A pandemic boom attracted scores of Americans seeking gains. Now that some are backing away, the markets risk losing a key support.

Amateur trader Omar Ghias says he amassed roughly $1.5 million as stocks surged during the early part of the pandemic, gripped by a speculative fervor that cascaded across all markets.

As his gains swelled, so did his spending on everything from sports betting and bars to luxury cars. He says he also borrowed heavily to amplify his positions.

When the party ended, his fortune evaporated thanks to some wrong-way bets and his excessive spending. To support himself, he says he now works at a deli in Las Vegas that pays him roughly $14 an hour plus tips and sells area timeshares. He says he no longer has any money invested in the market.

“I’m starting from zero,” said Mr. Ghias, who is 25.

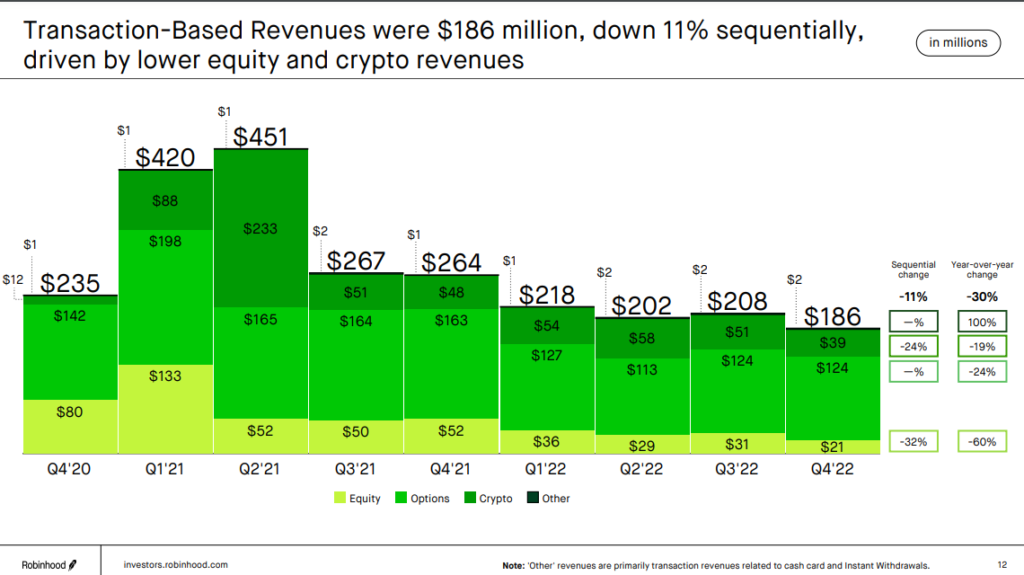

During the pandemic lockdowns in 2020 and 2021, scores of Americans got hooked on trading stocks, options and cryptocurrencies, driving up shares of companies that were once left for dead. Now some of these so-called retail investors are backing away from the markets after the worst year for stocks since 2008. Others are paring their positions or shifting their money to more conservative holdings, such as bonds or cash.

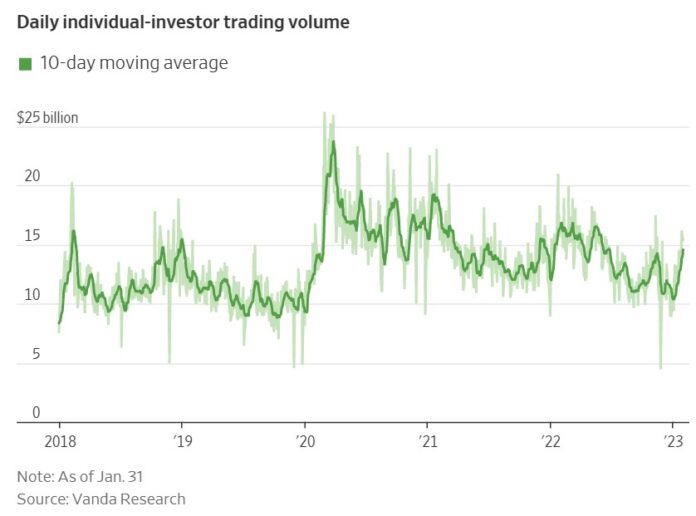

Last month, trading activity among retail investors as measured by dollar volumes hit its lowest level since January 2020, according to an analysis of some platforms by research firm Vanda Research.

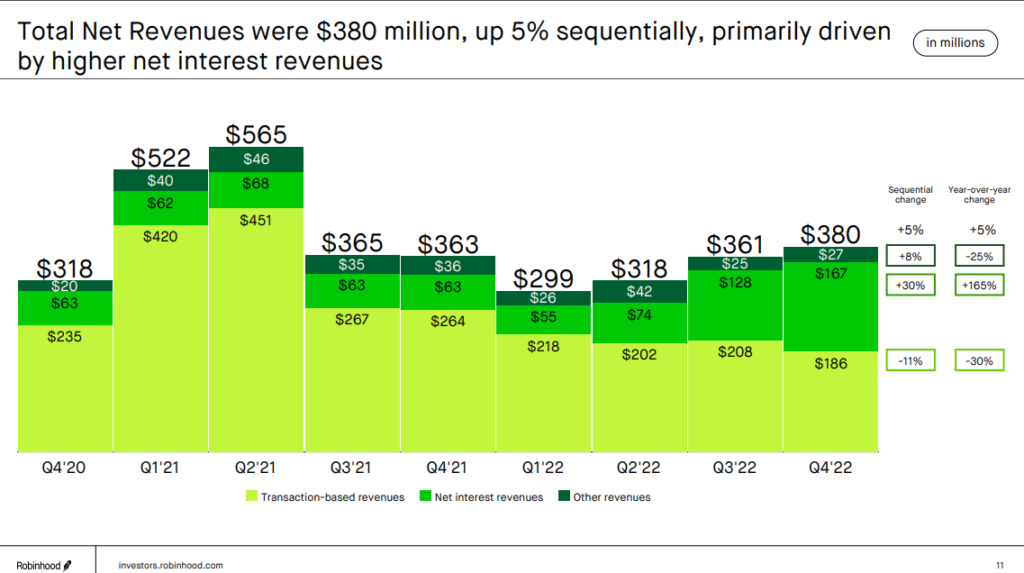

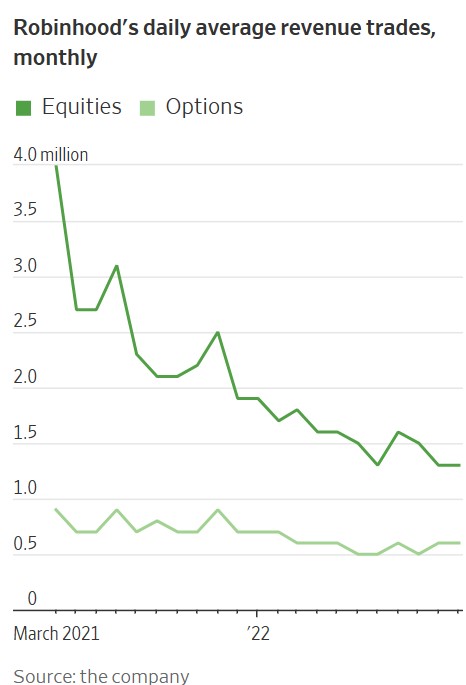

These investors are also trading less with brokerages that stoked their enthusiasm earlier in the pandemic, according to earnings reports. Households are expected to yank roughly $100 billion from the market in 2023, according to Goldman Sachs Group Inc., which would be the first net outflows since 2018.

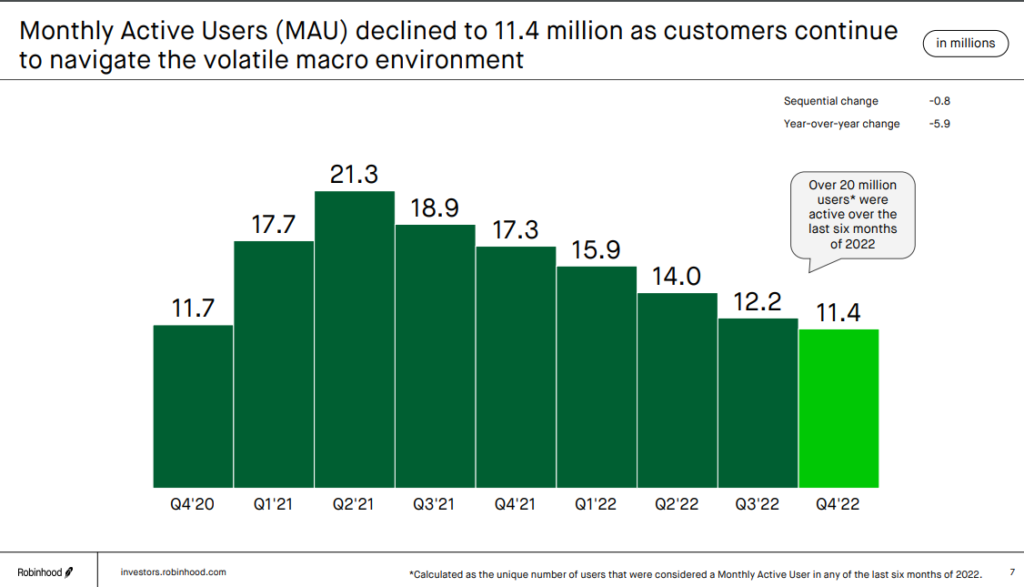

ROBINHOOD ACTIVE USERS