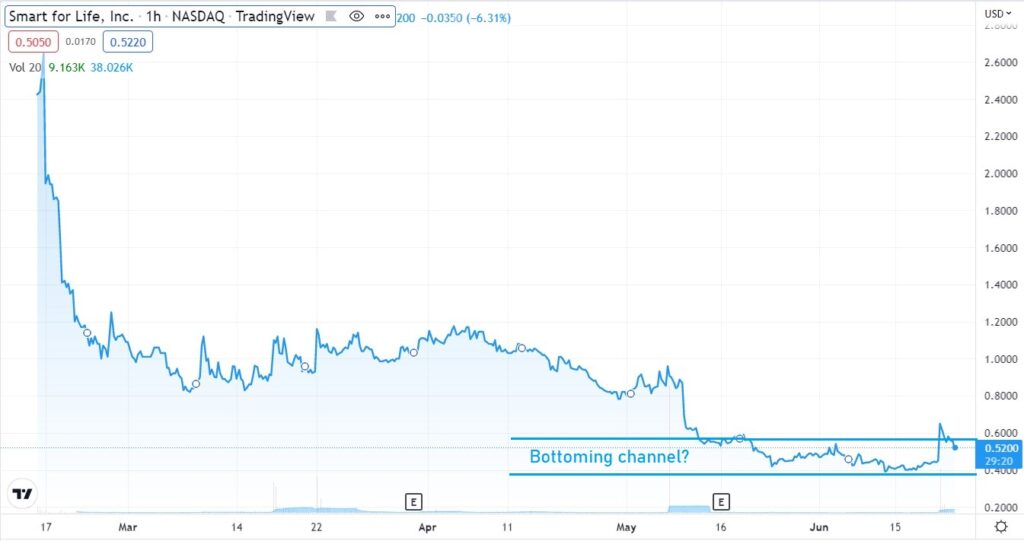

We Are Long Term Bullish on Smart for Life. After a Volatile Post IPO Trading, we may Have Seen the Bottom.

When we say we’re long-term bullish, we don’t mean we are looking for a ‘months out’ trade over $1.00 or towards its IPO pricing near $5.00.

We mean 2-3 years out, letting management perform on its mission to acquire its way to $200-300 million in revenues, from the massive ‘healthy-for-you’ CPG category.

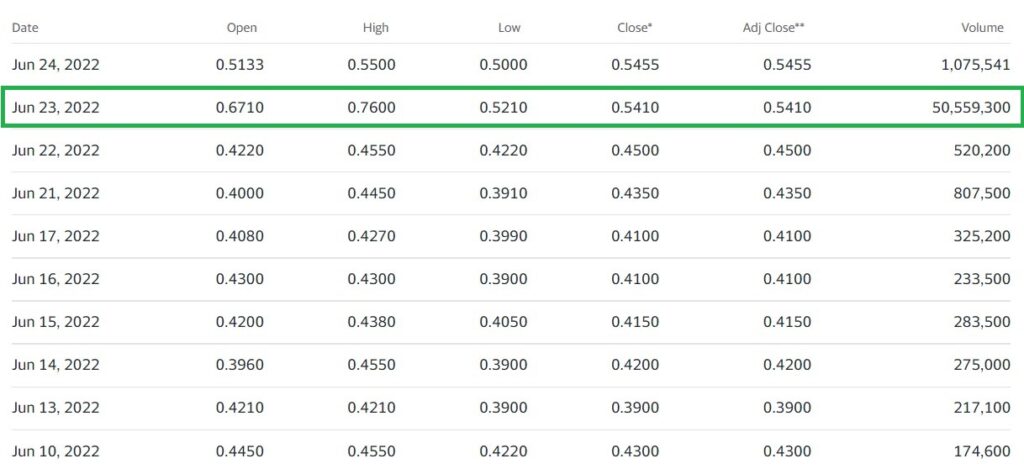

50 million shares traded? Booyha, as Kramer would say.

If successful in their revenue goal, this could be one of the top-performing consumers product companies over the coming decade. A mini-Gulf and Western if you’re old enough to remember that name.

As for share performance – and having a brand which can attract the attention of investors, their Sports Illustrated line should fill that bill quite nicely.

Smart for Life (SMFL) $0.43 on Track to Close Pending Acquisition

HAS THE BOTTOM BEEN SET?

CAPITULATION?

#SMFL

Forward-Looking Statements

This press release may contain information about our views of future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on management’s beliefs, assumptions and expectations of Smart for Life’s future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Although Smart for Life believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Smart for Life does not undertake any duty to update any statements contained herein (including any forward-looking statements), except as required by law. No assurances can be made that Smart for Life will successfully acquire its acquisition targets. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause Smart for Life’s actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Actual results may differ materially from the expectations discussed in forward-looking statements. Factors that could cause actual results to differ materially from expectations include general industry considerations, regulatory changes, changes in local or national economic conditions and other risks set forth in “Risk Factors” included in our filings with the Securities and Exchange Commission.

Disclaimer

The information provided in this press release is intended for general knowledge only and is not a substitute for professional medical advice or treatment for specific medical conditions. Always seek the advice of your physician or other qualified health care provider with any questions you may have regarding a medical condition. This information is not intended to diagnose, treat, cure or prevent any disease. Client, Institutional Analyst Inc., has been retained by SMFL to provide ongoing news coverage and reporting for six-thousand dollars per month for a period of six months. See report for full disclosure and disclaimer details.

Investor Relations Contact

Crescendo Communications, LLC

Tel: (212) 671-1021

[email protected]