Hepion (HEPA) Banked $88 Million Yesterday, Citius (CTXR) Banks $78 Million Today.

We’re beginning to believe (and it may be a “brief-belief”) that during a bull market and assuming you like the underlying company – tremendous buying opportunities can be created when certain companies do a “down round.”

While some investors look at it with a negative eye, we look at it as a corporate re-birth. And if the ‘re-birth’ analogy doesn’t work for you, think of our prior analogy of an Indy 500 race car stopping for fuel with many miles in the race left to go.

(PS. The average race car can go 40 laps between fueling, and we can go about 40 minutes between drinks – once our 60-day post stem-cell treatment moratorium expires.).

One has to wonder what these institutional (mostly) buyers read about their ongoing clinical trials (yes, all publicly available), to motivate them to pump a combined $168 million in these two relatively young companies. Like, what’s the hurry? Hmm, inquiring minds want to know.

The potential is so large in these financing-related events, we have an MIT student creating a ‘day-of’ down round alert system for us. In fact he already gave us another idea – a relatively unknown company which just raised $54 million, that we are studying now!

Hepion (HEPA) which is looking at solutions for fatty-liver, and Citius (CTXR) which is looking at solutions for bacteria infected catheters – are both looking like one of those opportunities. And as a bonus, if an investor is a ‘size’ buyer in either – they can typically get as much as they please, without running up the share price with their own buying.

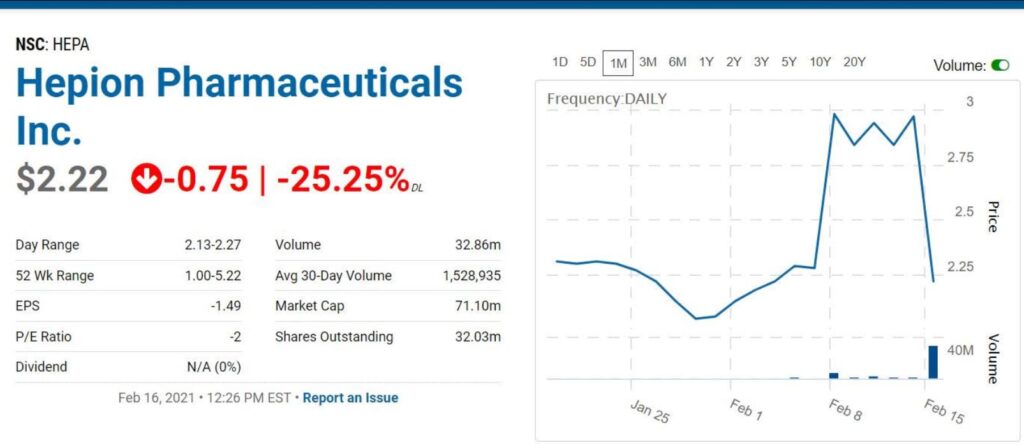

Hepion Pharmaceuticals Inc.

Hepion Pharmaceuticals Announces Pricing of Public Offering.

The shares traded as high as $3.18 on the 11th. Trading Volume

Adding to 2021 Biotech Six-Pack Portfolio.

LONGER TERM CHART

RELATED: News, As Huge As It Gets, From Hepion Pharma (HEPA) $2.10.

RELATED: Adding Hepion Pharma (HEPA) $1.73 to Watch List.

RELATED: Oh and we’ll take the current price level to add Hepion to our 2021 Biotech Portfolio, where we are very price sensitive. Now we have two names on it, which will total six names to make our “Biotech Six-Pack,” six stocks we expect to double*.

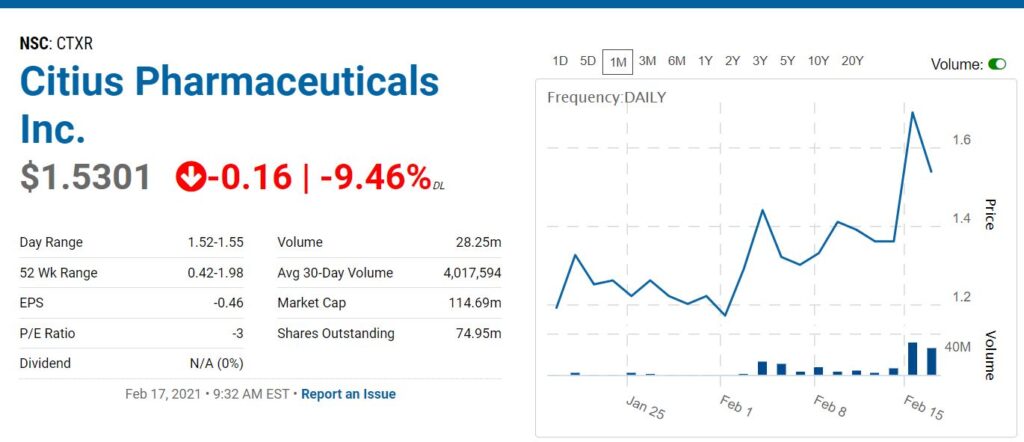

Citius Pharmaceuticals Inc.

The shares traded as high as $1.78 late last night. Trading Volume

LONGER TERM CHART

RELATED: Adding Citius Pharma (CTXR) $1.29 to the 2021 Biotech Portfolio.

RELATED: Adding Citius (CTXR) $0.55 to Watch List.

Video: Mel Gibson Stem Cell Testimonial.

UNRELATED: Insider Trading Tipster Brothers Walk Away With Millions

The government entered into a non-prosecution agreement with John Dodelande, pursuant to which he will not be prosecuted, he will serve no jail time, he will not forfeit any of the $12 million, and he will not even have a felony on his record

Talk about good lawyers..

Meanwhile, the Dodelande brothers have been spotted in St. Tropez, on the French Riviera, according to El Khouri’s lawyer.

While John is active in the art world, the only trace of Kevin is a news report last year that he’d gotten engaged to Russian model Alesya Kafelnikova, the daughter of former world No. 1 tennis player Yevgeny Kafelnikov. The brothers couldn’t be reached for comment.

Read more: Bloomberg News

*Eventually. Like no, not in weeks or months.

HEPA disclaimer. This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimated,” and “intend,” among others. These forward-looking statements are based on Hepion Pharmaceuticals’ current expectations and include statements regarding the offering, the expected timing of the closing of the offering and the planned use of proceeds therefrom. Actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, the satisfaction of all conditions to, and the closing of, the offering. Hepion Pharmaceuticals does not undertake an obligation to update or revise any forward-looking statement. Investors should read the risk factors set forth in Hepion Pharmaceuticals’ Form 10-K for the year ended December 31, 2019 and other periodic reports filed with the Securities and Exchange Commission.

CTXR disclaimer. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction. This press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are made based on our expectations and beliefs concerning future events impacting Citius. You can identify these statements by the fact that they use words such as “will,” “anticipate,” “estimate,” “expect,” “should,” and “may” and other words and terms of similar meaning or use of future dates. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition and stock price, and includes all statements related to the completion of the registered direct offering, the satisfaction of customary closing conditions related to the registered direct offering and the intended use of net proceeds from the registered direct offering. Factors that could cause actual results to differ materially from those currently anticipated are: market and other conditions; our ability to successfully undertake and complete clinical trials and the results from those trials for our product candidates; our need for substantial additional funds; risks relating to the results of research and development activities; uncertainties relating to preclinical and clinical testing; the early stage of products under development; the estimated markets for our product candidates and the acceptance thereof by any market; risks related to our growth strategy; patent and intellectual property matters, our ability to attract, integrate, and retain key personnel; our ability to obtain, perform under and maintain financing and strategic agreements and relationships; our ability to identify, acquire, close and integrate product candidates and companies successfully and on a timely basis; our dependence on third-party suppliers; government regulation; competition; as well as other risks described in our SEC filings. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as required by law.

Institutional Analyst disclaimer. Both companies are clients, please see respective reports for full disclaimer and disclosure details.