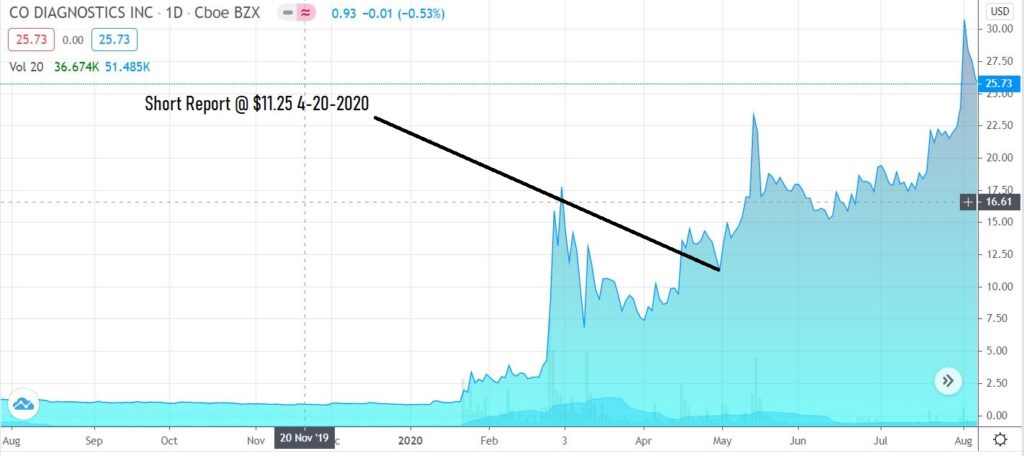

Hot Covid-19 test company has ties to offshore boiler rooms (SharesSleuth.com)

AKA, you’d have to have your head examined to short any individual stocks in this market. And ditto – if not more so, for anything related to the CoronaVirus. As our friends at SharesSleuth (a Mark Cuban owned company) learned the hard way, in just three short weeks.

April, 2020: Shares of Co-Diagnostics Inc. (Nasdaq: CODX) have risen tenfold since January when the company announced it had completed preliminary design work on a new Covid-19 test.

Co-Diagnostics, which has only a modest lab and headquarters building in Salt Lake City, said last month it was capable of producing as many as 50,000 tests a day, at a cost of just $10 per patient.

Although it has not publicized its participation, the company is part of a consortium that won $53 million in controversial no-bid testing contracts from the states of Iowa and Nebraska, as well as a $5 million deal from the state of Utah.

But a Sharesleuth investigation found that Co-Diagnostics has extensive ties to a group that once peddled shares of dubious public companies through boiler room-style brokerages overseas.

In fact, it appears that a newer boiler room sold interests in Co-Diagnostics before it went public. We discovered that MB Financial Advisory AG, which cold-called people in Europe with stock pitches, billed the testing company as an “investment capital client.”

Our investigation also found that three of Co-Diagnostics’ early funders have been the subject of Securities and Exchange Commission actions — one for his alleged role in a pump-and-dump scheme and another for violating touting rules.

In addition, some epidemiologists and public health experts in Utah are now raising questions about the accuracy of Co-Diagnostics’ test kits, or the manner in which the testing is conducted, according to a story in the Salt Lake Tribune.

At Wednesday’s closing price of $12.37 a share, Co-Diagnostics had a market capitalization of almost $340 million, not bad for a company that had less than $300,000 in sales over the past three years, and upwards of $20 million in losses.

(BSR note, CODX now has a maket cap of $706 million at $27 DOH!)

BOILER ROOM TIES

Co-Diagnostics’ chief financial officer, Reed L. Benson, previously was vice president and general counsel at Broadcast International Inc. (formerly Nasdaq: BCST). It offered video-communications software and services.

Broadcast International was one of the companies whose shares were marketed to foreign investors by the boiler rooms, some of which were linked to a former Utah stockbroker named Bryant L. Cragun, and one of his close associates, Lynn W. Briggs.

SEC filings show that Broadcast International gave Briggs a consulting contract just before it went public through a reverse merger in 2004. Foreign investors who got burned buying shares from the boiler rooms said Briggs pitched them in person, in Europe and Australia.

Broadcast International terminated Benson in 2008 after learning that Spanish regulators had charged him in a case against one of the boiler rooms that had been selling Broadcast International’s shares.

The regulators said Benson was a director of that firm, Carlton Birtal Financial Advisory SL, when it was selling securities without a proper license. They levied a fine of roughly $360,000 against Benson, Carlton Birtal and a second director.

Benson also played a pivotal role in the creation of another Salt Lake City company called Xvariant Inc. (formerly OTC: XVNT). It marketed video technology that let prospective home buyers take virtual tours of properties.

Its shares were pushed by Carlton Birtal and another boiler room, First Swiss Financial Management AG, which was the subject of regulatory warnings. SEC filings showed that a consulting company formed by Cragun and Briggs got some of Xvariant’s initial shares. The stock peaked at $5 in mid-2002 but was down to 30 cents by the end of 2003.

We found that MB Financial Advisory, which claimed to be based in Switzerland, pitched investments in five businesses connected to Benson between 2013 and 2018.

Xvariant is no longer in business. Neither is Broadcast International.

A COLD STOCK CATCHES FIRE

Until a few months ago, Co-Diagnostics was looking like a bust, too. Its stock was off nearly 80 percent from its July 2017 initial public offering price of $6 a share, and it had been warned twice by the Nasdaq exchange that it was in danger of losing its listing.

Then came the coronavirus pandemic. Co-Diagnostics’ stock went from under $1 in early January to $3 at the start of February – after the announcement of the Covid-19 test — and hit a high of a $21.75 at the end of February.

The company has taken advantage of the increased investor interest by raising more than $19 million, through three share placements. The surge in its share price has produced small fortunes – on paper at least – for company insiders and some funders.

Our investigation found that a firm called Legends Capital Group LLC, which Benson co-owns with Briggs’ son, Jason L. Briggs, was among Co-Diagnostics’ top shareholders when it went public in July 2017.

According to Co-Diagnostics’ most recent proxy filing, in August 2019, that stake totaled a little under 1.3 million shares, or 7 percent of the total then outstanding. The stock would have had a market value of $15.7 million as of April 29..

Another entity called Reagents LLC, controlled by the son of Co-Diagnostics’ chief executive Dwight H. Egan, was listed as holding 1.75 million shares, which would have had a market value of $21.6 million as of Wednesday.

Co-Diagnostics said in its annual financial report last month that two Canadian promoters who had provided it with $3 million in capital in late 2018 and early 2019 converted the remainder of the preferred stock they had received into 2.13 million common shares.

Those shares, issued in February and March, would have had a market value of more than $16 million at the end of last month.

Co-Diagnostics also said that 15 holders of its warrants converted them on a cashless basis in February and March, and got just under 700,000 new shares.

That stock could have been sold for anywhere from $2 million to $8.5 million or more, depending on the timing. The recipients almost certainly included some or all of the funders with SEC actions in their past.

Co-Diagnostics got another boost recently when a group of Utah-based tech businesses created an organization designed to screen people who think they might have Covid-19, get likely candidates tested and also track their movements.

The venture, overseen by a company called Nomi Health, chose Co-Diagnostics as its test supplier. It got its first contract in Utah, then got a much larger deal in Iowa after actor Ashton Kutcher, a native of that state, pitched the group to Gov. Kim Reynolds.

The Iowa contract has sparked a backlash because it was awarded without competitive bidding, and because the site where users can take a coronavirus assessment survey also asked whether they were allergic to hydroxychloroquine.

That drug once was thought to be a promising treatment for Covid-19 but studies have since suggested it has little benefit.

Mark Newman, the founder of Nomi Health, also is on the board of a pharmacy called Meds in Motion. According to a story in the Salt Lake Tribune, it had contracted with the state of Utah for 20,000 does of hydroxychloroquine at a cost of $800,000.

The Nomi Health-led consortium is supposed to conduct 540,000 Covid-19 tests in Iowa over the course of its one-year contract.

Some legislators in Nebraska also complained about the no-bid contract there, which also covers 540,000 tests. They said the process wasn’t transparent enough and that Gov. Pete Ricketts should have considered in-state companies as well.

Co-Diagnostics declined to answer a list of questions we submitted.

Instead, it issued this statement through its public relations and strategic communications firm:

“Co-Diagnostics, Inc. makes every effort to return all press inquiries in a timely manner while remaining focused on the important work of manufacturing and shipping COVID-19 tests to countries around the world and within the United States. Regarding your inquiries, it is the Company’s policy not to comment on requests for information concerning investors, consultants, customers, or employees.”

(Disclosure: Mark Cuban, owner of Sharesleuth.com LLC, does not have a position in the shares of any company mentioned in this article. Chris Carey, the editor of Sharesleuth.com, does not invest in individual stocks and has no position in any companies mentioned.)

We did not attempt to evaluate the quality or reliability of Co-Diagnostic’s coronavirus test. But according to one master list compiled by an online news site, 360Dx.com, it is just one of more than 150 that are commercially available around the world.

(BSR note double DOH!): July, Clinical Reference Laboratory Receives FDA Emergency Use Authorization for Best-in-Class Self-Collected COVID-19 Saliva Test

Instead, we focused on the unusual share activity at the company.

VANISHING INVESTORS

We found that Co-Diagnostics’ evolution bears certain similarities to that of Broadcast International and Xvariant. Before going public, all three companies reported that they raised much of their capital through share sales to entities in the Turks and Caicos Islands, a jurisdiction with no income or capital gains taxes and favorable secrecy laws.

Although the No. 1 investors in those three companies used different corporate names, they all used the same address, a postal box that doubles as the business address for a lawyer named Hugh O’Neill. We found that while each of them originally was listed as controlling 20 percent or more of their respective companies’ common stock, two of them quickly and inexplicably vanished from the ownership tables in SEC filings, with no reports of any share sales, distributions or other events that would explain that.

Under U.S. securities law, individuals or funds that owning 5 percent or more of a company’s common stock must disclose that, and also must disclose changes in their positions.

Our investigation also found that:

Read the rest here: