We Would Define This as Huge News..

- Citius Pharma would receive 67.5 million shares in Citius Oncology at $10 per share and retain majority ownership of approximately 90%.

- Management estimates the initial market for LYMPHIR currently exceeds $400 million, is growing and is underserved by existing therapies.

- Transaction anticipated to close in the first half of 2024

As the chart below depicts, it has been rough sledding for Citius (CTXR) for the past two years. But we believe we are staring at a major inflection point. Staring it straight in the eyes.

While early investors grew impatient with the Company getting its flagship treatment Mino-Lok approved by the FDA, they have been developing another shot on goal. This was done under the umbrella of Citius Acquisition Corp. (now called Citius Oncology) which was formed in August of 2021 and the drug name is LYMPHIR.

LYMPOHIR was designed for the treatment of persistent or recurrent cutaneous T-cell lymphoma (CTCL), a rare form of non-Hodgkin lymphoma. More on that in an upcoming report.

While it has been a long and arduous journey for Citius, we think any positions established under $1.00 as a gift from the stock market Gods!

We are still sticking to our guns that this is a ten-bagger from where we originally found it, which would suggest a price over $5.50.

Adding Citius (CTXR) $0.55 to Watch List.

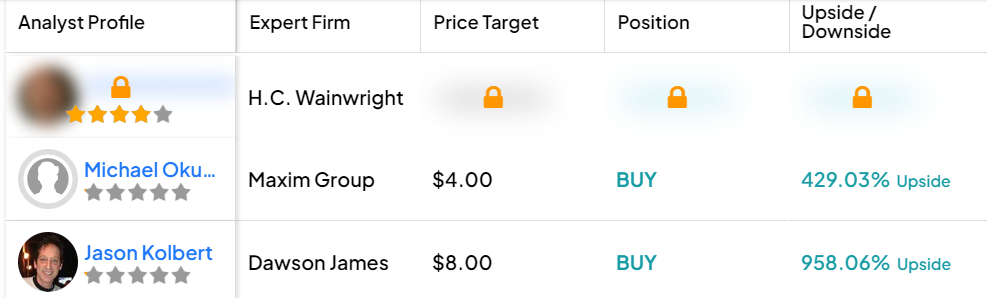

WHAT WALL STREET SAYS

HC Wainwright has a $4 price target. We don’t issue price targets, but as we said earlier, we can imagine a price above $5.50

TODAY’S PRESS RELEASE

Citius Pharmaceuticals Executes Definitive Agreement to Merge Wholly Owned Subsidiary with TenX Keane Acquisition to Form Publicly Listed Citius Oncology, Inc.

CRANFORD, N.J. and NEW YORK, Oct. 24, 2023 /PRNewswire/ — Citius Pharmaceuticals, Inc. (“Citius Pharma” or the “Company”) (Nasdaq: CTXR), a biopharmaceutical company developing and commercializing first-in-class critical care products, and TenX Keane Acquisition (“TenX”) (NASDAQ: TENK), a publicly traded special purpose acquisition company (SPAC), today announced that they have entered into a definitive agreement, dated October 23, 2023, for a proposed merger of TenX and Citius Pharma’s wholly owned oncology subsidiary that will continue as a public company listed on the Nasdaq exchange.

The newly combined public company will be named Citius Oncology, Inc. (“Citius Oncology”). Upon closing, pursuant to the terms of the merger agreement, Citius Pharma would receive 67.5 million shares in Citius Oncology at $10 per share and retain majority ownership of approximately 90%. The transaction has been approved by the Board of Directors of both companies and is expected to close in the first half of 2024.

This press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the products offered by Citius Pharma and Citius Oncology and the markets in which each operates, and Citius Pharma and Citius Oncology’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including, but not limited to: Such statements are made based on our expectations and beliefs concerning future events impacting Citius Pharma. You can identify these statements by the fact that they use words such as “believe,” “anticipate,” “estimate,” “expect,” “plan,” “would,” “should,” and “may” and other words and terms of similar meaning or use of future dates. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and stock price. Factors that could cause actual results to differ materially from those currently anticipated are: the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of Citius Pharma’s common stock; the risk that the transaction may not be completed by TenX’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by TenX; the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the business combination agreement by the stockholders of TenX; the satisfaction of the minimum trust account amount following redemptions by TenX’s public stockholders; the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement; the effect of the announcement or pendency of the transaction on Citius Pharma’s business relationships, performance, and business generally; risks that the proposed business combination disrupts current plans or operations of Citius Pharma; the outcome of any legal proceedings that may be instituted against Citius Pharma or TenX related to the business combination agreement or the proposed business combination; the ability to maintain the listing of TenX’s securities (which would be Citius Oncology securities) on Nasdaq after the closing of the transaction; after the closing of the transaction, the price of Citius Oncology’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Citius Oncology will operate, variations in performance across competitors, changes in laws and regulations affecting Citius Oncology’s business and changes in its capital structure; the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize additional opportunities provided by the business combination; the cost and timing of the resubmission of the BLA for LYMPHIR; the FDA may not approve our BLA for LYMPHIR; our need for substantial additional funds; the estimated markets for our product candidates and the acceptance thereof by any market; our ability to commercialize our products if approved by the FDA; our dependence on third-party suppliers; the ability of our product candidates to impact the quality of life of our target patient populations; our ability to successfully undertake and complete clinical and non-clinical trials and the results from those trials for our product candidates; risks relating to the results of research and development activities, including those from existing and new pipeline assets; uncertainties relating to preclinical and clinical testing; the early stage of products under development; market and other conditions; our ability to attract, integrate, and retain key personnel; risks related to our growth strategy; patent and intellectual property matters; our ability to obtain, perform under and maintain financing and strategic agreements and relationships; our ability to identify, acquire, close and integrate product candidates and companies successfully and on a timely basis; our ability to procure cGMP commercial-scale supply; government regulation; competition; as well as other risks described in our SEC filings. These risks have been and may be further impacted by Covid-19 and global geopolitical events, such as the war in Ukraine and the Middle East. Accordingly, these forward-looking statements do not constitute guarantees of future performance, and you are cautioned not to place undue reliance on these forward-looking statements. Risks regarding our business are described in detail in our Securities and Exchange Commission (“SEC”) filings which are available on the SEC’s website at www.sec.gov, including in our Annual Report on Form 10-K for the year ended September 30, 2022, filed with the SEC on December 22, 2022 and updated by our subsequent filings with the SEC. These forward-looking statements speak only as of the date hereof, and we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as required by law. Past client, see full reports for disclosure and disclaimer details.