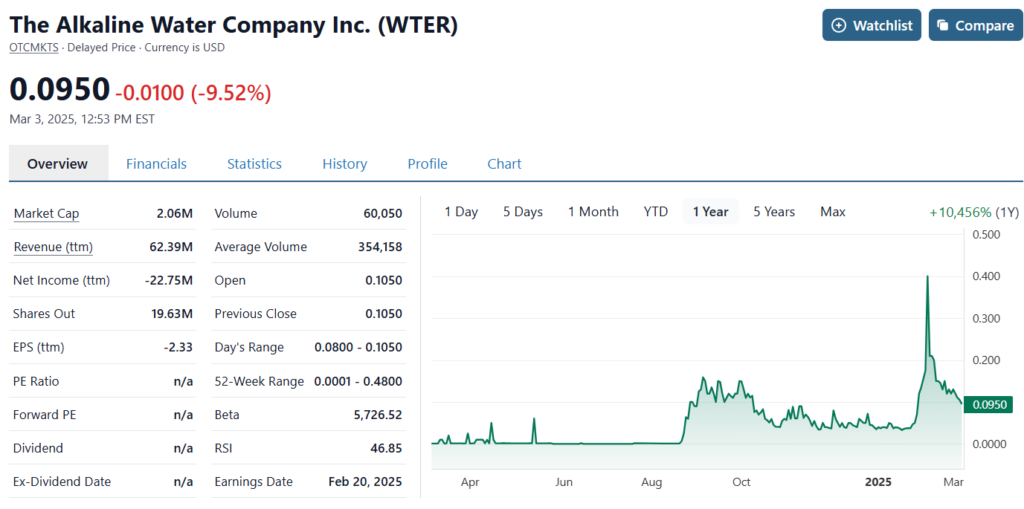

The Alkaline Water Company (WTER) Live Quote

This could be the comeback story of the decade. We will provide details..later. You can watch from the sidelines, and wait until numbers prove the comeback. Or you can strap on a set and participate in this comeback, like betting on the New England Patriots, when they were down 28-3 against the Atlanta Falcons in the third quarter of the Super Bowl LI with a 0.5% win probablity.

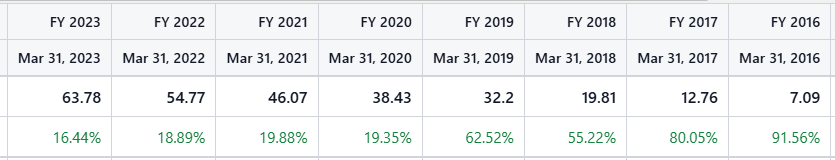

When we first met the management (CEO Ricky Wright) of WTER in 2015, they had sales of $3.7 million and a share price of $0.17. The very definition of tiny and risky, and in a hyper-competitive and cut throat industry.

The next year sales (by word of mouth and with no advertising) doubled to $7 million, creating a collective HMMM by investors. By 2024 sales hit an incredible $63 million. Again, without advertising.

We were sure they had grown large enough, proving consumer acceptance, to be acquired by one of the beverage giants (Coke, Nestle, Dr Pepper). Didn’t happen, oh well.

2015 was a good year to issue our Top 25 Beverage Stocks List. Among a long list of our winners was American Brewing $0.31 to near $9.00 (up 29 fold), and Celcius $0.99 to $99 up 100-fold (unadjusted for splits) in 2024.

And Alkaline Water, whose share price peaked at $77 (unadjusted for splits) by 2019, enjoyed the limelight that year, shortly after announcing their “intentions” of adding a CBD infused water to their lineup, when anything weed related lit up. Remember when Tilray (TLRY) had a $9 billion market cap and a $148 share price (now $0.68). Brings new meaning to the saying “up in smoke.”

To make a long story short, Ricky Wright resigned in June of 2022. Despite sales being 17 times higher from when we discovered them in 2024, they closed shop two years after he left..

But now Ricky Wright is back. To quote him from a recent press release, “Coming back to what I affectionately call ‘my baby’ feels like coming home, and the timing couldn’t be better.”

News related to his return in early February, resulted in the shares trading from under $0.05 to over $0.48 (intraday high), a gain of 860+% in a matter of days.

As in game on. It’s showtime folks! Not to sound like a broken record, but we have no idea where it trades in the next few weeks or months. But we will bet, consumers who liked it before, will like it again. If revenues of $63 million (wholesale) represents double that at the retail level, we feel confident that in saying it was a consumer favorite with retail sales over $100 million.

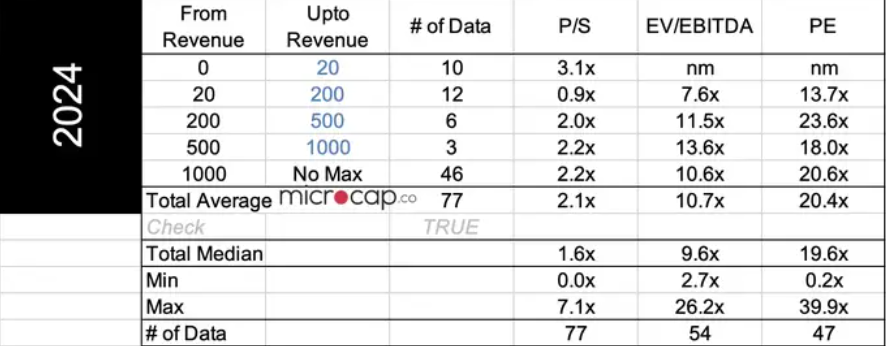

Within a couple years, this should result in significantly higher sales and if they learned from both the past mistakes and secrets to success, a significantly higher stock price. As a benchmark, fast growing beverage start-ups can be valued at 2-5 times revenues. Meaning $50 million in sales could equate to a market valuation of between $100 million and $250 million.

Of course there are a lot of factors which will affect the share price (like financing), but we are of the camp that significantly rising revenues, cures all ills.

Press Release: Former CEO Ricky Wright Returns to Lead The Alkaline Water Company

Society Pass (SOPA) Live Quote

Society Pass (SOPA) is an incubator (a term from the dotcom boom) who as of late, are described as accelerators. While the company doesn’t describe itself as an incubator, they function as one. Back in the day (2000) we made a killing in names like CMGI, Internet Capital Group and Rare Medium Group (all up 10x).

(2000) The Dot-Com Factories Internet Incubators Claim to be the new way to Create Great Companies.

In short, long story soon, the company acquires stakes in small tech start-ups and then grooms them with goal of an exit, via an acquisition or IPO spin-off. A market darling with their own IPO, Society Pass own stock soared 10 fold-shortly after its IPO.

Then inpatient investors lost interest, up until a few weeks ago when it traded from $1.00 to $6.75, a gain of 575% on news that two companies in its portfolio (finally) may be spun off into publicly traded entities!

As in game on, it’s showtime folks.

BELOW: All of these issuers ran on what was ‘perceived’ good news. Imagine what that can do on ACTUAL good news..

RECENT ‘RUNNING-WILD’ SHORT TERM CHARTS

GeoVax – Up 517%

ALKALINE WATER – Up 547%

SOCIETY PASS – Up 570%

DISCLAIMER.

Excuse typos, our spell check (and we are the worst in the world at spelling), appears disabled.

All three companies mentioned are previous clients for past news reporting and coverage. Our future disclaimer will reflect any compensation which may be received. As is standard, our compensation is primarily equity based, putting us on the same page as shareholders, in that the better the companies do, the better we and all shareholders do. And the vica versa of course.

Opinions expressed are those of Institutional Analyst Inc., only which are not reviewed or approved by management.

Certain statements that we make may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions, demand for and pricing of our products, acquisitions and divestitures, anticipated results of litigation and regulatory developments or general economic conditions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties, and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements.