Adding Fortress to Biotech Stock Review Watch List @ $1.73.

Misunderstood by Wall Street which tends to ‘over-analyze’ on occasion, we think the Fortress Bio story is as simple as they come. It’s the Fortress Machine.

See Investment Banker Research Report by Top Ranked Investment Analyst Link Below.

Fortress Bio (FBIO) is a like a venture capital fund, that is investing in and advising it’s portfolio of holdings, many which are publicly traded. It is lead by a brilliant CEO, Dr. Lindsay Rosenwald who has enormous experience in both medical technology and on Wall Street (essential to ultimate success), who is aided by a team of some of the sharpest minds around – all working synergistically to move the ball(s) forward to the goal line to benefit shareholders.

So the story is – give this impressive team the benefit of the doubt, invest and wait for management to incubate one (or more) of its many shots on goal. Many have the opportunity to potentially explode higher (think 10-20 fold higher), boosting Fortress Bio’s ownership stake and potentially its own shares 3-4x higher* with it. Rocket science this is not!

We have no idea which of the portfolio holdings may go onto greatness***, nor do we really care. Which is the beauty of the situation. Why invest directly in a lone Biotech (well asides from max-maximum upside) when you can invest in a portfolio of Biotechs picked by some of the brightest and best?

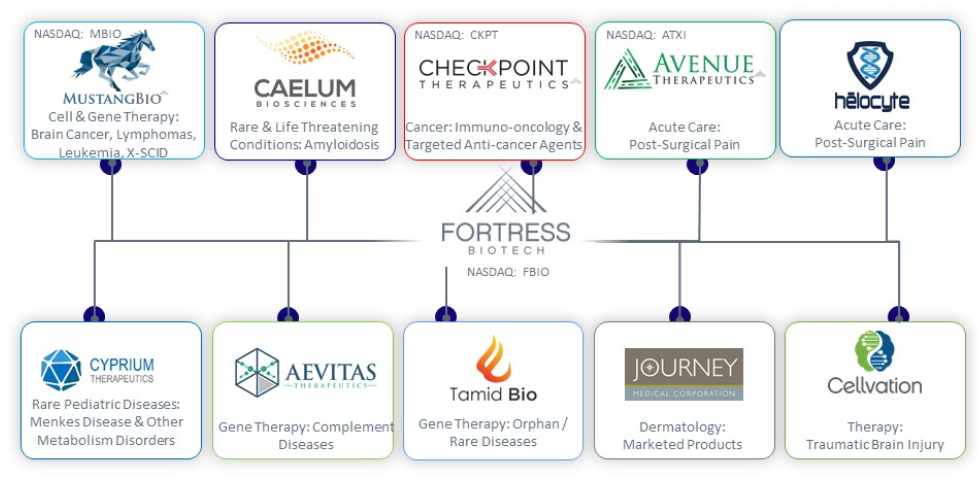

- Mustang Bio, public MBIO, (30%).

- Checkpoint Therapeutics, public CKPT, (32%).

- Avenue Therapeutics, public ATXI, (22% but 32% on sale).

- Caelum Biosciences (43%).

- Journey Medical (100%).

- Cyprium Therapeutics and other private companies (60% – 90%).

- Aevitas, Cellvation, Helocyte and Tamid Bio., all are internal Fortress companies and represent early-stage options.

(Combined, these Fortress’ clinical phase products have an estimated market opportunity potentially reaching into the billions.)

Best part is there are only 69 million shares outstanding giving it a market cap of $120 million**, too small for most institutional investors but perfect for individual speculators. Exemplifying the primary advantage that small aggressive investors can often have over larger and slower-moving investors.

To put the above simple story into perspective; if we were to construct an aggressive ‘model-portfolio’ for fans of the Biotech industry, we would construct it with 50% in the top five ranked Biotech/Life Sciences funds (Fidelity, Franklin, Janus etc.), 25% in Fortress (FBIO), and 25% spread evenly in 10 of your other favorite Biotech names.

We’ll actually create a model portfolio and include it in our upcoming Fortress Bio report. Sign up to this newsletter to receive your own copy of the report that you can share with two close friends.

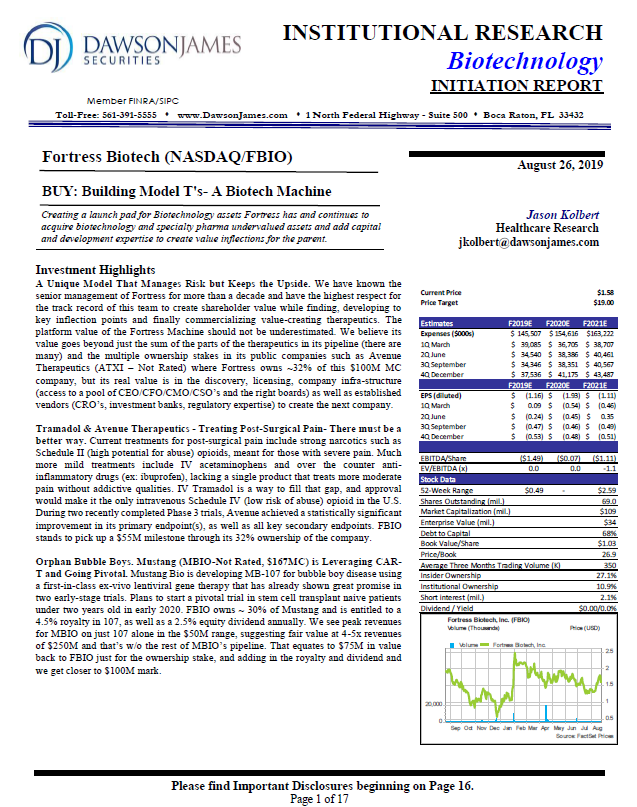

DAWSON JAMES SECURITIES RESEARCH REPORT

“We have known the senior management of Fortress for more than a decade and have the highest respect for the track record of this team to create shareholder value while finding, developing to key inflection points and finally commercializing value-creating therapeutics. The platform value of the Fortress Machine should not be underestimated.”

“Dr. Lindsay Rosenwald is not just another CEO. He is a biotechnology entrepreneur with a 20 year plus track record of successfully developing therapeutics. As an analyst, I have worked with Lindsay on and off on multiple projects over this period and watched him learn and master the art of developing new drugs.”

Jason Kolbert, Dawson James Securities

RELATED: Adding Mustang Bio (MBIO) $4.00 to Watchlist After Investor Presentation.

RELATED: Mustang Balance Sheet Bolstered With $83 Million in Cash.

FORTRESS – MUSTANG TRADING CORRELATION?

MUSTANG BIO CEO ON BLOOMBERG TV

CONCEPT

“Our focus is on business development. We have 10 subsidiary companies at the moment. We have a large team of more than 15 professionals whose job it is to look for other people’s discoveries and inventions. We don’t have laboratories and scientists looking to create new medicines. There are plenty of institutions, whether they are universities, NIH — National Institutes of Health — laboratories, or small or large companies, that do all the heavy lifting of creating all of these new drug candidates. What I have been doing for a very long time, because it is a pretty inefficient market, is to have our very talented people look at many different drug candidates that may be available for license and determine which ones we would like to move forward with. We are looking primarily for candidates that are already in human trials and that have shown evidence of effectiveness or efficacy.” Dr Lindsay Rosenwald

*On April 18th 2019, positive news related to one of its holdings Mustang Bio (MBIO) sent Mustang Bio’s shares up 250% intraday and Fortress up 62% with it. Like we said, simple story.

**$60 million float when excluding insiders and current institutions.

***If any, of course.