Answer Below..

Like why did we bother buying anything else? We’ve owned hundreds of Companies since 1999. Not to mention a lot of work in finding good Companies and promoting them. All we had to do is write a check in their IPO, sit back and sip a drink with a little umbrella in it.

Oh, yeah, we remember, it was fun!

Circle Group a client, traded from $0.36 in 2002 to over $7.00 per share a couple of years later and American Brewing, another client now known as New Age Beverage, traded from $0.30 to $8.95 (2015-2018). Oh, and let’s not forget Immunomedics, $3 to $26 (2016-2019). Woot.

Anyway..

Stock Symbol ??

Stock Exchange NYSE

IPO Date Oct 1, 1999

Valuation at IPO $895.8M

Amount Raised $126M

Share Price at IPO $14.00

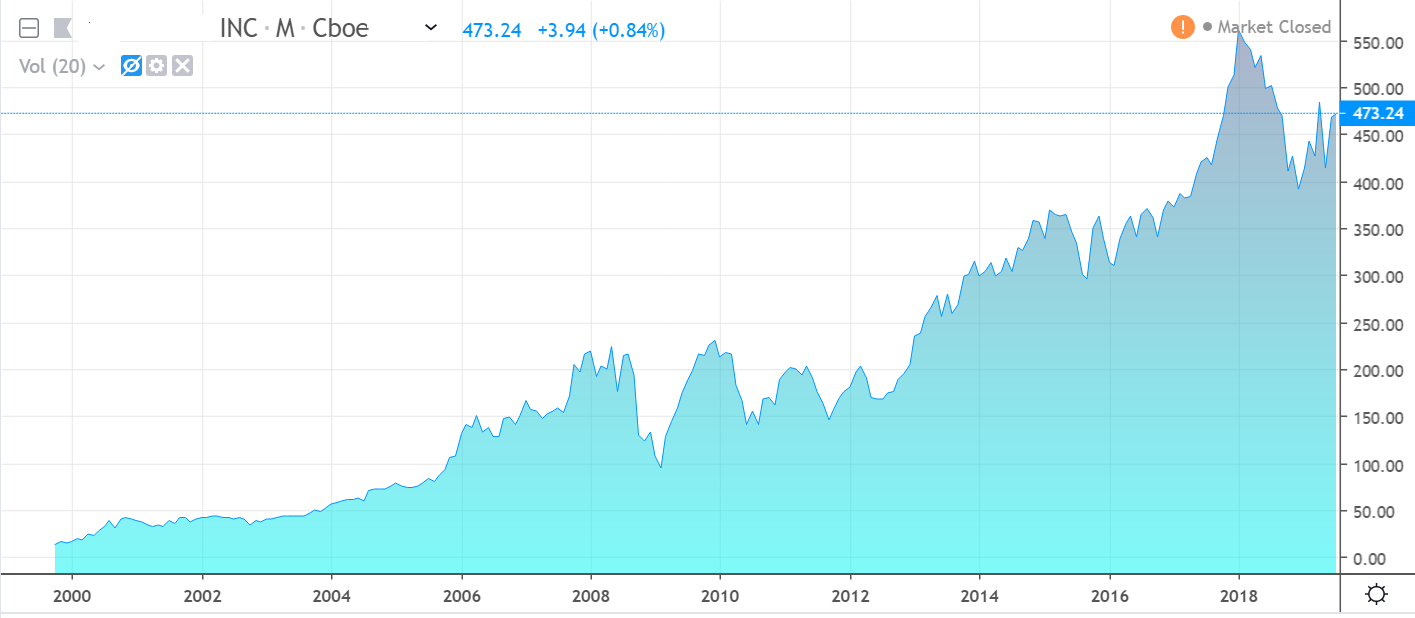

Recent High $593

Shares Sold at IPO 9,000,000

Shares Outstanding at IPO 63,982,635

If someone bought all 9 million shares in the offering, the $126 million stake was worth $5,049,000,000 at its recent peak!

Why were we buying other stocks again? Oh, that’s right..for the fun. Must remember that..

Somebody pour us a huge-ass Martini!

Here’s a Clue!

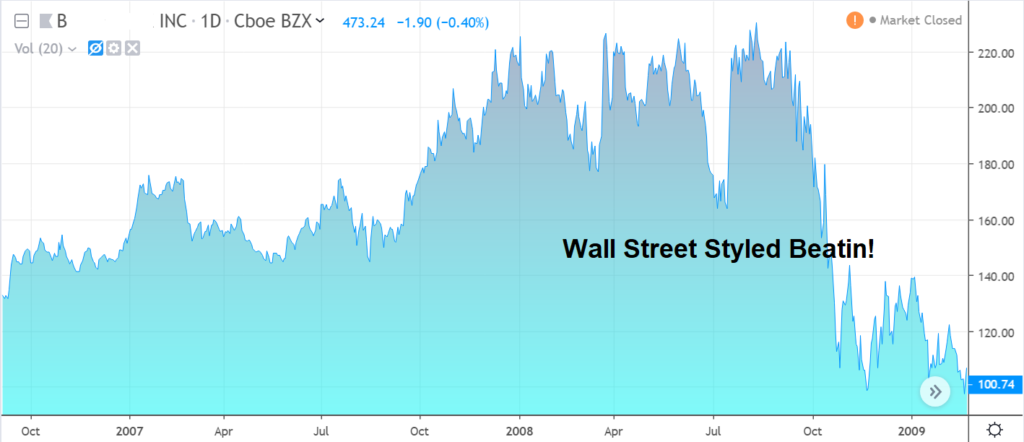

Not for the faint at heart, this mighty Company was cut in half from $208 in August of 2008 to $90 in February of 2009 – or seven months of pure hell.

It took another vicious spill falling from $590 in January of 2018, to $360 in December of 2018 – a royal pummeling. For the record, the DJIA was up 5% the year they took the Rock out to the shed.

And the Company is…Black Rock!

GOOD JOB LARRY!

Jul 19, 2019 | Dow 27,000

Versus the Dow in Case, You Were Wondering

Underwriters:

Merrill Lynch, Pierce, Fenner & Smith

Incorporated.......................................... 1,051,000

Goldman, Sachs & Co. .......................................... 1,051,000

Lehman Brothers Inc. .......................................... 1,051,000

Prudential Securities Incorporated............................. 1,051,000

Salomon Smith Barney Inc. ..................................... 1,051,000

Moral of the story, why invest in mutual funds, when you can invest in the mutual fund manager.