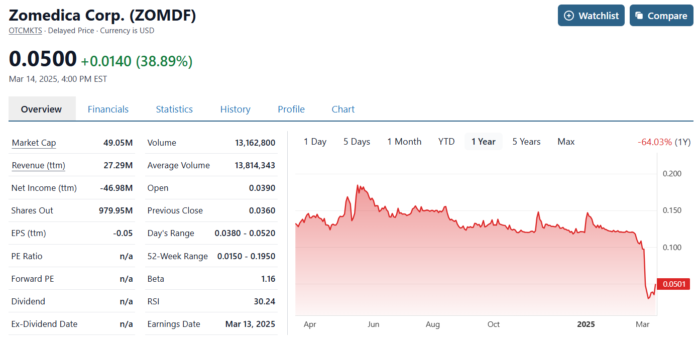

Stock Surges 40%, After Management Conference Call to Calm the Natives.

Insider Buying Unleashed Today?

Not a bad day ahead of the St Patrick’s festivities!

An excellent presentation we might add (see links below), after the close. Strong enough to now make us believe that not only is Zomedic an excellent trading opportunity, but quite possibly also a nice mid-term hold for speculators, after the delisting debacle which sent the shares spiral totally out of control.

In any event, the shares are still well below the recent high near $0.25. As a reminder they have $71 million in cash versus a market value of $49 million. In the past, with a few exceptions, buying shares in compaines for LESS than the cash they have, has turned out good for us. At $0.25 the company would be valued at near $250 million.

With 979 million shares outstanding, the upside is ‘naturally’ limited if you call a potential gain of only 100%, as limited. So what were saying is no ten-bagger here, but enough upside for an epic cocktail party or vacation to Bali after.

Final note, for to a variety of reasons Zomedica insiders who are heavily invested in the company have been restricted from trading since December 16th of last year. The window for Zomedica insiders to trade will be open this coming Monday, March 17, but will close again on March 18 due to the various insider trading rules.

So let’s see if they put there money where there mouth is today! Yeah, fun.

Orininal post with Wall Street brokerage research report link (($0.25 target) and company powerpoint. Click here: Zomedica, We Have a Trading Idea!

Three Charts for Your Viewing Pleasure.

We have three charts. One ‘long-term’ when it raised nearly $200 million, in a feeding frenzy back in 2021. A mid-term chart showing the shares were selling for $0.25, right before the delisting worries surfaced (initial warning from NYSE) which became the focus of fleeing investors. And the short-term chart where all sanity was lost in the delisting panic, and the shares hit an incredible intra-day low of $0.015. What they refer to as a ‘once in a life-time opportunity’ at that price.

Live quote click here.

ZOMEDICA – LONG-TERM CHART

MID-TERM CHART

SHORT-TERM CHART

Oh and before we forget, while no gaurantee, we are no longer fearful of the company voluntarily decided to ‘de-register’ and going dark. Management sounded like it would fight to keep investors informed, and fight to fully implement their gameplan of being one of the top animal healthcare companies out there with solutions to help Veternarians (their real client) make more money.

BTW there are 7 million horses in the U.S. 15% over the age 7, have asthma and are candidates for Zomedica’s asthma product. There are also 65 million homes with a dog and 46 million homes with a cat.. just saying.

Subscribe for further Zomedica news.

CONFERENCE CALL TRANSCRIPT

On SeekingAlpha

Audio of Shareholder Call.

Select Quotes (below by us).

Zomedica Reports Record Revenue of $7.9 Million for the Fourth Quarter and $27.3 Million for the Full Year 2024.

Total cash used during the quarter was approximately $6.5 million. When adjusted for non-recurring one-time items, non-GAAP operating cash burn was approximately $4.2 million.

Total cash used during the quarter was approximately $6.5 million. When adjusted for non-recurring one-time items, non-GAAP operating cash burn was approximately $4.2 million.

Now, today, instead of following our normal order, I’m going to start by addressing our recent delisting and our current market cap. Jeff Bezos coined the phrase, the company is not the stock and the stock is not the company. When Amazon shares fell 80% as the market adjusted in 2001, even while Amazon’s operations were performing very well. I believe that our situation today reflects that.

Your company is sound and is under no distress.

To that end Zomedica insiders who are heavily invested in the company have been restricted from trading since December 16th of last year. The window for Zomedica insiders to trade will be open this coming Monday, March 17, but will close again on March 18 due to the various insider trading rules.

PulseVet remains our leading product, but we believe its benefits can be even more widely utilized across a variety of indications in pets.

We made another exciting announcement in early 2025. In January, we announced a distribution agreement with Cresilon, a biotech company for its Vetigel Hemostatic Gel product line a proprietary plant-based gel. Its has been cleared by the FDA for use in humans

Vetigel is a groundbreaking, plant-based formula designed to stop bleeding rapidly within five seconds when applied directly to the source. It’s been clinically proven to save time during surgical procedures and significantly reduce blood loss in patients. Importantly, Vetigel is widely applicable across a variety of high volume veterinary use cases including surgical procedures, routine and surgical dental procedures, emergency care and liver biopsies. Vetigel is an invaluable tool for vets and this partnership with Cresilon allows us to expand the reach of the revolutionary product and be yet another cutting-edge solution under the Zomedica umbrella.

We remain committed to delivering value to our shareholders and the veterinary community as we continue to innovate in the animal health sector. I look forward to building relationships with you as Zomedica works diligently towards supporting our stock price through the launch of novel investor forums, including a webinar series designed to highlight our innovative product portfolio, introduce key personnel, showcase manufacturing capabilities and educate investors and strategic partners on the company’s long-term growth strategy.

DISCLAIMER

About Zomedica

Zomedica is a leading equine and companion animal healthcare company dedicated to improving animal health by providing veterinarians innovative therapeutic and diagnostic solutions. Our gold standard PulseVet® shock wave system, which accelerates healing in musculoskeletal conditions, has transformed veterinary therapeutics. Our suite of products also includes the Assisi® Loop line of therapeutic devices and the TRUFORMA® diagnostic platform, the TRUVIEW® digital cytology system, and the VetGuardian® no-touch monitoring system, all designed to empower veterinarians to provide top-tier care. In the aggregate, their total addressable market in the U.S. exceeds $2 billion. Headquartered in Michigan, Zomedica employs approximately 150 people and manufactures and distributes its products from its world-class facilities in Georgia and Minnesota. Zomedica grew revenue 8% in 2024 to $27 million and maintains a strong balance sheet with approximately $71 million in liquidity as of December 31, 2024. Zomedica is advancing its product offerings, leveraging strategic acquisitions, and expanding internationally as we work to enhance the quality of care for pets, increase pet parent satisfaction, and improve the workflow, cash flow and profitability of veterinary practices. For more information visit www.zomedica.com.

Follow Zomedica

- Email Alerts:http://investors.zomedica.com

- LinkedIn:https://www.linkedin.com/company/zomedica

- Facebook:https://m.facebook.com/zomedica

- X (formerly Twitter):https://twitter.com/zomedica

- Instagram:https://www.instagram.com/zomedica_inc

Cautionary Note Regarding Forward-Looking Statements

Except for statements of historical fact, this news release contains certain “forward-looking information” or “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur and include statements relating to our expectations regarding future results. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance, or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward-looking information.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, including assumptions with respect to economic growth, demand for the Company’s products, the Company’s ability to produce and sell its products, sufficiency of our budgeted capital and operating expenditures, the satisfaction by our strategic partners of their obligations under our commercial agreements and our ability to realize upon our business plans and cost control efforts.

Our forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: the outcome of clinical studies, the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments, uncertainty as to whether our strategies and business plans will yield the expected benefits; uncertainty as to the timing and results of development work and verification and validation studies; uncertainty as to the timing and results of commercialization efforts, including international efforts, as well as the cost of commercialization efforts, including the cost to develop an internal sales force and manage our growth; uncertainty as to our ability to realize the anticipated growth opportunities from our acquisitions; uncertainty as to our ability to supply products in response to customer demand; supply chain risks associated with tariff changes;; uncertainty as to the likelihood and timing of any required regulatory approvals, and the availability and cost of capital; the ability to identify and develop and achieve commercial success for new products and technologies; veterinary acceptance of our products and purchase of consumables following adoption of our capital equipment; competition from related products; the level of expenditures necessary to maintain and improve the quality of products and services; changes in technology and changes in laws and regulations; our ability to secure and maintain strategic relationships; performance by our strategic partners of their obligations under our commercial agreements, including product manufacturing obligations; risks pertaining to permits and licensing, intellectual property infringement risks, risks relating to any required clinical trials and regulatory approvals, risks relating to the safety and efficacy of our products, the use of our products, intellectual property protection, risks related to the COVID-19 pandemic and its impact upon our business operations generally, including our ability to develop and commercialize our products, and the other risk factors disclosed in our filings with the SEC and under our profile on SEDAR+ at www.sedarplus.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Investor Relations Contact:

Zomedica Investor Relations

investors@zomedica.com

1-734-369-2555

Non-GAAP Measures Non-GAAP EBITDA, Adjusted Non-GAAP EBITDA, and other measures presented on an adjusted basis are not recognized terms under U.S. GAAP and do not purport to be alternatives to the most comparable U.S. GAAP amounts. Since all companies do not use identical calculations, our definition and presentation of these measures may not be comparable to similarly titled measures reported by other companies. Management uses the identified nonGAAP measures to evaluate the operating performance of the Company and its business segments and to forecast future periods. Management believes these non-GAAP measures assist investors and other interested parties in evaluating Zomedica’s on-going operations and provide important supplemental information to management and investors regarding financial and business trends relating to Zomedica’s financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures. Reconciliations of non-GAAP measures to their closest U.S. GAAP equivalent are presented below.

* Non-GAAP EBITDA is defined as net loss and comprehensive loss excluding amortization, depreciation, non-cash stock compensation, and taxes while reversing out the benefits derived from net interest income.

** Non-GAAP Adjusted EBITDA is defined as Non-GAAP EBITDA, as defined above, excluding impairment charges and non-recurring items; including but not limited to specialized accounting, tax, and audit services, costs associated with programs related to regaining and maintaining compliance with the NYSE, as well as the QBT integration and associated direct labor costs, and other one-time items.