Internet Stock Review Adds Ebix (EBIX) $39 to Watch List. Short Squeeze Coming? Price Target $110.

- Short Squeeze Alert.

- Adding Ebix to Internet Stock Review Watch List – After Viewing From the Sidelines for 10 Years!

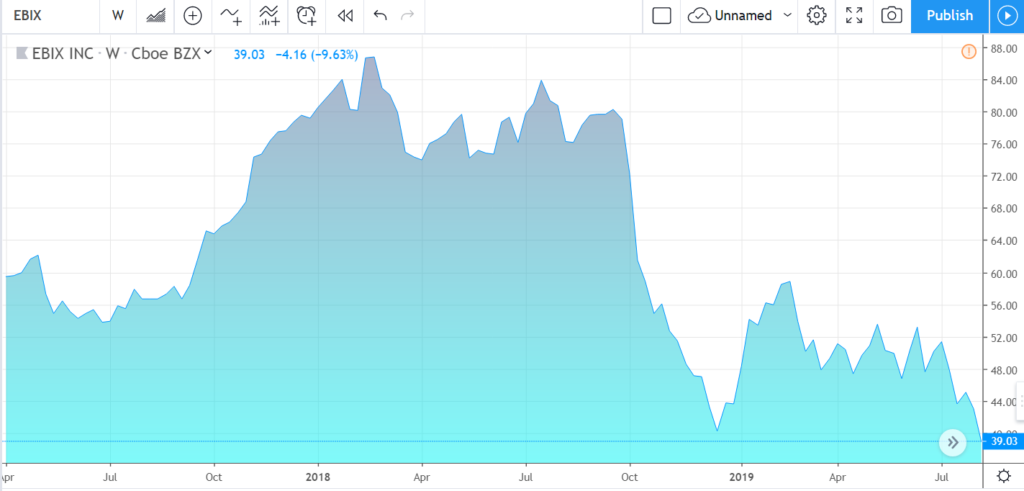

- One of the Top Performing Stocks in the Past Decade Trading From $6 to $86 – Ebix has experienced rough sledding from 2018 (see charts below).

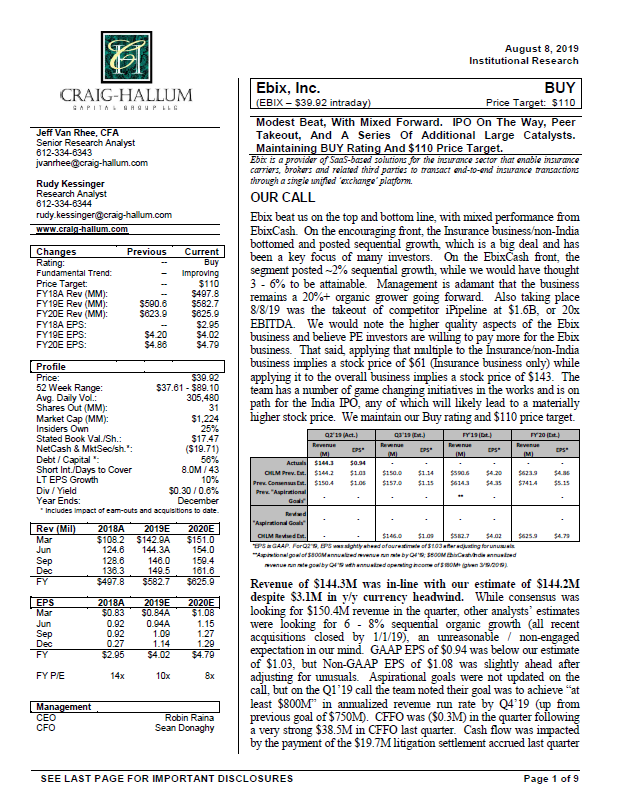

- Competitor iPipeline Acquired at $1.6B, or 20x EBITDA. Equates to $143 on EBIX.

- Broker Craig-Hallum Issues $110 Price Target (see below).

- 2nd Quarter Revenues Rise 16% to Record $144 Million.

- Conference Call Transcript.

- EbixCash IPO Could Spark Raging Fire Trapping Short Sellers.

2018 TO PRESENT CHART

- 1 Year, 100% Potential Gain Target From Sunil Shah, Former Coronation Hedge Fund Star Analyst.

- And here. 2/2018. Ebix: A Premier Indian Digital Wallet In The Making.

- The Icing on the Proverbial Cake; 8 Million Shares Short. That’s 26% of the Shares Outstanding and 50% of the Float!

- Our Last Short Squeeze Alert, Where we Crushed Them! IMMU, $3 to $26.

- And here at $3.40

- And here at $5.50

- At $10.50

DIGS AND SHORT CALLS!

- Viceroy Research, Short Report.

- A Lengthy 49 Page Dig on Viceroy and Fraser Perring.

- Economic Times Dig.

- Bloomberg Dig in 2013 After Shares Fell From $20 to Under $10 and Short Sharks Were Circling (it went to $35 two years later).

- Gotham Short Report in 2013 at $10 With a Target of $0. (it went to $86 instead – making it one of the worst short calls in history).

MARCH 2019 BLOOMBERG INTERVIEW

“I have personally owned Ebix stock since it was approximately 50 cents a share. I have sold very little Ebix stock over the last 19 years, except for a few sales, last in 2012, to pay for taxes on my stock gains. I am a firm believer in the Company’s fundamentals and in aligning my personal interests with the shareholders. Thus, it was a natural decision for me to request the Compensation committee to allow me receive my salary in Ebix stock instead of cash.” From Ebix Website

DISCLOSURE

*Short Squeeze Alerts are extremely risky and this letter is directed to our institutional readers only.

Institutional Analyst Inc. and Revelers.IO Media Group Inc., Disclaimers: Past performance of other companies added to Institutional Analyst’s various newsletters or otherwise mentioned in its research reports, newsletters or communication is no indication of future performance of any current or future companies mentioned. This publication is a Corporate Profile and may not be construed as investment advice. This profile does not provide an analysis of the Company’s financial position and is not a solicitation to purchase or sell securities of the Company. Readers should consult their own financial advisors with respect to investment in this or any company covered by the Reviews. An independent financial analyst should verify all of the information contained in this profile with the profiled company. Institutional Analyst, Inc. the parent company of the Internet Stock Review is an investment research and public relations firm and associated firms have not been compensated however friends and family have significant long positions in Ebix. Revelers.IO Media Group Inc. is a web design firm which manages IA’s websites and digital initiatives. In preparing this profile, the Publisher has relied upon information released from the company, which although believed to be reliable, cannot be guaranteed. This profile is not an endorsement of the shares of the company by the publisher. The publisher is not responsible for any claims made by the company. You should independently investigate and fully understand all risks before investing in this and any company profiled or covered by the publisher. The majority of startup companies have factors, which create uncertainty about their ability to continue as a going concern. These concerns are typically related to dilutive toxic financing (or lack of), competitive environments, lack of operating history and operating at loss levels which is typical of most start-ups. These statements can be found in their most recent 10Q filings and should most definitely be read. Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements which are not historical facts contained in this profile are forward-looking statements that involve certain risks and uncertainties including but not limited to risks associated with the uncertainty of future financial results, additional financing requirements, development of new products or services, government approval processes, the impact of competitive products or pricing, technological changes, the effect of economic conditions and other uncertainties detailed in the Company’s filings with the Securities and Exchange Commission. Impartial, we are not. Email: roland@institutionalanalyst.com